Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

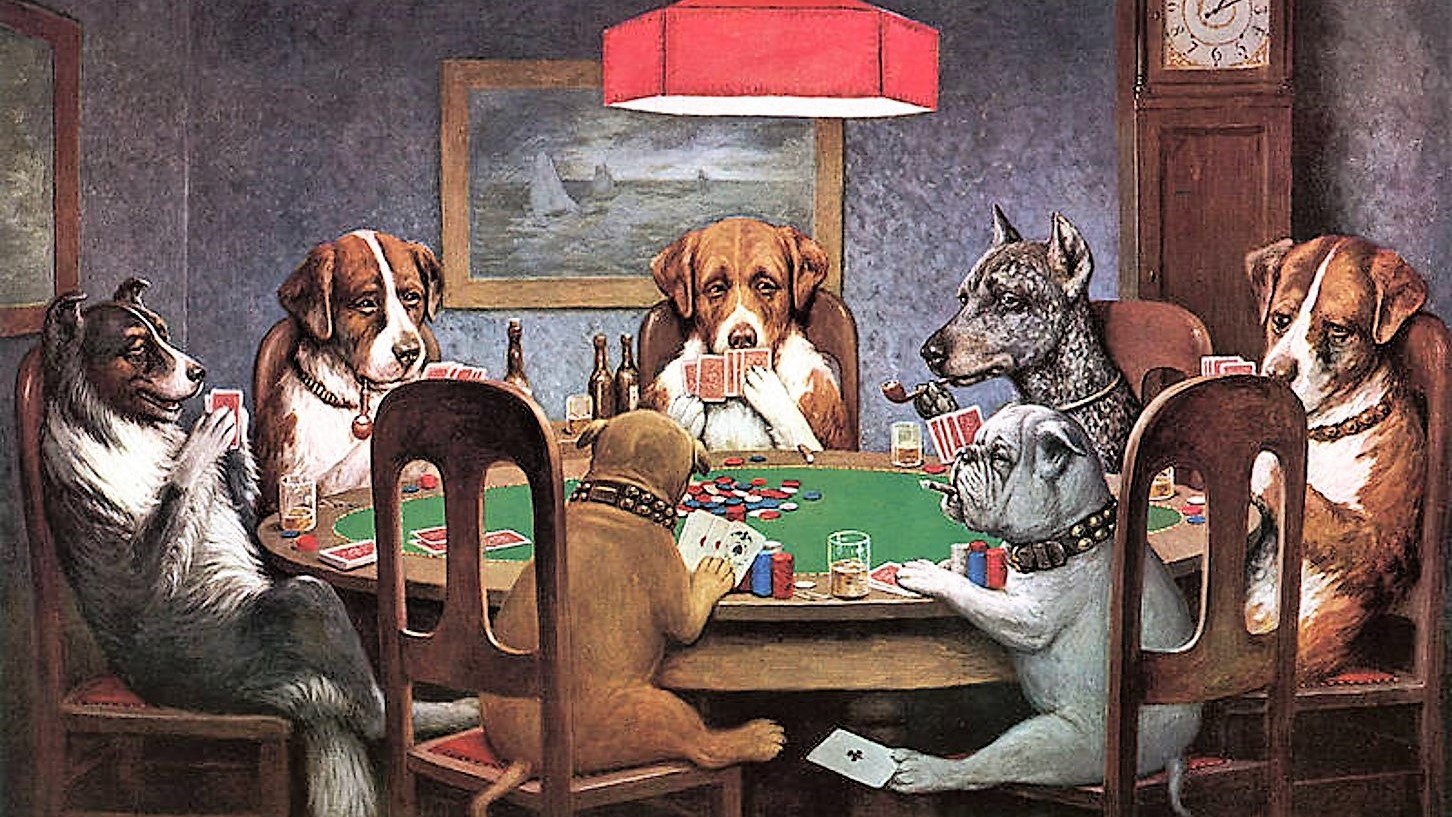

Scott: Hey, how’s your girl, man?

Ant-Man (2015)

Luis: Ah, she left me.

Scott: Oh.

Luis: Yeah, my … mom died, too.

[Beat; Scott gapes in awkward silence]

Luis: And my dad got deported.

[More silence]

Luis: But I got the van!

Scott:[quickly] … It’s nice!

Luis: Yeah, right?!

The Solution To The Fintech IPO Shortage [Forbes]

The headline is bullish. The tone is positive. But the article is dour as hell. Why haven’t we seen Fintech IPOs, it asks, then provides the answer: because they don’t have sustainable business models, the companies don’t have clear value propositions, they can’t get to scale, IPOs did terribly last year and they haven’t done anything to change the actual economic proposition of financial services products to end users.

Other than that, Mrs. Lincoln...

Still, the piece manages to end with the kind of relentless optimism that you have to admire on some level. If they can figure those fourteen things out, expect more IPOs! Still, it’s an interesting question, given how powerfully non-financial tech and VC has managed to cultivate a supportive narrative. The problem is pretty simple, and it’s a narrative problem:

Everyone knows that everyone knows that financial services switching costs are extremely high.

It’s the source of the fundamental economic malaise affecting these companies – their stratospheric customer acquisition costs. It’s the source of the scale problem. It’s the reason the business models aren’t sustainable. Having a product that disrupts something customers hate isn’t enough if they still can’t fathom the pain in the ass that is figuring out, learning and actually pulling the trigger to do something different.

The successful Fintech plays have (as the article points out) either served other financial services businesses directly or have figured out how to make the complicated process of switching or simply starting to use a financial product people haven’t used before, well, easy. Any such company that isn’t actively owning its Cartoon on this dimension – continuing to obsess over addressable markets and consumer frustration with incumbents – will continue to miss the boat.

Start the discussion at the Epsilon Theory Forum