A juvenile red-tailed hawk took up residence near our farmhouse soon after we moved onto the property, now eight years ago. The girls named him Indiana Jones, which is a wonderful name for a hawk, and his daily kreeeeeees thrill me every time I hear them. Red-tailed hawks are also known as chickenhawks, but we’ve never had a problem with Indiana in that regard, as he seems more than content to pillage our fields for ground squirrels, voles and the occasional snake. I am particularly happy for his attacks on the local vole population, as we lost a young apple tree to voles a few years back (they will eat the tender bark all the way around the thin trunk, “ringing” the tree and killing it). We don’t know if Indiana has been successful in finding a mate in one of the past few breeding seasons. We hope so. It’s a solitary life being a red-tailed hawk, all alone in your instinctive mastery of flight and field.

Tyger Tyger, burning bright,

In the forests of the night;

What immortal hand or eye,

Could frame thy fearful symmetry?

[Four stanzas later …]

Tyger Tyger burning bright,

In the forests of the night:

What immortal hand or eye,

Dare frame thy fearful symmetry?

– William Blake (1757 – 1827)

It’s the single word change in the first and last stanza of Blake’s most famous poem, the shift from Could to Dare, that moves me as much as Indiana’s kreeeeeees. It’s at the heart of all of Blake’s work, this notion that not only is it a difficult thing to frame/model the symmetry/pattern of Nature as found in a raptor’s swooping flight or a tiger’s slouchy walk, but that it is a dangerous thing, too!

Of course, that’s exactly what we humans do all the freakin’ time.

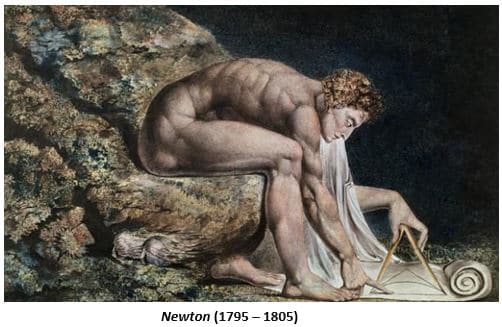

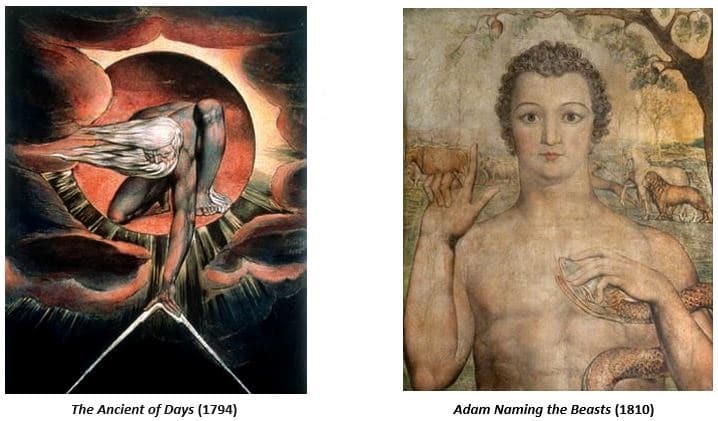

Here are some amazing William Blake paintings on this theme.

Blake’s famous quote was “Art is the Tree of Life. Science is the Tree of Death.”, so I suppose it’s no great surprise that Isaac Newton was one of the main villains in Blake’s philosophy, which saw science — particularly fundamental science focused on divining the “laws” of nature — as part and parcel of an inherently repressive political regime hell-bent (literally) on imposing a stultifying order and uniformity on mankind. The old man in “The Ancient of Days” isn’t the God of Genesis bringing form to the Void, but a god of mostly evil — Urizen by name — using that same compass of Newton’s to measure the Void and begin the repressive march of Science with a capital S. And then there’s my personal fave … Blake’s doltish Adam, hypnotized by the Snake as he asserts our most potent means of control — the power of names, aka the power of abstraction, aka the power of symbolic representation, aka the power of Narrative.

William Blake is the OG Epsilon Theory.

Okay, Ben, thanks for the art history lesson. But what’s the point? These ETFs aren’t going to trade themselves, you know.

Yeah, I know. And that’s actually pretty close to the point I’m going to make. But it’s bigger than that, too, and to get there I need to make one more observation about red-tailed hawks, science and social history.

There is nothing abstract about a red-tailed hawk and its mastery of flight. There is no active contemplation and scenario modeling required for Indiana to glide on a thermal, spot a chipmunk sliding through the tall grass, and dive Stuka-like to rend his breakfast with beak and talon. It’s beautiful, sure, in a deadly sort of way familiar to anyone who observes markets or politics for a living. It’s a mystery that a part of my brain would desperately like to solve, double sure. But most of all … it’s REAL. It’s utterly authentic and true. Not only to Indiana and the chipmunk, but to me the Observer, too.

There is no separation from what Indiana IS and what Indiana DOES.

I’m finding this style of writing and framing the market incredibly compelling having only found the site a few days ago. In regards to this blog in particular, I think I may have a few things I must add of note and/or in need of clarification on.

What happened to Icarus was unavoidable. I fail to see the use in telling any young person to not be Icarus. Such a suggestion implies ignorance is avoidable when it isn’t by definition.

I follow the cartoon characterization pretty well I think and see its use. I may have characterized this phenomenon via another term, “kayfabe” in similar contexts before.

By what means might someone employ to “short abstraction?” I’m interpreting this to say “capture the falling value of “abstraction phenomenon” that is going to take place in some near term future context.” I am fully onboard with “long volatility” strategy though for sure.

Bitcoin isn’t Icarus! Phoenix rather! I assume you prefer Gold. Also BTC not as dependent on Silicon Valley as far as I can tell you might be trying to imply but I think I follow the generally false “tech as always good future phenomenon” you may be trying to get at here.

Though I share your desire for employing more people with comparative lit-type backgrounds to the investment space, I don’t know I share your feeling that too much STEM is employed today. I think too many unqualified people claiming to have a stem background may be too prevalent in the space today though. Maybe you’re saying one section of this website is tackling the more narrative approaches while the other discretely tackles the more commonly known as quantitative. Very much an ongoing fan of this project regardless. - Dan

Personally see issues primarily dealing with definition inconsistency/inaccuracy and inefficient resource allocation

Dr. Hunt,

Would you please explain to an idiot what Blake is getting at. “could frame they fearful symmetry?” I know what symmetry is but have no idea what the guy is talking about. Should have stayed awake in that class.

“…I think a lot of people owe Jack Welch an apology.” Where did he come from? Please explain this comment.

I understand your points about hubris being the catalyst for collapse, not systematic bank failure. I think you really hit the nail on the head. Hubris and alienation make a disconnect from reality.

I don’t agree with Mr Schiltz’s comment below that what happened to Icarus was unavoidable. Icarus / youth suffer from hubris and push the limits, sometimes to their peril That seems to the point of the myth. Be careful in youth and listen to wisdom. It’s a warning. If it was inevitable, why tell the story?

I assume you mean by short abstraction companies that sell ideas, a world wide pizza delivery company rather than companies that sell something tangible, establish and essential, say oil, copper, software?

Greatly appreciate a response.

This note has three comments?!? A well-deserved and overdue bump then my dear sirs and madams! The Notes from the Field series feels more or less synonymous with my ET conversion story and I don’t think I would recognize the thinking of the person who existed before these notes came out.

@kendallweihe I wasn’t sure what note it was that came to mind during your comment today in OH but here it is. This seems like Ben’s OG Living Metaverse note several years before the metaverse idea came together in its own series. Language is dangerous in the nature by which it abstracts.

It seems possible that this is also the first introduction of Neb Tnuh…!? The link in this series between the abstraction embodied by Naming and Language with cartoonification and alienation imposed on us by Fiat World still sticks out in my mind as one of those early profound realizations that ET spurred in me.

Thanks for bringing this one back up! There are a couple of fundamental ET ideas introduced here for the first time.