I’m delighted to introduce Kyla Scanlon as a contributing author to Epsilon Theory!

Kyla is, in her own words, an educator, creator and author, and in my words she is one of the most interesting fresh voices in finance today. Please take a look at kyla’s Newsletter on Substack, because it’s really good, and she is an instafollow on Twitter (or whatever you want to call that platform) @kylascan. You can contact Kyla directly via email at [email protected].

As with all of our guest contributors, Kyla’s post may not represent the views of Epsilon Theory or Second Foundation Partners, and should not be construed as advice to purchase or sell any security.

“If you have to call it different names, it’s not a recession.” – Neil Dutta

“Are we in a Recession?” is probably one of the most asked questions of the past few years. Some people will respond with a full-throated “Yes, Absolutely”, others will point to the economic data that clearly outlines that we aren’t, and others will shrug their shoulders and turn back to focusing on what they need to get done.

The psychology of a person is a fickle beast.

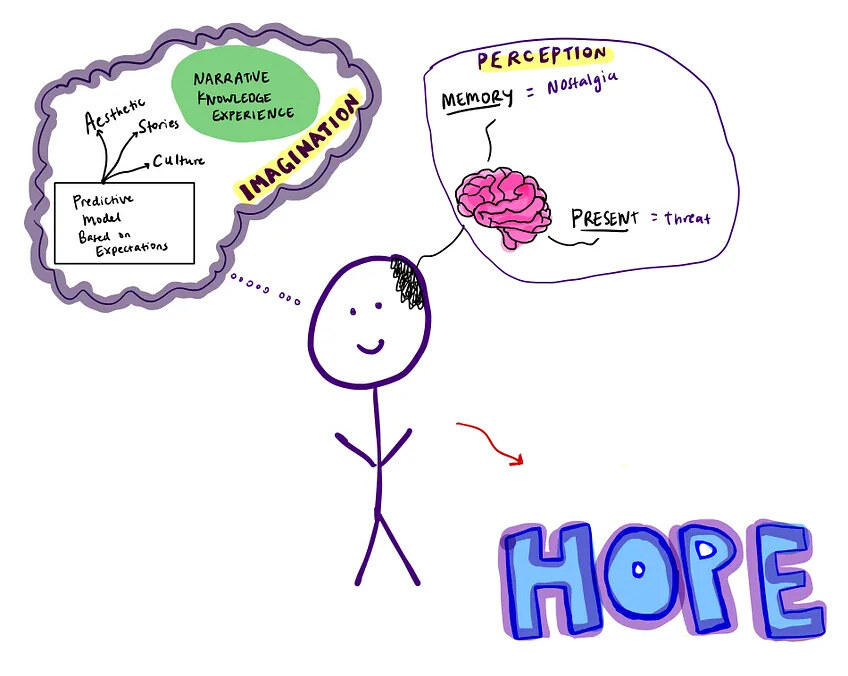

I started a series last week exploring the idea of nostalgia as a forcing function for why-people-do-things-the-way-they-do with the general idea that “good ol times”[1] drive a lot our perception of current times. Nostalgia is how we look upon the past and unfortunately, threats are how we see the present.

And today I want to walk through the whole “we are in a recession” ideology, contrasted against the nostalgia cycle loop, through economic perception, bifurcation, and cynicism.

Economic Perception

So the figure below shows a pretty rough model for how most people likely interact with the economy – there are a few questions like

1. “Can I afford a house”

2. “Is my job stable”

3. “Do I have enough money to buy things I need and things I want”

This is of course generalizing – but that’s pretty much most people’s economic model. Can I buy it if I want it?

- And the answer for a lot of people has been no – but people around them seem to be able to. And that’s annoying. And frustrating. And wealth is concentrated amongst just a few.

- The economic perception model is improving (home prices are going down, the labor market is stabilizing, real wages are sort of going up but inflation is going down which helps a lot) but still it doesn’t feel good.

There is also nostalgia within that – “I used to be able to” or “Society used to be able to” and that skews the model even more.

This gets into the second point of bifurcation.

Bifurcation

Millennials are finally catching up to the older generations, but for a long time, there was a large gap between generations that didn’t seem like it would ever get closed. And of course, across all of time, younger people have had to pull themselves up by their bootstraps or whatever, but the whole labor market model changed over the past few decades.

- You can’t really go as hard on a 9-to-5 salary.

- You can’t really buy a house (in places where most people are trying to buy houses) because life is expensive and wages haven’t kept up with that, something Noah discussed – “we can theorize about the psychology of the vibecession all day long, but maybe in the end it was just a wagecession.”

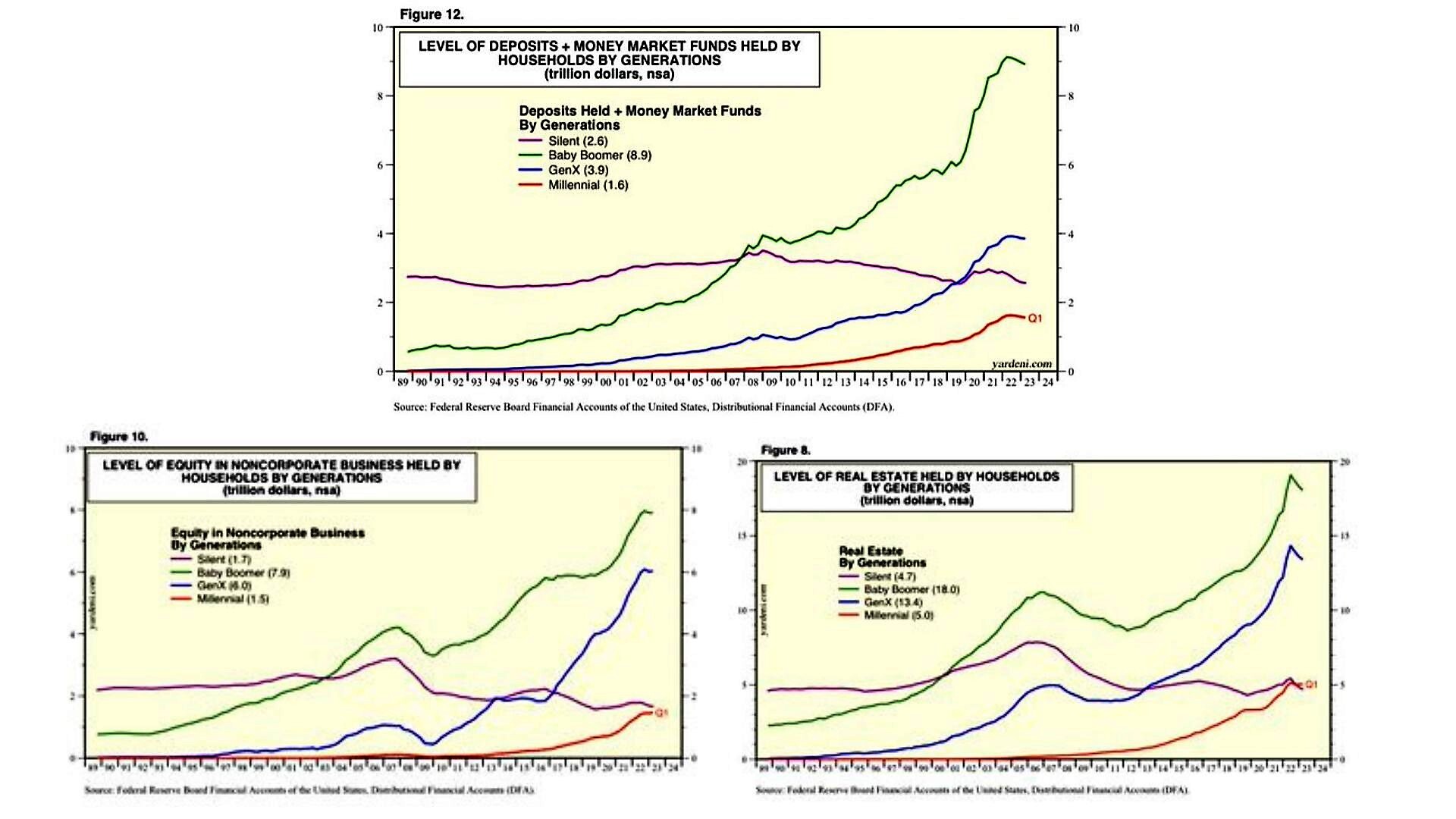

And ownership of assets is a whole separate issue. These three charts show the collective power of the Boomers – the amount of money that they have in money market funds, corporations, and real estate. They have almost $80T in net worth. That’s a lot of money! And real estate!

But this is of course, bifurcated too. Nearly half of boomers have no retirement savings. And this disparity is unfortunately nothing new. Top incomes in the US skyrocketed post-pandemic and while lower-income Americans did get a wage boost, it isn’t the wage boost needed to tip that scale back into balance.

So even within the generational bifurcation, there is further bifurcation.

Then there are the stories told.

Cynicism

So when we think about who has a lot of economic power it does ultimately end up being the boomers – a lot of spending and a lot of political sway. And Boomers pay attention. The collective stories we tell (something I’ve written a lot about) influence how people feel.

There are two things here –

1. Black Mirror-ification

2. Institutional Nihilism

Black Mirror

There is the Black Mirror-ification (a show that shows how dystopian all of this can really get) of everything as Ben highlighted –

“Black Mirror preys on the cultural appetite for dystopia-porn, & abuses the psychoactive memetic properties of fiction to imbue bad versions of reality with undeserved hyperstitial credence Make good art about the realities you want to instantiate, not the ones you want to avoid“

With a caveat that shows like Black Mirror let us process unease and move forward from the freakiness as Hayden Jackson said, but still, we tend to only focus on the unease. The present moment becomes a threat rather than something exciting.

- Marshall McLuhan was spot on here -“people prefer bad news to good news, because bad news provides them with a “survival emotion” while good news threatens them with change”

So when good things happen, we raise our eyebrows nervously. We lose trust in the underlying system because all the TV shows say that we should and also change is scary.

So when things are going okay, it doesn’t feel that way. As Joey wrote –

“A large part of the reason our economic discourse is broken is that a strong majority of people report hearing news about higher unemployment despite the fact that unemployment is at historic lows and the US has added like 1.5M jobs in the last 6 months“

It’s no secret that if you are a news organization and you publish an article saying “THE WORLD IS ENDING” people are going to click and read and then you get ad money or whatever. But the problem is some people believe the clickbait title and then they go and turn around and have conversations with their friends along the lines of “hey did you hear the world is ending?” who then talk to their friends, and boom, that’s the Discourse.

Institutional Nihilism

And then, people will look for someone to save them from the impending doom that they exist in. That’s the institutional nihilism – as Steve Bannon described it and Derek Thompson expanded upon –

“The “Tucker-Rogan-Elon-Bannon-combo-platter right.” It’s the paranoid style of politics, updated for the 21st century. A pu pu platter of “you can’t trust THEM” conspiracy-casting“

These are the people that will save you from the world ending, hypothetically. They are also people that sow seeds of distrust into existing structures, postulate on Twitter about Recessions, and tend to proclaim that things are Much Worse Than They Actually Are. The marginal cost of plausible bullshit is effectively zero.

As Anne Applebaum wrote –

“But a certain kind of autocrat, of whom putin is is the outstanding example, seeks to convince people of the opposite: not to participate, not to care, and not to follow politics at all… The constant provision of absurd, conflicting explanations and ridiculous lies – the famous ‘firehouse of falsehoods’ – encourages many people to believe that there is no truth at all. The result is widespread cynicism. If you don’t know what’s true after all, then there isn’t anything you can do about it. Protest is pointless. Engagement is useless.”

And there is a LOT to talk about there.

- Cynicism as a driving force for how people interact with the world

- A general sense of giving up

And the thing is, I really don’t think that this is how broad swaths of people really see stuff. It’s well known that the most annoying people speak the loudest, but those loud people, even if their beliefs aren’t that popular, tend to permeate the discourse just on sheer volume.

And to be fair! Some of this is warranted! If you see companies going through layoffs, it’s going to change your economic perception. It’s going to feel really bad, because it is really bad.

But there is a vein of distrust that runs deeper than that and this cynicism bleeds into how everyone interacts with the economy and interprets the collective reality, which creates some weird feelings (the vibecession).

The Constant Threat

The AP published a piece saying “well is it a rolling recession or a richcession or what is going on” and the thing is it’s probably a mix of all those things. Tech layoffs, finance layoffs, etc, it’s a concentrated part of the economy.

The economy is changing. Credit-sensitive industries are flopping around, because cheap credit can’t drive the economy anymore. The economy has been weird because of the looming threat of inflation, elements of declining growth, and just general fear. It makes sense that people are spooked out.

But what’s sort of funny about all of this is that fiscal policy has been the buttress for the economy. As the Fed has whacked at things with their rate hike hammer, the supportive fiscal policy that we had during the pandemic coupled with the now-enacted investment from pre-CHIPS and pre-IRA era (plus planned investment from both of those things) has made the economy… really good? We’ve managed to get inflation down AND see growth. Which is bonkers.

But even with that –

Some people will still throw their hands up and say “well we aren’t in the zero interest rate world that I remember, that I am nostalgic for, the world where I could get someone to drive to my house and pick me up and drive me somewhere else for very little money therefore I am going to be very cynical and angry”

As Matt Darling said

“Even when inflation is low (ie, Obama/Trump years) if you ask a non-econ nerd about inflation, they would immediately say “inflation is too high” because they understand “inflation” to mean “I would like goods to be cheaper.”

What fiscal policy has accomplished is honestly incredible. We are building a lot of chip fabs and EV manufacturing facilities, and that has provided support to the manufacturing side of the economy, which has allowed the U.S. to remain stable as other countries try to find their footing. As Rho Khanna said

“If you have an economy that is shaky because you have both inflation and a looming threat of, if not recession then declining growth, the only thing that can actually tackle both of those phenomenais an increase in productivity and increase in production“

We are doing that! And people are starting to feel better – Jordan Weissman highlighted that “only 44% of Americans think we’re in a recession, or will be soon according to Transunion’s latest polling… down from 60% in Q2 2022”

To be clear, there is a lot coming – student loan payments, funky real estate markets, firms in distress – it’s never perfect.

Final Thoughts

But circling back to cynicism, when we think about the economic perception model, it makes a lot of sense that people are frustrated. Wages haven’t kept up. Houses don’t seem attainable. There is bifurcation and stratification which is compounded by cynicism and distrust. But it’s like a personal thing too – Simon Sarris wrote:

“People avoid all talk of serious goals because if they admit them, even to themselves, then they would have to accept that they can fail.“

We have to accept failure. And scary things. And the fact that things are relatively okay-ish. It sometimes feel futile to be like “well here is what we could do to fix that” but there are antidotes (I think) like refocusing the collective imagination.

Cynicism is lazy. As Maria Popova said in her 2016 commencement address at the University of Pennsylvania –

“Today, the soul is in dire need of stewardship and protection from cynicism. The best defense against it is vigorous, intelligent, sincere hope — not blind optimism, because that too is a form of resignation, to believe that everything will work out just fine and we need not apply ourselves. I mean hope bolstered by critical thinking that is clear-headed in identifying what is lacking, in ourselves or the world, but then envisions ways to create it and endeavors to do that.

In its passivity and resignation, cynicism is a hardening, a calcification of the soul. Hope is a stretching of its ligaments, a limber reach for something greater.”

Hope and imagination, the ability to see a world different than the one we inhabit. I am going to include this giant passage from Ursula K. Le Guin because it’s very good –

“I think the imagination is the single most useful tool mankind possesses. It beats the opposable thumb. I can imagine living without my thumbs, but not without my imagination.

I hear voices agreeing with me. “Yes, yes!” they cry. “The creative imagination is a tremendous plus in business! We value creativity, we reward it!” In the marketplace, the word creativity has come to mean the generation of ideas applicable to practical strategies to make larger profits. This reduction has gone on so long that the word creative can hardly be degraded further. I don’t use it any more, yielding it to capitalists and academics to abuse as they like. But they can’t have imagination.

Imagination is not a means of making money. It has no place in the vocabulary of profit-making. It is not a weapon, though all weapons originate from it, and their use, or non-use, depends on it, as with all tools and their uses. The imagination is an essential tool of the mind, a fundamental way of thinking, an indispensable means of becoming and remaining human.“

Imagination is important. So is real world data. We have to make sure people get paid enough to live. And we have to figure out imagination – not harness it as a way of helping VCs return capital to LPs, but rather to create a better world for all of us to live in.

Thanks for reading.

Other Things

Google’s YouTube Is Testing an Online-Games Offering | The Zoomer Question | Never Underestimate Central-Bank Groupthink | Financial storm bears down on US commercial real estate | “So fine us, we can afford it”

Disclaimer: This is not financial advice or recommendation for any investment. The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

[1] Even though the good times weren’t that great – we went from spending 50% of our lives working to 20%!

Her videos on Twitter have been really enjoyable and it’s great to see her here at ET. A+ addition.

I came across Kyla’s work on YouTube a fair while ago and have been a stan ever since. Living proof that you don’t have to use $10 words to convey complex ideas in impactful and engaging ways.

She made a great short video on Twitter lampooning a Bloomberg article about how to cut grocery bills. It was like 55 seconds long, made me laugh, and was immediately endearing. She’s figured out how to deliver smart commentary while sounding like one of my wife’s high school students. It’s such a clever subversion of expectations. It reminds you that you don’t need to talk like a professor to get information across to an audience.

Talking about a ‘vibecession’ may not hook a grizzled Boomer, but it’s a term that you could see a young person immediately understanding and serving as a gateway to them wanting to learn more about a topic that perhaps was previously too stuffy or unapproachable.

I have never heard of Kyla, but I very much like my first “exposure” to her writing.

Next, Kyla should probably consider writing about the complicated interplay between words-on-paper/screen and the human mind, and how it can result in vastly different interpretations…As a vivid example, my pattern seeking brain has drawn a direct link between the following:

“do I have enough money to buy the things I need?”

.

.

.

crushing psychological weight of being alive

.

.

.

cynicism/nihilism

.

.

.

lack of hope/imagination

…forming a good argument for universal basic income! This is probably not at all what Kyla intended, hence my interest in the the strange space between her words and my brain.

But as the Popova quote (love The Marginalian!) points out, we don’t need blind optimism (i.e. expecting to have all of our wants fulfilled without applying ourselves) but we do need hope. (the ability to buy the things we need to survive).

I truly believe that hope is very effectively banished in favour of cynicism when we discover that the answer to the question “do I have the means to buy the things I need to survive” is a firm “no”.

And why do we need hope? Because as Kyla writes, we need imagination - on a grand scale. And imagination is downstream of hope. Not cynicism.

If we want a better world we need people in this world with the ability to visualise it. And this cannot be outsourced to the “one percent”.

Thanks for a great guest writer addition.

Kyla,

Your piece speaks to the heart of Epsilon Theory (imo).

Thank you.

Note: I discovered Maria Popova’s Brain Pickings maybe 12 years ago. Extraordinary resource of bringing ‘the old stories’ to life. Quite a few of my comments here have been influenced by her articles, including the works of Ursula K LeGuin.

Welcome to Epsilon Theory,

Jim

The Marginalian continues to be a free, IMO, small l library of ‘Alexandria.’

Hi Kyla,

Thank you for your contribution to Epsilon Theory. I’ll look forward to reading your writing.

I share your concern that the public have a low trust of institutions and their stories. But I think it would be really nice if institutions, including economic story-tellers, first go the extra mile in telling it as it really is.

Long term history is not promising. During the gold standard, it was ‘gold standard good, fiat bad.’ It was ‘gold peg will hold’ while it was about to collapse. Then it was ‘gold standard bad, fiat good’ under ‘fiat money.’

During the roaring 1920s, it was ‘great economy.’ It was ‘only a minor problem’ while it was about to implode. Then it was ‘austerity good, stimulus bad’ during the worst of the Great Depression. When the Great Depression was far in the rearview mirror, ‘stimulus good, austerity bad’ was trotted out whenever central banks wanted to pursue inflationary stimulus, but not right now, where the story is ‘economy holding, inflation bad.’

I agree that mainstream economists can be forgiven for holding on to outdated thinking, and what not. It just seems that they are much better at knowing the wishes of the powers that be, and championing them.

In its passivity and resignation, cynicism is a hardening, a calcification of the soul. Hope is a stretching of its ligaments, a limber reach for something greater.”

As a physically active person getting both crankier and creakier with age, this really hit home. Lots of good stuff in your note, thank you

Point well taken, but, ultimately, no good can possibly result from hope triumphing over experience.

The only possibly good way forward is to be clear eyed and hold all power, including those who write our economic stories, to account.

Loved the Popova excerpts from the commencement address. Thanks for sharing this additional resource.

Based on the comments, sounds like checking out Kyla’s videos will also be worthwhile.

The Pack is Alright The Kids Are Alright - The Who