The first actual rich person I ever met, I met at Wharton.

Same goes for the second, third and probably 100th, for that matter. At 17, I couldn’t have told you what a trust fund was, described what an investment banker did, or listed a single prestigious preparatory high school in the country. Life, as they say, comes at you fast.

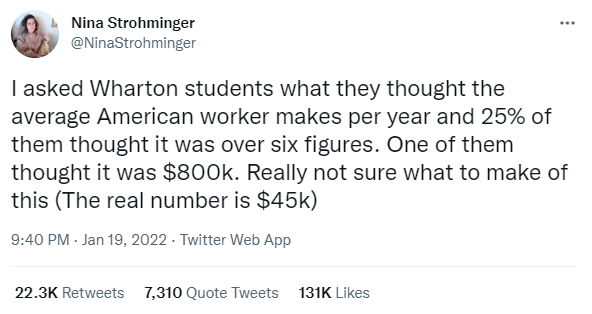

So when this tweet from a Wharton professor went viral over the last 24 hours, I had to chuckle.

Why was this worth a chuckle? Couple of reasons. First, because the Narrative that emerged from the tweet’s language – that rich students at an elite university are shockingly out of touch – is entirely consistent with my anecdotal experience. America’s elite universities are overflowing with some of the dumbest smart people you will ever meet. Strong Lucille Bluth guessing at the price of a banana energy.

The second reason I chuckled is that the narrative that emerged from the tweet had very little to do with its actual content. In fact, Dr. Strohminger went on to observe in the thread that she doesn’t think this is an unusual feature of these students at all, but rather the tendency of our individual estimates about population averages to be really, really bad.

What the tweet said is that 25% of students thought the mean income in America was over $100,000. A hundred grand is a really bad guess against the true number of $45-$50,000, but not wildly off relative to the average household income of $70-75,000 that some students probably had in their heads when they read the question. Figure that some of them probably thought they were being particularly clever by estimating greater skewness from income inequality pushing the mean above the more familiar median, and the 25% number giving an outlier answer is sort of worth a yawn in my book.

But what the tweet said doesn’t matter. How did it make us feel?

Even without intent on the part of the author, even without a fact pattern that supported it, the narrative that this was “about out-of-touch rich kids” resonated in all of our brains without a thought.

This, my friends, is our brains on Meme and metaverse.

— Rusty Guinn | January 20, 2022