Epsilon Theory In Brief

Daily short-form pieces for those without the time (or attention span) for classic Epsilon Theory notes. Look out for regular features like the subscriber mailbag and guest contributions from within the Epsilon Theory network.

It’s the defining quote for any performance-based social system, whether it’s football, politics, or markets. So let me ask you this: who owns your record?

Humility is in short supply on Wall Street. But the humility! Meme is not. Developing a process to understand the difference is important for any asset allocator.

Ben and I are pleased to announce the launch of Epsilon Theory Live – our audio/visual supplement to the existing written Epsilon Theory content! Epsilon…

The iPhone XS launch is attached to the strongest pre- and post-launch Narrative of any September launch since the iPhone 6. Does that tell you how to trade it? No. Can it help you think about how different outcomes might shape your thesis – and the thesis you believe other investors are following? Yes.

It’s easy to feel like we need more than hope to pass through troubling times, and it’s usually true. But sometimes hope is exactly what we need.

A stalking horse is a familiar shape that a hunter hides behind in order to get close to his prey. Once you start looking for them in markets, you will see them EVERYWHERE.

Using facts in your analysis doesn’t make your analysis a fact. Punchy language that leans on these ‘facts’ doesn’t often stand up to scrutiny.

Sometimes the absence of a clear central narrative can tell us something about a stock, too.

I can’t advise you on the Answers. I won’t advise you on the Answers. But I will advise you on the Process. Because that’s what we do for our fellow pack members.

The paradox of the Widening Gyre is that even when you’re right, you may be wrong.

“Just when I thought I was out, they pull me back in!”

Vito got out. Michael never did.

Enmity and competitive games can be beaten. Sometimes doing so requires someone willing to be booed by his home crowd.

When reading news, especially financial news, be vigilant for strings of causality. Most financial events are extremely overdetermined.

We have built industry standards around minimizing the appearance of risk. As a result, we now have an epidemic of ability-signaling, when what we really need is humility.

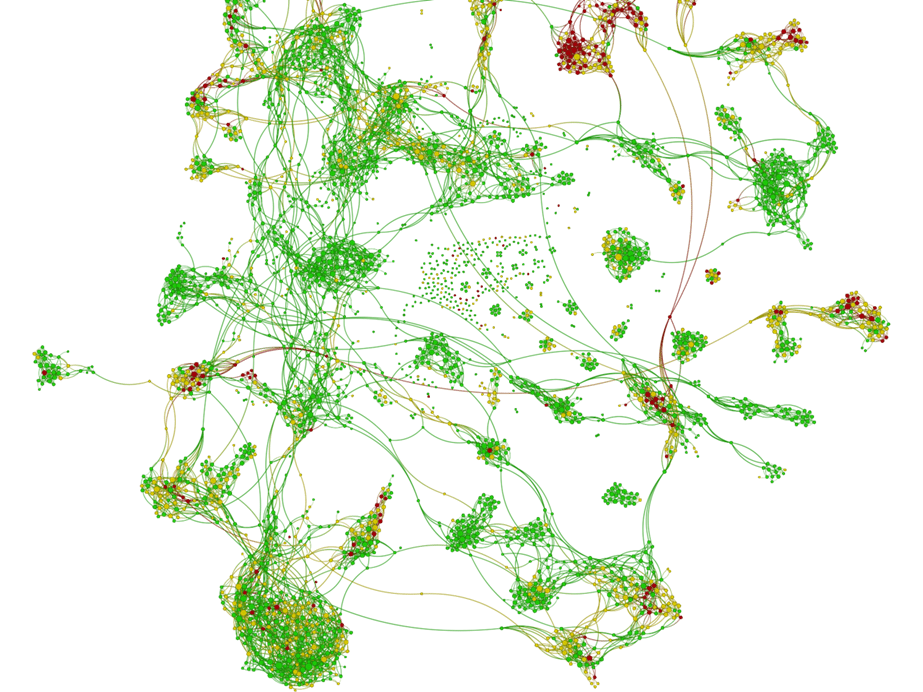

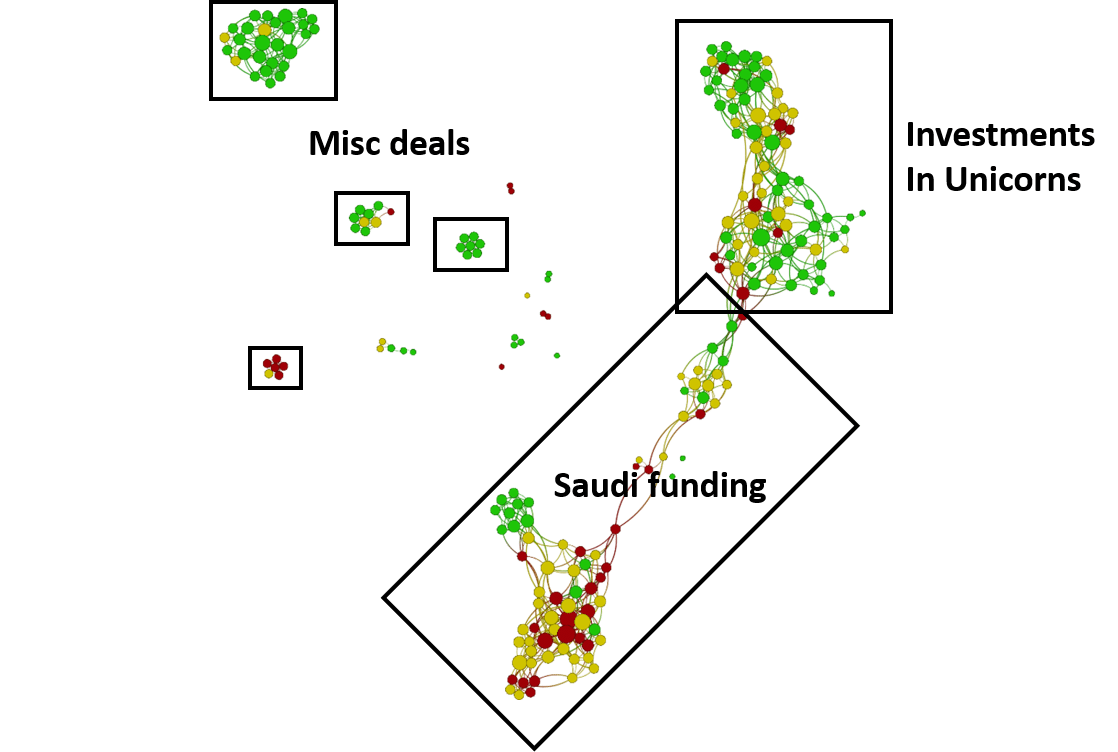

Shifting Common Knowledge on Saudi Arabia has infected the narrative around SoftBank’s Vision Fund, which in turn places unicorn valuations at risk.

The mechanics of effective storytelling and the tells of Fiat News are very similar. Add knowledge of them to your news-reading arsenal.

Take it from a list of terrible pop songs (and one OK, if overrated song from the Doors): lessons that provide an answer instead of a process are usually lessons badly taught and badly learned.

Nobody likes to admit it, but the investment industry hires and invests with the smartest-seeming people that seem sufficiently likable. And it doesn’t work.

“Order should not have priority over freedom. But the affirmation of freedom should be elevated from a mood to a strategy.” Yes, please.

An historic night it was. A pleasure to have a private dinner with the Crown Prince of Saudi Arabia, Mohammed bin Salman, his royal family…