Epsilon Theory runs the world's financial news through natural language processing-based cluster analysis to identify the most on-Narrative stories. We scan for those with the most similarity to all other stories as well as those with the most interconnectivity to multiple different key topics.

Stimulus is dominating market news, and even with an election coming up is playing an outsized role in political news. So what is the current fiscal stimulus really about?

Maybe more importantly, what is it absolutely, definitely NOT about?

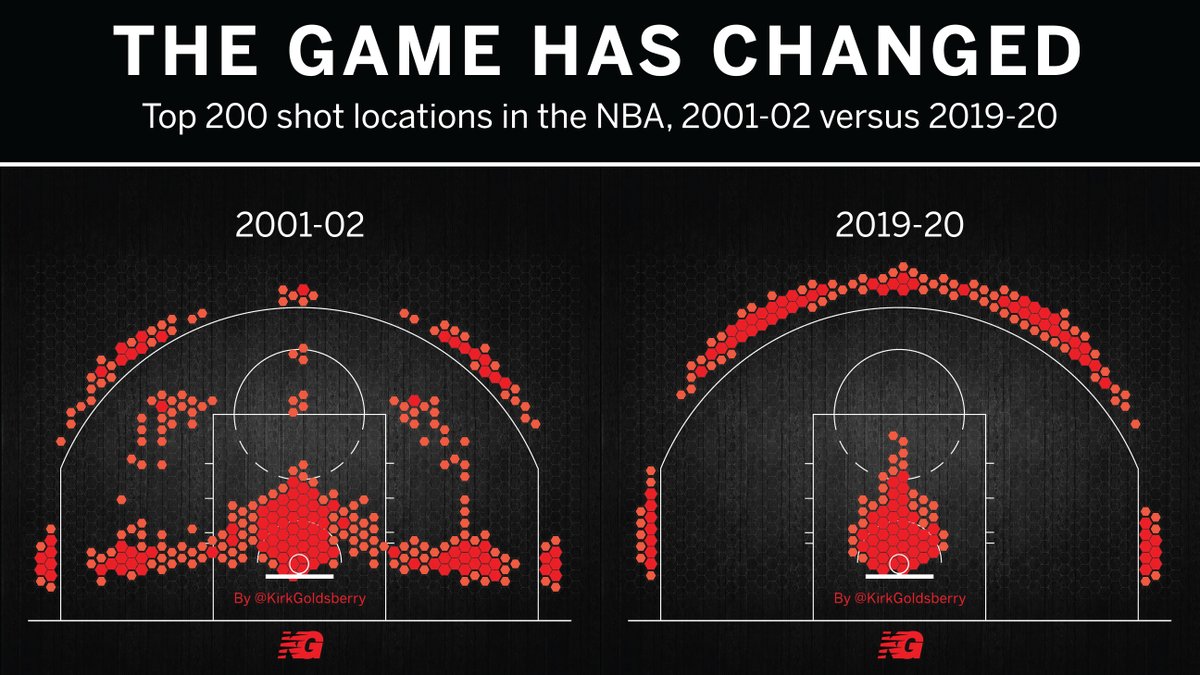

Once Daryl Morey’s new idea became the Common Knowledge of the NBA – once everyone knows that everyone knows that the way to win NBA games is to maximize 3-point shots and lay-ups – then it became a permanent feature of the way professional basketball is played. It became an equilibrium.

It’s exactly the same with politics.

The frustrated money manager is almost always a smart, accomplished professional in his own field who believes VERY much in the existence of The Smart Money ™.

The frustrated money manager is almost always a liiiittttle bit on the make.

Like a Vatican cardinal.

One day we will recognize the defining Zeitgeist of the post-GFC Obama/Trump years for what it is: an unparalleled transfer of wealth to the managerial class.

This Wall Street Journal article is not an attack on that system. It is a defense. It is telling you that the system is fine … we just need to do something about these bad apple CEOs.

Yesterday, 5 GOP Senators wrote a letter to Netflix, saying that their plan to adapt Liu Cixin’s “The Three Body Problem” for TV/film amounted to “complicity” with the CCP and their horrific mistreatment of the Uyghurs.

Why am I reading this NOW?

My RBG story …

I thought she’d be all about women’s rights and legal theory this and legal theory that. I was SO wrong.

RBG’s death is an enormous loss for the UNITED States of America.

The go-to move by sophists like Vox and Trump is to claim that “many people” are asserting their made-up premise that justifies an otherwise ludicrous position.

Why do they do this? Because it works.

Why does it work? Because common knowledge game. Because of the power of the crowd watching the crowd.

Recent price action in Tesla is the Common Knowledge Game in action.

It is the power of the crowd watching the crowd. It is the power of – not what you think is true, and not what you think the crowd thinks is true – but of what the crowd thinks the crowd thinks is true.

Seeing cartoons made from data doesn’t give us license to ignore the underlying feature of the world being measured – it gives us a duty to cut through the abstractions obscuring that feature of the world.

Doug Parker, American Airlines CEO and Chairman of the Board, wrote a letter to his employees today that pretty much defines high-functioning sociopathy.

I’m going to reprint excerpts from that letter – which is couched in the saccharine vocabulary of modern team-speak, but is in truth a shakedown letter to employees and a ransom note to the US government – and then I’m going to tell you a few things about Doug.

In the age of capital markets as carny show, we are told by barkers like Cramer that this is what a smart investor or management team does … they should look to the grift du jour for their edge.

There is nothing wrong with wanting the US to bring back certain critical manufacturing industries to its shores.

But don’t buy the narrative that a crazy scheme like the Kodak grift is the only way to make it happen.

Is murder bad? Hmm, I dunno. What are the chances I will be caught and what price will I pay if that happens? If the odds are high enough and the price steep enough, then yeah, I guess THAT would be bad. But the act of murder itself? I mean, I’m sure whoever I murdered – if I were to murder someone, that is, because I really don’t think you can prove that I did – was getting in the way of something that was very important to me. When you really think about it, they were doing the bad thing! Why do you ask?

Welcome to the world of commodity trade finance.

“He who controls the spice controls the universe.”

The world’s principal supplier of semiconductors – the spice of OUR global empire – is now Taiwan.

Thanks a lot, Intel. Thanks a lot, Bob Swan. Thanks a lot, Jack Welch. Thanks a lot, all you Wall Street wizards of financialization.

Taiwan is now Arrakis. And we WILL fight over it.

Everyone is in a tizzy about day traders and Robinhood. “Ooooh, they’re going to have such a hangover when the bubble pops.”

Pffft. They’ll be fine.

The investors facing a hangover are small family offices, plied with endless offerings of fee-heavy SPVs and SPACs by multi-billion dollar asset managers.

Both Trump and Biden have proposed $2 trillion spending plans for next year, confirming exactly what we wrote last December. To the dollar. To the word.

We can’t always write tomorrow’s headlines today. But we do try!

Sometimes good news comes from unexpected places.

And sometimes it’s best just to go with it.

Market propaganda used to be an art form, I tell you! What happened to us?

The transformation of capital markets into political utilities happened.

There is practically no information in knowing that everybody is talking about something. There is some information in knowing that everybody is using the same language to talk about something.

But there is a lot of value in knowing that people and publications with no underlying connection are simultaneously inspired to use the same language to talk about different angles of the same issue.

We all know someone who is in urgent-but-not-emergency need of some medical procedure that can’t be scheduled while Covid-19 is storming the hospital ramparts.

I’m one of them.