Epsilon Theory In Full

The soul of Epsilon Theory is our long-form content, a library of hundreds of pieces written by Ben, Rusty and others over the course of the last 5+ years. These are the print-and-take-home-for the weekend notes that made Epsilon Theory what it is today.

Good chart out from Barclays this morning showing the key problem for investors and financial advisors as inflation fears take root: bonds no longer provide…

Mortgages are pretty standard fare in the world of finance, but the American version is special: it grants its user a free option to refinance if they can get a cheaper rate elsewhere.

Every lender thinks they can thrive in this market. But every lender can’t be right.

As a non-American there are many things I don’t understand about America.

Most of all though, I don’t understand the most American of products: the 30-year fixed-rate fully prepayable mortgage.

Over the past four quarters, the United States has generated more wage inflation than at any point over the past 40 years.

This is not an anomaly. This is not a single quarter aberration. A wage-price inflation cycle is here.

I’m not predicting. I’m observing.

A Honda Accord cost $12,000 in 1990 and it costs $25,000 now.

A Mustang was $9,000 and now it’s $27,000.

The BLS has new car prices close to unchanged over the past 30 years.

ET contributor Brent Donnelly tries to wrap his brain around hedonic adjustments to CPI.

Bitcoin has been subverted by the neutering machine of Wall Street and the regulatory panopticon of the US Treasury Dept.

What remains is a constructed Narrative that exists in service to Wall Street and Washington rather than in resistance.

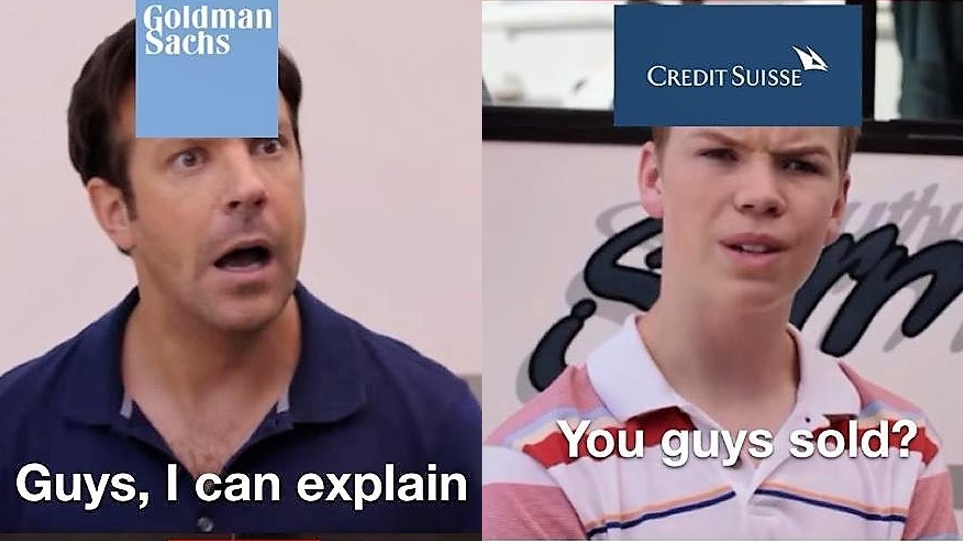

What do investment banks do, and why are European investment banks so bad at doing it?

Great piece by new ET contributor Marc Rubinstein!

What made Bitcoin special is nearly lost, and what remains is a false and constructed narrative that exists in service to Wall Street and Washington rather than in resistance.

The Bitcoin narrative must be renewed. And that will change everything.

ET contributor Brent Donnelly gives a crash course in Market Profile analysis and applies it to Bitcoin since the Coinbase IPO.

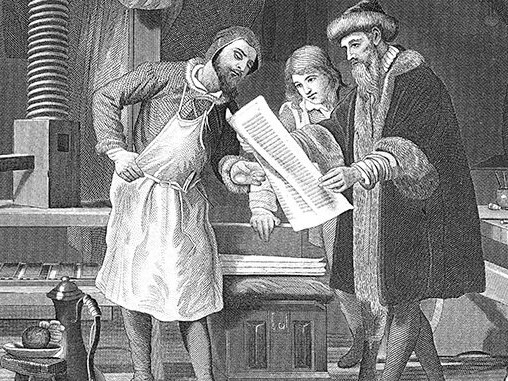

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

Jonathan Plotkin is a longtime ET reader and brilliant cartoonist. For years he’s been sending Ben illustrations inspired by our notes and we’ve been dying…

When we talk about and plan for inflation in our businesses and portfolios, we are usually focused on direction and magnitude. We also usually abstract away from price volatility.

We shouldn’t.

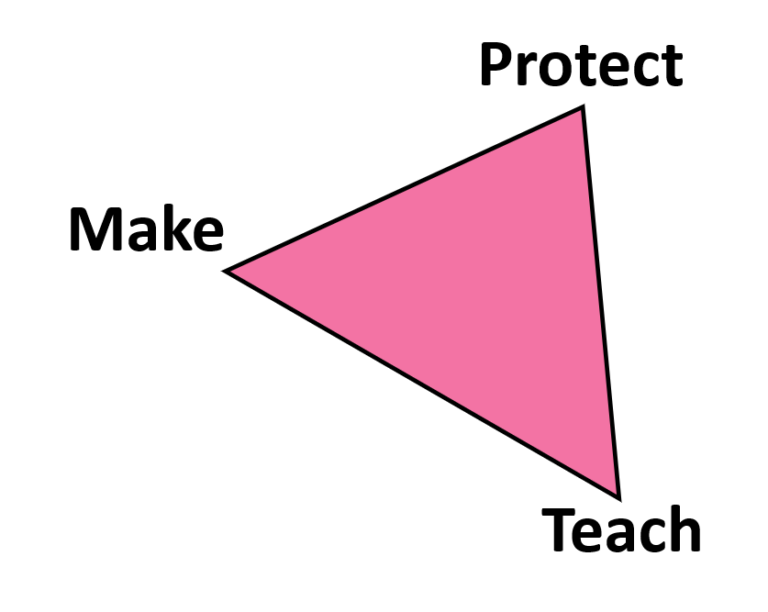

How do we change the world? Not through corporations and political parties from the top-down, but through free-thinking citizens from the bottom-up. Not as an alienated flock, but as a cooperative pack. Not with abstractions and transactions, but with making, protecting and teaching.

Let’s gooooooo!

We are now more than 900 Pack members strong on the ET Forum, with more than 1,000 posts contributed by smart, clear-eyed, full-hearted people from all over the world and all walks of life. Like you.

Here, I’ll show you. Here is some of the best and most thoughtful content on the internet today.

Here is the Mailbag that we need.

Here is the Mailbag that we deserve.

Modeling Common Knowledge by analyzing Missionary statements and their reverberations works. Except when it doesn’t.

Three blow-ups in three months: Archegos, Greensill, and Melvin Capital.

What do they have in common? Insane leverage employed to maximize private gain while socializing potential losses.

What do you get when you give a Raccoon billions of dollars AND invisibility from regulators? Collusion and insider trading.

ET contributor Brent Donnelly talks with Howard Marks about why traditional value investing is likely permanently impaired as a strategy and why Growth vs. Value is a false dichotomy. Boomshakalaka!

We’re going to Pack-source a slate of investment strategies for an inflationary world. Here are five tentpoles to organize and support that effort.

I think that the collapse of Greensill Capital has a lot of systemic risk embedded within it, particularly as the fraudulent deals between Greensill and its major sponsors – Softbank and Credit Suisse – come to light.

This is the first Big Fraud I’ve seen in 13 years with the sheer heft and star power to ripple through markets in a systemic way. Not since Madoff.