NGMI

To learn more about Epsilon Theory and be notified when we release new content sign up here. You’ll receive an email every week and your information will never be shared with anyone else.

Continue the discussion at the Epsilon Theory Forum

121 more replies

The Latest From Epsilon Theory

This commentary is being provided to you as general information only and should not be taken as investment advice. The opinions expressed in these materials represent the personal views of the author(s). It is not investment research or a research recommendation, as it does not constitute substantive research or analysis. Any action that you take as a result of information contained in this document is ultimately your responsibility. Epsilon Theory will not accept liability for any loss or damage, including without limitation to any loss of profit, which may arise directly or indirectly from use of or reliance on such information. Consult your investment advisor before making any investment decisions. It must be noted, that no one can accurately predict the future of the market with certainty or guarantee future investment performance. Past performance is not a guarantee of future results.

Statements in this communication are forward-looking statements. The forward-looking statements and other views expressed herein are as of the date of this publication. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and there is no guarantee that any predictions will come to pass. The views expressed herein are subject to change at any time, due to numerous market and other factors. Epsilon Theory disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein. This information is neither an offer to sell nor a solicitation of any offer to buy any securities. This commentary has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. Epsilon Theory recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial advisor. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Reading along nodding my head.

Yep. The Fed is clearly incompetent.

Yep. Borrowing money to finance stock buybacks is a misallocation of capital.

Yep. US politics does not allow long-term planning and thinking.

Then “I think we get a war. I think we get a man with a plan”.

Not “We might get a war. We might get a man with a plan”.

For someone as perceptive as Ben to state his predictions that strongly is sadly disturbing. There are many possible future paths but we do seem to be at a point in history taking a dark turn. Stakes are higher than ever before. Will nukes actually prevent conflicts from escalating beyond an ugly simmer or in the end are we just apes with godlike technology who burn our houses down. I’m old enough to have done the “duck and cover” nuclear drills in school. Crouching under my desk now will be just as effective as it was ao many years ago.

I gotta call 'em like I see 'em. No matter where that takes me.

Aside from being inspired to read Kashkari’s Wikipedia bio and getting a little nauseous, the most salient thing I learned from this essay is:

It is useful to think of financialization as path-dependent.

Financialization has been a long time coming, and it’ll be a long time to go. This is because it was not caused by any simple rate equation or other switch flippable by the feds.

Rather, financialization was caused by the separate actions of thousands of managers over the past 20–40 years. It can only be undone by managers, like Schultz, independently weighing the merits of risk-taking and productivity increases and making thousands of separate decisions to take risk in thousands of different ways, which will be industry-dependent.

Whether the rates set by the Fed will be high enough to be “risk-free”, in the eyes of each of these managers, is only one of hundreds of variables that need to align in the right ways in order to reverse financialization.

One place I’m confused after reading this is the precise relationship between our financialization and our inflation. @bhunt writes:

This implies to me that our current inflation is also path-dependent, as “embedded inflationary expectations” are one form of financialization. IOW: all the narratives, the missionaries, the blame, the excuses, the BS for the virus of rising prices, all of these things are one kind of profit margin growth without productivity growth.

So, here’s my point of confusion: I had assumed from other forum threads and reading about the Volcker era that, to a useful approximation, our current inflation is not path-dependent.

IOW, I had assumed that if somehow the political will existed tomorrow to wind down the Fed’s balance sheet and raise the prime rate to (say) 10%, then inflation would end.

If I interpret NGMI correctly, Ben is saying that this is wrong. If these things happened tomorrow, of course we’d find ourselves in a large economic contraction, and but our embedded inflationary expectations would still persist for some time. Depending on how strongly these expectations are now driving our inflation itself, we might also expect inflation itself to persist for quite some time, meaning we’d have The Mother Of All Stagflation.

Am I now thinking about this stuff correctly?

I will be quite poetic to see happening what Ben suggests. The Fed hiking, the economy slowing…and inflation being “stubbornly” high. What to do? More hikes! The economy slows more but inflation continues to be high! A poetic opposite to the 2010s

Not sure if I would put it as my base case, but definitely it’s a neglected risk as it goes against core beliefs economic policy makers and market participants have. Great insight Ben!

As the Fed starts to increase rates, it will be great to use this forum to keep track this if this corporate behaviour (e.g. Starbucks) gains pace. As Ben did on Twitter with inflation last year.

Curious to hear thoughts on who will become the winners and losers in this world (commodity producers vs companies of the gig economy?, bond holders even if they are positioned at the 2-5 year part of the curve?)

Bravo Ben , I agreed with virtually every word , the only issue I might take is that the productivity gains we have seen this year may be ,at least in part , to some people finally getting back into the office. I know our team has been way more productive since getting under one roof.

That is just splitting hairs though .

The FED will chicken out at the first sign of trouble and the next “stimulus” will be bigger than the last two. I wonder if the 8.4% CPI number but lower than expected “core inflation” does not give them some cover to back off a bit.

This post is gold.

Sounds like the same thing I have been expecting to happen for the past decade+…

Agree, but it’s the kind of finality I only thought about and hated to say out loud. It makes sense at D.C. will have to do something to take everyone’s minds off of the huge & increasing loss of their purchasing power, so why not take our Forever Wars! tm from ‘medium warm’ to ‘high’ and see if that works? I hope you are wrong, Ben, because I doubt that empires and oligarchs go gentle into that good night.

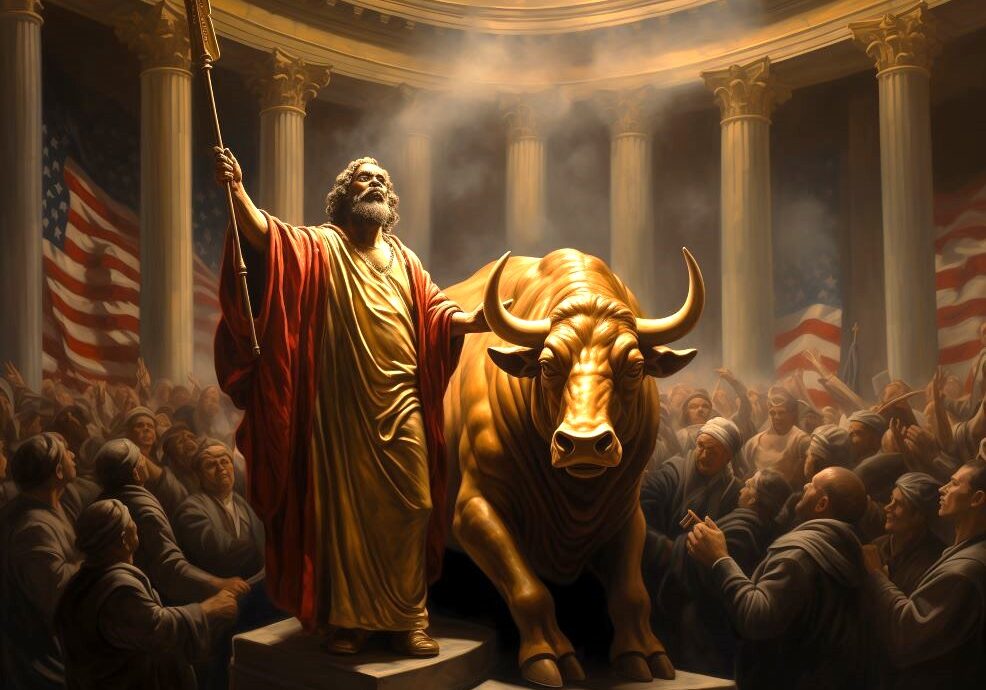

I overheard a conversation recently where a man and woman were discussing a sex scandal that had rocked the Christian ministry where the woman worked. When the friend asked if she had hope for the future of said ministry, her reply was “overall I am bullish on the future”. …“bullish on the future.” Someone who clearly works in a completely unrelated field used a market metaphor to express a core emotion, hope.

The “Speculation Layer” is now the Water We Swim In.

When everyday normies are casually using “number go up” symbolism to express hope for a better future, I think the moment number-goes-down for any length of time we’re NGMI. Unfortunately, I strongly suspect Ben is right about this leading to War and a Strongman-with-a-plan.

Thought provoking post, well done.

RE: Howard Schultz Gets It

Maybe. I’m willing to be persuaded by a detailed plan and evidence. But here’s what I argue Howard Schultz doesn’t get:

Succession Planning/Talent Management.

Schultz starts his 3rd bout as CEO, making him the Rocky Balboa of coffee.

With a combined ~23 yrs in the top spot, Schultz has had ample time, power, and resources to invest in talent and processes. Talent management/organizational effectiveness generally includes executive succession planning with identified successors and detailed developmental plans for each key executive.

Whatever Schultz thinks he needs to invest in, it should escape no one that Schultz was at the helm for more years than not over the past two decades.

Giving him the benefit of the doubt, perhaps Schultz’s people investment plan means better coffee, faster, at the same or lower price point thanks to productive, efficient employees. We will see.

I am elated that this note is calling attention to a question of massive importance, that simply no one is talking about and I can’t understand why. That question is:

WHAT is the deal with Putin and his giant tables?

Like.

Seriously. What is up with this? Does he like…have to shout?

I’m a very visual person so this bothers me. I concede that one of the great unspoken casualties of the pandemic is well-staged public figure photography, see, e.g., the awkwardness of this photo that makes me die a little inside from an internal cringe hemorrhage:

But I get it, world leaders are frequently old, so COVID is especially bad for them. The cringe for me in the G7 photo comes not from exactly how it looks, but the fact that I am sure everyone in this photo is fully vaccinated, so the social distance is just pandering to make them appear that they are in solidarity with the common folk. It’s also creepy due to the vague threat delivered with friendly smiles - “public health mandates issued from on high must be obeyed at all times, even when common sense dictates in certain situations that they are totally unnecessary. We are doing it, therefore you are going to do it.”

Well, but okay, it is also just how it looks. None of them but Trudeau know what do with their hands. If it were zoomed in or they could shake hands, or put them together on a glowing orb, or something, then the hand thing wouldn’t be an issue.

Putin is getting old, sure. He wants to social distance, maybe doesn’t trust the Sputnik vaccine. But then why have the meetings in person? I mean, yeah, you want the photo-op. The leader, taking charge, directing advisers, getting after people, for the motherland. But it’s producing a bunch of bad photos. Especially with the imbalanced spatial distribution of advisors/ministers, the interior setting with total absence of natural light (it looks like the Kremlin uses the same lighting guy as your local dentist’s office), this reads more like “paranoid isolated germaphobe” than “maverick defender of the Russian people.”

I’m only 45% joking when I say, to me this is actually the most disturbing signal to come out of the Kremlin. Putin doesn’t look strong, he looks unhinged, but even worse - apparently doesn’t realize that he looks unhinged? I thought this guy was supposed to be a master of manipulation and propaganda - but maybe he’s really more like late-life Howard Hughes with nukes? Maybe it’s not all just yes-men telling him what he wants to hear and it’s really Putin himself who is NGMI?

Now the other brief comment I had about the Fed and interest rates is this:

There seems to be a debate on whether the Fed’s actions will be effective, or whether they have been asleep at the wheel and this thing has gotten out of their control.

For months now I have been asserting to people that it’s neither - the Fed’s actions won’t be effective, but not because they are asleep at the wheel, because THERE IS NO WHEEL. They don’t really know what they’re doing and never did, and in a way it’s not their fault, because carefully controlling the economic behavior of millions if not billions of people, and trillions of dollars in commerce solely by tinkering around with a couple benchmark interest rates - in a way it is absurd to think that this is an effective tool to maintain control?

The truth is, they can AFFECT interest rates, and other economic activity. They can lean one way and they can lean another to try to make the car veer on direction or another. That’s not the same thing is as controlling things. In the absence of the ability to do that, their other main job is to put out propaganda to make people THINK they are Very Smart People Tackling Tough Complex Issues, and use their powers of professional academic research to produce sophistry purporting to prove that their recommended course of action or inaction is correct. One thing I have learned in life is that when dealing with complex systematic problems, academics and experts can become extremely proficient at finding sophisticated ways of avoiding saying, “I don’t know, and no one knows.” In truth, it is the same as with many other endeavors: Everyone is just winging it all the time.