2022 was our ninth year of publishing Epsilon Theory. It was also our best.

- We were early and we were right about the embeddedness of inflation and the inability of central banks to control it.

- We were early and we were right about the Russian invasion of Ukraine.

- We were early and we were right about the collapse of the crypto trading world.

- We’re changing the way investors see stock buybacks and director accountability.

- We’re changing the way all of us see the water in which we swim – narratives.

We published 35 long-form Premium notes and 36 additional Professional reports in 2022, adding to our library of more than 1,000 evergreen articles. We recorded 25 new podcasts and notes-on-tape, and we met for live Zoom calls every Friday. Our subscribers wrote 6,000 new posts on the ET Forum across more than 300 threads in 2022. We had half a million unique visitors to our website, reading more than a million long-form notes.

And we’re just getting started.

Watch from a distance if you like, with our free ET Intro subscription.

But when you’re ready to join a community of thousands of truth-seekers from all over the world and from all walks of life, speaking to each other with respect and learning from each other with trust, please consider a Premium or Professional subscription.

Clear Eyes. Full Hearts. Can’t lose.

Embedded Inflation and the Inability of Central Banks to Control It

Throughout the year, and continuing a theme we launched four years ago, we wrote extensively on the embeddedness and non-transitory nature of inflation here in the pandemic bubble, as well as the inability of central bank tools to put the inflation genie back into its bottle.

The basic problem for the Fed is this:

In exactly the same way that the Fed was unable to spur inflation by cutting rates to exceptionally low levels, so is the Fed unable to curb inflation by raising rates off those exceptionally low levels.

Unfortunately for the world, monetary policy is non-linear.

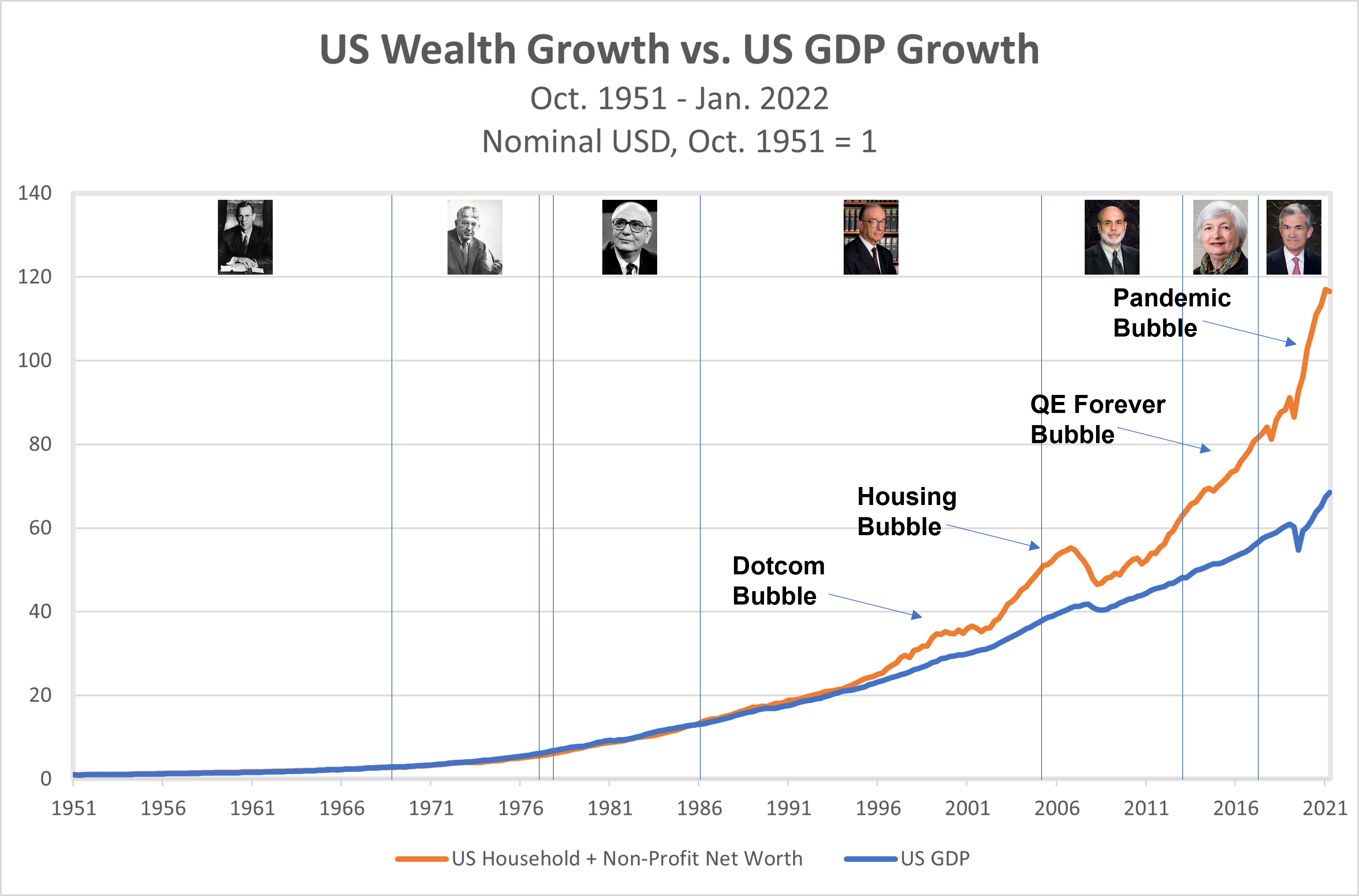

It’s not just that the Fed has to raise rates far higher and for far longer than they thought would be necessary to put the inflation genie back in the bottle, but it means reversing 40 years of an intentional monetary policy program that increased our wealth faster than our economy grew.

That sort of reversal is painful to say the least. It requires crushing asset prices. Honestly, I don’t think it’s possible without another Great Recession, and I don’t believe the political will exists to do that. It’s all part of our Hollow World.

What happens when interest rates go up far higher for far longer? What happens when a 40 year policy is not just halted, but actively reversed? Something breaks.

The near collapse of UK pension funds and the UK sovereign debt market is just the canary in the coal mine for 2023.

The Russian Invasion of Ukraine

Based on our analysis of domestic Russian media, we wrote in January that Russia would not stop with ‘international negotiations’ or a limited war, but that the Kremlin was preparing its citizens for an all-out attack.

For 2023, we have added domestic media from Russia, China, Iran, India and many other countries to our Narrative Machine.

The Collapse of the Crypto Trading World

We called out the corrupt and fatuous crypto ‘revolution’ back in May, highlighting Sam Bankman-Fried’s central role.

And then we chronicled the FTX collapse and the design of Bankman-Fried’s fraud better than anyone.

Sam Bankman-Fried’s con was old Wall Street wine in a new crypto trading bottle.

The lesson for 2023 is recognizing the next one.

Stock Buybacks! TM

I love stock buybacks, but I despise Stock Buybacks!™ – the issuance of new shares to management with one hand and the buying back of those shares with the other.

The ultimate culprit in this trillion dollar transfer of wealth from shareholders to managers is the entrenched board of directors that works hand in hand with self-dealing management.

Here are specific proposals for 2023 to break the crony circle and reclaim a better narrative for capitalism.

Narrative Early Warning System (NEWS)

At the core of our research is a new science of narrative, built on a foundation of linguistics and biology. Our goal is to understand the structure of narrative, so that we can identify the weaponization of language in service to the Nudging State and the Nudging Oligarchy, and so that we can defend ourselves from these narratives of control.

These are the notes we published in 2022 that define us. Start here, with An Inconvenient Truth.

And continue with our cornerstone 2022 series, Narrative and Metaverse.

And here’s where it all comes together in 2023.

We’re building a Narrative Early Warning System (NEWS) to help inoculate ourselves against the weaponized narratives of Big Tech, Big Media and Big Politics.

This is how we change the world.

With cutting-edge research and applications like NEWS.

With our first international conference this spring in Nashville, Tennessee to celebrate the launch of the McGee Applied Research Center (ARC) for Narrative Studies at Vanderbilt University.

With dozens of notes and articles that help you see the world more clearly.

With a community of thousands – the Epsilon Theory Pack – that help you engage with the world more fully.

We are Second Foundation Partners, and we invite you to join us!

A lot of organizations will say it’s been their best year yet. I don’t know that it’s always true. But without question 2022 was the best year Epsilon Theory has ever had. And that’s tough to say, because 2016 was pretty incredible. 2018 was even better. Things Fall Apart probably changed more about the way I look at the world than anything I’ve ever read. and yet…2022 was was something altogether different and better. And I know what it was that made it so special.

The Pack. This forum. This place where we gather to discuss the notes and share our reactions and our stories. This place where we create our own topics and engage with each other in a way that I haven’t seen anywhere else on the sandblasted Hellscape of the modern internet. I’ve learned so much from the people here. With very few exceptions disagreements have been civil and have lead to more understanding of others and their respective positions. If social media operated this way there would be no need for ET to exist.

But of course the world outside of these gates is a mess, awash in rage and animus. But here in this place we have proven–if only to ourselves–that the world needn’t be the way it is. (I think that Saint Hippo guy had a quote about anger and courage and changing the world, but somebody fact check me on that)

You may be thinking of:

“Hope has two beautiful daughters – their names are anger and courage; anger at the way things are, and courage to see that they do not remain the way they are.” – St. Augustine

Amen, DY, amen! It’s changed my life.