If you’re like me, you’ve been put off from digging deeper into DeFi by the terrible signal-to-noise ratio of anything crypto-related on the interwebs. That’s why I found this DeFi primer (using Maker DAO as a specific example) by ET contributor and banking analyst Marc Rubinstein to be so fantastic.

Yesterday, the 20th anniversary of 9/11, I read and heard several mainstream references to “the Widening Gyre”. It makes sense that yesterday would spur that sort of Narrative connection, as the juxtaposition of the political images and texts from then and now is breathtaking. It’s amazing (and obvious), how polarized we’ve become over the past two decades.

But at this point – where the Widening Gyre is not happening but has already occurred – I think what we’re seeing is the Widened Gyre, where everything is autotuned to the poles of the gyre, including references to the Widening Gyre itself!

Case in point, on Twitter I am now routinely criticized for “contributing” to the Widening Gyre if I don’t engage in perfunctory political whataboutism on any topic that has a political dimension … which is to say ALL topics.

What is the Widened Gyre?

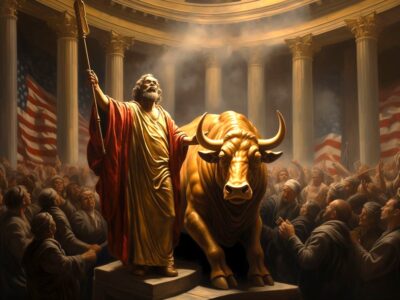

Yesterday, the most recent former president of the United States gave a paid speech to Moonies and then made a paid appearance at a sham boxing match where 58-year-old Evander Holyfield was knocked out in 90 seconds.

On 9/11.

And it will change no one’s politically polarized views. Not his supporters. Not his detractors. No one.

The Widened Gyre is a VERY stable equilibrium.

— Ben Hunt | September 12, 2021|

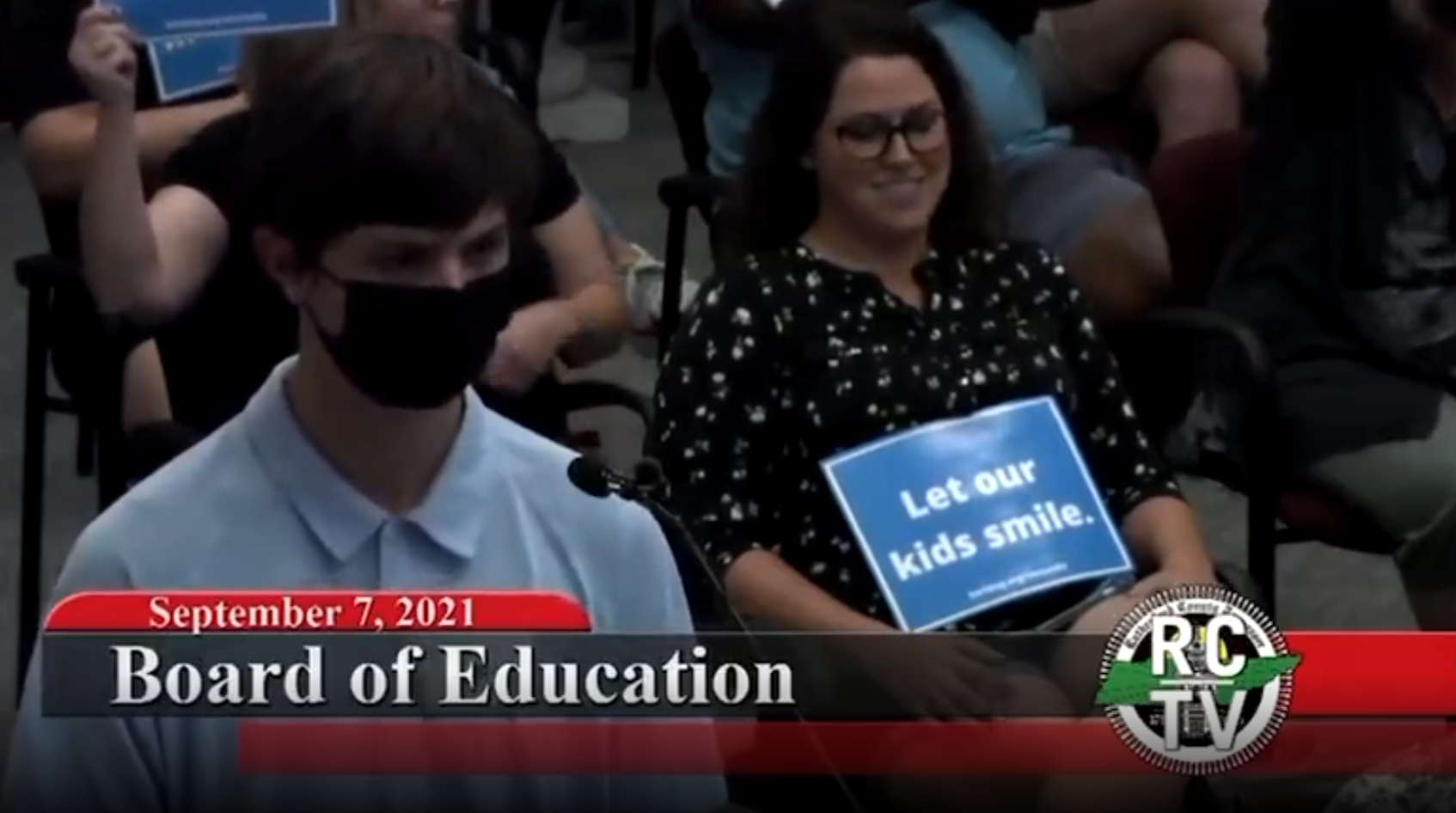

A video made the rounds on various social media platforms last night and this morning. By now you have probably seen it. A young man presents his case for a mask policy to the school board in Rutherford County, Tennessee. He recalls the death of his grandmother by COVID and begins to express fear that this could happen to other people he cares about.

And that’s where most cuts of the video end. You see, the young man’s speech was interrupted by the shouting and snickering of adults behind him. Adults holding ‘Let our kids smile’ signs.

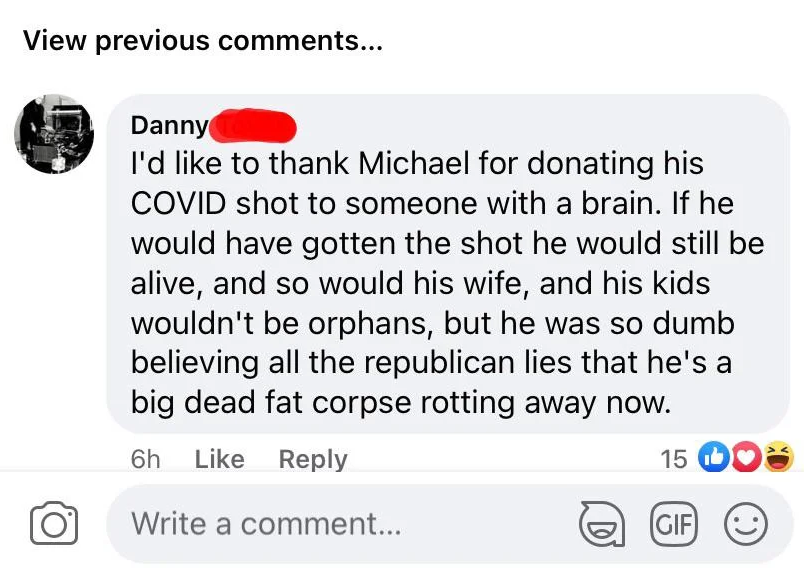

Elsewhere on the internet, there is a very similar – and very different – trend emerging. It is a simple Meme. You find someone who dies of COVID or asks for prayer or good thoughts after having downplayed the virus, the vaccine or masks only weeks or days before. Then you juxtapose their statements for internet points. If you’re in a particularly virulent version of this community, maybe you even post something vile on their family’s announcement of the person’s passing on Facebook. This is NOT cherry-picking. There are entire social media sub-communities and hashtags devoted to these memes.

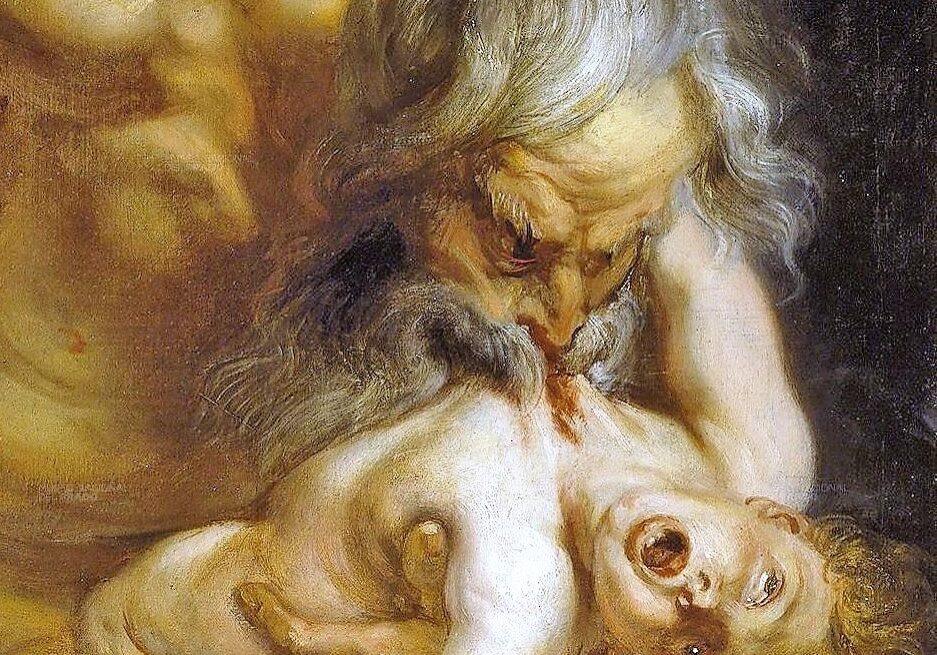

We have written several times about the imagery of Ionesco’s landmark play Rhinoceros. I’m abridging rather thoroughly here, but the main conceit of the play is that the humans gradually change into rhinoceroses. But the shock of the story isn’t the devastation the beasts cause, rampaging about town. The shock is that, at some point, we are no longer shocked. We see the family, friend, neighbor or colleague we once knew and and say simply, “Oh, a rhinoceros.”

Many of us today will shrug and say, “Oh, a rhinocerous” to adults laughing and jeering at a child discussing his grandmother’s death. The Real Issue, you see, is that the child made a statement about the role of masks with inadequate information to justify his claim, and that might unduly influence local policy.

Many of us today will shrug and say, “Oh, a rhinoceros” to those who barge in on a family grieving the loss of someone they shared their entire lives and dreams with. The Real Issue, you see, is the good we can do by making an example of how wrong they were about COVID.

Maybe it’s time to remind ourselves that it isn’t normal for humans to transform into rhinoceroses.

Maybe it’s time to wrap up a little bit less of our individual and collective identity in Being Right About COVID.

For news junkies and the Very Online, one of the most well-traveled news stories over the past couple days has been the story of the “American students who are stranded in Afghanistan.”

The first version I read of the story came from this piece published by The Hill, although it borrows heavily from a piece published in the LA Times and San Diego Union-Tribune the same day.

Dozens of California students, parents stranded in Afghanistan after summer trip abroad [The Hill]

The key excerpt if you don’t feel like clicking over is here:

Dozens of California students and parents are stranded in Afghanistan after taking a summer trip to the country.

More than 20 students and 16 parents from the Cajon Valley Union School District in El Cajon, Calif., visited Afghanistan on summer vacation. Now they are among thousands of people who are waiting to leave the country amid the chaotic U.S. withdrawal that has caused political unrest across the nation, according to the Los Angeles Times.

Cajon Valley Superintendent David Miyashiro alerted school board members on Tuesday that he would be meeting with Rep. Darrell Issa (R-Calif.) to discuss the situation, the Times noted.

Source: The Hill

However much of the headline or article you read, you will still arrive at the same two questions that roughly half of America has since yesterday: (1) What the devil were a group of students doing taking a summer trip abroad in Afghanistan, and (2) Why is one of the students’ parents talking about worries that they are missing class?

It’s the funny thing about news. We more or less define it based on the assumption that it tells the truth, and this article does. These students from California absolutely went to Afghanistan over the summer. They are absolutely stranded there. These are facts.

But at some point here, you have to feel like a writer without an axe to grind might have felt inclined to mention that the California students are LITERALLY REFUGEES FROM AFGHANISTAN WHO WENT TO THEIR OLD HOME TO VISIT FRIENDS AND FAMILY. And look, that doesn’t change that they are people just as deserving of our efforts to extract safely as anyone else. It just takes away the single reason the article went viral, that is, that a bunch of kids going to Afghanistan for summer vacation seemed pretty wacky.

The ability to influence our behaviors as information consumers isn’t confined to whether we are explicitly being told how to think about something. Narrative is just as easily communicated through the selective absence of information, through its placement on a page, and through editorial decisions regarding the volume and emphasis of its coverage.

So which explanation for this preposterous framing do you think is true? And remember, you can always pick more than one:

- Never attribute to malice that which is adequately explained by stupidity. They just didn’t think about the very obvious omission, or they didn’t do the basic research to inform it.

- They were terrified of getting canceled for maybe implying that refugee status was a relevant detail to the story.

- Clickbait. C’mon.

Join us in the forum which you think it is – or offer another explanation!

— Rusty Guinn | August 26, 2021|

An Australian Pack member living abroad published what I think is an outstanding review of the depths to which Australia’s Covid-zero policy has descended. Here’s the skinny:

We are a country that pulls things out of the ground, sells coffee to each other, and invests every dollar we don’t have in residential property. And that’s been fine until this point. Australia, more than any other country, has ridden a wave of prosperity over the last 30 years that resulted in a quality of life almost unsurpassed anywhere in the world. But it has bred complacency, and the country’s response to COVID has revealed this complacency and its worrying lack of urgency. We’ve convinced ourselves that we generated long-term prosperity because there’s something special about us; but a lot of it’s been due to luck.

Taking a step back, Australia’s approach to COVID implicitly includes the following: a comfort with severely curtailing its citizens’ liberties; the capacity to absorb and pay for economic calamities; a belief that its brand is strong enough to recover from the damage inflicted and to once again attract talent and capital; zero tolerance for risk or its citizens ability to manage it; and conviction that trust in authority will remain despite all the failures, hostility and dishonesty.

Daniel Bookman

— Ben Hunt | August 25, 2021|

If Barbara Tuchman were alive she would be adding another chapter to her classic The March of Folly.

I am fascinated to see what narratives spring forth from this sad and tragic failure to accomplish anything other than leave behind a string of broken promises.

Z.

‘‘Experience keeps a dear school, but fools will learn in no other, and scarce in that; for it is true that we may give advice, but we cannot give conduct.” said another Ben

T.C.

— Ben Hunt | August 18, 2021|

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

Most of us are under the impression that a protracted conflict within China will increase national unity. Not this time.

Recent Notes

When You Destroy the Tools of Creativity

We are in an age of tremendous uncertainty. Trust has evaporated. But agency, the individual expression of trust, has evaporated, too.

Before we can rebuild trust in institutions, we have to start by rebuilding agency in ourselves.

The Intentional Investor #4: Bogumil Baranowski

In this episode of The Intentional Investor, host Matt Zeigler is joined by Bogumil Baranowski to discuss the power of investing with a multi-generational mindset. Baranowski shares his personal journey from growing up in communist Poland to discovering the transformative potential of free market economies and property rights. We also discuss the importance of viewing wealth as a tree that can be planted, nurtured, and enjoyed by future generations and explore the value of community, education, and personal experiences in shaping one’s perspective on investing and life.

How To Win At Story: Conan’s Hot Ones Masterclass

Please, let’s have a laugh at Conan on Hot Ones, but let’s also think this out together:

How do you win at story?

I’ve got 10 rules to try and help. And, using plenty of examples from the show, let’s see if we can’t get just a little bit better at the stories we tell ourselves too.

Breaking News #21: Donald Trump and the Story the Media Isn’t Telling

In this episode of Breaking News, we explore a range of topics, from the lack of media coverage surrounding the billions of dollars funneled to Donald Trump through his social media company, to the pervasiveness of gambling and speculation in our society. We discuss the embedded wage-price inflationary environment and its potential impact on our fragile, optimized systems. Additionally, we delve into the creative process behind Kelly Clarkson’s hit song “Since U Been Gone” and how it relates to the construction of pop stars, media stories, and political narratives.

The Story that Changes The World

The ‘monomyth’ or Hero’s Journey isn’t just a script for movies. It’s also the script of our society and our individual lives.

If we let it.

The Intentional Investor #3: Howard Lindzon

In this episode of The Intentional Investor, host Matt Ziegler interviews Howard Lindzon, the founder and CEO of StockTwits. Lindzon shares his journey from aspiring comedian to stockbroker, entrepreneur, and investor, highlighting the importance of mentorship, tight networks, and adaptability in the ever-changing landscape of business and technology. The conversation covers Lindzon’s early investments in companies like Robinhood and eToro, the evolution of social media platforms like Twitter and YouTube, and the lessons he’s learned from navigating bull and bear markets.

Fidelity Reminds ETF Industry It Doesn’t Have To Care

Free is a good price. It’s how we got Fortnite, and Radio, and a terrible internet. People hate paying for things.

That’s what Fidelity was counting on when they decided to make a stink about 9 ETF issuers not signing their revenue sharing deal.

And they’ll win. They always win.

Breaking News #20: Hot Ones and Phony Wars

In this episode of Breaking News, we examine the recent situation with NPR and how it relates to the concept of Fiat News. We also delve into the current state of tensions between Iran and Israel and why we may see a ‘phony war” in the coming months. Additionally, we examine the underwhelming sales of Tesla’s Cybertruck and the broader decline of the EV narrative. We also have a dumb question about expansion of NATO and a Cultish Corner on Conan O’Brien’s masterful appearance on the show “Hot Ones”.

The Intentional Investor #2: Justin Castelli

In this episode of the Intentional Investor, Matt Zeigler and Justin Castelli explore the intersection of life and investing, discussing the importance of aligning your financial plan with your personal values and vision. Justin shares his unique perspective on setting goals versus having a vision, emphasizing the significance of investing in experiences, relationships, and intellectual property rather than solely focusing on traditional financial metrics. The two discuss the role of financial advisors in helping clients live authentically and the potential for an abundance mindset within the financial system. Justin also touches on his aspirations to support others through creative ventures and the generational wisdom he hopes to pass down to his children.

Cursed Knowledge #28: Casual Gambling in Videogames

Gambling is a big deal. And everyone’s got an opinion one way or another. It’s had a pretty insane increase over the last few years. But what happens when Gambling becomes gambling? When it stops being a grand event and is instead a much more insidious and, well, casual thing. Spoiler Alert. Nothing good. It’s now showing up everywhere. From sports, to finance, to politics, to videogames. It’s rarely obvious gambling, and that’s what we need to be worried about.

The Intentional Investor #1: Ben Hunt

In this episode of The Intentional Investor, Matt Ziegler has a wide-ranging conversation with Ben Hunt, discussing Ben’s journey from academia to finance and the pivotal moments that shaped his career. Ben shares his lifelong fascination with games, puzzles, and cracking codes, which eventually led him to the world of investing. They delve into Ben’s experiences in academia, the lessons he learned from starting a software company, and his realization that fundamentals and value in investing are ultimately driven by narratives and game theory. Ben also discusses the genesis of Epsilon Theory, and his ongoing quest to find structure in unstructured data and stories. Throughout the conversation, they explore the interconnectedness of human, intellectual, social, and financial capital in shaping one’s life and career.

IT’S. ABOUT. THE. MONEY.

If you were a smart guy like MicroStrategy CEO Michael Saylor and you thought a stagflationary tsunami of enormous proportion was going to wash over the US economy regardless of who wins in November, what would you be doing right now?

I think you might be doing whatever you can to get liquid in the global reserve currency without spooking the marks.

Breaking News #19: Number Go Up For November

In this episode we discuss how the upcoming November election is shaping the current political and economic landscape. We discuss why inflation, the stock market and the war in the Middle East are all being viewed through a political lens as the election approaches and those with a vested interest seek to influence its outcome . We also discuss the prevalence of conspiracy theories, the erosion of trust in institutions, and the importance of curiosity in a left brain focused world.

I Think The Gun Helps

Our kids are being rewired.

The data implicating the smartphone-based childhood are compelling but not conclusive – and may never be.

So how should governments, communities, schools and families decide what to do?

Breaking News #18: The Rise of the Raccoons

As anyone who has ever left their trash lid loose would know, raccoons have a tendency to come in and clean up the leftovers. And they make a huge mess while they do it. That isn’t the only place they exist, though. Raccoons also exist in the financial world, the self help world and a lot of other places. They come in and take what is leftover from what would otherwise be positive innovations and make a mess of them for their own benefit. In this episode, we take a detailed look at raccoons. We look at the tactics they use and how all of us can better spot them before they do their damage. We also discuss the danger of carved out inflation metrics, whether fundamental investing is dead, what steam boat operators have to do with finding your true self and a lot more.

Bitcoin Endgames & The New Hyper-Agents

If the HODLers are right, they’re also the new Elites.

Not in a “my thumbdrive will make me the Duke of West Hartford in this post-apocalyptic hellscape” sort of way, but in ugly-but-mainstream scenarios with ugly-but-mainstream power/wealth transfers.

Breaking News #17: The Rise of Financial Nihilism

Younger generations today feel like they don’t have a chance. Whether it be rising home prices or income and wealth inequality, they feel that they are starting with a significant disadvantage relative to older generations. One of the responses to this has been to resort to more aggressive gambling when it comes to their investments and their lives. Whether it be sports gambling or investing in riskier investments, some have sought to overcome their starting position by making risky bets. In this episode, we take a deep dive into this idea of financial nihilism and look at its real world implications. We also discuss Elon Musk’s treason allegations against Joe Biden and also look at the amazing behind the scenes story of the creation of the song “We Are the World.”

And You Wonder Why Bitcoin and Gold are at Record Highs

The Fed’s inflation-fighting credibility is shot and everyone in Washington and on Wall Street is in the bag for nominal growth, ie Number Go Up on EVERYTHING, through the November election.

After that … well, as Louis XV so aptly put it: après moi, le déluge.

Wheeee!

Financial Nihilism

The Boomers have all the money. The American Dream of upward mobility is dead for you. That is Financial Nihilism.

So if you’re on the wrong end of this, what do you do about it?

You gamble. You f**king gamble.

The Semantic Universe

Between the idea

And the reality

Between the motion

And the act

Falls the Shadow