Rusty Guinn

Co-Founder and CEO

Rusty Guinn is co-Founder and CEO of Second Foundation Partners, LLC, and has been a contributing author to Epsilon Theory since 2017.

Before Ben and Rusty established Second Foundation, Rusty served in a variety of investment roles in several organizations. He managed and operated a $10+ billion investment business, led investment strategy for the second largest wealth management franchise in Houston, and sat on the management committee of the 6th largest public pension fund in the United States.

Most recently, Rusty was Executive Vice President over the retail and institutional asset management businesses at Salient Partners in Houston, Texas. There he oversaw the 5-year restructuring and transition of Salient’s $10 billion money management business from legacy fund-of-funds products to a dedicated real assets franchise.

He previously served as Director of Strategic Partnerships and Opportunistic Investments at the Teacher Retirement System of Texas, a $12 billion portfolio spanning public and private investments. Rusty also served as a portfolio manager for TRS’s externally managed global macro hedge fund and long-only equity portfolios. He led diligence, process development and the allocation of billions of dollars across a wide range of indirect and principal investments.

Rusty’s career also includes roles with de Guardiola Advisors, an investment bank serving the asset management industry, and Asset Management Finance, a specialized private equity investor in asset management companies.

He is a graduate of the Wharton School, and lives on a farm in Fairfield, Connecticut with wife Pam and sons Winston and Harry. He serves as a member of the Board of Directors of the Houston Youth Symphony, and with Pam has been a long-time supporter and founding Friend of the Houston Shakespeare Festival. He plays guitar and drums on the worship team at his church in Connecticut, and dabbles in cooking, whisky, progressive rock and beating Ben at trivia.

Articles by Rusty:

A busier than usual week, as first quarter earnings season kicks off for banks and airlines. A few other notables in tech and energy, as well.

In this news cycle, if an issue sticks around for more than a week, you can be sure that it isn’t by accident. It’s because it represents an abstraction, and because those in influence like how that abstraction changes our behavior.

Distillation isn’t a process of concentration. It isn’t a natural progression. It is a violent changing of the underlying thing. So, too, is portfolio construction.

It’s easy to convince ourselves that the opposite of being Narrative-driven is being data-driven. This is a lie. The most common way that narrative influences our behavior is through unadorned data, presented with the unstated implication that it is necessary, sufficient and explanatory.

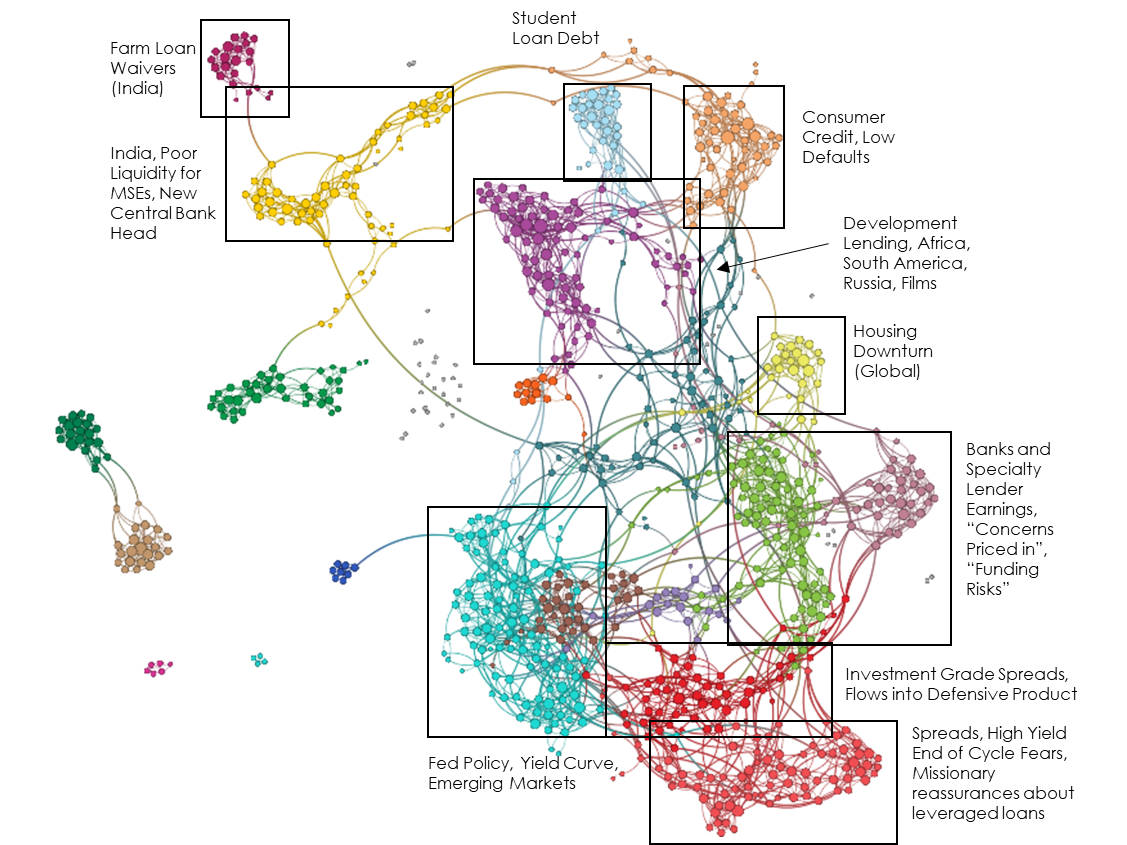

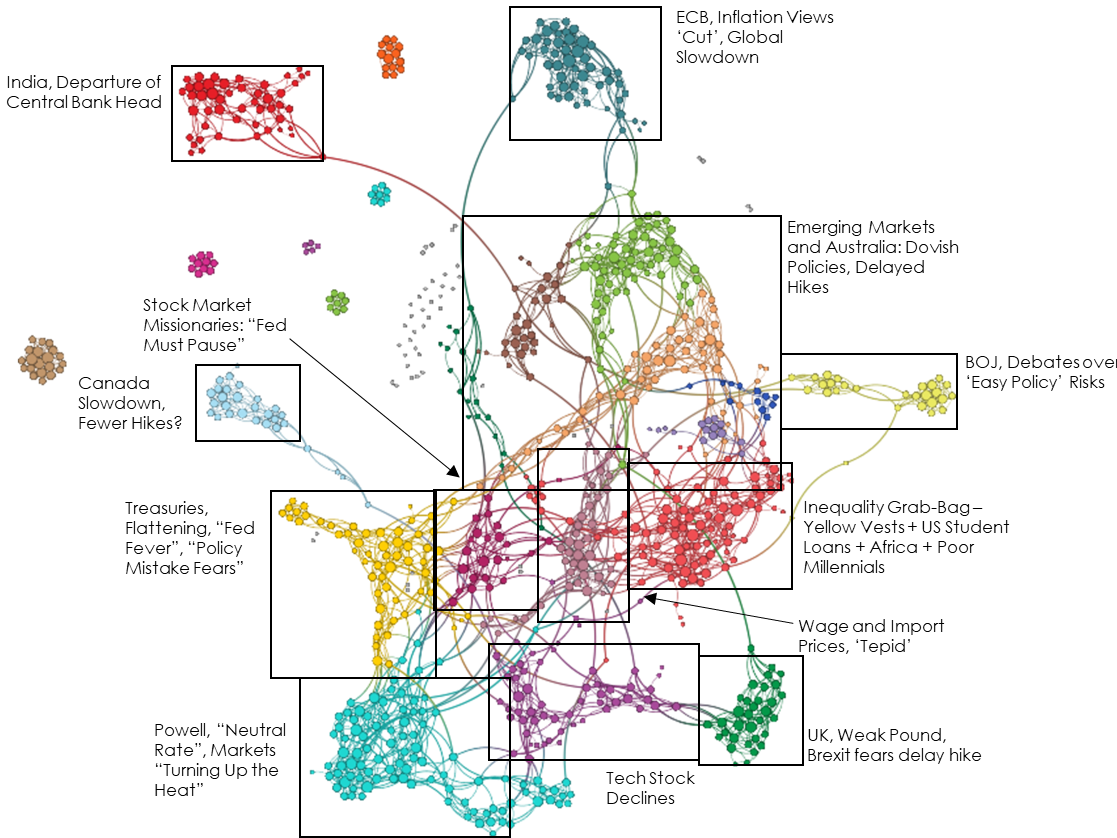

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. As we noted in November, missionaries in force were a leading indicator for…

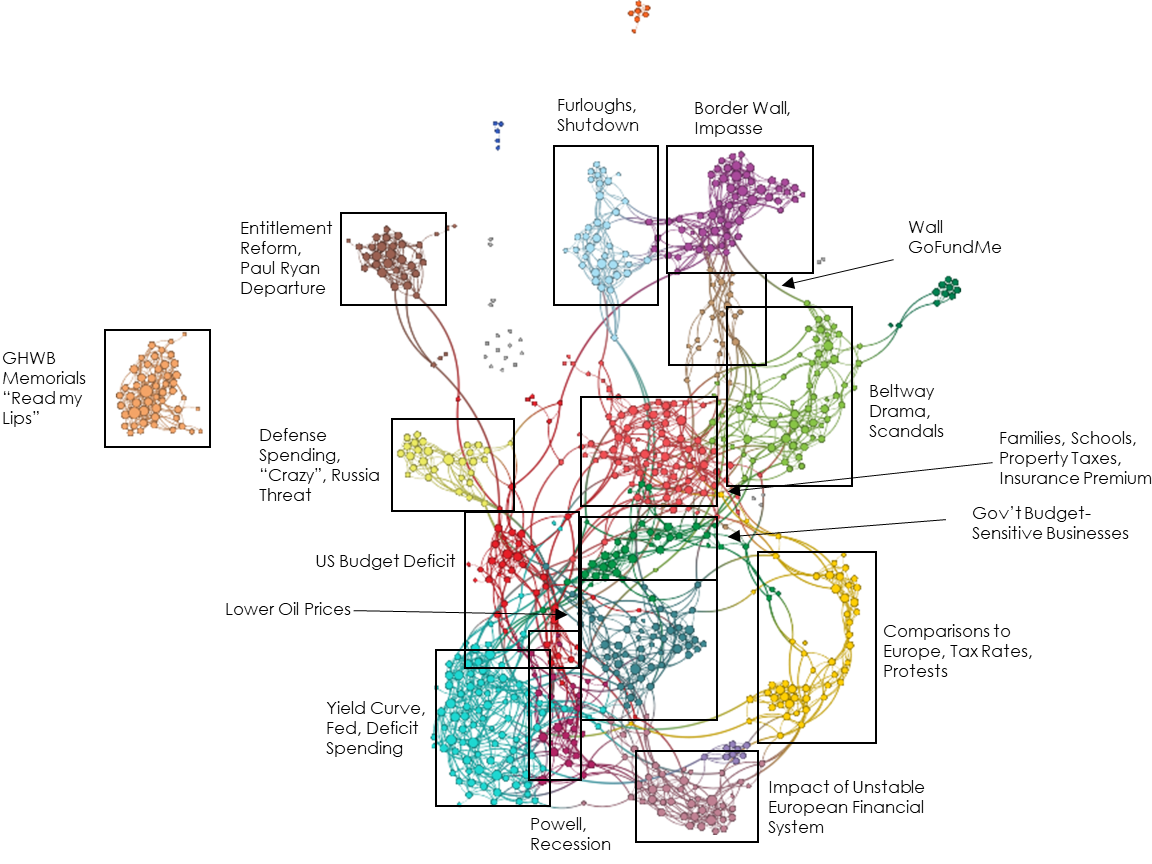

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. Fiscal policy in the US remains a largely low-attention topic with little in…

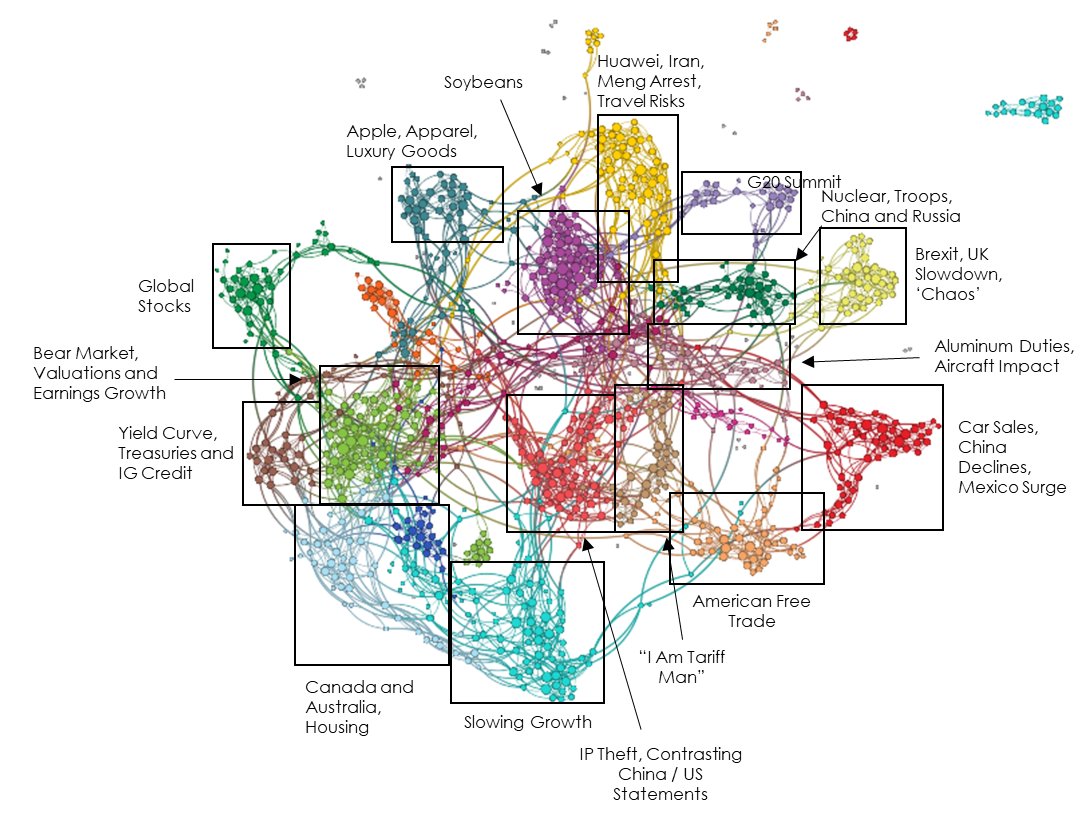

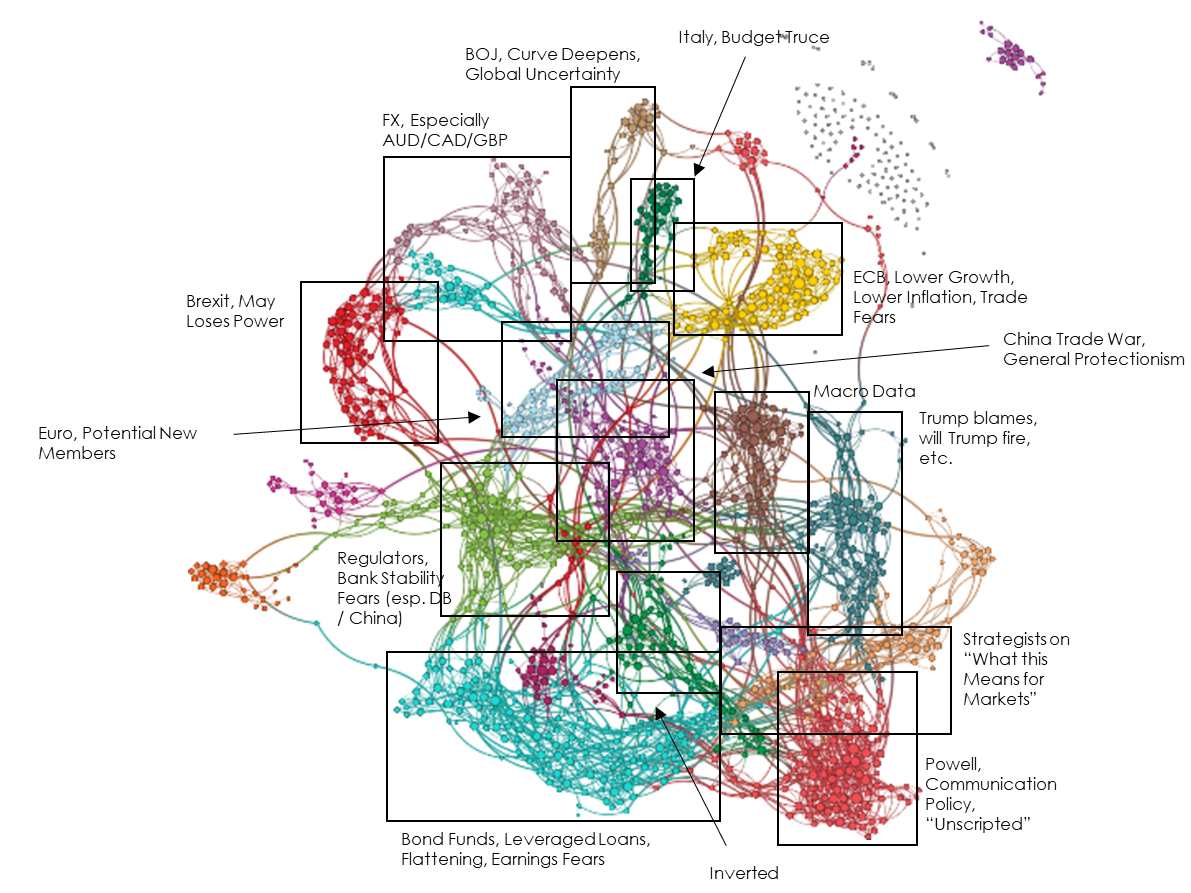

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. The focus on a China Trade War narratives accelerated even further in December.…

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. Attention to central bank narratives rose sharply in December, with a renewed attention…

Access this month’s monitor slides in Powerpoint and in PDF. Access the monitor values in Excel. For yet another month, stock market declines refocused investor narratives – especially concerning…

Three reporting companies this week. The most-connected articles include an odd weed obsession among media and analysts, and a…rather unfortunate Delta experience.