Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He plays guitar and drums on the worship team at his church in Connecticut, and dabbles in cooking, whisky, progressive rock and beating Ben at trivia.

Articles by Rusty:

A big day for the Green New Deal, tax policy old and new, a solution for morale problems at Palantir and a solution for god only knows at Davos.

Today’s Zeitgeist has a bit of private markets, Boeing and Apple, conspiracies and tax avoidance.

Food and retailing are top of mind (and…bullish?), trade continues to dominate content and commentary, and a hero rides in to protect the Lu Ann Platter.

The next stops in our discovery of the process of discovery? A town of 1,282 people and the mind of a German physicist named Arnold Sommerfeld.

Like it or not, the 2020 election season has begun. But I’ve got good news for you: someone has The Answer for the political center, and he’d very much like to discuss it with you.

Tech, telecom, pharma and defense report. Plus some…er…highlights, from Davos.

Oil falls, gas bounces, banks are buoyed. It’s apparently a weird gravity metaphor grab-bag on a Monday Zeitgeist.

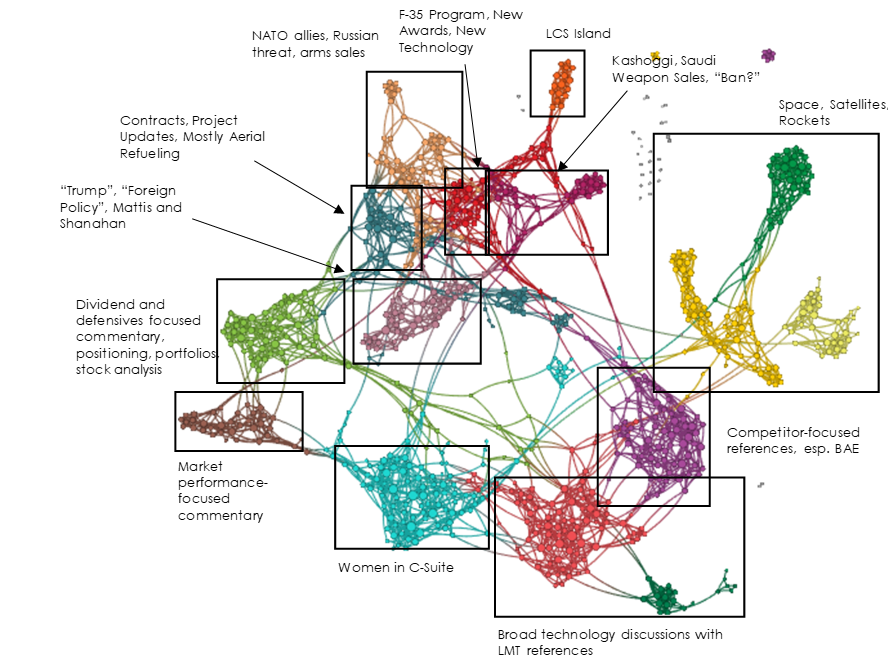

With aerospace and defense in the spotlight, we turn our own spotlight to the sector. We find a generally weak Narrative structure with a lot of vulnerability to positive and negative events. We also find some interesting shift in project-specific narratives for Lockheed Martin (LMT).

Billionaire penthouses, vertical integration in cannabis, non-musical music power, and a shifting tone in tech.

An American mutual fund gatekeeper does PR for China, DNC gunning for Wall Street, multiple missionaries live from the pulpit in Davos.