Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

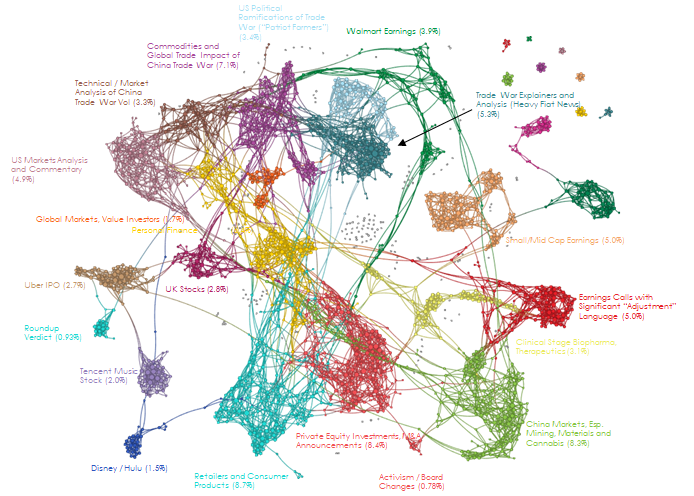

May 15, 2019 Narrative Map – US Equities

Stocks Stabilize as U.S.-China Trade War Enters New Stage [NY Times]

Still, the tone across financial markets was positive.

The original headline was ‘Stabilize’; it’s since been changed to ‘Rebound’.

You see this sort of revisionism a lot these days. Of course, if it had been anyone but the NYT, they would have used ‘Recover’ instead of ‘Stabilize’ and ‘Soar’ instead of ‘Rebound.

We’re only in the Denial stage of the market grief cycle regarding the potential death of a US-China trade deal.

The Pivot In U.S.-China Trade Policy May Herald Long-Term Tension [Seeking Alpha]

Additionally, and importantly, years of negotiating with China have left bipartisan scars in Washington. U.S. negotiators feel that many previous negotiations have played out in a similar fashion: lots of talk, promises of concessions, and perceived advancement, followed by equivocation and backpedaling when the time actually came for China to deliver. While other administrations have pursued a more patient approach, Trump (and many other policymakers in Washington) seems to have little tolerance for this now and is willing to take a more direct approach.

Lastly, China trade issues play well with Trump’s base politically, so keeping them in the headlines as the 2020 campaign season intensifies could have benefits for the president.

Not quite sure why PIMCO is now a Seeking Alpha contributor with 306 followers, but whatevs.

From a narrative perspective this is interesting to me because PIMCO is definitely a Missionary, and the more Missionaries who take this stance, the sooner we advance along the Kubler-Ross scale.

How Viable Are AOC’s Green New Deal Energy Proposals? Just Ask Europe [Fortune]

No country on Earth has tried to implement all the Green New Deal ideas at once—it’s a policy smorgasbord heaving with environmental, social and stimulus-related offerings. Critics have painted the resolution as radical, but many of its social elements are so common in Europe they’re almost taken for granted, such as universal healthcare. And two of its energy-related proposals have started to become reality there, too. Europe has, in essence, tested the viability of transitioning to renewable energy and making houses more energy efficient. And the results of those experiments are worth inspecting, particularly when it comes to timing and the question of jobs.

Honestly, I was expecting this article to be a fountain of Fiat News. It’s not. The simple fact is that we CAN implement many of the Green New Deal policies if we choose to do so, at the cost of structurally lower economic growth, higher taxes across the board, and greater political polarization.

It’s a political choice FOR a Widening Gyre.

Which is why I think it’s got legs. Because as much as we all tsk-tsk about the center not holding, we can’t take our eyes off the political entrepreneurs spinning us into oblivion.

Trump says he’ll meet with China’s Xi amid intensifying trade fight [CNN]

The article itself is nothing … a regurgitation of everything else you’ve read over the past few days. But I couldn’t stop staring at this picture of Larry Kudlow.

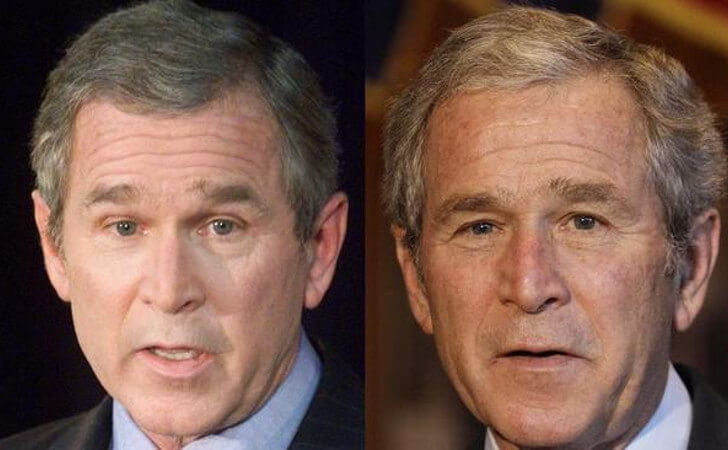

There’s a famous body of work on how serving as President ages you in office. Here are the three most recent ex-Presidents, with the photo on the left as they entered the White House and the photo on the right as they left.

My strong sense of the Trump White House is that The Donald will look exactly the same when he leaves as when he entered. It’s the people working for him that age in dog years.

Many Americans Will Need Long-Term Care. Most Won’t be Able to Afford It.; the new old age [NY Times]

The United States, unlike many Western democracies, has never created a broad public program covering long-term care. Medicare pays for doctors, hospitals, drugs and short-term rehab after hospitalization — not for independent or assisted living.

That could change one day — imagine a new Medicare Part LTC — but “that will be incredibly difficult to achieve politically,” Ms. Pearson said.

Ehh … not that difficult. Before it’s all said and done, the Boomers are going to pull forward every bit of national wealth for the next 100 years to service their needs.

Think of Trump as one of the main characters on Seinfeld or Always Sunny. Everyone they meet gets ruined in some way, but they somehow just keep on truckin.

“Ehh … not that difficult. Before it’s all said and done, the Boomers are going to pull forward every bit of national wealth for the next 100 years to service their needs.”

They’ll try, but the Millennials are on to them - they get the game being played against them - and are starting to fight back politically. Not a perfect fit to our discussion, but still, a lot of relevant ideas in this WSJ Op/Ed from yesterday:

https://www.wsj.com/articles/boomer-bequest-is-millennial-misery-11557788725?mod=itp_wsj&ru=yahoo

PIMCO probably a Seeking Alpha contributor because contributors can make money with their writing.

“…because PIMCO is definitely a missionary.” What about Pimco in particular makes them a missionary…or would you say all of the big asset managers are?