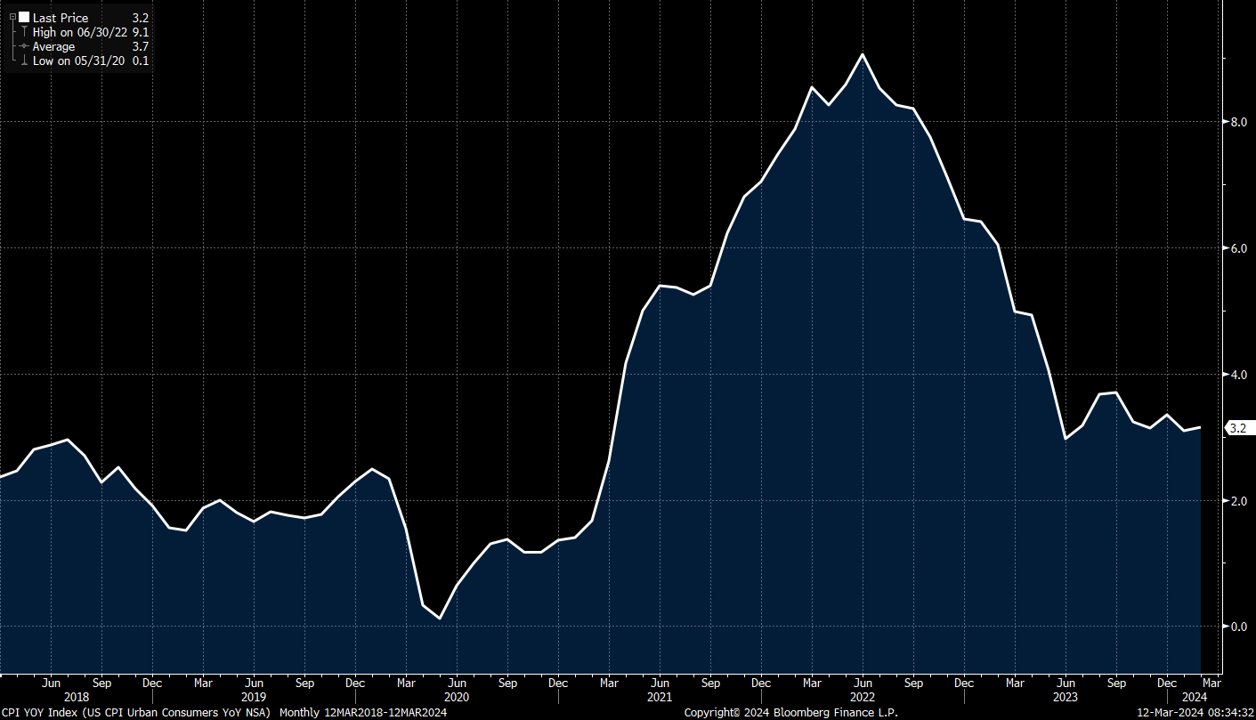

Every month I publish the annualized inflation chart following the CPI release, and every month I get enormous pushback on it.

Corporations are passing through price increases at will, keeping margins and earnings growth strong. Wages are increasing at 4%+. We’re adding 250k+ jobs per month, even after revisions. Rents are now climbing again, +2% month-over-month. There is *massive* fiscal spending flowing through the real economy via use-it-or-lose-it ARPA billions, Bipartisan Infrastructure Bill programs, and the initial Inflation Reduction Act programs.

Inflation stopped going down 8 months ago and we’re about to take off again. I don’t know why this is so hard to understand. Or rather, I do know why this is so hard to understand, because a lot of jobs on Wall Street and in Washington depend on not understanding it.

Including jobs at the Fed. Which I suppose explains their ‘reaction function’ these days.

The White House, The Fed and Wall Street all have a deeply vested interest in “2%, Mission Accomplished!”. And all for very different reasons. Ben, I think the amount of kabooki theatre and fiat language we will see around the CPI reports as we move into the fall is going to blow the October 2012 unemployment report you’ve written about before out of the water. This is the one Axelrod has talked about as being the turning point in the 2012 election.

This was a really interesting comment on today’s CPI report:

A few minutes playing with excel and I see 2% inflation doubles prices every ~ 35 years and 4% inflation doubles prices every ~ 18 years. My naïve self thinks “Are prices doubling every 18 years really so catastrophic?”

I’m trying to understand what breaks if the Fed accepts 4% core inflation.

Ben, is your prediction that it is not going to stay at 4%, but rather is going to spiral up to much higher levels of inflation?

It is very important to consider how inflation is generated. Using the gross domestic income decomposition, 70% of GDP is wages and compensation. If inflation runs at 4%, as today, and RGDP grows around 2%, as today, the 5% median wage growth the Atlanta Fed observes is the largest component of inflation.

If this wage growth is broadly distributed I think the inflation it produces should be tolerated. IMO, 2% inflation and 1% wage growth is worse than 4% inflation and 5% wage growth. We’ve had high wage growth/higher inflation economic environments in the past - late 40s, late 60s and early 70s, and most of the 90s. I think those were better periods for the average person in our country than the slog of the 2010s.

Guy,

IMO, Market recognition that the Fed is waving the white flag on inflation means the first thing that goes is the Bond Market. Bond yields would then HAVE to be at least 2% above that accepted 4% Inflation. i.e. 6% on 10 Year bonds, therefore 8-9% on 30 year mortgage rates.

And that 2% premium over Inflation is being generous as the Demand / Supply outlook for US Tsy bonds is terrible given the size of the Deficits, the size of the existing Debt to be rolled over , the shortness of existing maturities (Way to go Janet Yellen) i.e. the amount of debt issuance is rapidly rising ( e.g. 5 yrs ago the monthly 2 year issuance was $25 Bil, now it’s $63 Bil and rising). And demand is falling as Foreign buyers have been rapidly reducing their US Treasury buying for some time now.

Yet everything I’m seeing is that “the market” (bonds and stocks) still believe that Inflation and bond yields will retreat to pre-pandemic levels.

Thank you Peter.

After the bond market drives mortgage rates up, the high mortgage rates might tank the price of houses, which then puts stress on banks as people default on their mortgages (like the “jingle mail” of the 2008 financial crisis when people posted their keys to their houses back to their mortgage lenders). This in addition to the stress the banks have from bond prices falling, which lowers the value of any reserves held in bonds (although the Fed seem to have magiced that problem away by accepting such bonds today as collateral at future redemption value).

I live in the UK, and here there seems to be a national obsession (including in government) that house prices must never go down. This is probably driven by many stakeholders (all except young people and others who want to buy houses). However I think that a fundamental reason for “house prices can never go down” is that mortgage debt acts as a ratchet on house prices because if house prices go down, then banks can’t sell houses to pay off mortgage debt of people who defaulted, which breaks banks. So mortgage debt creates an ugly constraint on the system, especially for young people. One solution would be nominal house prices staying steady while wages rise, which makes houses more affordable without breaking banks, because debt is a nominal figure that be inflated down in real terms. This might be achieved by adjusting the supply of new housing up or down as needed to keep house prices steady. Granted, that adjustment is hard to implement.

Overall I can understand why some people think that the solution is to stockpile food and ammunition, although beware the prepper motto that warns that you always prepare for the wrong emergency.

What breaks? Banks. Regionals and community banks specifically. Pension funds. Casualty insurance companies. Municipalities.

Good thread to re-read.

Listened to a podcast yesterday (Infinite Loops with Jim O’Shaughnessy) and his guest Jim P?? who has written a book about being an “Up Winger”. The theme is we in the US used “to do hard things” but the myriad of rules and regulations has virtually stifled anything that pushes advancement and ingenuity. Though some things are being created in spite of all the negativity. I couldn’t help thinking just how sclerotic and monopolistic our economy has become based on the financialization of everything, regulatory capture, and regulations favoring giant monopolies. The fact that everything seemingly revolves around the returns of one company (NVDA) and when the Fed will or won’t cut rates is the epitome of this, in reality, very fragile system.