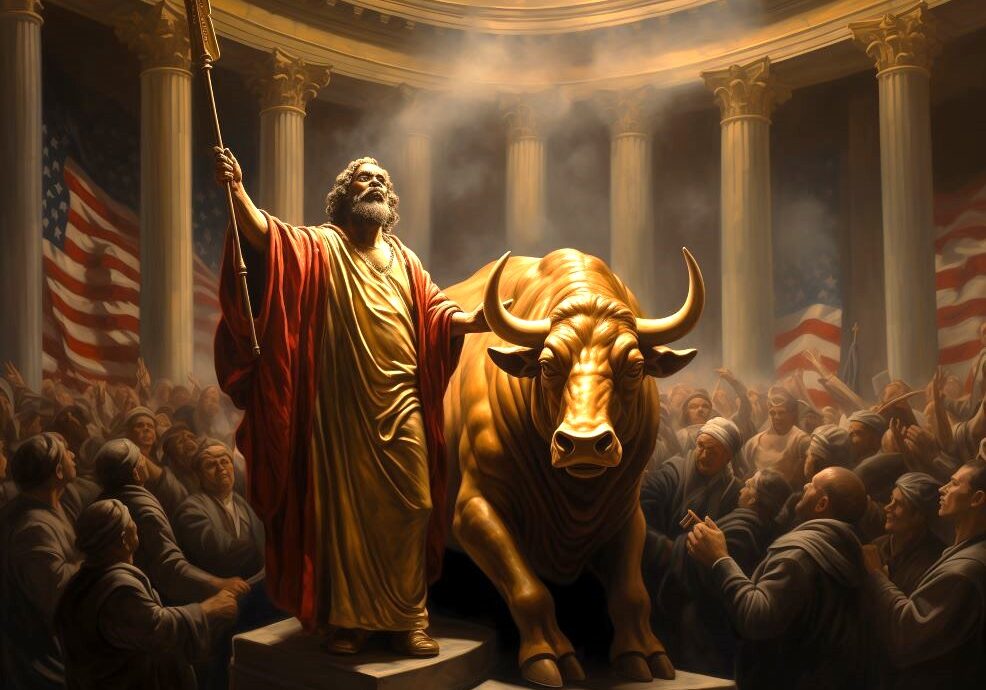

The collapse of the Terra/Luna crypto ecosystem, along with the general carnage in crypto more generally over the past few weeks, got me thinking. Not so much about the crypto price movements and the misbegotten Ponzi scheme of Terra/Luna per se (although yes), but more about the structure of the crypto "industry" and what it has become.

I thought a lot about Orwell's other classic - Animal Farm - and the final scene where all the animals who had followed Napoleon the Pig's orders to rise up against their human masters look through the windows of the farmhouse where the Pig leadership took up residence.

The creatures outside looked from pig to man, and from man to pig, and from pig to man again; but already it was impossible to say which was which.

Yay, crypto revolution!

The answer is not, as Boxer the Horse said before the Pigs killed him, "I must work harder." The answer is not a more earnest crypto project. The answer is not Better Code TM.

We need to talk about how we got here and why the revolution failed. Then we can talk about what we're gonna do.

Brilliant. And I’m so looking forward to part 2!

Cool, like you know, like whatever like.

I’ve been waiting for this one! Having been invovled in DeFi since before it was known to be DeFi, the piece on Bitcoin always struck me as applicable to the entire crypto space. It really wasn’t until the Terra implosion that I truly realized what it meant for Defi™ to materialize. Looking at the SBF and FTX playbook, almost admirable players compared to some of their peers, it’s obvious this was always what it was going to become.

It pains me, and I should probably just end the post here, but I can’t help but try to see the brighter side of the space. I belong to a younger generation than Ben, so perhaps its my misguided youth. I know better, I always described crypto was always weaponized narrative, but there was a spirit that came with Bitcoin, DeFi, and whatever it becomes next (Web3?) that seemed to fit a needed culture of the moment for my generation.

DeFi was a builders paradise. The fact that Bitcoin had to be adopted, rather than shutdown, was an indicator that the “blockchain” could serve as a platform of some resilience for at least some period of time. In that time, what was developed was a foundation of individualism, ownership, and futurism, oriented around novel digital networks. This foundation provided a bottom-up innovation that took place in the closely guarded, ever-corrupt, and ever-inaccessible realm of finance.

Clearly this wasn’t enough. The larger movements in society, the Sauron, Nudging, and Racoon cultures were never really addressed by any of this. Rooted in a reactionary energy and built to serve a digital culture, the tools of narrative where almost doubly effective in crypto. The same foundation that should have been the strengths of the system inevitably served as a fundamental weakness.

It’s a damn shame and I still can’t help but think that the we can use this to build better systems and tools in society. I see signals of the mechanisms and solutions that can create cash-flowing assets, based on productive economic activity, and rooted in empathetic social systems. But these are drowned out in the noise and often neglected. I know Ben recognizes some of this himself as the ideas proposed in the Green Protocol or what’s been discussed in NOAH and SEED leverage some of these tools. But again, whether this turns into anything like the revolution it was advertised as is still up for debate. Or perhaps it’s not and never will and it’s only my youthful optimism.

I’m really interested to see where this series goes next. I’m cautiously optimistic (see youthful disclaimer) that this ends with something as constructive and hopeful as the Narrative and Metaverse series did. Maybe I should just listen to what the cultural icon of my generation would say, “Don’t ever play yourself”.

I enjoyed this. I think some aspects of the fundamental differences between Bitcoin and “everything else crypto” are missing, but that’s not a serious impediment to the points made in this article. I’m looking forward to the next one.

That’s a fair observation, Em. Will have more to say about this in Part 2, but in general I’d say that I believe all of crypto (including ETH) operates, not on a gold standard, but on a Bitcoin! TM standard. Bitcoin! TM as the terra firma for funding, USDT for liquidity.

Thanks for a great piece. I’m very much not crypto-savvy, so SBF’s example was pretty powerful to me. Can I ask a potentially dumb question: why does it yield 16% at 100mm capitalisation?

Reading this, I couldn’t help thinking how similar the Bitcoin! TM crowd is to the Red Guard women from 3 Body Problem who are fully engaged and kill Ye Wenjie’s father during the struggle session. When Ye Wenjie finds them later in the book, they’ve been so broken and abused, they can’t even bring themselves to apologize. Everyone bringing the Cultural Revolution about suffered tragedies.

How many Bitcoiners will face a similar fate?

Great stuff!

Not dumb at all. It yields 16% because the owners of the MacGuffin (either through protocol or through governance tokens) say that it yields 16%. It’s yield by proclamation. It’s yield by fiat.

A brilliant note for many reasons. I closed all my crypto positions in January. My personal view is that the crypto boom - or rather, bubble - of the past 2 years is because the Fed started printing money and giving it out for free, and yet the pandemic hamstrung the real economy in such a way that there was nothing for that liquidity to do. It is the same reason that throughout 2021 you were hearing “stocks only go up.” There was literally nothing to do with that liquidity except speculate with it. So, when the Fed indicated they were serious about turning off or at least turning down the money printer, it’s time to get out.

The thing that has truly astonished me in recent months is the level of blatancy. I share Matt Levine’s aghast-ness at how so many supposed crypto “believers” are open and frank that they are running Ponzi schemes. I want to give them the benefit of the doubt and say, they are trying to be optimistic about a new paradigm of how to store and exchange value.

But there is something inherently cynical about the idea of crypto to begin with. Yes, it is true that fiat currencies are not in reality based on anything but collective belief in the value of the currency. But no fiat currency started off that way. Every traditional currency started off as being back by a claim on some kind of hard asset considered to be of intrinsic value by everyone regardless of who was issuing the currency. People start off trading in, say, gold, then they eventually find this problematic (hard assets are costly to acquire, secure, and transfer), so solve that problem by printing paper which is a theoretical claim on the gold. Then over time they create too many claims on the gold by printing too much paper, they try various tricks to relieve this but eventually they will have to unlink the paper from the gold. At that point it becomes fiat that is backed by the credibility of the issuer. The value of the currency is established by “fiat.”

There is therefore a certain ignorance or dishonesty in claiming that anyone can just create currency which backed by nothing other than the belief in the value of the currency and (cryptographically secured) agreement on the global balance of all accounts. “Fiat” currency is kind of a misnomer in a way. The currency’s value is established by fiat but what actually backs the currency is the decades or centuries of that currency being redeemable for something of value, it used to be gold directly from the treasury of the issuer, now it is gold (in the private market) or something else of real economic value.

Now with crypto you have people going around saying, “Look these coins don’t have anything behind them but belief and agreement yet, but some of these coins might build a narrative of reliably being linked to real economic value, one day.” How can that ever become a true medium of exchange or store of value? It looked like it might work for a while because when money is easy, people feel free betting on the “maybe some day” part, or just purely betting it will go up and not down, or betting that others will bet on it going up for a while and they won’t be left holding the bag.

“You know, my original idea for how to save the world was to use the tools of the Snake to beat them at their own game…

Ego, man, it’s a trip.

Not that I couldn’t pull it off. I really think I could! At first. But before long the project would be corrupted, maybe by me, maybe by someone else. Not intentionally, I’m sure, but eventually, for sure. I mean … this is one of the core stories of the human condition, the hero taking the MacGuffin of Power to do good, only to have it corrupt him over time. You can’t outrun a story like this, no matter how much your ego tells you that you can!”

All I could think about while reading this note was the above section from the Luther Protocol.