What are Stock Buybacks...Really

-

What is a stock buyback?

-

- It’s the greatest transfer of wealth in 100 years. Not to founders. Not to visionaries. Not to inventors. Not to entrepreneurs. Nope … to managers. - When was I radicalized

-

- A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. - https://www.forbes.com/advisor/investing/stock-buyback/

-

- A stock buyback, or share repurchase, is when a company repurchases its own stock, reducing the total number of shares outstanding. In effect, buybacks “re-slice the pie” of profits into fewer slices, giving more to remaining investors - https://www.bankrate.com/investing/stock-buybacks/

-

Are buybacks good for investors?

-

- In addition to using 88% of its stock buybacks in a non-sterilizing, actual share count reducing manner that does in fact return capital to shareholders in a tax-advantaged way, Apple also returns capital directly to shareholders through a dividend. Put these together and Apple has returned more than 90% of its free cash flow to investors through stock buybacks and dividends over the past decade, a total of more than $600 billion. - Stock buybacks! And the monetization of stock based compensation

-

- … in nearly all cases where companies buy back stock, in the narrowest interpretation of that specific action of buying back stock, is management acting ethically and in the interest of shareholders”? Almost universally yes, because math. - So I got that goin’ for me

-

Why would a company do a stock buyback?

-

- In my experience, cash burns a hole in most management teams’ pockets. Their natural instinct is to spend the cash – and it is MY cash as a shareholder, not their cash – on an empire-building acquisition or internal expansion, and if they’re not going to give me MY money back directly in the form of a dividend (on which I have to pay taxes, so ugh, but okay), then the least harm they can do is buy back shares and shrink the share count. - Stock buybacks! And the monetization of stock based compensation

-

- In some cases, a buyback can hide a slightly declining net income. If the share repurchase reduces the shares outstanding to a greater extent than the fall in net income, the EPS will rise irrespective of the financial state of the business. - https://www.investopedia.com/terms/s/sharerepurchase.asp

-

- A stock buyback is one of the major ways a company can use its cash, including investing in the operations, paying off debt, buying another company and paying out the money as a dividend to investors - https://www.bankrate.com/investing/stock-buybacks/

-

What happens when a company buybacks shares?

-

- For the past five years, Texas Instruments has been nothing more than a tracking stock for a passive semiconductor index.For this privilege, shareholders have rewarded management and directors with $6.2 BILLION in stock, plus a couple of BILLION in cash compensation. - Yeah it’s still water

-

- In a poker game, the rake is the cut that the casino dealer takes out of every pot. It’s usually a couple of dollars per hand … barely noticeable, certainly not noticeable to a casual poker player like me. But what if the dealer started taking 18-25% out of every pot as his rake? Would you notice then? That’s what JP Morgan management does with its “return of shareholder capital” through stock buybacks. - The Rake

-

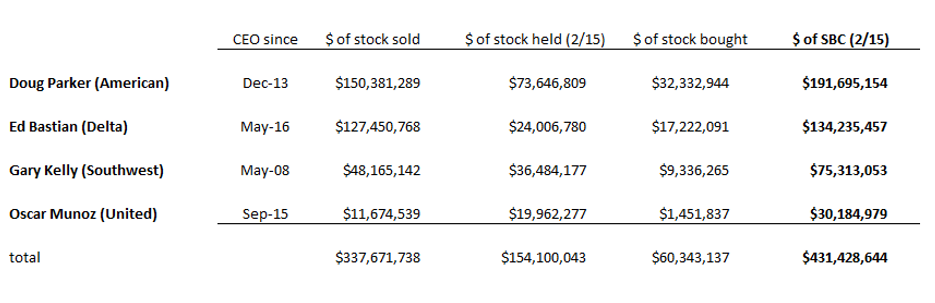

- For each CEO, I’ve compiled a comprehensive list of every share of stock in their company that they’ve sold (and the price they sold it for), every share of stock they still hold, and the price at which they’ve acquired the stock that they have sold or currently hold (usually the acquisition price is $0, but occasionally they exercise an option). Notably on that last item, there are ZERO examples of any of these CEOs buying stock in their own company in the open market. ZERO. From these three data points (value of stock sold, value of stock held, cost of stock sold and held), we can construct the total profit each CEO has made on their stock transactions in their respective company. Realized stock sales + unrealized stock sales – cost basis = total stock-based value received. Here’s the compiled data.

-

Why are stock buybacks bad?

- I do not believe that buybacks are inherently evil or that they should be banned from existence. I DO believe, however, that they are intentionally used by management to obfuscate and sterilize ludicrous stock-based compensation schemes, so that much of the capital that is supposedly “returned to shareholders” through buybacks is not returned at all, but is hijacked directly into management’s pockets. - Do the right thing

-

Stock Buyback Reading List: