Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it. But for whatever reason these are articles that are representative of some chord that has been struck in Narrative-world. And whenever we think there’s a story behind the narrative connectivity of an article … we write about it. That’s The Zeitgeist. Our narrative analysis of the day’s financial media in bite-size form.

To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

Nuke the site from orbit. It’s the only way to be sure.

It’s the best line from a movie full of them.

I couldn’t help but think about the idea of nuking inhuman monsters from orbit, when I saw this PR release from Buckingham Palace today, as Prince Andrew comes clean about his relationship with Jeffrey Epstein.

Prince Andrew releases lengthy statement regarding his relationship with Jeffrey Epstein [Hello! Magazine]

“I am eager to clarify the facts to avoid further speculation. I have stayed in a number of his residences. During the time I knew him, I saw him infrequently and probably no more than only once or twice a year. At no stage during the limited time I spent with him did I see, witness or suspect any behaviour of the sort that subsequently led to his arrest and conviction. I have said previously that it was a mistake and an error to see him after his release in 2010 and I can only reiterate my regret that I was mistaken to think that what I thought I knew of him was evidently not the real person, given what we now know.”

It’s the most convoluted, putrid, horrific, non-apology apology sentence ever written: “I was mistaken to think that what I thought I knew of him was evidently not the real person, given what we know now.”

Prince Andrew is “appalled” by everything associated with Jeffrey Epstein. In fact, “His Royal Highness deplores the exploitation of any human being and the suggestion he would condone, participate in or encourage any such behaviour is abhorrent.”

LOL.

Also, this.

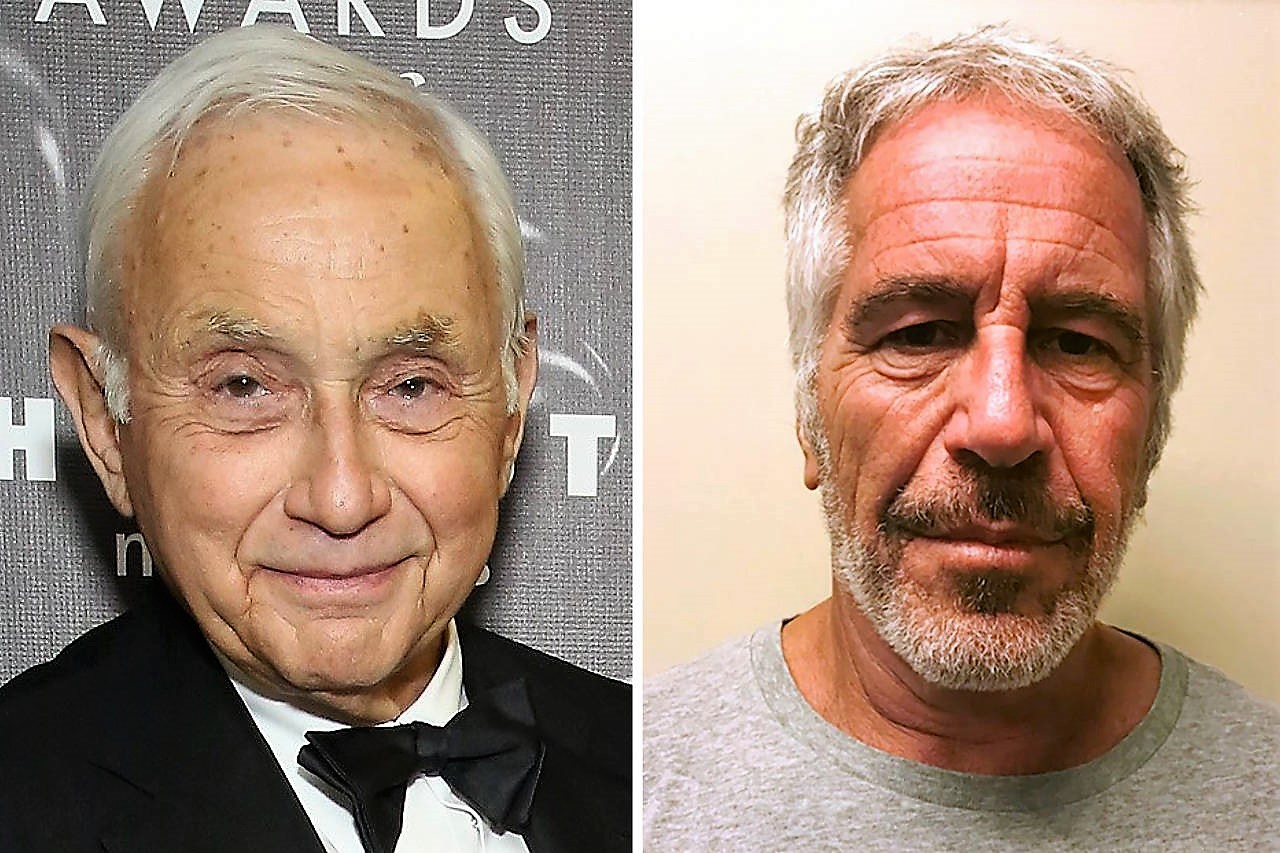

Interestingly enough, this isn’t even the most egregious post-Epstein-death PR tour. Here’s the taker of the proverbial cake, courtesy of Wall Street Journal “writer” John Stoll and his co-conspirators, the entire L Brands public relations team.

Trusting Jeffrey Epstein Taught a Retail Legend a Hard Lesson: Be Careful Whom You Trust [Wall Street Journal]

“L Brands’ founder Leslie Wexner, who accused the disgraced financier of stealing vast sums of money, recalls his father’s warning about too much optimism.”

You see, this is why billionaire “retail legend” Les Wexner, a man who sells bras and panties to little girls under the Pink brand, gave tens of millions of dollars, a gigantic Manhattan townhouse, and power of attorney over all of his funds to Jeffrey Epstein – because he was just too nice of a guy. Because, gosh darn it, he was just too optimistic and trusting.

Oh well. Lesson learned!

It’s the most corrupt “article” printed in a major American publication that I have ever read, a stain on the souls of the “writer” and everyone who green lit its publication.

Haha. Souls. As if.

Thank you Ben and ET for refusing to let this disgusting event “go quietly into the night “

FWIW, after this WSJ “article “ came out I attempted twice to imply that perhaps, just perhaps, that Werner was a client of Epstein’s.

Twice , my comments were sent to the “commentariat police”, never to be seen .

I did not use profanity or even post meanness in my comments, just pointing out that Wexner’s connection with Epstein could just as well have been due to his being a client.

So disappointed with the WSJ for taking that very low road.

Keep going Ben and Rusty, Clear Eyes, Full Heart and maybe, just maybe we can’t lose.

The comment section has been closed on the article “The conversation on this article is currently closed. WSJ limits the number of articles that are open to reader responses. For more information, please reference our community guidelines.” All the “featured” comments are a long the lines of “trust.” And not on the real lesson of Epstein. The system is corrupt.

So let me make sure I’m understanding this correctly: You are against people who take advantage of those that can’t fight back. We should “Nuke them from orbit”?

That’s rich.

Narrator: J was not understanding this correctly.