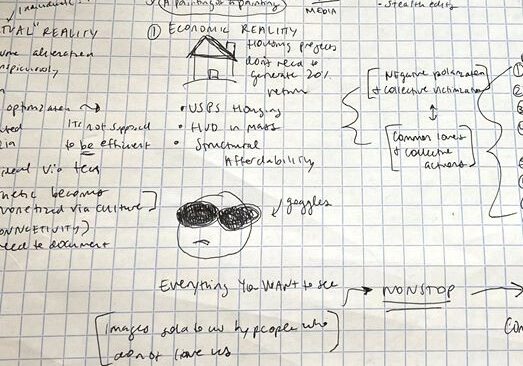

Hello again, ET readers! I have been struggling with a lack of inspiration on the writing front recently. Fortunately, recent events have jolted me out of my creative malaise. Today, I am writing to share a Cartoon I have been sketching.

Meet the Very Serious Investor.

Back in the halcyon days of 2012, during the sturm und drang surrounding the US budget deficit and credit downgrade, Paul Krugman began using the phrase “Very Serious People” to describe politicians he deemed better at sounding serious than developing policy solutions. As another blogger once put it: “being Tom Friedman means never having to say you’re sorry.”

Love or hate Krugman, I’ve always found this a useful little cartoon. Recent events have caused me to extend it to the concept of the Very Serious Investor (pictured above). Very Serious Investors are a direct product of the Wall Street money machine. For the Wall Street money machine greases its gears with credentialism. If you have made your career in finance, you are almost certainly aware that credentialism and its attendant rituals are essential to the smooth generation of fee income.

There is a difference between sounding correct and being correct about a thing. The business of investing (as opposed to the actual act of making money in financial markets) is much more about the former than the latter.

Very Serious Investors, and the discipline of Very Serious Investing, are first and foremost rent-seeking. The Very Serious Investor wears the face of a risk-taker. An optical resemblance to risk-taking is of critical importance to Very Serious Investing. In actuality, Very Serious investing is focused on the extraction of large and (relatively) predictable revenue streams via “heads I win, tails you lose” (HIWTYL) fee structures.

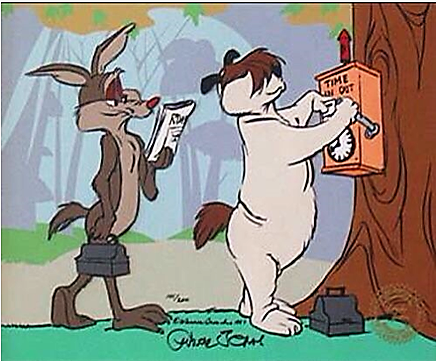

The best thing that ever happened to Very Serious Investors was the transformation of markets into political utilities.

Now, no Serious Investor will ever admit this in conversation. There are appearances to be maintained. There are fists to be shaken at a burdensome regulatory state. Clouds to be shouted at while justifying charging 1.5 and 15 on market beta to LPs (even Very Serious Investors are not immune to some fee compression these days). There are compelling stories about top stock positions to be told.

Through all of this, it is of the utmost importance that the seriousness of investing be conveyed. Investing is not some game to be played. It is not a source of amusement or crass “lulz.” Investing is a science to be practiced by a properly-credentialed, properly-educated, properly-connected professional. Such professionals ought, in turn, to be compensated in a manner befitting their station and breeding.

Thus, the Very Serious Investor is quite disturbed by recent goings-on in illiquid, small cap stocks with high short interests. These happenings represent an assault not only on the Very Serious Investor’s livelihood, but his entire cosmology. For the Very Serious Investor, this offends the natural order of things. Imagine! People placing profitable discretionary trades in the financial markets when they lack even a single Ivy League degree. How dare the plebians challenge their betters?

Ordnung muss sein.

The Very Serious Investor couches his objections in the language of finance.

“stocks divorced from fundamentals”

“inefficient capital allocation”

“significant mispricings in the cost of capital”

By dazzling the unwashed masses with his scientism, the Very Serious Investor endeavors to put them in their proper place. What matters most to the Very Serious Investor is that a particular cosmic order is preserved. A great chain of being with the plebs located somewhere above the oyster and the Very Serious Investors somewhere up near the seraphim.

Yet how often does the Very Serious Investor take to CNBC when his long positions become badly divorced from fundamentals?

How often does the Very Serious Investor bemoan the ways in which explicit government policies of rock-bottom interest rates and permanent liquidity support distort his portfolio’s value?

Where was the Very Serious Investor’s shame when she beseeched the Fed to reverse course on rates in December 2018 after blaming the Fed for the prior four years’ underperformance in every quarterly investor letter?

Where were the Very Serious Investor’s anxieties about the integrity of corporate finance when his airline holdings levered up their balance sheets to engage in reckless and unsustainable returns of capital? Where were her high-minded ideals when she tweeted in favor of an airline bailout?

Of course, to pose these questions is beside the point.

The Very Serious Investor does not care about any of these things. What the Very Serious Investor cares about is money. He can hardly abide when others are making more of it than him. Least of all when those people are his inferiors.

On the other side of the world bad things happen to serious investors who fail to live up to the expectations of society.

https://www.bloomberg.com/news/articles/2021-01-29/china-finance-official-executed-in-bribery-case

A prize spectacle of those with head of the family syndrome.

You know the one, where no-one has told them they are wrong

for so long and if they were told, it merely glanced off

their invulnerable status, that they have no mechanism of mind to deal with it,

throwing the toys out of the pram.

How wonderful is nature, it is soft revenge porn.

No attribution. Ben? Rusty? It doesn’t matter to me, but I figure one of you guys want’s credit. After all, we’re not communists