Every successful institution, from a marriage to a superhero to a firm to a nation, needs an origin story.

The origin story of arguably the most successful hedge fund institution of the modern world – Bridgewater Associates – is that of Ray Dalio, working out of a small New York apartment in 1975 and publishing a newsletter of “Daily Observations.” The newsletter came first, not the hedge fund, and it was the compelling strength of Dalio’s writings about markets and what he would later term “the Economic Machine” that convinced a few institutional investors to give him some actual capital to invest. The rest, as they say, is history.

In 1975, Dalio struck just the right chord at just the right time with his metaphor of an Economic Machine – the idea that macroeconomic reality across time and place could be understood as a cybernetic system, with rules and principles and behaviors stemming from those rules and principles (essentially, lots and lots of if-then statements and recursive loops, with observable inputs from real-world economic fundamentals). As importantly as being an effective communicator, Dalio was actually right. Bridgewater has translated the metaphor of the Economic Machine into actionable investments for 40 years, with a track record that speaks for itself.

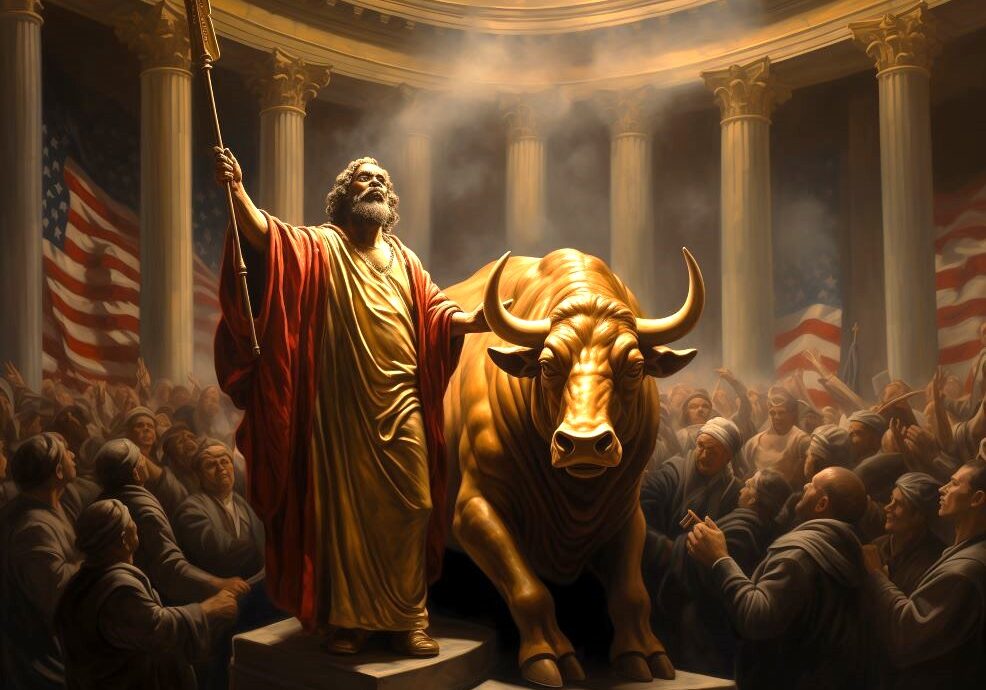

Today I want to propose a new metaphor for the world as it is – a Narrative Machine – where macroeconomic reality is still understood as a cybernetic system, but where the translation of “reality” (all of those economic fundamentals and if-then statements of the Economic Machine) into actual human behaviors and actual investment outcomes takes place within a larger Machine of strategic communication and game playing.

Start the discussion at the Epsilon Theory Forum