Epsilon Theory In Brief

Daily short-form pieces for those without the time (or attention span) for classic Epsilon Theory notes. Look out for regular features like the subscriber mailbag and guest contributions from within the Epsilon Theory network.

It is a frustrating truth that good – even great – investors rarely know exactly what it is that makes them good. And so the inevitable guilty pleasure of investors – building portfolios from the best ideas of their various managers and advisors – is almost always doomed to fail from the beginning.

There is very little that an investor can do to more easily become a better investor than to better understand his behavior. But the investor who relies on awareness, discipline and self-control remains susceptible to a world that seeks to influence his standard for correct behavior.

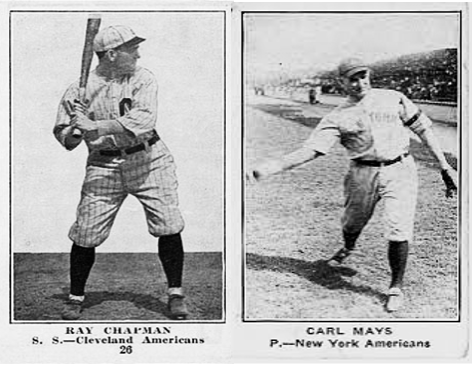

Imitation is not only the sincerest form of flattery, it’s also the engine behind so much of what we do in both professional baseball and professional investing. The trick, of course, is not to get beaned in the process!

Common knowledge effects, credentialing and missionaries are everywhere. You may differ in your view of their importance, but if your framework doesn’t acknowledge their role in price-setting, you’re not seeing the full picture.

ET contributor Pete Cecchini, better known as Cantor Fitzgerald’s Chief Market Strategist, is back with the December installment of his series, In the Trenches. For ET readers who want a less philosophical but no less smart take on markets, Pete’s your guy.

No matter how much you try to make mama tell you what part of the snake you’re eating, and no matter how much the answer might comfort you, it’s important to know that neither you nor she is telling the truth.

We are pleased to announce the launch of Epsilon Theory Professional, or ET Pro. It is a service designed to leverage our Narrative research more directly for investors and asset owners. Learn more about the types of content and research we’re doing here.

Discretionary investment always and in all ways boils down to two things: edge and odds. In the US-China trade war game of Chicken, you have no edge. And you don’t know the odds. Time to sit this dance out.

We will be live at 2PM on Tuesday, December 11, 2018. Click here to get more information about ET Live, how to subscribe and how to get your questions in for the day.

It’s possible to do good AND to do well. ET’s Neville Crawley interviews Lev Plaves, Senior Investment Manager at Kiva, on banking the unbankable – refugees and internally displaced populations.

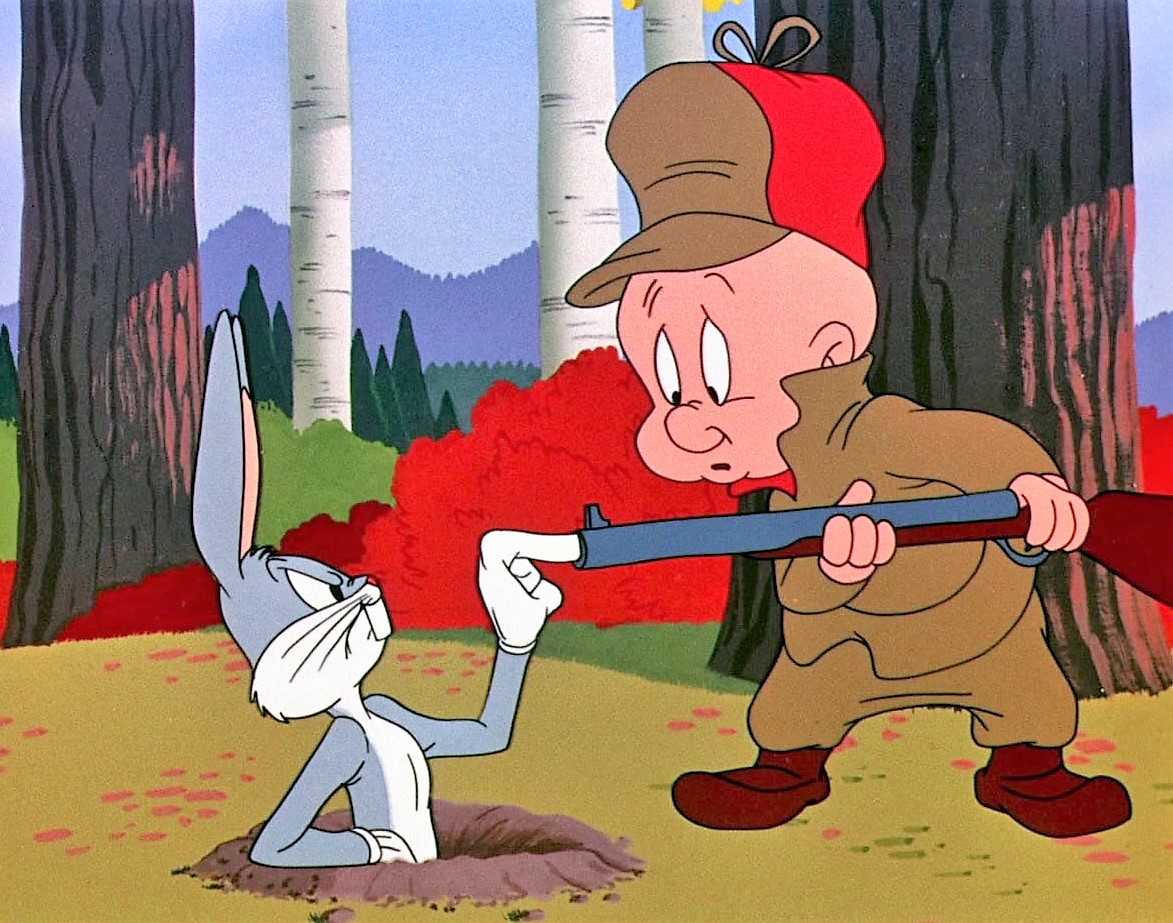

Sometimes the dog that doesn’t bark gives as loud a warning as the dog that does. That was true for Sherlock Holmes, and it’s true for investors, too.

Just because something is true doesn’t mean that it can’t also be transformed into a Meme. That is, in fact, the usual outcome when an idea encounters resistance. But this isn’t a path to truth.

The market is not a clockwork machine, even though we all think it is. No, the market is a bonfire.

If you want to learn how you will be nudged in the future, look to the same places: Vegas and Video Games.

Fresh thoughts on the intersection of technology, freedom and decentralization.

ET’s Neville Crawley interviews Alex Gladstein, Chief Strategy Officer for the Human Rights Foundation (HRF).

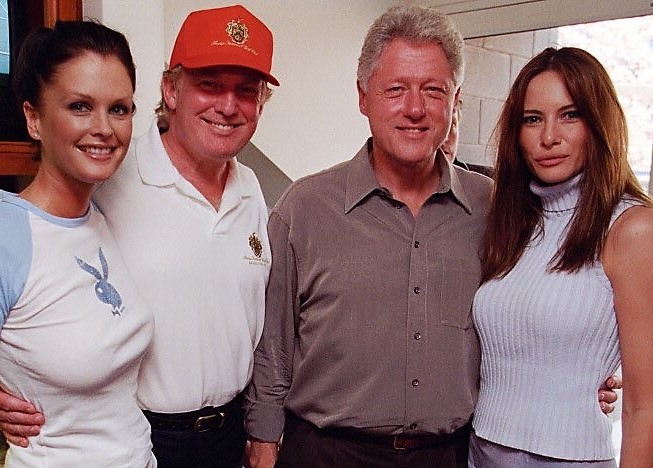

What will it take to Burn The Oligarchy Down? Pics of a certain sort. Which is why “doctored” will be 2019’s Word of the Year.

In our November 2018 update to the Fiat News Index, we review some topics that media outlets are even happier than usual to tell us how to think about.

In the Common Knowledge World, we lose the ability to distinguish between what we think and what we think we think. It’s Fiat Thought, and here’s how you beat it.

The emphasis of asset owners on private assets investments is meta-stable – robust to a lot of potential changes in market environment. The reason? The deals! meme.