Travis Kling is the Founder and Chief Investment Officer of Ikigai Asset Management, a L/S multi-strategy crypto asset hedge fund. Travis was an analyst at Magnetar and a PM at Point 72 before going down the crypto rabbit hole and founding Ikigai in 2018. He writes an excellent monthly note which you can find (and sign up for) here, and is a superb Twitter follow @Travis_Kling.

As with all of our guest contributors, Travis’s post may not represent the views of Epsilon Theory or Second Foundation Partners, and should not be construed as advice to purchase or sell any security.

So, apparently last month’s main section “A Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”…was quite a doozy. I’ve been writing these for a long time so I think I have a decent sense of when I write something above or below the average of all the monthlies I’ve written previously. And I knew the one last month was a good one when I wrote it. But even I underestimated how much “A Lack of Pretense…” was going to strike a chord with folks. Because when I turned the main section into a tweet thread, it went properly viral – 2k+ bookmarks, 500k+ views. Big numbers for content that meaty. But it wasn’t just the raw numbers of the response, it was the qualitative characteristics of the response. The thesis REALLY resonated with people. I received many dozens of responses through numerous avenues (Twitter comments, reposts, DMs, Telegrams, text, email, podcasts). By my estimate:

- 80% of the response was strong agreement (with varying levels of begrudgingness);

- 10% was “you don’t know what you’re talking about”; and

- 10% was some form of pushback/disagreement (with varying levels of thoughtfulness).

I did two podcasts in the weeks that followed unpacking the thesis further – you can listen/watch here and here.

Probably the topic within the thesis that garnered the most discussion was the concept of “financial nihilism” – the idea that cost of living is strangling most Americans; that upward mobility opportunity is out of reach for increasingly more people; that the American Dream is mostly a thing of the past; and that median home prices divided by median income is at a completely untenable level. You can click this link and spend 10 mins scrolling through the mentions of “financial nihilism” on Twitter over the last few weeks. It would be 10 minutes well spent.

Given how much discussion this concept sparked and how deeply it resonated with folks, this month we will unpack Financial Nihilism in more detail. To begin, it is not my term. Credit belongs to Demetri Kofinas, the host of the Hidden Forces podcast. He first introduced the concept at least 2 ½ years ago. Financial Nihilism goes hand in hand with Populism – a political approach that strives to appeal to ordinary people who feel that their concerns are disregarded by established elite groups. Populism is a topic I’ve discussed numerous times here in the past, perhaps most pointedly in my February 2021 monthly about Gamestop. The underlying drivers of Financial Nihilism and Populism are the same – this system is not working for me, so I want to try something very different (e.g., buy SHIB or vote for Trump).

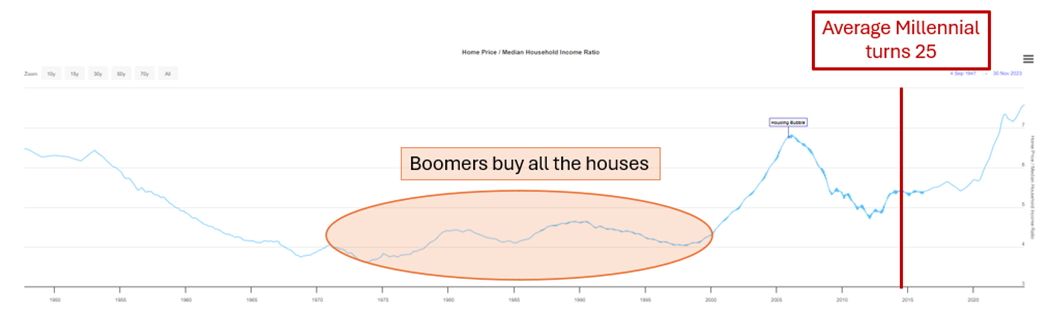

How would you go about characterizing the drivers of Financial Nihilism? As previously mentioned, the chart of median home prices to median household income is the single most emblematic symbol of Financial Nihilism in my opinion.

Shown below with a couple annotations –

You can see Boomers (and GenX) bought all the houses at about 4.5x annual income. Then subprime lending fueled the housing bubble and the bubble collapsed. Not long thereafter, Millennials entered the workforce and got to the point where they could start buying houses at ~5.5x annual income. Then Covid happened, the Fed printed $6 trillion, and now houses are 7.5x annual income, much higher than even the peak of the housing bubble. Simply out of reach for many millions of Americans under 40. The numbers just don’t add up.

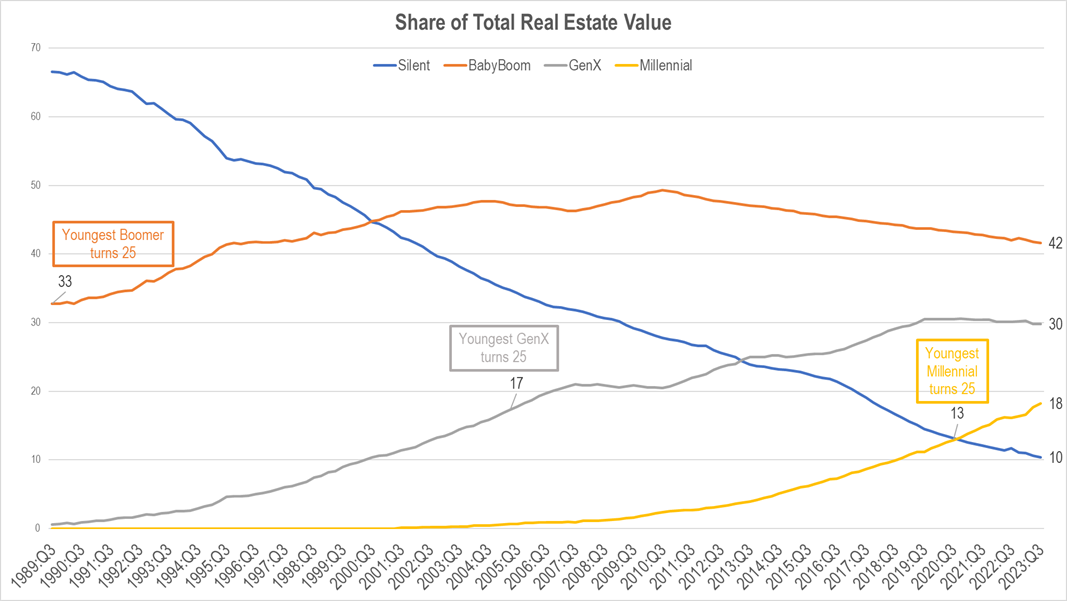

We can drill down into this real estate situation further. Shown below is the share of total real estate value by generation in the US-

From 1989 to 2023, the total value of US real estate held by households went from $7tn to $45tn, nearly a 7x increase. In 2020, when the youngest Millennial turned 25, Millennials held 13% of total real estate value. In 2005, when the youngest GenX turned 25, their share of housing wealth was 17%. And in 1989, when the youngest Boomer turned 25, they already had 33% of total real estate value. Kind of a raw deal for the current generation of young folks, right?

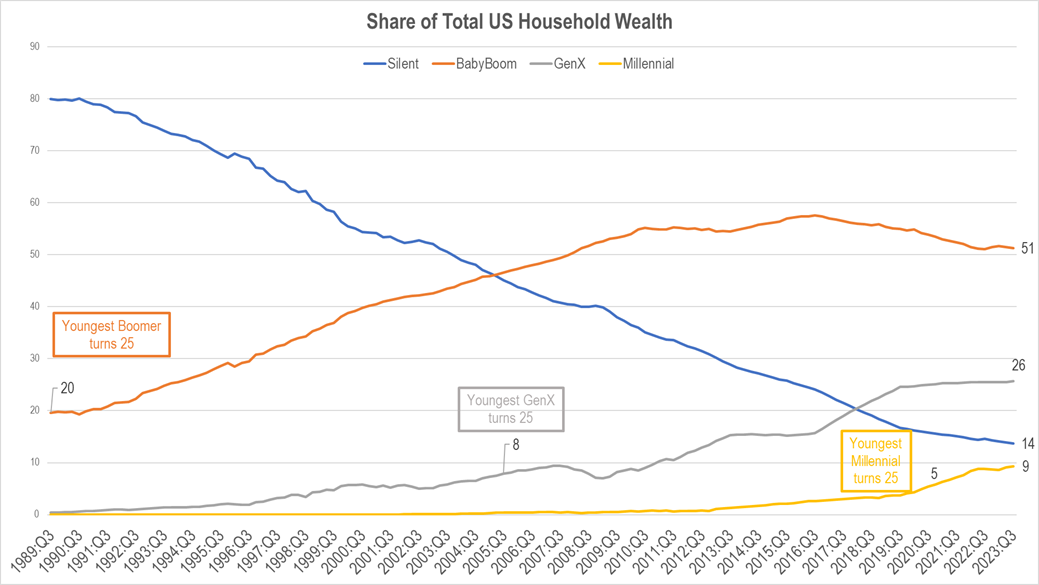

Let’s keep going though. Here’s the distribution of household wealth by generation. Similar type of chart as above, but looking at total net worth vs just real estate –

From 1989 to 2023, total US household wealth increased from $20tn to $143tn, a 7x increase.

Drilling down into these numbers, the rise of Financial Nihilism among young people is hardly surprising. In 2020, the youngest Millennial turned 25, and Millennials had a paltry 5% of total household wealth. Compare that to GenX – in 2005 the youngest Gen X’er turned 25, and their generation had already amassed 8% of all household wealth. Then compare that further to Baby Boomers – in 1989 the youngest Boomer turned 25 and by that point the Boomer generation had gathered 20% of total household wealth. Maybe they got that from making coffee at home and skipping the guac at Chipotle!

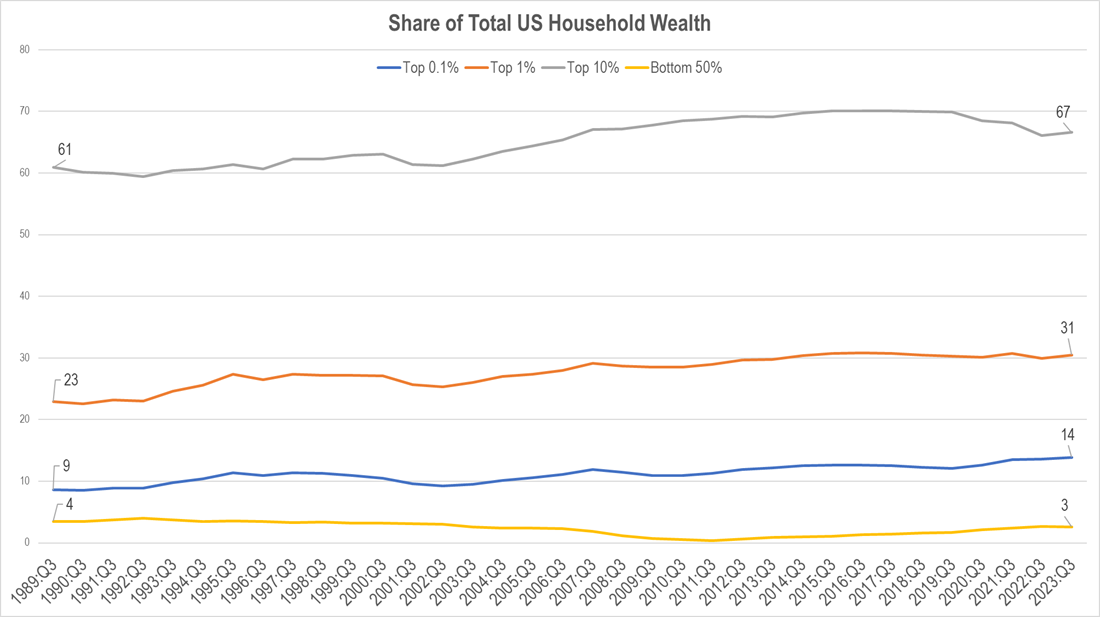

Looking at these statistics from wealth percentile instead of generation is equally as discouraging-

Again, total wealth over this time increased 7x from $20tn to $143tn. The top 10%, top 1% and top 0.1% all saw big increases in their relative share over this timeframe, while the bottom 50% actually lost a little ground. Literally watching the rich get richer while the American Dream of upward mobility slips out of reach for the majority. Tough.

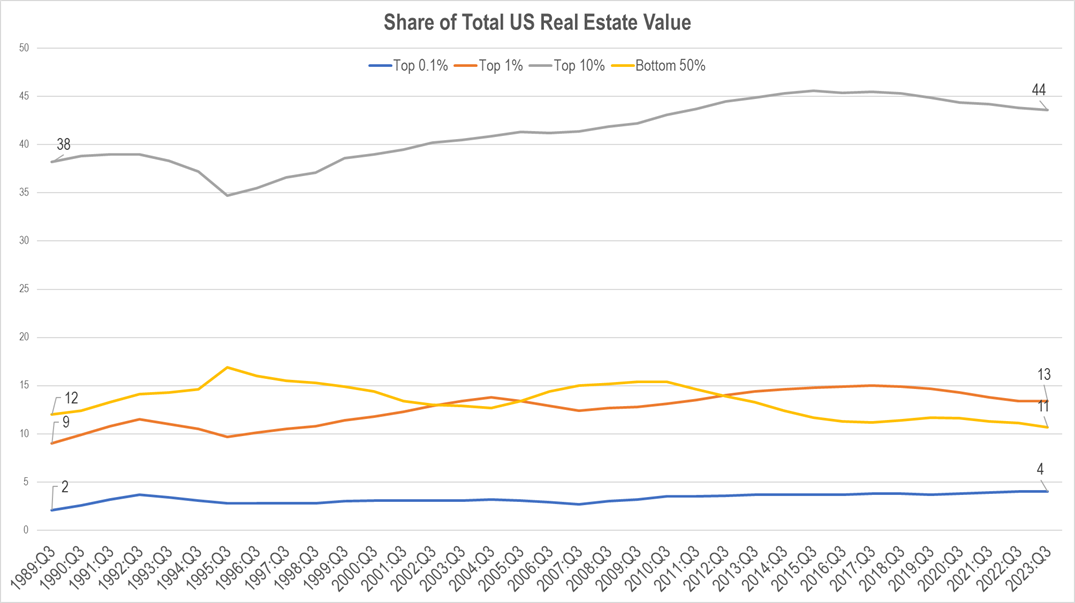

Looking at the same analysis for real estate value yields a slightly different looking chart but with the same results –

The whole pie grows $38tn over this time, and the rich get richer while the Bottom 50% actually lose ground.

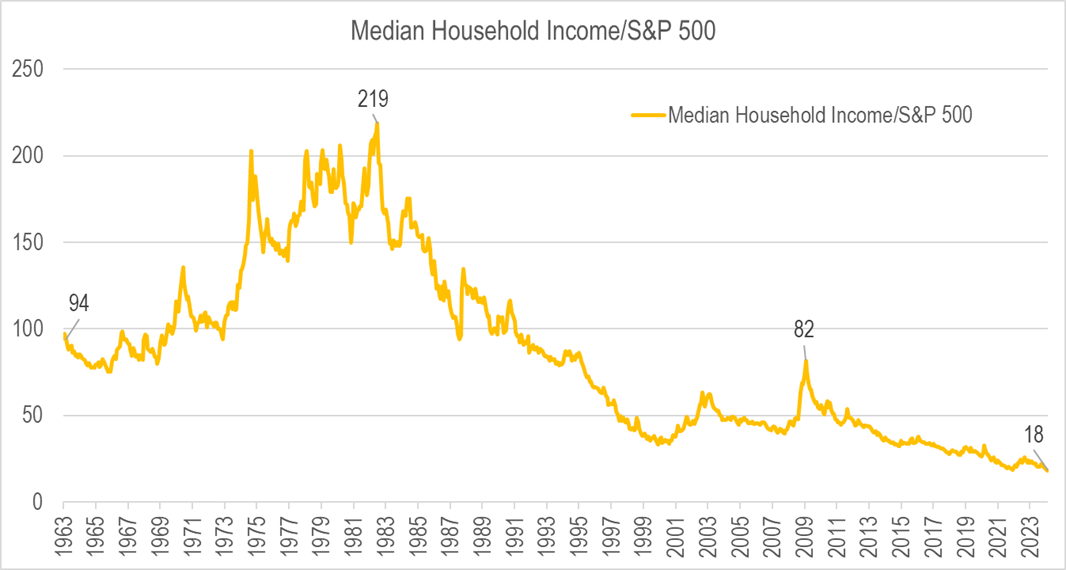

I’ll give you one last chart to prove my point before we move on. Below is the ratio of Median Household Income to the S&P 500. Think of it as, “how many shares of the SPX can I buy with a year’s worth of median income?”

Again, it paints a tough picture. Back in the early 60’s you could get 94 shares of the SPX with the median household income. That peaked in the crash of 1982 at 219 shares and then structurally collapsed. The stock market is getting less and less affordable for the average American.

That’s the setup. The Boomers have all the money. The rich have been getting richer while the poor are getting poorer. The American Dream of upward mobility has been slipping out of reach for increasingly more people. Why do you think Oliver Anthony exploded out of nowhere into such popularity? That is Financial Nihilism. So if you’re like the large majority of Americans and you’re on the wrong end of this, what do you do about it?

You take bigger risks. You feel driven to take bigger risks to try and leapfrog from your current financial position (mostly paycheck to paycheck; buying a home feels nearly impossible; saddled with student loans; salary increases not keeping up expense increases) to something more tenable. More comfortable. More baller.

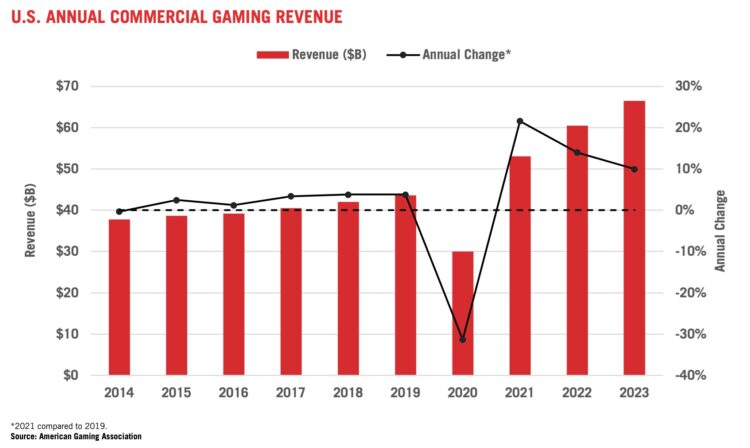

So you gamble. You. F**king. Gamble. You look anywhere, for anything, that can give you a 5:1, 10:1, 50:1 type of payout. Naturally, you look to literal gambling, which is growing at a breakneck pace-

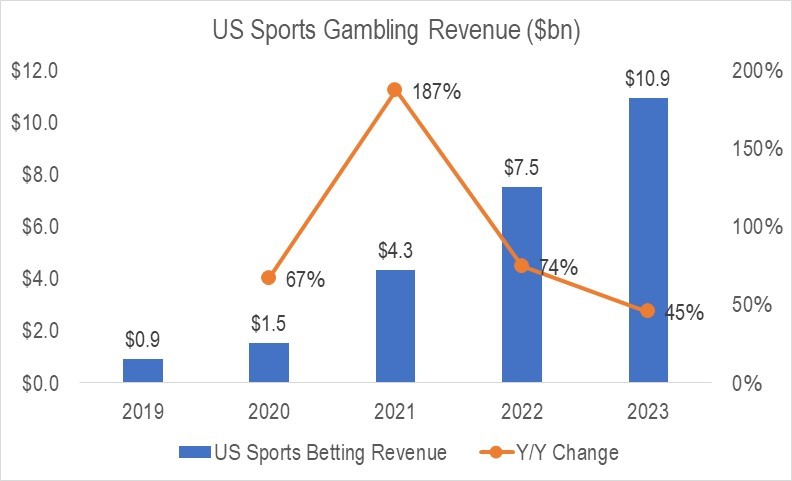

Within gambling broadly, you look to sports gambling which is now available on your phone while you’re sitting on the couch. Incredible growth rate –

By the way, this year’s Super Bowl? Smashed betting records-

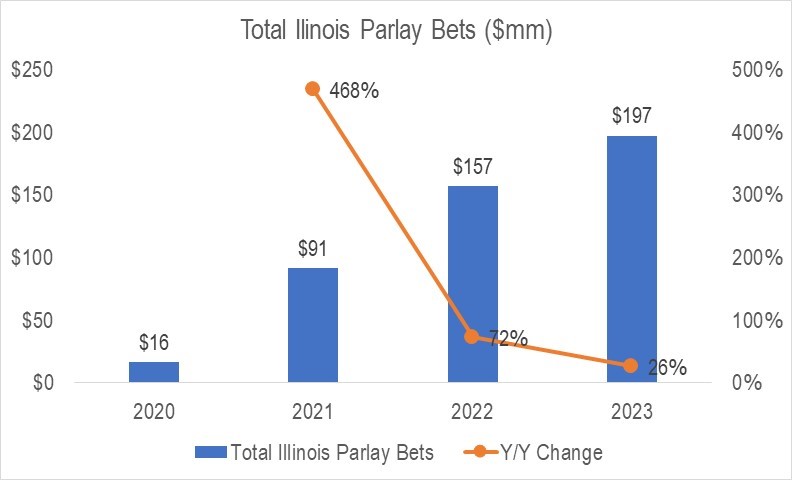

Going even further towards Financial Nihilism, you could look at the rise in the popularity of parlay bets, which include winning multiples of your original bet if you correctly win all bets made in a multi-bet series.

The state of Illinois was the only source I could find that had parlay-specific data going back multiple years. But that insane growth shown in the chart above is indicative of the growth in popularity of parlays broadly. And as a reminder, these are bets where the “house odds” are better than regular bets, even while the potential payoff is much higher. When the numbers don’t add up, might as well swing for the fences even when you’re more likely to strike out.

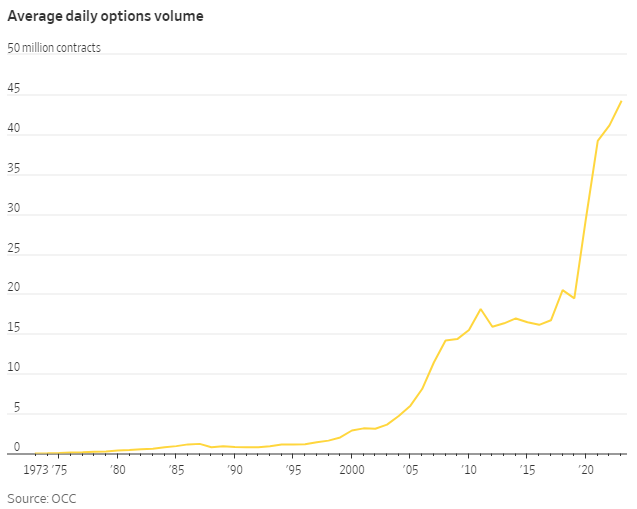

You know what parlays are kinda like? 0DTE options – options that expire the same day they are bought. Like parlays, 0DTE options offer higher probabilities of loss while offering potentially multiples of upside. Oh yeah, and either way the outcome occurs the same DAY you place the bet…err umm, same day you “make the investment”.

You know what 0DTE options popularity has been doing lately?

0DTE popularity has doubled since Covid. That’s a growth rate that looks familiar, right? Between 2016 and 2023, 0DTE trading increased from 5% of total SPX options volume to 43%.

The evidence for the rise of Financial Nihilism is all around us. Think about the cultural movement that was WallStreetBets, DeepFuckingValue, Gamestop, AMC, Bed, Bath & Beyond, Blockbuster. They cranked out a Seth Rogen movie in like EIGHTEEN MONTHS. That’s how top of mind Financial Nihilism is.

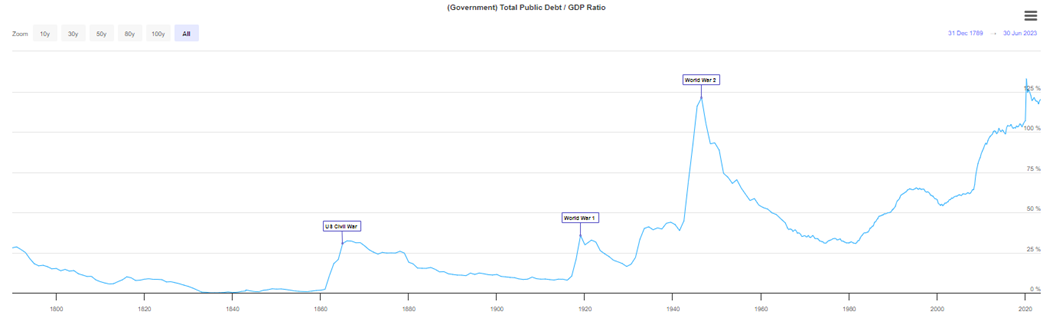

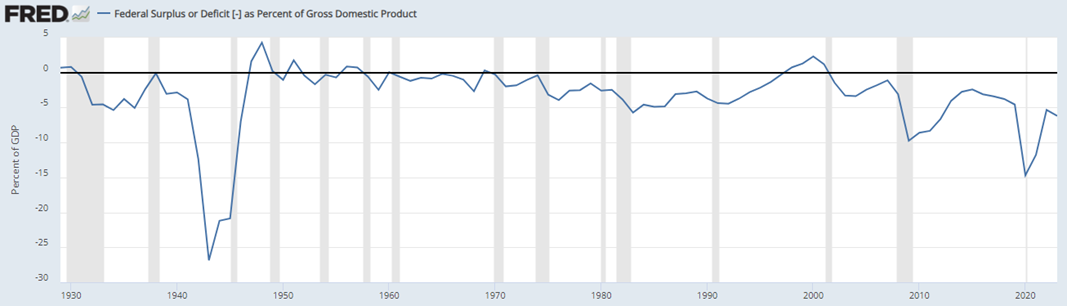

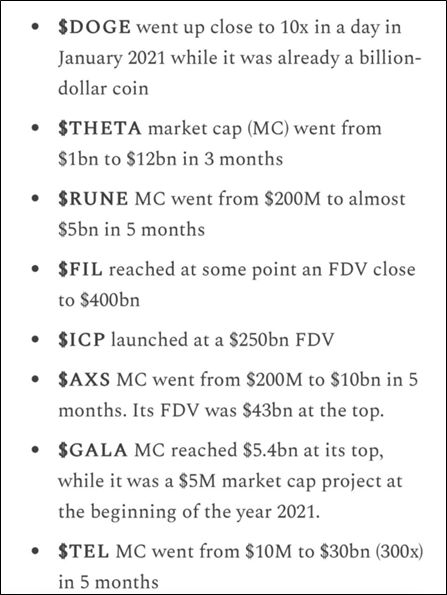

One more thing to add, and then I’ll bring this all back to crypto. Those individuals choosing to act out Financial Nihilism are doing so in direct response to, and in imitation of, the monetary and fiscal policies of the Fed and the US government. Those monetary and fiscal policies have been a major driver of wealth inequality both through generations and wealth percentiles. The US government has been egregiously irresponsible. Makes a poker player look like Dave Ramsey. I’ve talked about this for years here, but I’ll give you a couple reminders-

US been wilin’ with the dollar lately. Bitcoiners were on to this before anyone else. When the government is acting crazy, you might need to do something crazy in response – a 5-leg parlay, 0DTE TSLA calls, or long magic internet money – because the money printer has been, and will continue to, go brrrr. This causes asset price distortions of all sorts. This causes risk-taking distortions of all sorts. You’d be foolish to think otherwise.

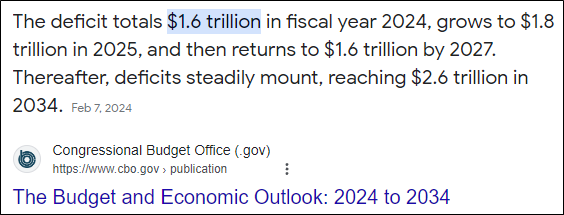

Which brings us all the way back to crypto – the Roman Colosseum for asset price and risk-taking distortions. We will do some stuff that makes 0DTE Tesla calls looks like gold sitting in Fort Knox. Our Memecoins do numbers that make the Memestocks look like the DXY-

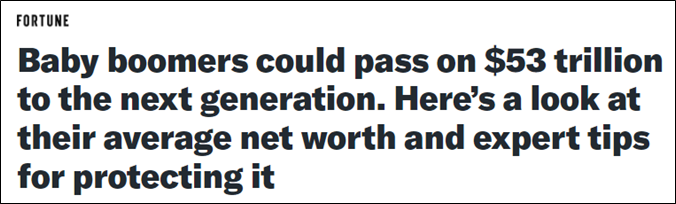

Importantly, crypto is a populist movement. A countercultural movement. A YOUNG PERSON’s movement. Boomers don’t get it. It’s “our” thing. It’s the one thing we can actually beat Boomers at (so far). Regardless of whether Boomers show up to crypto now, in the coming years, or not at all, eventually they will leave this world behind for that big country club in the sky. And their assets, which are tremendous –

…will pass down to the next generation. What is going to come of those assets? More gambling. More 0DTE options. More crypto. Be honest with yourself. Run this whole thing out 20-30 years. What do you honestly think it’s going to look like? Like if Dave Portnoy and Ready Player One had a baby.

So What?

I wrote this month’s main section about Financial Nihilism because I believe the concept is such a key driver of crypto price action, and because it struck such a chord with folks last month. I hope you understand it now better than you did a few minutes ago. I feel like I understand it better now than I did when I started writing this. I’ve come away with the view that Financial Nihilism is strong and getting stronger. It’s a feeling that’s pervasive in American society (and abroad). Financial Nihilism is a major driver of crypto price action, you can argue it’s getting even stronger, and it will be with us in a major way this coming cycle.

You can wish that weren’t the case. You can wish the crypto market would be more sound-minded. More sober. More focused on providing solutions to real problems. More rooted in reasonable valuation methodologies. Less bubble-ish. But I believe those wishes will be left ungranted. At least this cycle. There’s good reason to think this market is going to shitcoin harder than ever this cycle. That there will be an even greater “Lack of Pretense That Any of This Shit Does Anything or Will Ever Do Anything”. That we will blow an even bigger bubble and subsequently collapse an even bigger bubble. The drivers of Financial Nihilism and incentive structures that come along with it are simply too overwhelming. Act accordingly.

I’ll have to read later today —but I’m so looking forward to it.

I think this is a very well timed piece. Another recent piece, and much active conversation in the forum, paints a narrative that the existence of smartphones and dopamine hits is the root cause of behavioral changes in young people.

And Kyla’s piece included the idea that the existence of the vibecession should be very confusing.

As this article highlights, I have seen strong evidence since at least GME that if one finds the vibecession and associated nihilistic behavior confusing then one might be more on the elite side of the elites vs deplorables spectrum than one realizes.

I think the generational appeal of the phones narrative vs the generational appeal of the financial nihilism narrative is easy to map stereotypically and so it is difficult to avoid. I am interested to see if this will show up in either engagement with or opinions about this article relative to the phones. These cyclical forces are a story as old as culture. I always feel some guilt in pointing out the demographics here, but I don’t see how the community can have a chance at sensemaking without self awareness.

As someone stuck in the middle of these generational forces, as is often the case I think ‘AND’ has to be the correct answer. But in the narrative space I’m exposed to I see narrative control as heavily weighted toward the elder generation’s stereotypical biases; I think this provokes me to verbalize more often in defense of the younger generation.

I think another ‘stuck in the middle’ phenomenon is that I have also learned via experience of another way to approach this Bust-Out conundrum. And it is also heavily tinged with nihilism and the opportunity for alienation. Essentially, at any point since I understood the stakes of the macro situation I could’ve gambled my soul by pursuing membership in the professional/managerial caste. In terms of efficient and productive use of my time I find this caste to be mostly useless. Yet at any point I could attempt to join it and better my chance of vertical mobility. The opportunity to embrace such alienation is a siren call that will never end unless the Long Now ends first.

I am reminded of my observations as I started my career in the mid-1980’s. The portfolio managers who controlled the vast majority of the capital and decisions had cut their teeth in the prior 20 years; with inflation, double-digit interest rates, low P/E’s, a bank trust set of price-setters, and a Dow Jones (the index of the day) that cycled between 600-1000 for the majority of their careers. None of that muscle memory was instructive to navigating 1982-1999. I see similar dissonance with the predominant advice of the recent past and present elevating asset allocation to the pinnacle of financial practice. It is grounded in math, logic, believable forecasts, risk reduction, and client comfort. But, it has not confronted the changed market structure, particularly share buybacks, and the fact that valuation has come to mean nearly nothing in the financial markets other than during brief episodes of cyclical credit stress. The nihilism of so many price setters, both individual and corporate, with their flow cannot be dismissed. Ignoring it has, and will continue to compromise investment performance.

nihilism /nī′ə-lĭz″əm, nē′-/

noun

“nihilism in postwar art.”

This, imo, is nothing new in the history of human civilization. Interesting that I find myself as an aging boomer taking deep dives down this rabbit hole and finding serenity. It’s been gradual over my lifetime and fortunately I have always found the way out, humbled but not humiliated. I have no idea why.

I see the existential fear invoked by nihilism in myself, and both sides of the political, religious and economic spectrum. We want the ‘water’ in which we swim to be certain. Well, imo, it’s not, never was. Jacob Bronowski, fifty years ago discussed a vital but neglected characteristic of science: that ‘‘all information is imperfect’’, and ‘‘our ability to work and act in the real world depends on our accepting a tolerance in our recognition and in our language’’.

Jacob Bronowski's principle of tolerance - PubMed.

For much of my life I was hung up on worshiping words given to me by my tribe. And I must say that I benefited by them even though I spent a lifetime questioning them.

Thanks Ben for adding this post. I look forward to the comments.

Packer Jim

The Boomers have all (most) of the money and the assets. They have a small and shrinking share of the labor.

The pendulum has reached its apogee.

The Boomers will trade their money and assets for labor before they die. The financial claims they created by voting themselves tax cuts without spending cuts are included in this trade. Later, we will call this inflation and financial repression.

I think the pressure to gamble is more Raccoon-ish Millenial and X-er cross sectional behavior than Boomers vs. the rest, but rest assured the Boomers will not be the first generation to manage to “take it with them”.

Yes! The balance between Capital and labor is a swinging pendulum throughout history.

Agree entirely with your premise about what’s behind the “gambling” — wealth inequality (aka late stage capitalism wherein Capital begets the Capital).

Forgive me taking this starting point in a different direction for a moment:

First: It seems clear that our official measure of inflation, CPI (and its permutations) do not reflect the lived experience of the typical American. Our cost structures are going up, regardless of what the official measure of the cost of a basket of goods is. We’re layering Amazon Prime + Apple Music + Spotify + ParamountPlus + MAX + Hulu + Netflix + Microsoft365 + Adobe + Quicken + Doordash + Walmart+, + Costco membership + Peleton or Soulcycle + XM Radio, etc. Not to mention ever increasing square footage of homes and the cost of maintaining said home.

I have a thesis that econometrics typically used by Wall Street and the traditional economic practitioners reflect the aggregate economy, but the “real” economy in the US should be thought of on a capital weighted basis. Let’s call it the Capital Weighted Economy. In this economy - the [40%] of the population who controls [90%] of capital in the country is experiencing a different economy than the [60%] of the population who controls a small fraction of the capital. In this note - as evidenced by who owns the Real Estate. Capitalism’s principal of Capital-Begets-Capital at work…Philosophically, this can’t continue indefinitely because in its logical endgame of populism, the pitchforks will come out to self correct…going back to Plato on why a straight democracy isn’t stable as the have-nots will eventually vote to take from the haves…but that’s just a fun macro aside and outside the scope of what I’m trying to articulate here. While it feels we’re well along that path – my analysis is that in this Capital Weighted Economy, the mean and the median experience across the population across various important aspects of society are diverging. And Mean is of course a “capital weighted” figure. The so what? The wealth effect is far larger than understood by traditional econometrics. Those who hold (control?) the lion’s share of the capital are doing just fine, and the financial nihilism is justified among those who don’t have the privilege of a personal balance sheet.

In the capital weighted economy, those with the capital can absorb the higher cost structure of life. The spending by those with the capital and corporate revenues from those who’s customers have the capital reflect this. It’s a different way of thinking about the wealth effect. And those who don’t have the capital…gamble?

What does the backside of this dynamic look like? Feels to me that the wealth effect is largely misunderstood, or understood using an historical framework that won’t be so relevant in the future. Feels like a very unstable equilibrium to me.

The other “fun” aspect of your household income based charts is the generational change in the definition of household. At some point within the last 2 generations The average # of adult providers in a household went from close to 1 to much closer to 2, making your charts using household income that much more horrifying in comparing current generations with those of the past.

I think another aspect of financial nihilism is the prospect that households, by necessity, are going to blow past 2 and eventually get closer to 3 or maybe even 4 as adult family members are forced to shelter together to survive.

As much as most people love their parents, the motivation to not live with them in their old age is strong.

Consider that within the last couple of generations we’ve also gotten virtually ubiquitous labor saving products (vacuums, dishwashers, washers and dryers, microwaves) and services (take-out food, daycare and preschool, maid, yardwork, and home repair). In other words, for most households there were always 2 adult providers, it’s just that one of them had to work around the house.

When it comes to additional adult providers - this is a bit like Keynes’ dictum of “if we can make it, we can afford it.” There’s enough housing for everyone in this country already, and we are adding a few million units per year. With the US’s current demographic path, how could it get so crowded that 3-4 adults usually have to live together?

Let’s add insult to injury. There are millions of homes that are short term rentals, or second/third/fourth homes which are not part of air bNb and are occupied only a few weeks a year. I attempted to get data on this but it’s either old (2018) or of unknown (to me) reliability.

Channeling the “it’s more just” line from Dr. Zhivago now