It has been a long week.

I am hopeful that an optimistic Friday close - or better yet, some time with family and (er, appropriately small) groups of friends - has allowed you to put some of it in perspective.

I suspect that perspective won't be entirely pleasant. Yes, realizing that those we love are what matter may assuage the anxieties of one of the most volatile weeks in US financial markets history. But it also means that a lot of the real anxiety, frustration and pain is still ahead of us. We are on the front end of whatever Covid-19 curve we end up experiencing. At long last, we are making plans to look more like Singapore and less like Italy, but the speed, competence and consistency with which we execute those plans will determine whether that is, in fact, what we experience. We aren't ashamed to say we think this will prove to be our finest hour.

Truly excellent work Rusty. My imagination goes in many directions, but many of them can be reduced down to one factor that does not seem to be priced in anywhere. Inflation.

Rusty, this piece is a pleasure to read and, like your BBQ, I went back again to consume a second time. Many thanks! I’m surprised you didn’t mention passive strategies’ deterministic investing equation: cap-weighted ETF plus time equals 7% compounded returns (and an annuity stream for advisors). The opposite of imagination. What about an active manager who considers the limitations of historical performance due to the obvious need to consider U.S. political risk in risk budgets. Where in a Monte Carlo simulation do you insert monetary policy working as a political utility? Where in the capital asset pricing model is the footnote that points to what to do when the S&P 500 CBOE Implied Correlation achieves 90% - for the second time in 12 years! And in the value investing arithmetic that capex budgets have been replaced with opex budgets, and the cloud-based productivity software companies that drive innovation via opex (nothing short of a complete re-platforming of entire industries) themselves have balance sheets made up of intangibles. Would love to excavate more along these lines…

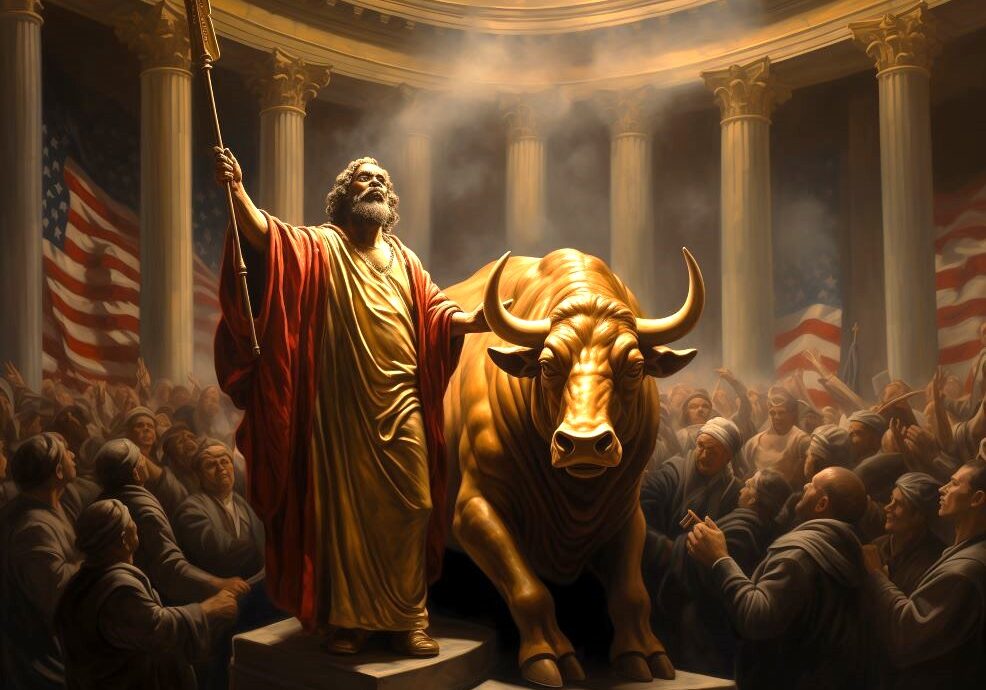

Truly excellent work Rusty. My imagination goes in many directions, but many of them can be reduced down to one factor that does not seem to be priced in anywhere. Statism.

Statism week is coming.

The new, new world order is here.

I agree so much that it is my avatar. Statism/de-globalization = the world is no longer “flat”. Game changer for inflation. Man, if only we could go back to the Thomas Friedman’s “flat world” for a while.

Over the medium-to-long term, we think that remains the horseman that requires the most imagination from us - by far.

You are right! There are so many analyses that have been cartoonified into a single decision or variable. You are also right that we could fill up a whole section of the site with them!

Absolutely a potential cousin to deglobalization that must be part of our imagination exercise.

Le roi est mort