ET Origins

Lets Start At The Very Beginning

We've written a lot of notes over the years. A lot of great ideas and terminology has been created and that can make it hard to dive right in. So here's what we consider to be the essentials. The notes that you need to read to understand Epsilon Theory. Most of our recent grander and more complicated ideas have their humble origins in these earlier notes.

A Very Good Place To Start

Epsilon Theory Manifesto

Our times require an investment and risk management perspective that is fluent in econometrics but is equally grounded in game theory, history, and behavioral analysis. Epsilon Theory is my attempt to lay the foundation for such a perspective.

Through the Looking Glass, or … This is the Red Pill

The first ET note focused on Information Theory.

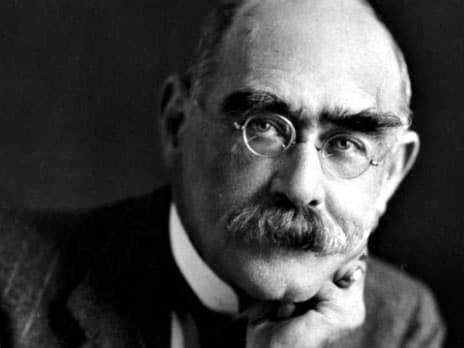

How Gold Lost Its Luster, How the All-Weather Fund Got Wet, and Other Just-So Stories

In some periods of history gold is money. In other periods of history gold is not. But gold is always something, and that something is defined by the Common Knowledge of the day.

Today our Common Knowledge is that gold is an insurance policy against central bank error.

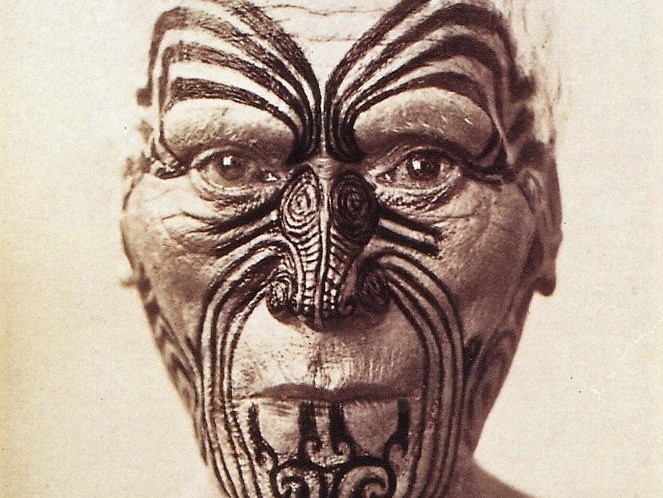

It Was Barzini All Along

“Tattaglia is a pimp. He never could have outfought Santino. But I didn’t know until this day that it was Barzini all along.” – Don Vito Corleone

Same with Emerging Market growth narratives. It was Developed Market monetary policy all along.

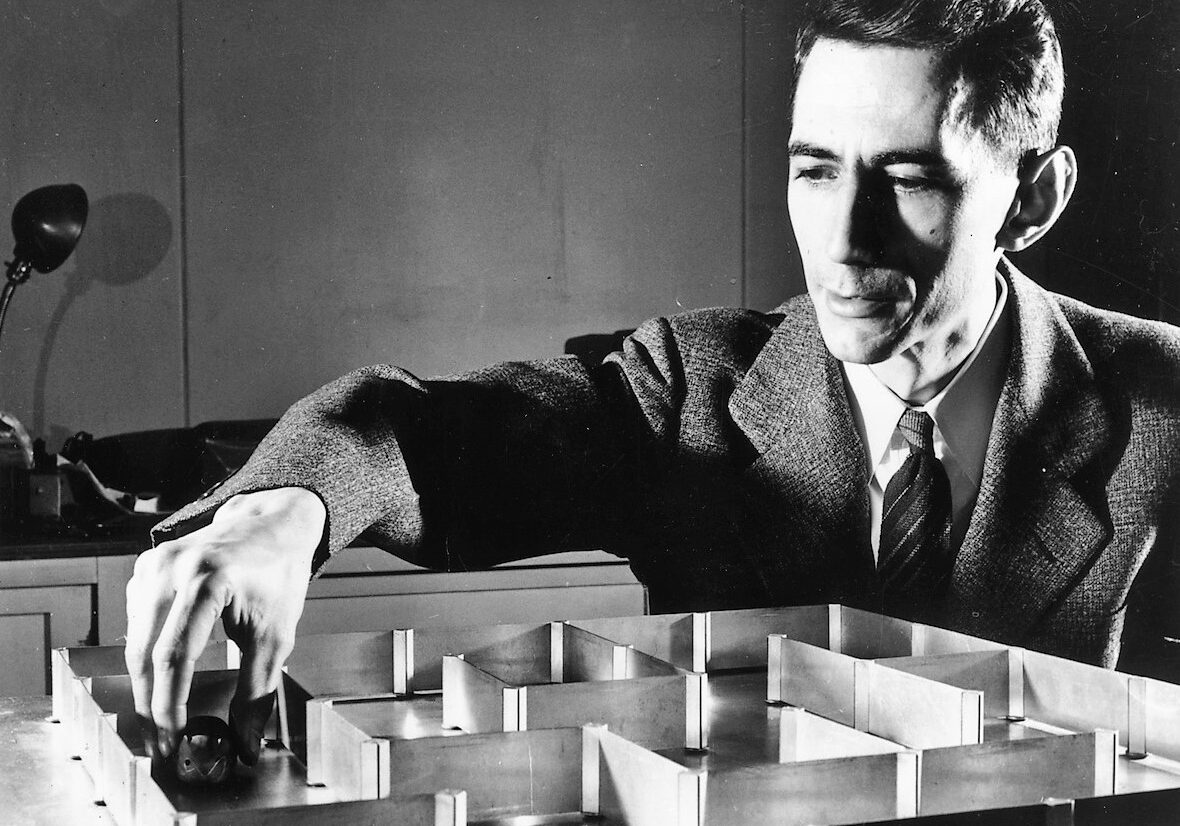

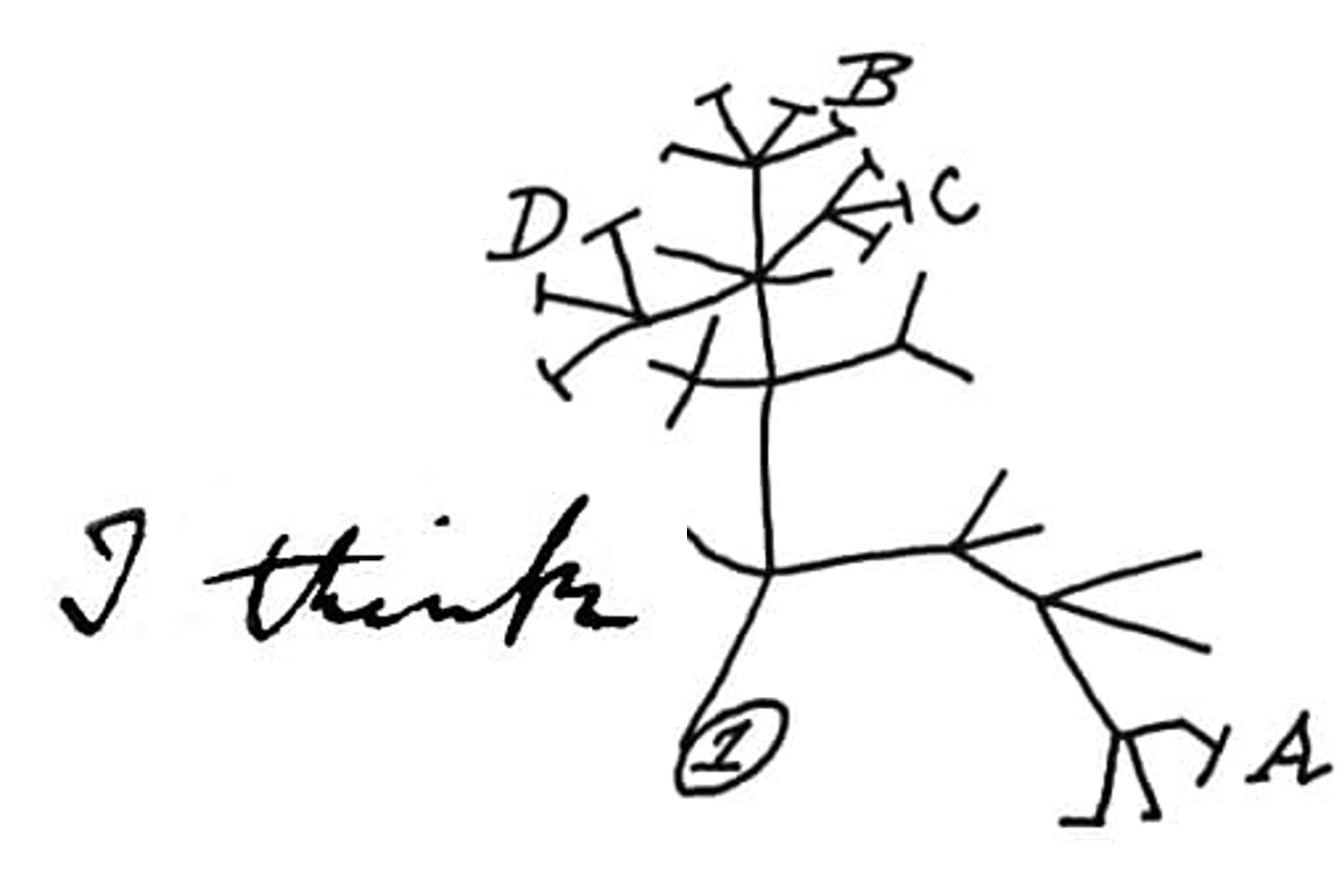

Adaptive Investing: What’s Your Market DNA?

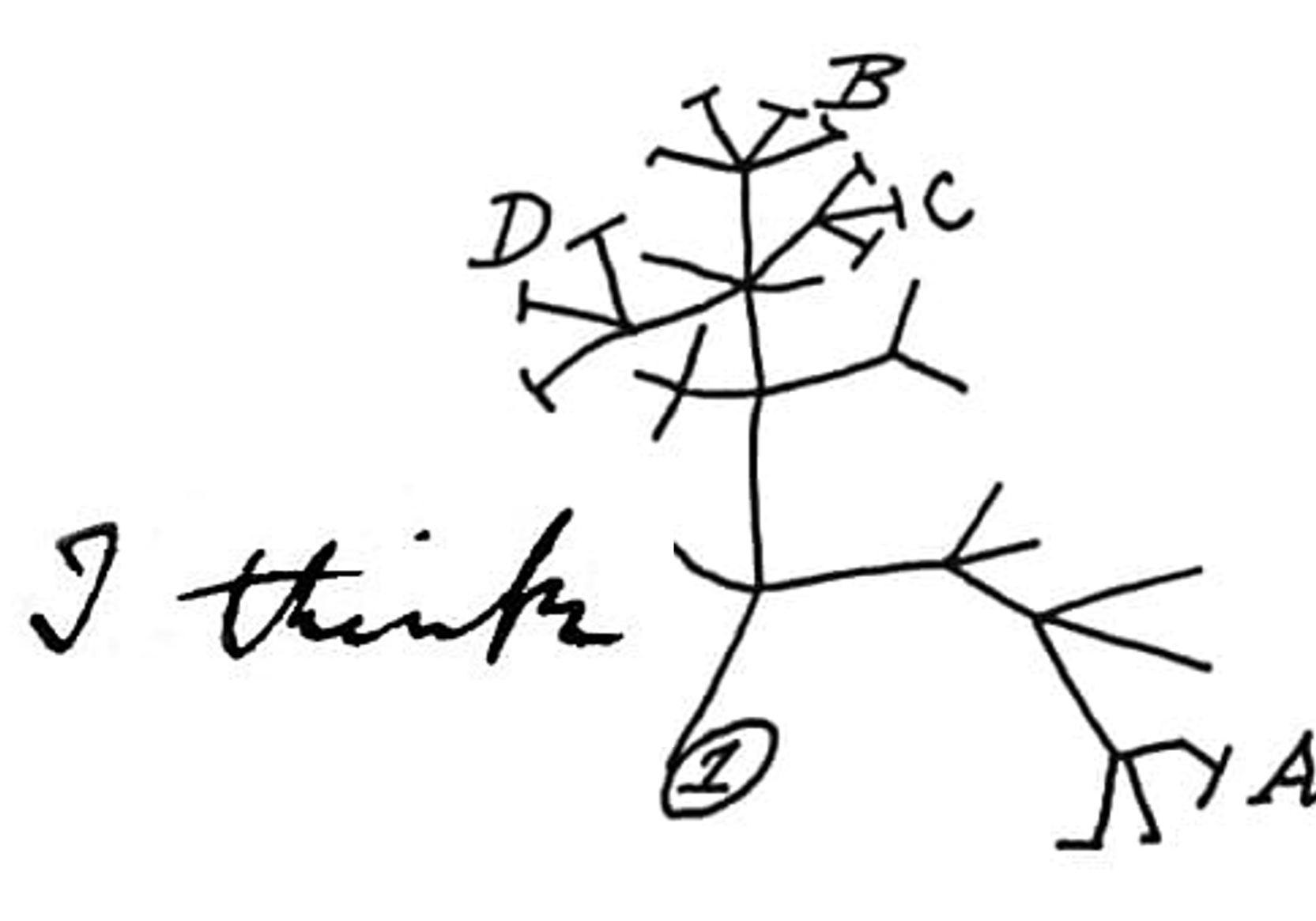

In 1837 on page 36 of his so-called “B” notebook, Charles Darwin wrote the words “I think” followed by the first depiction of an evolutionary tree.

The rest, as they say, is history,

When Does the Story Break?

Margaret Bourke-White took this photo of the Garment District in 1930. Every single person on the street is wearing a hat. How did THAT behavior change over time? How did the common knowledge that All Men Wear Hats change?

Answer: the Common Knowledge Game.

Hobson’s Choice

I’d like an omelet, plain, and a chicken salad sandwich on wheat toast, no mayonnaise, no butter, no lettuce, and a cup of coffee. Now all you have to do is hold the chicken, bring me the toast, give me a check for the chicken salad sandwich, and you haven’t broken any rules.

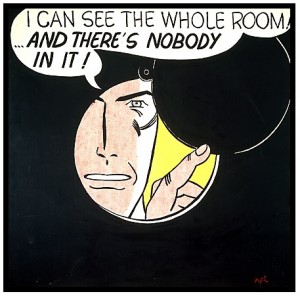

The Narrative Machine

“So, in the interests of survival, they trained themselves to be agreeing machines instead of thinking machines. All their minds had to do was to discover what other people were thinking, and then they thought that, too.” – Kurt Vonnegut

If there’s a better description of modern markets, I have yet to find it. We have become agreeing machines.

Magical Thinking

The problem with magical thinking run amok and its perpetuation of a fantasy world is that sooner or later the dream of the delusional king becomes a real world nightmare for real world people. It’s time to wake up.

Virtue Signaling, or … Why Clinton is in Trouble

Don’t get me wrong. I’m thoroughly despondent about the calcification, mendacity, and venal corruption that I think four years of Clinton™ will impose. Trump, on the other hand … I think he breaks us. Maybe he already has. He breaks us because he transforms every game we play as a country — from our domestic social games to our international security games — from a Coordination Game to a Competition Game.