If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Epsilon Theory may have gotten its formal start in 2013, but the soft launch took place in 1991. That’s when my partner Ben finished his doctoral work at <lifts nose slightly> a school up in Cambridge. His work there (and his 1997 book, Getting to War) focused on how news could be used to predict the likelihood of war. It also analyzed how news was used by institutions and individuals to foment an appetite for and belief in the necessity of war, which is related to but not the same as the ability to use that news for predictions.

So yes, we were interested to read about Project Cassandra, a collaboration between German academics and military leaders to quantify the risk of conflicts using…literature. The Guardian covers it here in what I think is a very worthwhile read.

The project is really interesting. It confirms, or at least shares, many of the core principles of our Narrative Machine project. Not least among them is the recognition that oft-mined sentiment possesses a fraction of the influence of memes with subjective power that can only be identified objectively through words and phrases of meaning. Or the observation of identifiable, recurring story archetypes.

Leaving aside that we focus on different universes of creative output, our projects DO differ in one respect. The Cassandra Project appears to place great emphasis on the ability to quantify the popular and critical acclaim of a fictional literary work. For example, more popular, more viral, more well-regarded work would have different influence, which is a perfectly sensible hypothesis.

Because we focus on a larger and more frequent dataset of news, blogs, press releases and transcripts, we get to do two different things: first, instead of estimating how much of an audience has heard an idea and how much that idea has changed their minds, we can more easily observe how much a specific memetic idea has reproduced within the dataset over time.

Second, because our dataset includes items which are nominally news / non-fiction content, we can observe the extent to which explicit and implicit opinion language is being deployed, which also provides a window into the narrative-shaping efforts of Common Knowledge missionaries.

Two different approaches to a similar problem. I prefer ours, because I feel more confident saying that an idea has reproductive legs by observing how it changes the language other people use to discuss it, and because knowing some of the intentions of powerful institutions and influential individuals is an indispensable part of any effort to quantify the potential effects of narrative.

But there are absolutely features of the zeitgeist which will only manifest in the arts, in literature, and in the groanings and yearnings of those who make the songs. For that reason alone, we think the Germans have the right of it here in the way that the Scots did before. It’s a very cool project.

Let me make the songs of a nation, and I care not who makes its laws.

Andrew Fletcher, Commissioner of the Old Parliament of Scotland (1703)

— Rusty Guinn | July 8, 2021 | 12:32 pm

The politicization of inflation into a partisan “There Is No Inflation!” TM Narrative by the nudgers and mandarins on the left is really depressing.

The politicization of inflation into a partisan “Biden Inflation!” TM narrative by the clowns and raccoons on the right is really depressing.

It’s really depressing because it makes it impossible for me to say anything on inflation without getting lumped into an insane partisan box. It’s an entirely constructed and false framing of the issue, and I’m just so freakin’ weary of it.

We call this political auto-tuning. We call this a political shock collar.

It’s the go-to move of incumbents in a two-party system with high-peaked bimodal electorate preferences. THIS is why there are no successful centrist politicians. THIS is why there are no stable centrist policies. THIS is why we can’t have nice things.

THIS is why I believe that top-down societal change is impossible, but instead must emerge from the bottom-up through an authentic social movement of Make/Protect/Teach.

Watch from a distance if you like, but when you’re ready … join us.

— Ben Hunt | July 2, 2021 | 11:09 am

We make it no secret that our research program here is all about using natural language processing to identify and measure narratives in the world. But is Narrative truly only shaped by verbal and written communication? Do Missionary statements have to be made with the mouth?

Of course not.

Here’s narrative missionary Max Scherzer, pitcher for the Washington Nationals, providing an exaggerated form of protest against the revised MLB enforcement policy regarding the use of foreign substances. The umps have generally been inspecting hats gloves and belts for these substances. Max decided to give them a little, shall we say, extra on the belt removal.

Here’s Oakland Athletics pitcher Sergio Romo, picking up every nuance of Scherzer’s crystal clear communication to the commissioner’s office.

Scherzer and Sergio’s sticky substance strip show is memetic perfection in the form of malicious compliance. There is no press conference speech either pitcher – or the others who will no doubt mimic their displays in the coming days – could have made that would have more clearly shifted Common Knowledge to the belief that the foreign substances rule was being applied, interpreted and policed in an absurd, preposterous way.

Bold prediction: this narrative doesn’t peak until Joe West enrages Zach Greinke into an NC-17 display on national television.

— Rusty Guinn | June 23, 2021 | 9:21 pm

The average American news consumer is exposed to far more headline text on news websites, social media apps and content aggregation sites than they are to the prose of the articles themselves. It should be no surprise, then, that more Fiat News and Missionary behavior exists in headlines than almost anywhere else. It typically gets a pass because, well, the whole job of a headline writer is to summarize what an article is about. But that’s precisely the task that lends itself so perfectly to telling us how we should think about the article. What’s important? What should our conclusions be? How should we feel about it?

I’ll give a free subscription to our free newsletter if you can find the fiat news language in this gem of a headline to a CNN news article.

Here are the companies rushing workers back to the office — and the ones that aren’t [CNN]

Aside from the general observation to take care in our content consumption habits, remember that it is the constant barrage of articles – and headlines – like this that reinforces our belief that the missionaries of the “Work From Home Forever!” narratives are dominating the field, at least in the Narrative war.

— Rusty Guinn | June 22, 2021 | 9:58 am

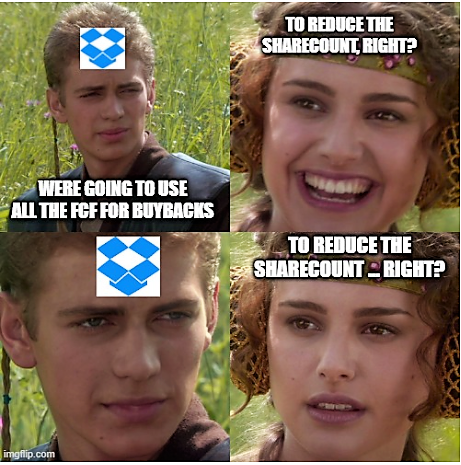

I saw this work of art on Twitter today, referring to Dropbox management using stock buybacks to sterilize their outrageous stock-based comp, and it made my day.

The Epsilon Theory notes I wrote about stock buybacks in 2019 are the most controversial thing we have ever published. They generated more anger, more arguments and more cold shoulders from the mainstream finance community than anything else we’ve done. Here’s my position:

When stock buybacks are used to sterilize stock-based comp (i.e., a company gives managers stock with one hand and buys it back from them with the other hand), no money is “returned to shareholders”. This is true whether or not management actually sells its shares into the buyback program.

Stock buybacks only “return cash to shareholders” to the degree that the buyback program reduces the sharecount. To the degree the buyback program does not reduce the sharecount, but simply sterilizes new issuance to management, it is purely a transfer of wealth from shareholders to management.

As the kids would say, it’s just math.

I think you would be AMAZED at the proportion of stock buyback programs that go towards sterilizing stock-based comp. I certainly was. I think it’s the greatest transfer of wealth in human history.

Not to founders. Not to entrepreneurs. Not to risk-takers.

Nope … to managers. To asset-gatherers. To fee-takers. To rent-seekers. To rakes.

Yep, Jamie Dimon is the rake. But then so is every S&P 500 management team. So is every Wall Street management team. That I’m aware of, at least. It’s the water in which we swim.

“Yay, Stock Buybacks!”

It’s amazing how many people get very angry at me when I say this.

Anyhoo … in addition to The Rake, here are the notes that started all the fuss.

— Ben Hunt | June 15, 2021 | 4:04 pm

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Recent major media stories that feel to us like they’re part of a larger narrative campaign.

Modeling common knowledge by analyzing missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

The Intentional Investor #9: Ryan Krueger

In this episode of the Intentional Investor, Matt Zeigler speaks with Ryan Krueger, founder of Freedom Day Solutions. Ryan shares his journey from working at a baseball card shop as a child to becoming a successful financial professional. He discusses his philosophy on investing, which focuses on transparency, partnership with clients, and a unique approach to retirement planning called “Freedom Day.” Ryan emphasizes the importance of trust, ethical practices, and long-term commitment in his business. He also touches on personal values, such as the influence of his family, his desire to make a positive impact, and his goal of continuing to work and grow rather than retire. Throughout the interview, Ryan’s passion for helping others achieve financial freedom and peace of mind is evident, as is his dedication to building lasting relationships with his clients and team.

Human Being in the Age of AI

The human animal is a social animal, in the truest sense of the words, more similar in our essence to ants, bees and termites than to any other creature. And like any social animal, we are pushed by our very nature towards The Hive, a meaning for our species where consciousness is outsourced, autonomy is abdicated, and discovery is denatured. In his keynote presentation at Epsilon Connect 2024, Ben Hunt shows how the technological push towards The Hive has never been stronger than here at the dawn of the Age of AI, but also how we can use those same tools of language, memory and story to reclaim our human society, our human dominion, and our human being.

Breaking News #25: The Trump Assassination Attempt and Our Plunge Into the Great Ravine

In this episode if Breaking News, we discuss the recent assassination attempt on former President Trump and explore its implications within the context of “The Great Ravine” – our term for the current period of political strife and violence. We analyze how media, technology, and politics intersect to shape public narratives, often transforming sadness into anger directed at opponents. We examine the rationality behind this behavior in closed political systems and discuss the challenges of maintaining critical distance. We also discuss the event’s impact on the 2024 election and explore themes of nourishment and healing through an analysis of the TV show “The Bear.”

This is the Great Ravine

Our mediated cultural transition from sadness to generalized anger to focused anger at specific people and institutions of the Other Party is an entirely intentional effort by Big Politics, Big Tech and Big Media.

This is the Great Ravine, and it’s all going to get much worse before it gets any better.

The Intentional Investor #8: Wes Gray

in this episode, Matt Zeigler speaks with with Wes Gray, founder of Alpha Architect and ETF Architect. Wes shares his fascinating journey from growing up on a ranch to pursuing a PhD in finance at the University of Chicago, serving in the Marine Corps, and eventually building successful businesses in quantitative investing and ETF infrastructure. He discusses key moments that shaped his career, including early experiences with investing, his time in academia and the military, and how he identified opportunities in the ETF space. Wes provides insights into his entrepreneurial approach, the importance of community and collaboration in investing, and how his businesses have evolved over time. The conversation covers a wide range of topics including quantitative investing strategies, ETF structures, and Wes’s philosophy on building innovative financial businesses while maintaining a focus on family and work-life balance.

Breaking News #24: The Debate That Changed Everything | Joe Biden’s Common Knowledge Moment

In this episode of Breaking News we look at the impact of the presidential debate and the role it played in changing the common knowledge about President Biden’s fitness for office. We explore the concept of common knowledge and illustrate how public perception shifts when everyone knows that everyone else knows something. We discuss the implications for the 2024 election, the role of media in shaping these narratives, and the potential fallout within the Democratic Party. Intertwining serious political analysis with lighter anecdotes, including a story about the Beastie Boys’ early days, we emphasize the importance of community and shared understanding in navigating these turbulent times. Join us as we break down what’s making us tick with Clear Eyes and Full Hearts.

Joe Biden and the Common Knowledge Game

Common knowledge is what everyone knows that everyone knows.

Common knowledge is why the 2024 Biden/Harris campaign has collapsed.

All that remains is the cope.

The Intentional Investor #7: Rusty Guinn

In this episode, Matt Zeigler talks with Epsilon Theory co-founder Rusty Guinn. Rusty shares his life journey, from growing up in rural Texas to working on Wall Street and eventually co-founding Second Foundation Partners. He discusses his experiences in finance, including roles in investment banking, private equity, and asset management. Rusty reflects on the lessons learned throughout his career, emphasizing the importance of humility, earnestness, and agency. He also talks about his decision to move to a farm in Connecticut, where he now balances his work in finance with homeschooling his children and running an apple orchard. Throughout the conversation, Rusty provides insights into the investment industry, personal growth, and the search for meaningful work and life balance.

The ETF Innovation Black Hole

Welcome to regulatory stagnation: ETF Industry style.

Innovation is still happening inside the four walls of the established ETF ecosystem. But the structure itself?

Late-Stage.

Breaking News #23: Biden’s Losing Narrative Strategy

In this episode of Breaking News, we examine the current state of the 2024 US presidential election and how it is playing out in the narrative world. We explore the recent Trump trial and its minimal impact on public opinion, as well as growing concerns about President Biden’s age and fitness for office. We then shift to reflections on our recent Epsilon Connect conference about being human in an age of AI, highlighting the importance of maintaining humanity and ethics in our use of technology. We also delve into the troubling state of higher education in America, particularly the exorbitant costs and increasing commercialization of college athletics.

The Intentional Investor #6: Daniel Crosby

In this episode of The Intentional Investor, we sit down with Daniel Crosby, a clinical psychologist turned behavioral finance expert and author of the upcoming book “The Soul of Wealth.” We explore Daniel’s fascinating journey from punk rock bassist to leading voice in the world of investing psychology, discussing the importance of setting healthy boundaries, letting life’s phases run their course, and the art of translating complex ideas into actionable insights. Join us as we dive into the power of narrative, the process of learning and unlearning, and the gift of being present in life’s heaviest moments, all while uncovering the parallels between Daniel’s work and our own mission to help people navigate the intersection of investing and life.

The Intentional Investor #5: Perth Tolle

In this episode of The Intentional Investor, host Matt Zeigler interviews Perth Tolle, founder of the Freedom Index and Life + Liberty Indexes. Perth shares her remarkable journey from growing up in China to launching a freedom-weighted emerging markets ETF strategy, which recently celebrated its 5th anniversary. She discusses her experiences with personal and economic freedom, the importance of objective data in the investment process, and the challenges she faced in bringing her vision to life.

Breaking News #22: Israel, Meme Stocks and the Rising Risks Across the Globe

Risks are rising on a variety of fronts across the world. And market players are positioning themselves to profit before they are realized. In this episode of Breaking News, we take a tour of some of the major issues we face in the current challenging environment. We discuss the peculiar announcement by Ireland, Norway, and Spain recognizing the Palestinian state, the potential for total war in the Middle East, Rick Rieder’s suggestion for interest rate cuts and the return of Roaring Kitty and the GameStop saga. We also cover President Biden’s questionable housing proposal, and the lessons we can learn from Conan O’Brien’s appearance on the YouTube show Hot Ones.

When You Destroy the Tools of Creativity

We are in an age of tremendous uncertainty. Trust has evaporated. But agency, the individual expression of trust, has evaporated, too.

Before we can rebuild trust in institutions, we have to start by rebuilding agency in ourselves.

The Intentional Investor #4: Bogumil Baranowski

In this episode of The Intentional Investor, host Matt Zeigler is joined by Bogumil Baranowski to discuss the power of investing with a multi-generational mindset. Baranowski shares his personal journey from growing up in communist Poland to discovering the transformative potential of free market economies and property rights. We also discuss the importance of viewing wealth as a tree that can be planted, nurtured, and enjoyed by future generations and explore the value of community, education, and personal experiences in shaping one’s perspective on investing and life.

How To Win At Story: Conan’s Hot Ones Masterclass

Please, let’s have a laugh at Conan on Hot Ones, but let’s also think this out together:

How do you win at story?

I’ve got 10 rules to try and help. And, using plenty of examples from the show, let’s see if we can’t get just a little bit better at the stories we tell ourselves too.

Breaking News #21: Donald Trump and the Story the Media Isn’t Telling

In this episode of Breaking News, we explore a range of topics, from the lack of media coverage surrounding the billions of dollars funneled to Donald Trump through his social media company, to the pervasiveness of gambling and speculation in our society. We discuss the embedded wage-price inflationary environment and its potential impact on our fragile, optimized systems. Additionally, we delve into the creative process behind Kelly Clarkson’s hit song “Since U Been Gone” and how it relates to the construction of pop stars, media stories, and political narratives.

The Story that Changes The World

The ‘monomyth’ or Hero’s Journey isn’t just a script for movies. It’s also the script of our society and our individual lives.

If we let it.

The Intentional Investor #3: Howard Lindzon

In this episode of The Intentional Investor, host Matt Ziegler interviews Howard Lindzon, the founder and CEO of StockTwits. Lindzon shares his journey from aspiring comedian to stockbroker, entrepreneur, and investor, highlighting the importance of mentorship, tight networks, and adaptability in the ever-changing landscape of business and technology. The conversation covers Lindzon’s early investments in companies like Robinhood and eToro, the evolution of social media platforms like Twitter and YouTube, and the lessons he’s learned from navigating bull and bear markets.

Fidelity Reminds ETF Industry It Doesn’t Have To Care

Free is a good price. It’s how we got Fortnite, and Radio, and a terrible internet. People hate paying for things.

That’s what Fidelity was counting on when they decided to make a stink about 9 ETF issuers not signing their revenue sharing deal.

And they’ll win. They always win.