Life and Career Advice

There's a lot of advice and sayings out there about the importance of being yourself and sticking to your guns. Well, before you can do any of that, you have to know yourself. So we want to ask, who are you as an investor? Maybe you already know. Maybe you don't. If you're still figuring that out, we've got some thoughts that could help you.

The Best Advice We Have To Give

Before You Fly The Nest: Advice for kids heading to college

ET contributor Brent Donnelly went out and asked some people he respects what advice they would give kids heading off to college. Here’s what he found.

How to Succeed as a Sell Side Trader

ET contributor Brent Donnelly has some advice that’s ostensibly for sell-side traders, but is actually for everyone in markets. And everyone who isn’t.

Money Can Buy Happiness (in variable and diminishing quantities)

What does your money/happiness curve look like? Is it curved or linear? Does it flatline somewhere? If so, where?

There’s the game of trading and the metagame of life. To win the latter, you have to Know Thyself.

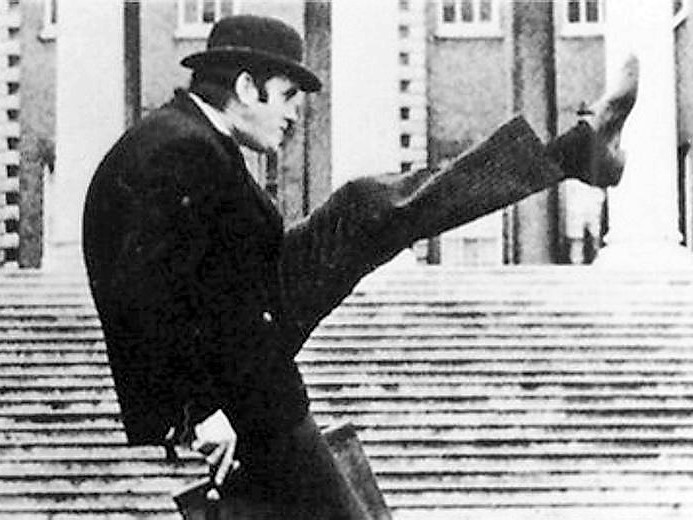

25 Anti-Mimetic Tactics for Living a Counter-Cultural Life

The social rewards that come from imitating others feel good, but they come at a high price.

Here are 25 Anti-Mimetic ideas that can help us craft a life that is a little more free from the herd, and a bit more open to the spontaneity and wonder of new things.

Starry Eyes and Starry Skies

The student loan crisis is a Big Deal. And it is only a part of a Bigger Deal: the Myth of College.

This issue will be front-and-center in the upcoming elections. We will all be handed our very own ‘Yay, College’ signs to raise high. More often than not, we will be asked to raise them in service of market-distorting policies which will make our problems worse.

The Ministry of Rites and the Compassionate Man

“Oh, little Jimmy is going to 20-Years-Ago-This-Was-A-Second-Rate-University? I hear really good things about that school. Congratulations!”

“Thanks! We’re all very pleased. Everyone except my bank account, that is. Hahaha!”

It’s true, everyone is VERY pleased by the current system. Prestige university credentialing is a steam valve … \whispers\ just like elections.

In Praise of Work

The problem isn’t that we derive too much of our worth and value from work. The problem is that our jobs are becoming increasingly abstracted from work. Friends: Your work is holy.

We Had The Same Crazy Idea

It is a frustrating truth that good – even great – investors rarely know exactly what it is that makes them good. And so the inevitable guilty pleasure of investors – building portfolios from the best ideas of their various managers and advisors – is almost always doomed to fail from the beginning.

Oh, hell, Martha, go ahead and burn yourself if you want to.

I can’t advise you on the Answers. I won’t advise you on the Answers. But I will advise you on the Process. Because that’s what we do for our fellow pack members.

Investment Diligence and the Cornelius Effect

Nobody likes to admit it, but the investment industry hires and invests with the smartest-seeming people that seem sufficiently likable. And it doesn’t work.