To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

Until an hour before the Devil fell, God thought him beautiful in Heaven.

That’s my fave Arthur Miller quote, from The Crucible.

Our Devil is inflation, and today we think him beautiful in Heaven.

Low consumer inflation opens the door for Fed to cut interest rates further [MarketWatch]

The low rate of inflation, reflected in the CPI and other price barometers, may allow the Fed more leeway to trim rates if growth in the economy continues to slow. Wall Street puts a high chance the central bank will reduce rates again at the end of the month.

With inflation largely under wraps, the Fed has said it would be prepared to cut interest rates again if the outlook for the U.S. economy worsens.

Common Knowledge is what everyone knows that everyone knows.

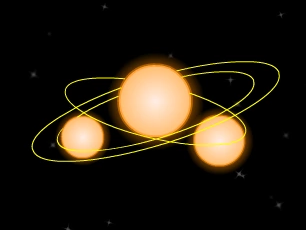

The strategic interaction (a “game” in the technical sense) by which Common Knowledge is created is, at its core, the process by which the crowd evaluates the crowd, and it is the primary driver of our lives as social animals, both in politics and in markets. It’s also the theoretical sun of the Epsilon Theory solar system.

For a crash course, here are some of the ET notes that have focused on the Common Knowledge Game, going all the way back to original Manifesto.

One of the most powerful and pervasive strands of Common Knowledge today is that inflation is practically non-existent.

Everyone knows that everyone knows that inflation is low.

We know this because we are told by our betters – by Missionaries in the game theoretic parlance – that inflation is low, and so it is … not in reality, but in the Common Knowledge. And that’s what counts.

It doesn’t matter if you personally believe that inflation is not-low. It doesn’t matter if there’s obvious data that inflation is not-low. It doesn’t matter because if you act publicly in opposition to the Common Knowledge … if you say that the Missionaries are wrong … then you will be punished for your public action so long as the Common Knowledge persists.

If you rely on the Missionaries for your bread and butter, then you can’t cross the Missionaries.

This is why the author of this MarketWatch article yesterday takes the most recent inflation data – some of which shows headline inflation rising less than expectations, but NONE of which shows core inflation falling – and frames it in a way that communicates “ho-hum, more low inflation just as far as the eye can see … green light for stimulus!”

Let me put it a different way.

Core inflation in the US is now at a 10-year high.

But we are told – in this ARTICLE ABOUT INFLATION – that precisely the opposite is true.

Is this “runaway inflation”? Of course not. But c’mon, man.

I’m really not trying to pick on this guy … I could pick 1,000 articles and 1,000 authors who do this, and we’re all just trying to make a living here. That’s my point, in fact. It’s not evil to write the article this way; it’s entirely rational.

This is also why “Don’t fight the Fed!” is not just a truism … it’s actually true.

But here’s the thing.

At some point a new Missionary will rise. One always does. And that new Missionary will change what everyone knows that everyone knows about inflation.

I’ll leave you with two thoughts on all this.

Sometimes Mr. Market is a Missionary.

The Fed has zero ability – ZERO – to combat that Missionary by raising interest rates and squelching the inflation Narrative.

You saw what happened in December of last year. You saw how Jay Powell was taken out into the public square and politically emasculated for raising rates. You think that’s ever happening again? LOL. Sorry, market peeps, but the Fed does NOT have your back on this one.

I look at that core CPI chart and see a massive consolidation below a flat top and the beginning of a breakout higher.

It is striking that when I chat with active market players, that the no-inflation view is a given, not a question.

Even when the data shows different

Even when some of the narrative supporting no inflation (like Globalization) has withered

Health insurance premiums are spiking, with recent YoY trends of 20%.

If you think there is no inflation google this: hedonic quality adjustments