The MacGuffin, as Alfred Hitchcock famously put it, is the object of desire.

It is Prince Charming. It is the Princess Bride. It is the Way Out. It is the Way In. It is the Secret. It is the Answer to the Question. It is the Ring of Power. It is the Alien Technology. It is the Map. It is the Treasure. It is Whodunit.

It is the thing or emotion or idea or state of being around which the plot of a story revolves, and every movie you have ever seen, every scripted TV show you have ever watched, they all have a MacGuffin.

So does your life. Your life has MacGuffins, too.

One of the oldest and most powerful MacGuffins is the Magical Money Machine.

The Magical Money Machine is Draupnir of Norse mythology, the golden ring of Odin that would make eight perfect copies of itself every nine days. The Magical Money Machine is the straw-into-gold spinning wheel of Rumpelstiltskin, an evil protagonist in a story that dates back 4,000 years. The Magical Money Machine is the genie of the lamp, the purse that has a few gold coins in it every morning, the goose that lays golden eggs. The Magical Money Machine is a reasonably common MacGuffin in today's movies, like the supercomputer of Westworld and the superintelligence drug of Limitless. But the best place to find this MacGuffin today isn't in Hollywood but on Wall Street. Because once you start looking for the Magical Money Machine in financial media and financial advertising and, most prominently, in the stories that we financial professionals tell ourselves, you will find it EVERYWHERE.

Oh sure, we citizens of Wall Street know full well that of course there's no such thing as a Magical Money Machine, and when we talk with each other in public we laugh at the idea of a Magical Money Machine, like 'oh, haha, get a load of these rubes who believe in this nonsense'. But in private we whisper our heart's truth, that there is such a device. Because the human truth is that deep down in every single one of us who makes our living in the financial world, we believe that there IS a Magical Money Machine and that if we just look hard enough or get lucky enough we will find it. I know that I do. Intellectually I know that the Magical Money Machine doesn't exist, that it can't exist, and yet ... this is the MacGuffin that has driven the story arc of my professional career. Actually, that's not completely true. The truth is that I've been searching for the Magical Money Machine for as long as I can remember, ever since I was a child. It is the MacGuffin of my life.

Once upon a time, Sam Bankman-Fried found a Magical Money Machine he called Alameda Research.

Or at least he thought he had found a Magical Money Machine. I've known that feeling (briefly!), and it's the best feeling in the world if that's your life's MacGuffin, as I suspect it is with SBF. Not for the money itself, mind you, but for what you can DO with it. And not even for what you can do with it, but just for knowing that YOU solved the biggest puzzle in the world.

But the feeling doesn't last because, alas, you did not actually find a Magical Money Machine. It does not actually exist. Most likely it never existed, and what you thought was a Magical Money Machine was just an artifact of luck and circumstance. Like being a private equity guy and mistaking cheap capital and infinite leverage for skill. Or like being a public markets guy and mistaking a bull market for brains. Then again, maybe it did exist, kinda sorta, for a couple of years until other really smart Wall Street types figured out your secret and they end up - in the lingo - 'arbing away' your edge.

I think SBF had a Magical Money Machine hedge fund for a couple of years, and then it stopped being magical as more experienced Wall Street professionals got into the crypto world.

SBF was early to the professional crypto trading world (he launched Alameda in 2017), and there were plenty of persistent informational asymmetries in that early market for a smart guy like SBF to skin with a portfolio of systematic quant strategies. Also, and the importance of this really shouldn't be underestimated, commodity trading in general and crypto trading in particular has a much laxer regulatory framework, especially when it comes to what would be considered insider trading and 'material, non-public information' in the stock market and the bond market. Basically, there's no such thing as insider trading when it comes to commodities, and let's just say there's a reason that all of these crypto trading shops are based in Asia and the Caribbean. So I think SBF and Alameda probably killed it in 2018 and 2019, but by the time Covid hit, Alameda was just one of many crypto hedge funds competing with each other over an increasingly difficult-to-navigate market.

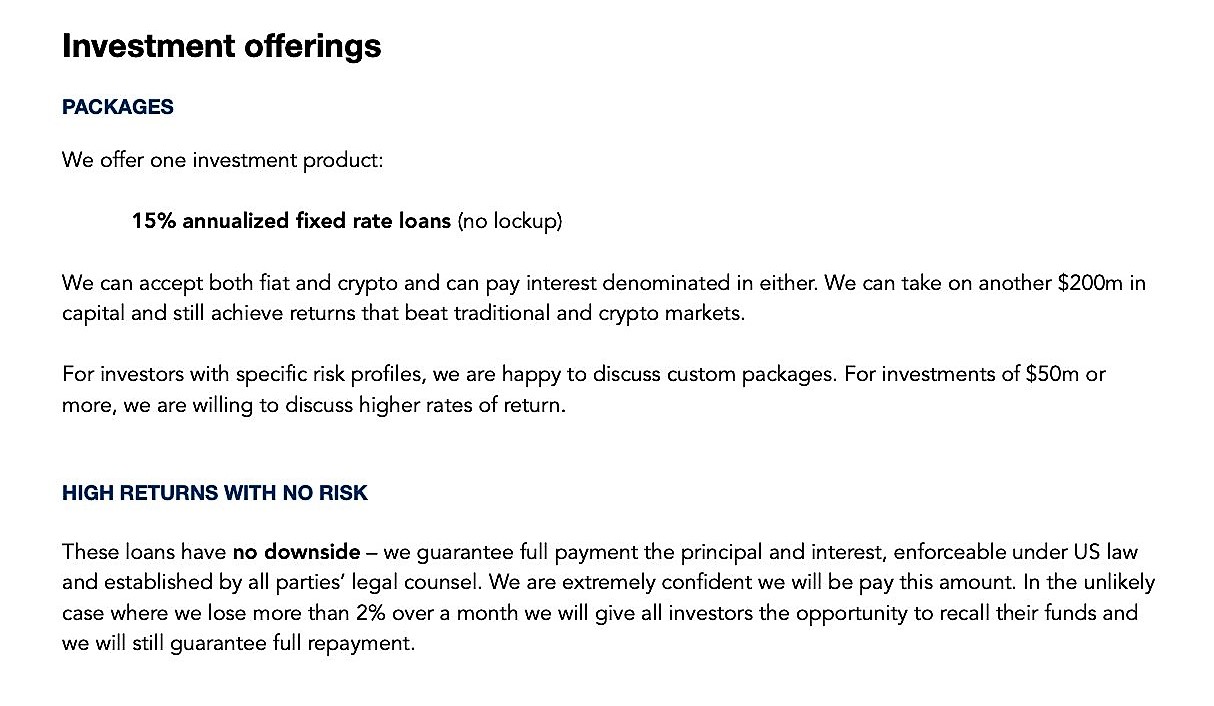

Here's the thing, though: Alameda had no outside investors who would know that performance had declined from Magical Money Machine levels to non-magical levels! See, Alameda did not take on outside investors the way that most hedge funds take on outside investors, with an annual management fee (1-2% of the amount invested) and a performance fee (10-30% of the profits) on the capital account established for the investor within a limited partnership vehicle. No, Alameda didn't take investors (LPs) in their fund at all. Instead, you lent money to Alameda and they promised you at least a 15% annual return on your loan. Also, they promised that you could cancel your loan and get your money back anytime they had even a slightly bad month.

It's both a really interesting and really troubling offer! On the one hand, it creates an enormous mystique and reputation as a Magical Money Machine (nope, we're going to make crazy consistent profits with your money, so much so that we'll promise at least 15% annual returns, but we're not going to share more than 15% with you because you're lucky we're even talking with you). On the other hand, this IS the recipe for a Ponzi operation (oops, we didn't cover the 15% this year, but we can cover it with new client loans and some fudged accounting and no one will ever know) and most troubling of all, they are selling themselves as a Magical Money Machine. I mean, if the words "HIGH RETURNS WITH NO RISK" don't give you the heebie-jeebies as a potential investor (not to mention that this sort of language would be outright illegal for a US-registered or EU-registered investment vehicle) ... well, I don't really know what to tell you. Actually I do know what to tell you. If you 'invested' money with Alameda on the basis of this deck, you allowed a MacGuffin to take over your decision making, and all of the bad things that are happening to you now stem from your failure to recognize and control your MacGuffins. I'm sorry, but you should not be responsible for managing other people's money.

Ultimately, I believe, Alameda became a Ponzi, using new funds to cover the returns they promised on client loans, all while maintaining a reputation as a Magical Money Machine.

The thing about people who slip over time into outright fraud, like Bernie Ebbers and Jeff Skilling and Elizabeth Holmes and Bernie Madoff and (IMO) Sam Bankman-Fried, is that they don't start off doing outright fraud. They have a couple of bad lab results (Holmes) or a couple of bad quarters (Ebbers and Skilling and Madoff), and they decide to fudge the data or the payments as a temporary thing. You know, just until we get back on track. Just until the Magical Money Machine starts being magical again. It's for the greater good! My god, what a tragedy it would be for the world if all the good we've accomplished and - more importantly - will accomplish in the future gets blown up over some bad luck we had. No, no ... the right and ethical thing is to fudge the data and the accounting. Not for me, mind you. For humanity!

Now smart guys like SBF (who I really do think is really smart) don't want to leave this recovery from a temporary setback to chance. No, they're looking for a new Magical Money Machine or an evolved Magical Money Machine to replace the not-so-magical-anymore machine.

SBF found an evolved Magical Money Machine in FTX, where he could channel the dark magic of FLOW.

Pulling all of that together in a few days! If you need another side hustle, Forensic Accountant would suit you. Thanks for adding meat to the bones we had all started piecing together from Twitter, Bloomberg, and other sources.

And, for including the link to Part 4 of Things Fall Apart. Can’t read these foundational thoughts enough.

I hope all your readers get to the last handful of paragraphs, which for me are 100x more important than the fraud story. I find that the narratives which can be summed up by Number Go Up have commandeered the living metaverses of detractors of crypto/btc in an equal but opposite way of how it corrupted many of the supporters. “Forget all that” is 100% right, too bad it is so difficult! The slope of enlightenment for distributed trust systems will be applications that marry the digital and real world in communities where trust >>> money. After the last few weeks many people will think that a future which embraces and benefits from this kind of thinking has gotten more nebulous and further away, but as you hint in those concluding paragraphs it is truly the opposite.

100%. I hope they get there, too!

Great note Ben!

I think I’ve quoted your “too clever by half” note a few too many times to my friends and colleagues at this point.

In tech, I think Crypto (the legal Casino) was seen by a few too many engineers as sort of the “easy way out” to working for yourself.

For anyone looking for some of the OG blockchain coyotes, they went off to think about things like improved public goods funding or making voting mathematically optimal for the public good.

Reminds me of The Bezzle

Fantastic note Ben. Really well done. Please make a PDF available for easier sharing.

Ben,

I have been following your tweets on the topic and although you have pounded into me the importance of narrative and narrative control, looking at the tweets that are coming out I am constantly thinking back to the novel 1984 vs. the law of identity in philosophy. In philosophy the basic law of identity is A = A. In 1984 we are told not to believe what our eyes tell us and that 2 + 2 = 5…Big Brother told us…it’s common knowledge. The audacity of some of these guys that AFTER the fact are still trying to spin a controlled narrative of hey I’m the good guy amazes me.

Thank you for bringing some clarity to this muddy puddle of crypto for me.

HIGH RISK WITH NO RETURNS.

I am blessed with dyslexia, and as God is my witness, this is how my brain actually read that sentence.

Another great post, Ben!

Soooo blockchain voting by 2024 to stop the widening gyre and trustless elections from turning into Civil War 2.0? Or is that mere apophenia?

I’ve been around long enough to have personally witnessed this very similar scam.

Mark Ross Weinberg would borrow money from investors at usuries rates and speculate in commodities. His claim to fame was that he got advance notice of Jimmy Carters grain embargo on Russia from a relative (who I seem to remember worked at the White House, may have been his father) and made a small fortune. When the “rube” who invested would want his money back, Mark would claim that the investor was a “loan shark” and that Mark would sue for treble damages. It all when wrong when he borrowed from the mob who were, indeed, loan sharks. Years later he ran another scheme involving gold.