Called It

Nailed the Narrative

Epsilon Theory is all about using narrative to understand the world and big part of that is predicting what comes next. And we're not above saying "we told you so". These are the notes where we made predictions that (for better and worse) came true.

All The Times We Called It

The MacGuffin, Part 2: The Story Arc of SBF and FTX

The MacGuffin is the object of desire.

It is the thing around which the plot of the story revolves.

Here is the story arc of SBF and FTX, and the MacGuffin that anchored it all – the Magical Money Machine.

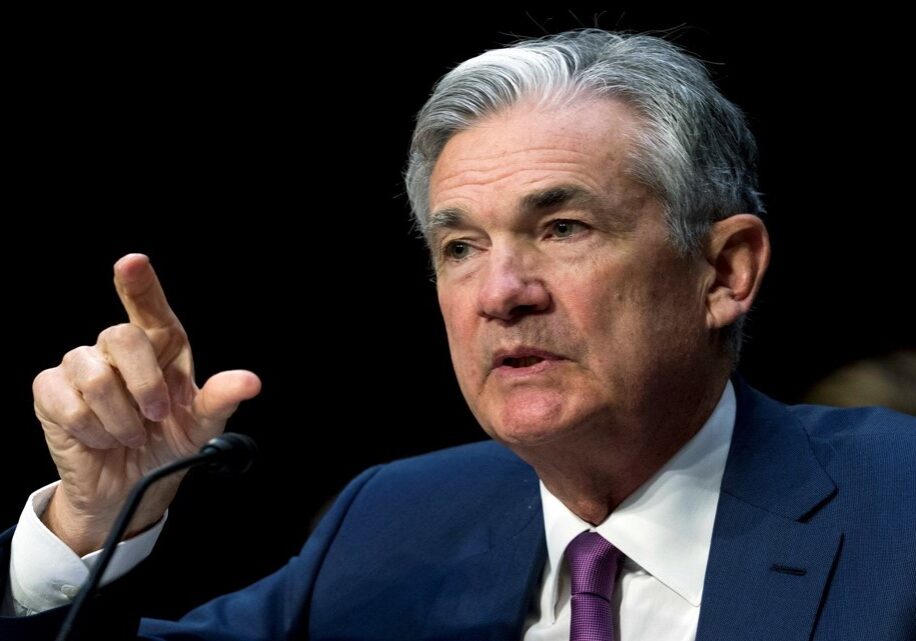

Monetary Policy is Non-Linear

The relationship between interest rates and inflation is non-linear and non-monotonic, and in exactly the same way that the Fed was unable to spur inflation by cutting rates to exceptionally low levels, so will they be unable to contain inflation by hiking rates off these exceptionally low levels.

The Fed first has to get interest rates to this monotonic tipping point before further interest rate hikes will have any appreciable effect in the real economy.

Hollow Men, Hollow Markets, Hollow World

Over the past 25 years, our leaders have intentionally constructed an Apocalypse Now world of proclamation and fiat, where our wealth has grown much faster than our economy.

The bill is due for their hubris, and inflation is here to collect it.

Getting to War

The international “negotiations” over Ukraine are 100% designed for domestic Russian consumption. They are as necessary a part of successfully invading Ukraine as mobilizing troops and tanks.

Enemies Real and Imagined

I think there’s a non-zero chance that the delta-variant becomes something that markets really are focused on. Maybe that happens months from now. Maybe days.

But until that happens, the delta-variant narrative explaining markets is a wall of worry, an artificially easy hurdle to climb for a market that only really cares about a dovish Fed sticking to its transitory inflation story.

I’m So Tired of the Transitory Inflation “Debate”

When a famous person shakes his or her finger at you, they’re not telling you a fact.

They’re telling you how to think about a fact.

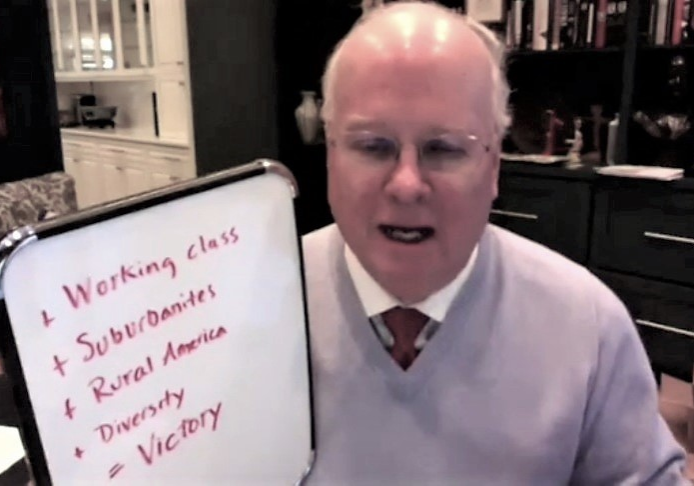

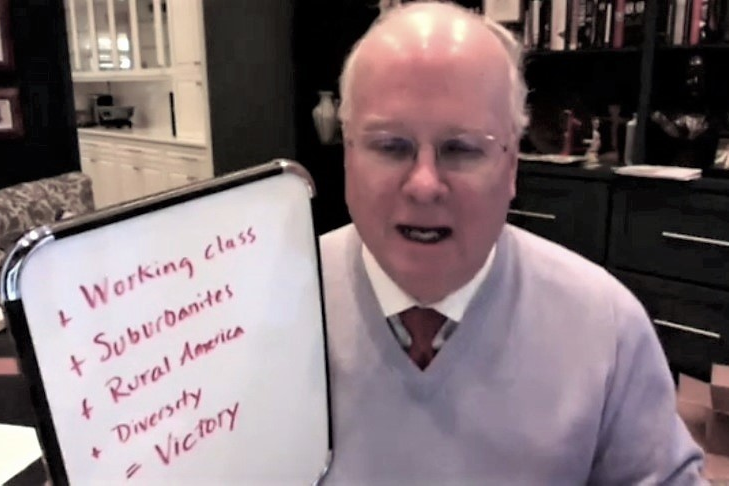

A Working Narrative

The future of remote work after the pandemic ends has been a part of the zeitgeist for more than a year.

Now it IS the zeitgeist. It is also a narrative battlefield being actively conflated with a half dozen other major social and policy topics.

In Praise of Bitcoin

What made Bitcoin special is nearly lost, and what remains is a false and constructed narrative that exists in service to Wall Street and Washington rather than in resistance.

The Bitcoin narrative must be renewed. And that will change everything.

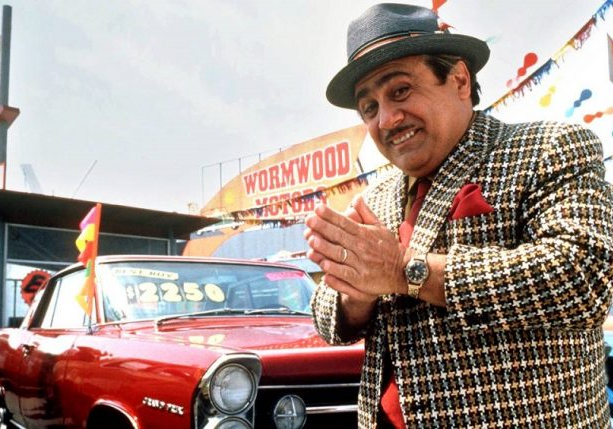

Manheim Steamroller

When we talk about and plan for inflation in our businesses and portfolios, we are usually focused on direction and magnitude. We also usually abstract away from price volatility.

We shouldn’t.

The Third Rail Switch

In the same way that narrative shaped a conversation about the role of police going forward in 2020, narrative can shape a conversation about the role of teacher unions and public sector unions more broadly. My money is still on the status quo, but I’ve been wrong before.