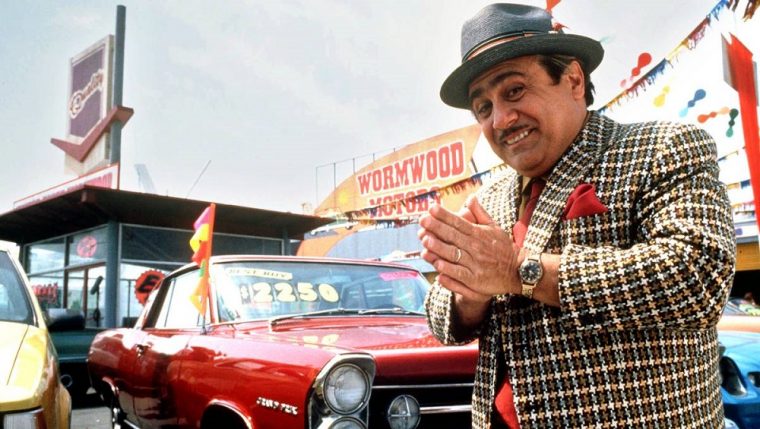

I'm fed up with all this reading! You're a Wormwood, you start acting like one! Now sit up and look at the TV.

Matilda (1996)

A couple weekends ago I visited a car dealership to buy a new car.

Like most people, I look forward to this as much as I look forward to, say, going to the dentist or watching the Oscars. And like most people, I suspect you look forward to hearing someone complain about a car dealership experience about as much as you look forward to reading a rant about a bad airline experience.

Don’t worry - this is not that kind of story. But it is an unusual story.

I went to buy a car for a very ordinary reason. My wife is 8 months pregnant with our third child. Since my pickup truck can’t really accommodate three car seats, it was the obvious choice to take one for the team. So it is that I am now officially “regularly googling Korean-made three-row SUVs” years old.

Now, the whole car-buying experience is something I have more familiarity with than I’d like, having previously served in a professional capacity setting sub-prime auto loan pricing for one of the largest non-captive lenders in the space. Buy Rate shenanigans in the finance manager’s office, the economics of trade-ins, the loss severity impact of repossessed collateral - all of this garbage lives in the career-only skills section of my brain, next to dynamic named ranges, Black-Scholes formula components, state regulatory requirements for investment advisers and banking confidential information memorandum templates. In probably 90% of my life, I operate with barely enough knowledge to be dangerous. Lamentably, the world of purchasing an automobile is part of the other 10% where I have real knowledge - even if it is decidedly cursed knowledge.

All this, and still I left without a car. Which is not very interesting.

What IS interesting is why I left without a car. It wasn't because of lack of inventory or credit availability or too much "cargo net and window tint" lagniappe or some guy pushing the undercoating option like he was $1,000 away from topping the monthly sales leader board. It wasn't even because they wouldn't honor the deal their internet sales manager had agreed to before I walked in the door.

It was because they couldn't.

You have probably heard or read that used car prices are up this year.

You may not know how much used car prices have risen. For a variety of reasons (e.g. rental car company activity, some pent-up consumer demand, and yes, semi-conductor supply constraints), used vehicle values have skyrocketed since the early 2020 COVID trough. Manheim, Cox Automotive's wholesale auction and consulting platform, publishes an index of these values.

As it happens, some auto segments are experiencing this pricing pressure more acutely than others. These are, to put it bluntly, extraordinary times for this particular good..

Looking forward to seeing how the BLS will twist these shockingly high increases in car prices into a 1-2% impact on the CPI reports

Rusty, I feel your pain. We looked for 4 months for a vehicle – ANY vehicle: car, SUV, truck, whatever. Only through the grace of Midwestern small-towns and dumb luck did we manage to find something suitable at an decent price. An experience I would wish only on a few, specific worst enemies.

Hedonic pain.

I think the last calc had a 8-9% change in this category, but at the weighting it gets it didn’t do a fraction of that.

Absolutely, Steve! Although I’d already resigned myself to paying pretty close to sticker, TBH. But the $5,000 gap between what two dealerships were willing to offer on a pretty basic pickup was the really wild part.

It seems like the perfect time to sell your car in a private transaction…

From my Twitter feed this morning, and yes base effects are at play. But still.

SentimenTrader has a good stat on inflation. For the first time since 1971, over half of commodities within a broad commodity basket have registered gains of over 50% YoY

Congrats Rusty!

I must just be an absolute sociopath because I love shopping for a new car. I’m already tormenting my poor family with my discussions of the new Mustang Mach E and I don’t need to look for a car for another six months.

My friend that is general manager/minority owner in a Chevrolet dealership in Houston said he thought inventory of new and used would be better by now, getting to a critical point where he will not be able to deliver on current demand if things don’t improve pretty quickly. He ordered a bunch of Chevrolet volt’s to fill spaces on the lot, thought that might be a good transition. He needs to sell 6 per month to breakeven, has sold 2 in April. He has said time and time again for about 2 years, he just cannot compete with publicly traded companies like Carvana’s for used cars because he can’t lose money and they can.

It’s embarrassing in 2021 to admit this, but I listened to the last earnings conference call for Carvana, Vroom, and AutoNation. I know, I know, don’t laugh at me for being a dinosaur and listening to a conference call. :-) The themes on all 3 calls were pretty much the same: tight inventory, higher prices at auction and trade-in, and demand durability related to stimulus. They all also said, they expected higher prices for some time in the future and would manage their way through it. I swear the guy from Carvana could take Powell’s place, he said everything but the word…TRANSITORY.

There is this wildcard theme that keeps getting mentioned, analyst keep asking about “talks” with all the new car companies/brands i.e. Canoo, Lucid, Fisker, etc and if there are distribution agreements coming? It’s the biggest load of crap, but it’s just enough of a prospect to keep up with bizarro land valuations in 2021.