Inflation

Inflation is an ever present force that we find ourselves talking about quite a bit. It may seem simple on the surface, but there's more than meets the eye. Here we've gathered our collection of notes on Inflation to help clarify the many facets that we must face.

Much Ado About Inflation

Hollow Men, Hollow Markets, Hollow World

Over the past 25 years, our leaders have intentionally constructed an Apocalypse Now world of proclamation and fiat, where our wealth has grown much faster than our economy.

The bill is due for their hubris, and inflation is here to collect it.

NGMI

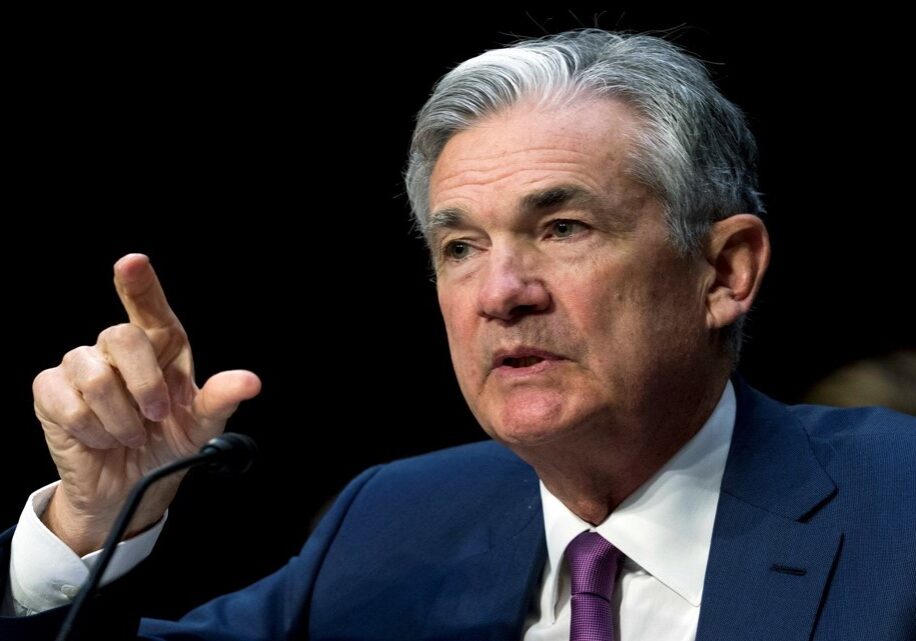

The Fed’s rate hikes to curb inflation?

Not gonna make it.

Inflation and the Common Knowledge Game

At whatever point in time you think inflation will start to fade, you are being too optimistic.

Why? Because common knowledge.

Where do we go from here? To a Man With a Plan, I think. And war.

I’m So Tired of the Transitory Inflation “Debate”

When a famous person shakes his or her finger at you, they’re not telling you a fact.

They’re telling you how to think about a fact.

Wage Inflation Isn’t Coming. It’s Already Here.

Over the past four quarters, the United States has generated more wage inflation than at any point over the past 40 years.

This is not an anomaly. This is not a single quarter aberration. A wage-price inflation cycle is here.

I’m not predicting. I’m observing.

I’m Trying To Understand Hedonic Adjustments

A Honda Accord cost $12,000 in 1990 and it costs $25,000 now.

A Mustang was $9,000 and now it’s $27,000.

The BLS has new car prices close to unchanged over the past 30 years.

ET contributor Brent Donnelly tries to wrap his brain around hedonic adjustments to CPI.

What Do We Need To Be True?

Modeling common knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

The Opposite of 2008

In 2008, the US housing market – together with a Fed that thought the subprime crisis was “contained” – delivered the mother of all deflationary shocks to the global economy.

In 2021, the US housing market – together with a Fed that thinks inflationary pressures are “transitory” – risks delivering the mother of all inflationary shocks.

The ET Pack is going to figure this out … together.

A Song of Ice and Fire

We are the human animal.

We are non-linear.

We ARE a song of ice and fire.

It’s a song that has built cathedrals and fed billions and taken us to the moon. It’s a song that can do all of that and more … far, far more … if only we remember the tune.

The Pack remembers.

Pricing Power (pt. 3) – Government Collaboration

What killing active investment management? It’s not some monster hiding behind the rabbit. No, it IS the little white bunny. It’s the Zeitgeist of capital markets transformed into a political utility, innocuous on the surface … but with killer teeth.

How do you defeat the Zeitgeist? You don’t. The smart move, in fact, is to help the killer rabbit.

But there IS another way.