Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories. On the weekend, we leave finance to cover the last week or so in other shifting parts of the Zeitgeist – namely, politics and culture. It’s not a list of best articles or articles we think are most interesting … often far from it.

But these are articles that have struck a chord in narrative world.

Bringing the Border to the Front Range [Boulder Weekly]

Increasingly rare, but powerful even so, are pieces which demonstrate high connectivity in narrative structure not because of their adherence to a particular common narrative, but because they connect otherwise disparate language with their own familiar language. It is the power of AND, a thing that most on-narrative journalism and writing misses, so caught up in hewing to some particular interpretation of facts.

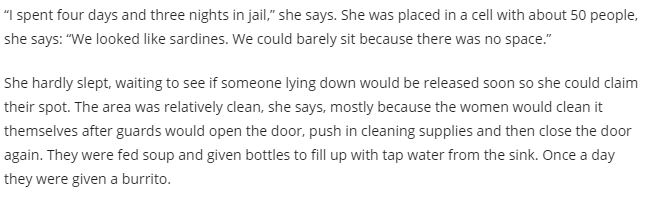

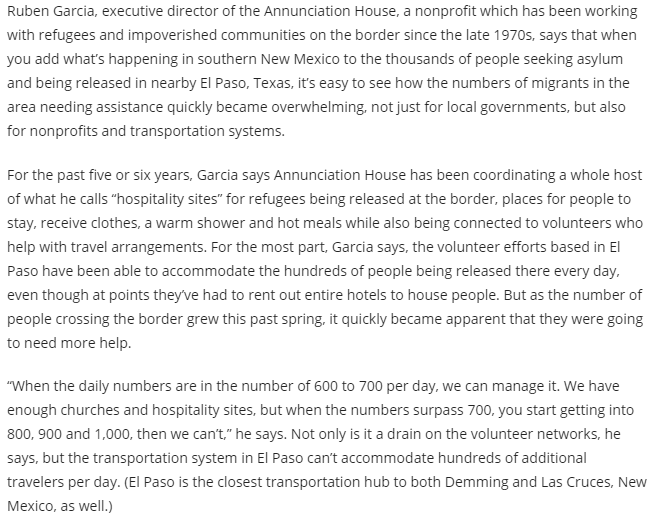

This is one. It does not shy away from discussing conditions of detention facilities at the border.

AND it does not shy away from discussing an influx of asylum-seekers that is not a fantasy.

AND it tells both the stories of those who fear the current administration’s policy’s effects, and those who admit that, under some definitions, it is working.

The piece is feature journalism. There are opinions, affected language and structural decisions that convey a view in this piece. But broadly? This is gyre-closing, not gyre-widening work. No, it’s not about always naively presenting ‘both sides’. It’s about remembering that most of our complicated issues warrant far more ANDs.

Yeah, well, Rusty…this may be pulling the gyre together, but it sure didn’t impact the people we would like it to. The comments after the piece surely do not display the sympathy we would wish our fellow Americans would feel…or do you think that the sympathetic (pack-like?) readers would not comment because the article is consistent with their thinking?