Every winter, we lose something here on Little River Farm. It’s like a tithe that nature takes, year after year after year. This winter was particularly tough. Polar vortex and all that, I suppose.

None of the bees made it.

Sigh. I’ve lost hives before. It happens. But it’s never easy. Never anything but sad. They work SO HARD at staying alive through a New

England winter and they’re all boxed away for months and you can’t open the hive to check on them because that would weaken them for sure and it wouldn’t do any good anyway and so you wait and you worry and you do all you can to set up windbreaks and you don’t know if they’re hanging in there and it finally gets warm enough to crack open the hive and get them some help and … death. Nothing but death.

Loved it Ben !

Great note - thanks.

And this is why I subscribe to, read, and re-read Epsilon Theory.

Elegant writing. Here in the UK we are fighting Yay, Europe!

Really smart stuff. I’ll probably have more of my, as always, not-nearly-as-smart stuff to say after I’ve read it again / studied it, but even the first time through, you know this one is special.

Quick thoughts:

I feel really bad about the bees (an early ET piece turned me into a huge bee fan)

Good for the goldfish / what did they eat all winter?

Love the macro clockwork machine versus bonfire analogy

Brilliantly developed and argued, but the non-linearity of money should be obvious to the Fed by now or, at least, it should get that funny things happen around zero rates (like Newton’s laws in the subatomic world)

I’ve seen change happen in the corporate world the way you describe it - it can happen, but as you note, it needs a high-level advocate and time.

Agree with you Mark - I also felt pretty sad about the bees…

Great piece, Ben! Non-linearity and the fallacy of extrapolating the present indefinitely into the future are like pride in a Greek tragedy. Felt like a mini-reread of “Ubiquity, Why Catastrophes Happen”. I’m reminded of the 1800s futurist who predicted that there would be 4 feet of horse dung in the streets of NYC by 1945 based upon population growth, need to move foodstuffs and waste around, etc…totally missing the invention of car/truck. Nuf sed.

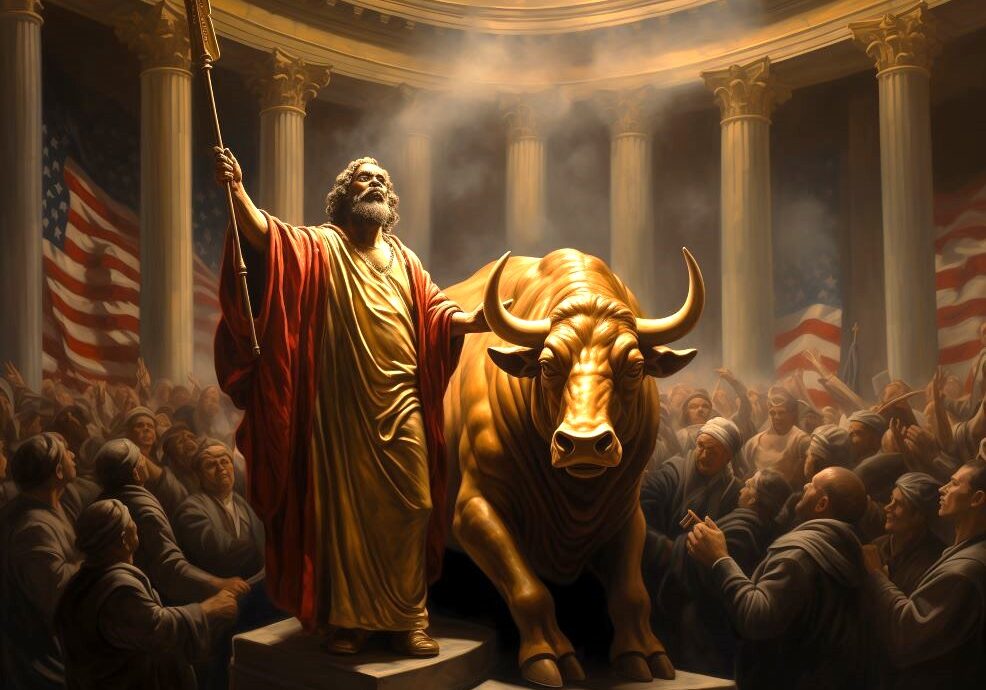

I differ with your statement re low risk re stock buybacks versus investing in plant and equipment. It only looks risk-free/lower risk NOW because the consequences have as yet been realized. Here too, the non-linearity that is the unwind of bovine investor herding, complacency, lack of volatility, passive indexation, lulling of investors by way of political utility, etc. will eventually kick in an manifest itself in super-geometric fashion via the explosion of risk aversion…the equivalent of yelling “fire” in a crowded theatre. Haul-ass, bypass, and Re-gas!

Beautiful, very well written. The only macro/economic writing I read that stirs up real emotions.

Am I wrong to be troubled by how much sense this well-developed line of thinking continues to make, and how little our current reality and predictable (such as it is) future does?

Rhetorical question, of course.

Please keep up the excellent work, Dr. Downer, and I’ll keep reading.

I loved this piece and as usual it has me staring out across the irish countryside wondering what other stories and narratives are gestating as suitable metaphores for our human reality. And then I realise, of course (Duh! as the two generations below me on the ladder might put it) that all systems are organic and bio-dynamic and we should never be surprised (Duh!) that life behaves according to the non-linear determinations of the natural world - with all its extraordinary potential for surprise, decimation and regeneration. Just ‚coz we don‘t understand it doesn‘t mean it ain‘t so. Or words to that effect.

One quibble: Tithes can‘t be extracted. They are always volontary. That is the point of them. Taxes, penalties, fees, fines, levies and even seigniorage can be demanded and extracted by force, but not tithes.

Best wishes and as always thank you for your service to the cause of truth-seeking.