Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

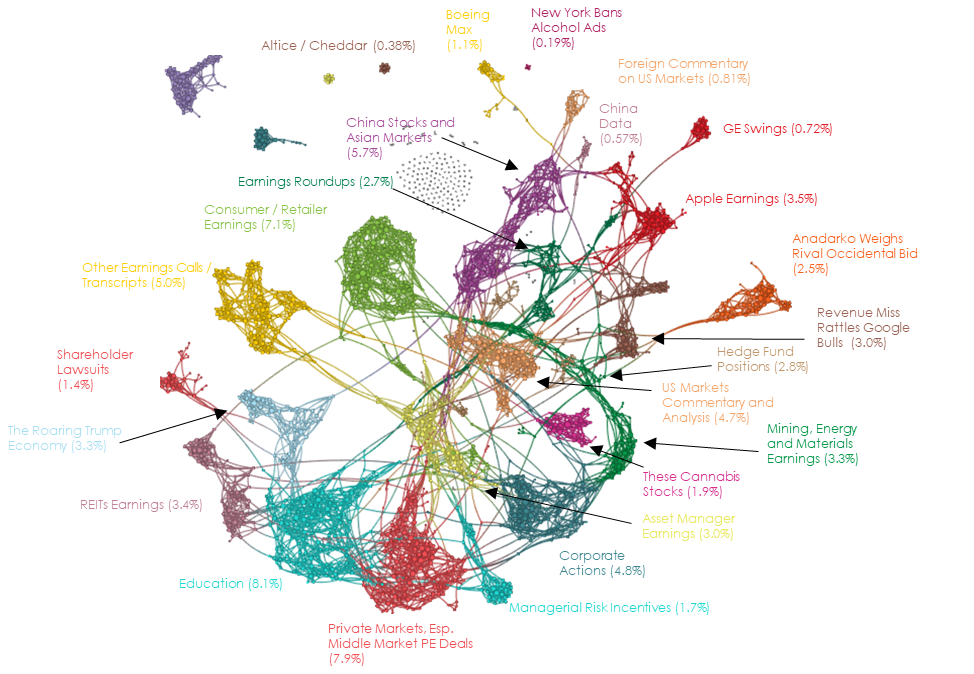

May 1, 2019 Narrative Map – US Equities

Americans are spending on their dogs and cats like children. That’s a boon for Chewy [CNN]

Americans’ obsession with their pets is lifting Chewy, the online pet food and supply company.Chewy announced on Monday that it will go public. It chose a good time for its IPO: Chewy pulled in $3.5 billion in 2018, around a 65% increase from the year prior.

The Pets.com IPO in February, 2000 came to symbolize the tech bubble, and for good reason. This was a bullshit company to take public … negative gross margins, total sales of $7 million (that is not a typo) in its 12 months of operation. By November, 2000 the company was in liquidation.

Lots of people have forgotten that Jeff Bezos built Pets.com and was responsible for pushing this abomination onto the public.

I haven’t.

Wealthy California couple expected to plead guilty in college admissions scandal [USA Today]

Bruce and Davina Isackson … who have apologized publicly for their actions, have accepted deals with prosecutors pleading guilty to conspiracy to commit mail fraud and honest services mail fraud. Bruce Isackson, the head of a Bay-area real estate firm called WP Investments, has also agreed to plead guilty to money laundering and conspiracy to defraud the U.S. for deducting the payments from their taxes as charitable contributions.

Bruce and Davina Isackson love their children. Bruce and Davina Isackson would do anything for their children. Bruce and Davina Isackson get the joke. Bruce and Davina Isackson are rich.

The problem for Bruce and Davina Isackson is that they aren’t rich enough.

Equifax survey reveals saving is a challenge for most consumers [Press Release]

Equifax Inc. (NYSE: EFX), a global data, analytics and technology company, today released the results of its annual Financial Literacy Survey, in which nearly half of surveyed adults indicated they do not have enough savings to cover at least three months of living expenses. This percentage has increased 35 percent from 2018 among respondents ages 45 to 59 – with six in 10 consumers in this age group responding they lack an emergency fund.

In addition to lacking an emergency fund and enough savings to cover at least three months of living expenses, more than half of surveyed consumers (56 percent) said they don’t have any money left over at the end of the month. And while slightly more than 62 percent of surveyed consumers have created a budget over the past year, 35 percent of surveyed consumers admitted they are not saving for retirement – up from 29 percent last year.

Texas company Tellinga turns your life into a comic [San Antonio Express-News]

Combining the fun of a comic strip with the anticipation of waiting for something special to arrive in the mail, Tellinga (as in “telling a…”) bills itself as a way to turn personal stories into unique gifts.

I actually think this looks like a cute product. But here is where we are in 2019 business plans … snail-mail delivery is now a feature rather than a bug, as it creates “the anticipation of waiting for something special to arrive in the mail.”

Tom Sawyer was a piker.

Technisys raises $50 million to continue empowering banks with disruptive tech [Press Release]

It’s hard to win Buzzword Bingo in a 10-word headline, but here you go.

Warren Buffett gets in the middle of oil bidding war [CNN]

Occidental said Berkshire Hathaway would receive 100,000 shares of preferred stock that pay a sizable dividend of 8% a year [on $10 billion]. That compares with a roughly 5% dividend on Occidental’s common stock.

Existing Occidental shareholders could have their positions watered down because Berkshire would receive warrants to purchase up to 80 million shares of common stock. The warrants have an exercise price of $62.50, compared with the current price of about $59.

I think I saw that the preferreds can’t be bought back by Oxy for something like 10 years. LOL

What is shadow banking? THIS.

Not that there’s anything wrong with it. Hey, this is Uncle Warren’s true face, and I’m a fan of authenticity in all its forms and ways. But if you think poorly of a guy like, say, Ken Griffin because you think Citadel was “bailed out by the US taxpayer”, and you don’t think EXACTLY the same about Warren Buffett and Berkshire Hathaway … then you’ve been played.

Uncle Warren…the ultimate wolf in sheep’s clothing! I own the stock despite loathing the man. What does that say about me other than I have pee-ompted myself out to the system…

Btw, my generation…not satisfied in having enfeebled our children, Opra-fied style, we have to now rapidly move to enfeeble our pets (same allergies, designer foods, pet “esteem”, blah-blah=blah)! Wtf?!