Called It

Nailed the Narrative

Epsilon Theory is all about using narrative to understand the world and big part of that is predicting what comes next. And we're not above saying "we told you so". These are the notes where we made predictions that (for better and worse) came true.

All The Times We Called It

Hunger Games

You have been told that the odds are ever in your favor. You have been told this for your entire life.

More and more, you suspect this is a lie.

Over the past few weeks you have been told a new story. A brave story. You have been told that by banding together and acting as one, you can “democratize” the stock market.

Today, as you see the collapsing stock prices of the companies you supported, you suspect that this was a lie, as well.

What now?

The Ireland Event

I believe there is a non-trivial chance that the United States will experience a rolling series of “Ireland events” over the next 30-45 days, where the Covid effective reproductive number (Re not R0) reaches a value between 2.4 and 3.0 in states and regions where a) the more infectious UK-variant (or similar) Covid strain has been introduced, and b) Covid fatigue has led to deterioration in social distancing behaviors.

Reap the Whirlwind

There is a brief window where I think we have the opportunity to commit to building a common national identity together. Seizing this opportunity will mean leaving a lot of anger we will feel is entirely justified at the door.

Not seizing it, I fear, will mean that we all reap the whirlwind.

Taiwan is now Arrakis

“He who controls the spice controls the universe.”

The world’s principal supplier of semiconductors – the spice of OUR global empire – is now Taiwan.

Thanks a lot, Intel. Thanks a lot, Bob Swan. Thanks a lot, Jack Welch. Thanks a lot, all you Wall Street wizards of financialization.

Taiwan is now Arrakis. And we WILL fight over it.

Too Connected to Fail

We have written that one of the major social changes occurring at present is the transformation of capital markets into public utilities.

The COVID-19 pandemic and policy response have accelerated that transformation. It is now the water in which we swim.

First the People

This is not a chronicle of errors and mistakes made during COVID-19.

This is the story about the inevitable, simultaneous failure of each of the institutions designed to operate in our interest.

It is the story of how we respond to fragility with resilience.

Lack of Imagination

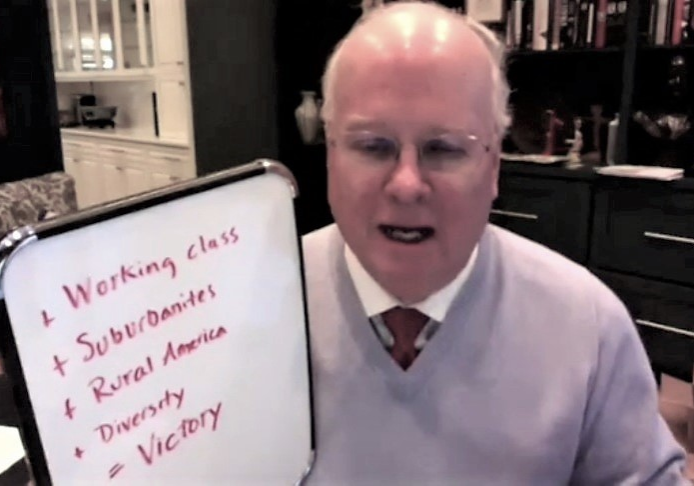

The structurally bullish will warn us against failure of nerve. The traders will warn us against hesitation. The structurally bearish will warn us about being unable to shift into a defensive shape. But what we should be worried about now is a lack of imagination.

Body Count

China is fighting nCov2019 exactly like the US fought North Vietnam … with policy driven more by narrative control than by what’s best to win the war.

That was a disastrous strategic mistake for the US then, and it’s a disastrous strategic mistake for China today.

A Song of Ice and Fire

We are the human animal.

We are non-linear.

We ARE a song of ice and fire.

It’s a song that has built cathedrals and fed billions and taken us to the moon. It’s a song that can do all of that and more … far, far more … if only we remember the tune.

The Pack remembers.

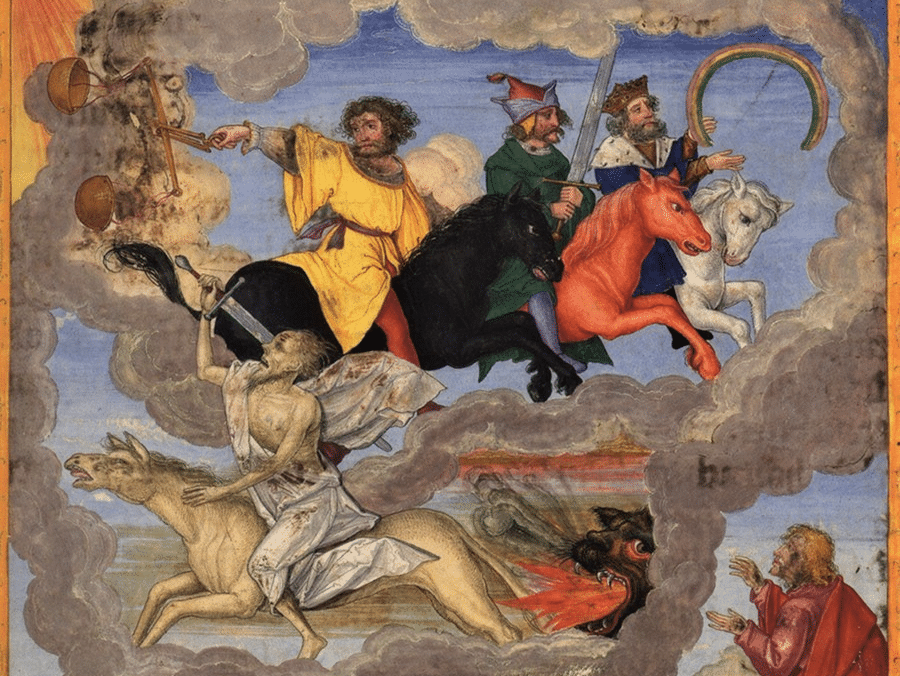

Things Fall Apart (Part 3)

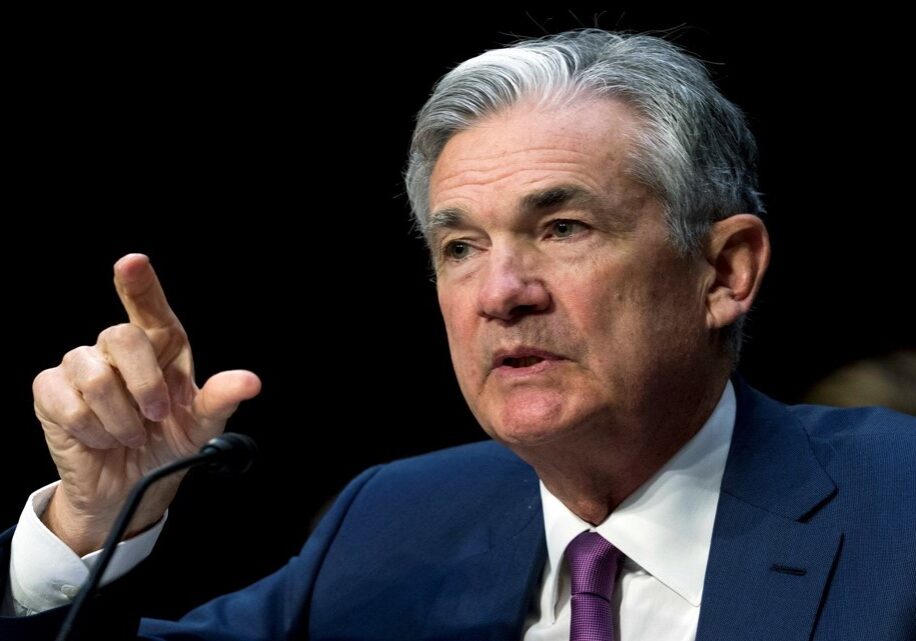

The Fed, China and Italy are the Three Horsemen of the Investment Semi-Apocalypse. They’re major market risks, but you’ll survive.

There’s a Fourth Horseman. And it will change EVERYTHING about investing.

- « Previous

- 1

- 2

- 3

- Next »