Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

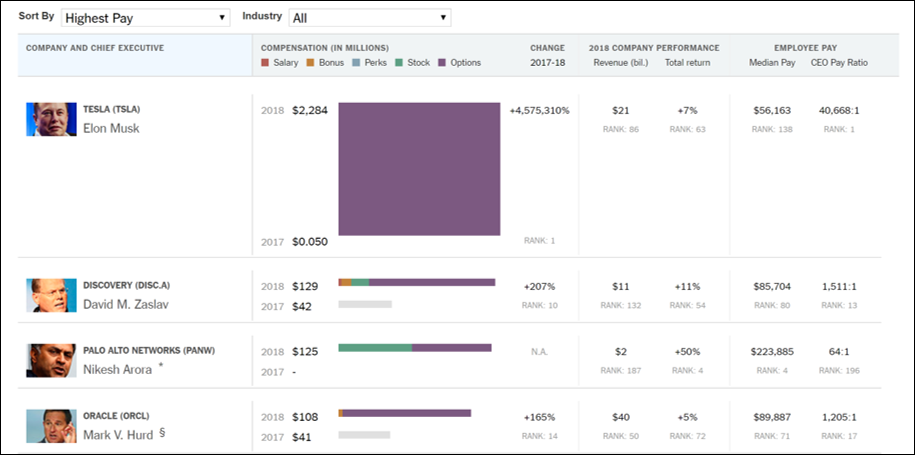

It’s Never Been Easier to Be a C.E.O., and the Pay Keeps Rising [New York Times]

In our annual ranking, we’re used to seeing paydays so big that they’re difficult to comprehend. But 2018 posed a problem on an entirely new scale. The pay package Tesla promised to Elon Musk was so large, we had to add an extra dimension to the chart below to display it accurately.

You don’t run the same gag twice. You run the next gag. – Ocean’s Eleven

It’s the best line in a movie full of great lines.

Elon is running the next gag.

Squares well with this tearjerker from the obfuscating man micromanaging and cutting employee costs…

https://www.bloomberg.com/news/articles/2019-05-29/musk-says-his-tesla-compensation-was-net-negative-last-year

Look a Squirrel