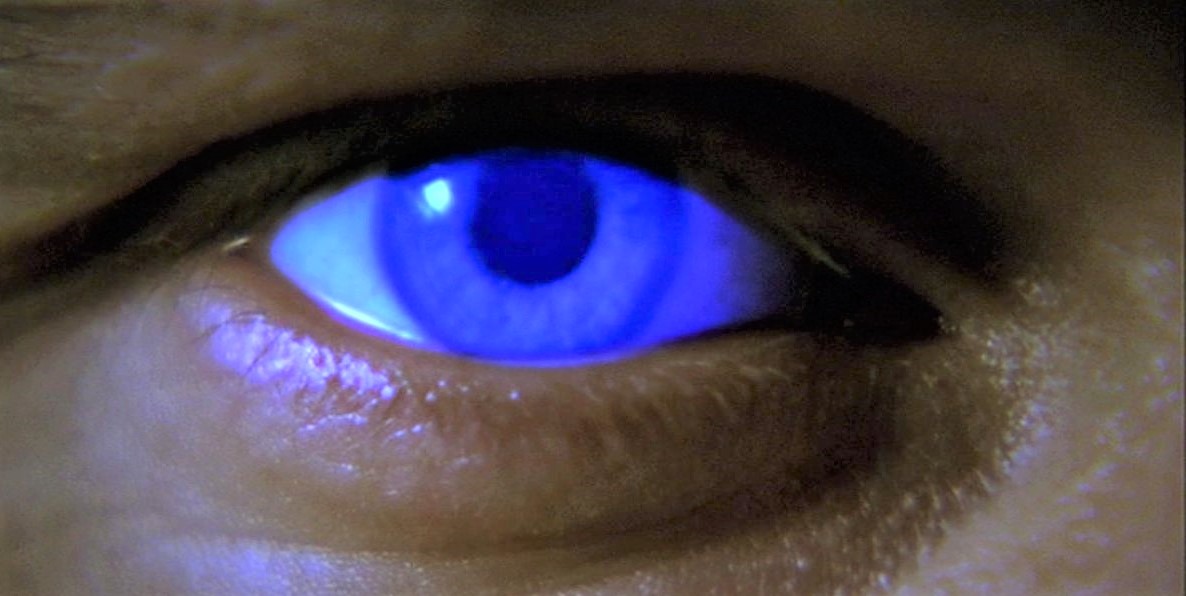

He who controls the spice controls the universe.

Yep, that’s the plot of Dune, by Frank Herbert.

It is, in fact, the plot of the entire Dune series of books, one of the ur-texts of modern science fiction. There’s this galactic empire, see, and interstellar travel requires access to a certain narcotic drug, colloquially called “spice”, which only exists on one barren world – Arrakis. So if you want to control the empire, you have to control the supply of spice. And if you want to control the supply of spice, you have to control Arrakis.

I thought about all this when I read this little gem in the aftermath of Intel’s self-immolation last week … you know, the earnings announcement where this crown jewel of American innovation and strength told us that they had decided to financialize themselves into oblivion. Or as I like to call it, “pull a GE”.

TSMC gets large Intel chip order, Apple R&D plant (Seeking Alpha)

Taiwan-based newspaper Commercial Times reports that Intel has ordered 6nm chips from TSMC for next year.

The unprecedented Intel order would reportedly include 180,000 wafers, only slightly behind the raised 200K order from AMD, major TSMC client and Intel rival.

TSMC’s leading-edge capacity is now fully-booked for the first half of next year.

In other news for the pure-play foundry, Economic Daily News says Apple is setting up a display tech R&D plant within TSMC.

The world’s principal supplier of semiconductors – the spice of OUR global empire – is now Taiwan.

Forget about Hong Kong. Forget about the Uighurs. Forget about the virus. Forget about the Trade Deal. Forget about the South China Sea. Forget about all the reasons you’ve been told that the United States should or could be at odds with China.

And by forget, I don’t mean that you should really forget. What I mean is that none of these reasons really matter anymore. None of these reasons are spice. None of these reasons are the supply of semiconductors – the sine qua non of modern global power.

There is no future where the United States can both maintain its existential national interests and allow the world’s principal supplier of semiconductors to come under the direct political control of China.

And there is no future where China can both maintain its existential national interests and allow the world’s principal supplier of semiconductors to remain outside its direct political control.

Thanks a lot, Intel. Thanks a lot, Bob Swan. Thanks a lot, Jack Welch. Thanks a lot, all you Wall Street wizards of financialization.

Taiwan is now Arrakis. It’s now the most important country on earth. And we WILL fight over it.

Interesting, TSMC is looking for land right now in the Phoenix-area for a huge manufacturing plant.

We are Duned!

Ha! I just finished reading Dune yesterday; it’s been over 30 years since the last time I read it.

It is amazing how we find so many short-sighted ways to put ourselves at a long term disadvantage.

Good thing Taiwan is in such a defensible location…

This is somewhat of a departure from Moore’s Law.

Maybe we can ‘worm’ our way in.

Two things embedded in this piece that are worthy of further thought, IMO:

(1) if the world’s “most important commodity” is now information (yes, I know - oil is still foundational) than computer processors and say, search algorithms, are of strategic importance themselves (what you’ve said, obviously, with this entire piece and comparison to Dune) — truly living in an age of information though, processors and tech can change the balance of power instantly, like a digital Dreadnought, and

(2) the great, overarching, slow-motion story of the age is the conflict between the nation-state and non-state actors. This instance puts this idea in stark relief as corporations that are not constrained by national boundaries or dictates can cause “problems” for countries.

Just some thoughts.

Back in the late 60’s, I was an assembler language programmer on a 16 bit 64 KB Varian 620i. It was the size of a small refrigerator. Most programming errors (bugs) were initialization or reinitialization flag flaws. These flags were usually set with a single bit in one byte of core (ram).

Yesterday, my grandson showed me his toy camera which had a 32 GB mini-SD card smaller than my little fingernail. I don’t code anymore, but I would suspect flags today are still set with only a few bits in a byte. So I would suspect the real power (spice) will be manipulation of the flags, not the flag holders.

At this point, BenH might be thinking exactly right, it’s not about the supply, it’s about the backdoor intercept loop that only insiders are aware.

(Interrupt loop)

Can you expand on the end there? Are you speaking metaphorically or literally? That is, do you mean it matters how the actual chips can be manipulated by state actors?

The users of the circuits can indirectly be utilised.

It is a food chain.