Here’s what we’re reading and working on this week at Epsilon Theory.

To receive a weekly full-text email of The Zeitgeist, please sign up here. It’s free, and your email will not be shared with anyone. Ever.

Every item in this email is a discussion thread on the Epsilon Theory Forum – a safe space to speak your mind, a safe space to find like-minded truth-seekers. Watch from a distance if you like, but when you’re ready … join us.

A Raccoon (in Epsilon Theory lingo) is a financial huckster or conman.

I hate raccoons.

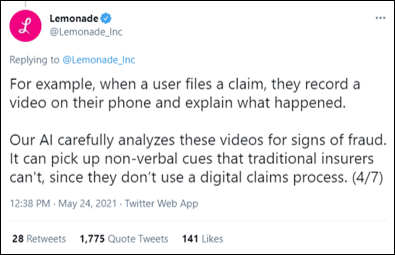

P&C insurer Lemonade (LMND) went public last year and now has a $5 billion market cap. They’re not just a sleepy insurance company, of course. No, no … they’re actually a cutting edge AI Company! TM.

That’s why it’s okay that they lose more money with every new customer.

That’s why their CFO, Tim Bixby, gets a puff-piece written in the WSJ’s hard-hitting CFO Journal section, spouting gems like this:

Lemonade has made it a priority in recent months to communicate more with nonprofessional investors about its business model and plans, Mr. Bixby said. The idea is to reach young or novice investors where they spend their time—for example on YouTube or investment apps—and speak about its strategy and performance in simple terms, he said.

“While we can’t directly affect our stock price, we can expand and widen the communication net to bring in a broader, more diverse range of investor opinions and strategies,” Mr. Bixby said.

To be clear, by “a more diverse range of investor opinions and strategies”, he means the diamond hands Reddit crew and the momo hedgies who play that crowd like a fiddle. Did we mention that Lemonade is actually an AI Company! TM ?

But then we got this gem of a social media campaign. Oops!

Shot …

Chaser.

They’ve deleted the tweet above and issued a classic non-denial denial on their blog:

Let’s be clear:

AI that uses harmful concepts like phrenology and physiognomy has never, and will never, be used at Lemonade.

We have never, and will never, let AI auto-reject claims.

LOL. So their AI Jim textbot + video recognition program (I am not making this up) isn’t using phrenology and it can’t auto-reject claims. No, no … the supervisor will reject the claim.

I hate raccoons.

Meanwhile, back on CNBC …

Honestly, I kinda like Chamath-the-CNBC-talking-head. He’s iconoclastic and smart. A little too much Ben Shapiro / college debate team-esque with the “if I talk really fast maybe you’ll just ignore that jaw-droppingly stupid thing I just said”, but better than the usual CNBC fare regardless.

But Chamath-the-portfolio-manager? Raccoonery in action.

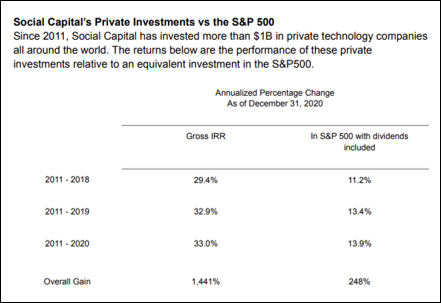

Here’s the Social Capital 2020 annual letter, published five months into 2021. There’s no mention of the disastrous year to date, which demands that you ask the core Epsilon Theory question: Why am I reading this NOW? But even taken on its own terms – hey, let’s talk about 2020 performance going into June, 2021 – this is just a complete crock.

Chamath describes his fund’s performance as “gross IRR” over aggregated multi-year periods. We have no idea of the fund’s performance in 2020, even in “gross IRR” terms, but are required to compare 2011-2019 average annual return to 2011-2020 average annual return. Then Chamath compares his “gross IRR” to S&P 500 total return over the same periods. Then he compares that to Berkshire Hathaway over “the first nine years” of the two investment funds. LOL.

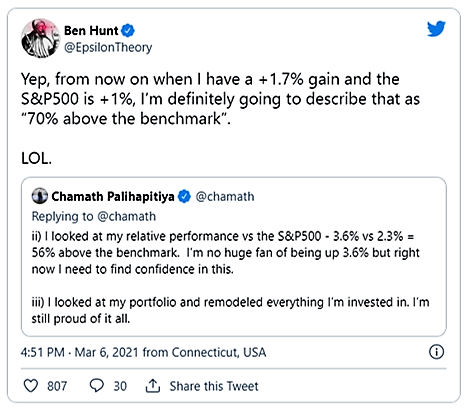

The final picture below – a tweet I put out after a Chamath tweet storm in early March – highlights the rest of his raccoon math.

And then there’s this in a Bloomberg opinion piece on Thursday.

Chamath: “PIPE investors need investor protections and have the ability to change the terms of the deal if market conditions change materially.”

Also Chamath: SPACs “level the playing field” for ordinary investors.

When I think about all the compliance pushback I’ve gotten on investor letters and marketing decks over the years … when I think about all of the SEC and regulatory proctology exams my funds have endured … this just makes me so angry.

I hate raccoons.

To me it looks like he’s trying to pull the ladder up after he’s already gotten to the top. And no, he will not be returning any of the money he made under the system he believes is rigged and bad, why do you ask?

Ben, I think of this often but I rarely get the impression from talking to regular folks that people see a life built on Bullshit as all that shameful (that’s just good Hustle!). I feel like that wasn’t true when I was younger but then I remember working on the NYSE floor when a dealer made “an honest 8th” and the whole crowd gave the guy a facetious round of applause (the idea being nearly all the money a specialist made came by taking advantage of a market participant). Have we always been a bunch of secret Raccoons yet just told ourselves different?

As Seth Klarman wrote in Margin of Safety many years ago, every financial disaster follows the same three steps:

A good idea

A good idea twisted/perverted

A good idea twisted/perverted with leverage.

The only question is which one or combination will be the undoing this time: Fed Balance Sheet, US Gov Debt, SPACs, record new investors in short dated call options, etc…I think I am going to be sick.

I was remarking to myself just how poorly written the whole thing was (the annual report). The tired attempts to use literary references, to say… “lots of shit happened this last year”. I’ve found the last two to have insights worth the hubris; not this one.

This is one point that Yves Smith tries to make in her book Econned. Her narrative is that before the 80s or so, people tended to be more civic-minded as a whole. At that point, there was the rise of a particular flavor of Capitalism ™ that tends to celebrate and reward rentiers and raccoons and diminish other factors outside of the ideology such as civic-mindedness.

Smith sees this promotion of this version of capitalist ideology as a coordinated effort by certain academic economists. As a non-finance guy, I’m curious about the extent to which financial people buy this narrative.