Gold is money. Everything else is credit.

– John Pierpont Morgan

The relationships of asset performance to growth and inflation are reliable – indeed, timeless and universal – and knowable, rooted in the durations and sources of variability of the assets’ cash flows.

– Bob Prince, Co-Chief Investment Officer, Bridgewater Associates

Like every middle-aged white guy I know, I am a big fan of Rudyard Kipling. I grew up on his Just-So Stories and as an adult found that his novels and poems spoke to me, as they did to my father and his father before that. Kipling writes simply, directly, and evocatively. Whether it’s a poem, a short story, or a novel, the man knows how to tell a story. He was the youngest winner of the Nobel Prize in Literature (as well as the first English-language recipient), and after a too-long period of disfavor in the academy he now enjoys a well-deserved renaissance of interest and acclaim.

But there is also no doubt that what Kipling wrote was used by political and economic entities of his day to support their own self-interests. As George Orwell said, with wildly popular poems like “The White Man’s Burden” he was the “prophet of British imperialism.” Was he a simplistic rah-rah tout for the rewards of Empire? Not in the least. There is tension, nuance, and respect for the human condition in everything Kipling wrote, at least that I’m aware of. And this is exactly why he was such an effective prophet, such an effective Narrator for mainstream British policy in the first three decades of the 20thcentury. Kipling’s skill as an author allowed British citizens to feel good about themselves and to support their government’s policies without requiring them to check their brains or their scruples at the door.

These are the hallmarks of effective Narratives – they have an intrinsic ring of truth (“truthiness”, to use Stephen Colbert’s wonderful phrase) that speaks to us on an intellectual and emotional level AND they coincide with the goals and preferences of powerful political and economic entities. Neither of these qualities is inherently a bad thing, whatever “bad” means. Nor is the content of a Narrative necessarily less truthful because it helps serve broader interests, whatever “truthful” means. Questions of truth and falsehood, good and bad, are impossible to assess from the informational content of the Narrative itself and are only meaningful in the broader context of human society at some given point in time. Kipling’s work gave a voice to the orthodoxy of foreign policy Common Knowledge in 1905 and the anti-orthodoxy of foreign policy Common Knowledge in 1965, even though Kipling’s words themselves never changed. In both eras, the Narrative of Imperialism – pro in 1905, anti in 1965 – was highly relevant to political and economic entities, which gave the world a public lens to interpret Kipling’s work. Today no one cares about the Narrative of Imperialism. It is a dead Narrative, like Manifest Destiny or Cultural Revolution. What Kipling wrote 100 years ago is largely irrelevant for the Narratives that shape our world today, which is probably what allows his work to be better appreciated for how it moves us on a personal level.

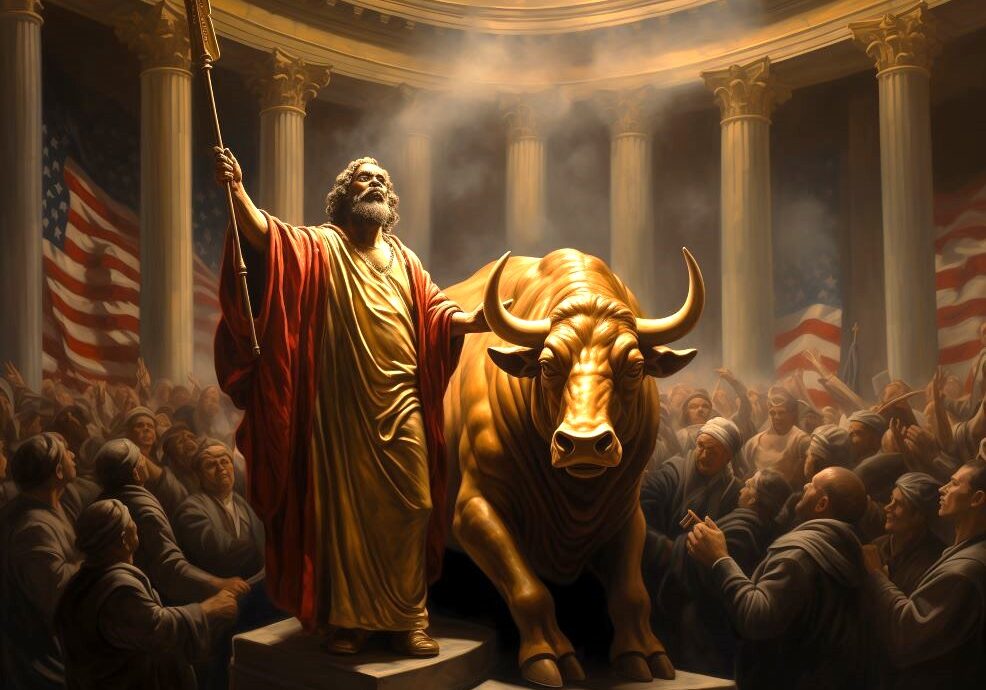

The Narrative of Gold was relevant 100 years ago and, unlike the Narrative of Imperialism, it remains relevant today. But like the Imperialism Narrative in 1965, it has morphed from a centerpiece of Common Knowledge orthodoxy into the foil or antithesis for a more modern, ascendant Narrative. Just as the Narrative of Imperialism was supplanted by the Narrative of Self-Determination, so has the Narrative of Gold been supplanted by the Narrative of Central Banker Omnipotence.

So long as the Narrative of Self-Determination was useful to powerful political and economic entities, the Narrative of Imperialism was relevant as well. It’s much easier to make an argument for something when you have something to argue against. But when the Narrative of Self-Determination lost its usefulness (not coincidentally with the end of the Cold War), so did the Narrative of Imperialism fade away. Today the Narrative of Central Banker Omnipotence is extremely useful to powerful political and economic entities, which means that the Narrative of Gold is important, too. Gold is just not important in the same way that it was important 100 years ago, and that shift in meaning makes all the difference in understanding the price of gold.

What “Jupiter” Morgan said about the primacy of gold above all other stores of value rang true to almost everyone when he said it. Did his public statements in support of the gold standard also serve his own self-interest? Absolutely. The US Treasury bought 3.5 million ounces of gold in 1895 from the House of Rothschild and … J.P. Morgan, using funds from a massive (for the time) 30-year bond issue syndicated by … J.P. Morgan. In a highly unusual (i.e. unconstitutional) move, this bond issue was carried out by the White House without any Congressional approval, under the authority of a forgotten Civil War era statute that was identified by … J.P. Morgan.

But while there’s no question that the bond sale and subsequent gold purchase lined Morgan’s pockets and served the interests of the rich and powerful considerably, there is also no question that these moves effectively ended the Panic of 1893. Why? Because everyone knew that everyone knew that gold was money. And now the US Treasury had lots of it. Huzzah! Confidence is restored as the Republic is saved by Grover Cleveland and Jupiter Morgan.

To be sure, the Narrative of Gold as told by J.P. Morgan was not accepted at the time by everyone as good or wise policy, any more than the Narrative of Imperialism as told by Kipling was accepted by everyone as good or wise policy at the time. Political oratory being what it was back then, in fact, William Jennings Bryan famously compared the imposition of the gold standard as the equivalent of “crucifying mankind on a cross of gold” at the Democratic national convention of 1896 and was nominated by acclamation as his party’s Presidential candidate. This despite Bryan being only 36 years old (the youngest Presidential candidate in American history) and despite Grover Cleveland, the outgoing President who bought the gold from Morgan and Rothschild, being a Democrat and the standard-bearer of the party. Clearly that must have been one hell of a speech!

But Bryan and his Free Silver Democrats weren’t opposed to the gold standard because they disagreed with the notion that gold was money; they just thought that silver should be money, too. Whatever you thought about the policy implications, the Common Knowledge about the meaning of gold in 1895 was clear: it was money, and the behavior of market participants in buying and selling gold reflected this meaning.

Now imagine if the current head of the House of Morgan, Jamie Dimon, made the same statement as Jupiter Morgan did, equating gold with money. People would think it was a joke. Everyone knows that everyone knows that gold does not mean the same thing to Jamie Dimon that it did to J.P. Morgan.

To market participants in 2013 gold means lack of confidence in money, and their behavior in buying and selling gold similarly reflects this meaning. Buying gold today is a statement that you believe that global economic events may spiral out of the control of Central Bankers. It is insurance against some sort of massive monetary policy mistake that cannot be fixed without re-conceptualizing the global economic regime – hyperinflation in a developed nation, the collapse of the Euro, something like that – not an expression of a commonly shared belief in some inherent value of gold.

The source of gold’s meaning, whether you are a market participant in 1895 or 2013, comes from the Common Knowledge regarding gold. J.P. Morgan said that gold is money, and he was right, but only because at the time he said it everyone believed that everyone believed that gold is money. Today that same statement is wrong, but only because no one believes that everyone believes that gold is money.

You may privately believe that J.P. Morgan is still right, that gold has meaning as a store of value. But if you participate in the market on the basis of that belief, then you will buy and sell gold in an incredibly inefficient manner. You would be a smart gold investor in 1895, but a poor gold investor today. Or let’s say that you privately believe gold to be a “barbarous relic” and that it’s ridiculous for gold to have any ascribed value at all other than what jewelry demand would bring. You, too, will buy and sell gold in an incredibly inefficient manner. In fact, you would be a poor gold investor in both 1895 and today.

In some periods of history gold is money. In other periods of history gold is not. But gold is always something, and that something is defined by the Common Knowledge of the day. To be an efficient gold investor in any period, I believe it’s crucial to identify and measure the relevant Narrative that is driving the Common Knowledge regarding gold. Only then can one construct an informational surface that predicts how the equilibrium price of gold will respond to new information (see “Through the Looking Glass” for a description of this game theoretic methodology).

There is no stand-alone Narrative regarding gold today, as there was in 1895. Today gold is understood from a Common Knowledge perspective only as a shadow or reflection of a powerful stand-alone Narrative regarding central banks, particularly the Fed … what I will call the Narrative of Central Banker Omnipotence. Like all effective Narratives it’s simple: central bank policy WILL determine market outcomes. There is no political or fundamental economic issue impacting markets that cannot be addressed by central banks. Not only are central banks the ultimate back-stop for market stability (although that is an entirely separate Narrative), but also they are the immediate arbiters of market outcomes. Whether the market goes up or down depends on whether central bank policy is positive or negative for markets. The Narrative of Central Banker Omnipotence does NOT imply that the market will always go up or that central bank policy will always support the market. It connotes that whatever the central bank policy might be, it will drive a market outcome; whatever the market outcome, it was driven by a central bank policy.

Like all effective Narratives it has a great deal of “truthiness” … it rings true to our intellect even as it appeals to our emotions. How comforting to believe that there is a reason why markets go up and go down, and that this reason is clearly identifiable and attributable to the decisions of a few Wise Men and Women, as opposed to the much scarier notion that the world (and markets) are adrift on a sea of chaotic events and hidden currents. And like all effective Narratives it serves the interests of the world’s most powerful political and economic entities … not that there’s anything wrong with that.

The strength of the Narrative of Central Banker Omnipotence has nothing to do with whether people believe that central bank policy is wise or foolish, good or bad. To predict market behavior it really doesn’t matter if QE is the balm of Gilead or the work of the Devil, any more than it mattered in 1895 whether the gold standard saved the Republic or crucified mankind. The only thing that matters from an Epsilon Theory perspective is whether everyone believes that everyone believes that central bank policy determines market outcomes.

The stronger the Narrative of Central Banker Omnipotence, the more likely it is that the price of gold goes down. The weaker the Narrative – the less established the Common Knowledge that central bank policy determines market outcomes – the more likely it is that the price of gold will go up. In other words, it’s not central bank policy per se that makes the price of gold go up or down, it’s Common Knowledge regarding the ability of central banks to control economic outcomes that makes the price of gold go up or down.

Look below at the price chart for gold over the past year. Gold peaked in late September and early October 2012, immediately after the Fed announced its open-ended QE program (red line). From the perspective of traditional macroeconomics, this makes no sense at all. The Fed had just announced its most aggressive monetary easing policy in history. Not only were they announcing yet another balance sheet expansion, but this time they were telling you that they weren’t going to stop at any pre-determined level, but were going to keep going for as long as it took to satisfy their full employment mandate. This is an inflation engine, pure and simple, and gold should go up, up, and away in price if the standard macroeconomic correlation between the price of gold and monetary easing held true.

But what was more relevant for the price of gold was the strengthening of the Narrative of Central Banker Omnipotence after the open-ended QE announcement. When you examine the public statements in major media outlets in the weeks following this announcement through a Common Knowledge methodology – both direct statements from Fed governors and “analysis” statements from prominent journalists, investors, and politicians – there was remarkably little opinion-leading or Narrative effort devoted to the direct economic or market implications of the new QE program. There was a one-day spike in inflation expectations and a few public comments to quell the “Oh my God, this means rampant inflation” crowd in the first day or so, but very little else. Instead, the focus of the mainstream Narrative effort moved almost entirely towards what open-ended QE signaled for the Fed’s ability and resolve to create a self-sustaining economic recovery in the US. And it won’t surprise you to learn that this Narrative effort was overwhelmingly supportive of the notion that the Fed could and would succeed in this effort, that the Fed’s policies had proven their effectiveness at lifting the stock market and would now prove their effectiveness at repairing the labor market. Huzzah for the Fed!

Within a week or so, however, opinion-leading voices from other prominent journalists, investors, and politicians joined the fray to say that this congratulatory viewpoint of the Fed’s new policy was entirely misplaced. There was absolutely no evidence showing that further expansion of the Fed’s balance sheet would have any impact whatsoever on US labor conditions, and that to claim otherwise was simply magical thinking. Moreover, according to this counter-argument, there was clearly a declining economic utility to more and more QE, so this latest program was a bridge too far.

But here’s the crucial point … whether these opinion-leaders and Narrative creators thought open-ended QE was a wonderful thing or a terrible thing, they ALL agreed that Fed policy had been responsible for the current stock market level. It was J.P. Morgan and William Jennings Bryan all over again, just arguing the merits of more QE versus less QE instead of the merits of the gold standard versus the gold + silver standard. But just as the debate over Free Silver only intensified the Common Knowledge that gold was money in 1896, so did this debate over the merits of open-ended QE only intensify the Common Knowledge that Fed policy was responsible for market outcomes in 2012. This was a positive informational inflection point in the Narrative of Central Banker Omnipotence, and as a result the price of gold has not had a good day since.

Gold is the most pronounced example of an asset with a mutable behavioral foundation because for all practical purposes there is no practical use for gold. It’s pretty and shiny and relatively rare, but so are a lot of things. For gold, at least, there is no “timeless and universal” relationship between it and economic constructs like inflation and growth, or monetary policy constructs like easing and tightening. There is a relationship, to be sure, but the nature of that relationship changes over time as the Common Knowledge regarding the meaning of gold changes.

The same is true of every other symbolized asset, which is to say every cash flow or fractional ownership interest or thing that is securitized and traded.

Not to the same extent as gold … there’s a continuum to this perspective, with securities representing gold and other precious metals at one end, then securities representing foreign exchange, then securities representing industrial metals and other commodities, then securities representing publicly traded stocks and bonds, and finally securities representing privately traded equity and debt at the other end of the spectrum. Within each of these categories, the more symbolic the security the more fragile the correlation between it and real-world economic factors (so, for example, an aggregation of stock symbols via an ETF is more prone to game-playing than an individual stock.) Put slightly differently, the more clearly identifiable and directly attributable the cash flow foundation of an asset, the less the impact of the Common Knowledge game. Still, the assignment of value to any symbolized asset is inherently a social construction and will inevitably change over time, occasionally in sharp and traumatic fashion.

The notion that the preference function of market participants may change over time has been around for a long time, particularly in the study of commodity markets. Ben Inker at GMO recently wrote an excellent paper on this topic (“We Have Met the Enemy, and He Is Us”) that I highly recommend if you want to dig into the gory details, but here’s the basic idea:

Back in the 1930’s Keynes proposed an idea called “normal backwardation” to explain how commodity futures markets could support a profit for traders who specialized in those markets. In this theory, commodity producers like farmers were typically risk averse when it came to market risk, and so would be willing to accept a forward contract guaranteeing a lower future price for their crop than a straightforward projection of the current spot price would suggest. The difference between this agreed upon futures price and the projected futures price was the risk premium required by the specialized commodity trader to take the other side of the trade. As Keynes pointed out, the risk premium would have to be pretty high for the commodity trader to engage in this trade (and thus push the futures price down) because, obviously, the commodity trader’s entire livelihood was based on making a profit on these trades.

But now let’s fast-forward 80 years to a world where anyone can be a commodity trader, or rather, anyone can make commodity trades without being a specialized commodity trader. In fact, the notion of an entire market being made by specialists seems terribly quaint today. More importantly, the meaningof a commodity futures contract has changed since Keynes proposed his theory, in the same way that the meaning of gold has changed since J.P. Morgan smoked his last cigar. Pretend you’re a giant pension fund with several hundred billion dollars worth of current assets and future liabilities. Do you think about owning a commodity futures contract because you’re interested in making a small profit in the difference between a farmer’s hedge and a projected forward spot price? Are you agonizing over a few basis points like a specialized commodity trader? Of course not. The only reason you are interested in owning a commodity futures contract is because you’re worried about inflation within the context of your portfolio of assets and liabilities. It’s your preference function regarding inflation that will drive your behavior, not a preference function regarding the intricacies and competitive risk premium associated with this particular commodity.

Whatever historical correlations and patterns existed in this commodity market when it was limited to specialty traders have to be tossed out the window when the pension funds and other enormous asset managers get involved. It’s like playing poker at a table with five penny-pinching off-duty Vegas dealers, and then moving to a table with five rich doctors in town for the weekend. If you don’t change the way you play your cards, even if you’re dealt exactly the same cards from one table to another, then you’re a fool.

This transformation in the composition and goals of market participants is by no means limited to commodity markets. Over the past decade there has been a sea change in the structure of global debt and equity markets, as well. Multiple papers by Simon Emrich and Charles Crow at Morgan Stanley lay out the structural transformation in equity markets in fantastic detail, most recently “Trading Strategies for 2013 – Optimal Responses to Current Market Structure” (March 18, 2013), but here are the two most striking findings from a game theoretic perspective:

1) Over the past 10 years, institutional management of equity portfolios has increased from 54% to 81%.

2) Over the same period, the share of what Emrich and Crow call “real institutional trading” has declined from 47% of trading volume to 29%.

There are far fewer market participants today than just ten years ago, managing much larger portfolios across more asset classes, and using much less trading. In future letters I’ll lay out in detail how this structural shift has large and specific consequences for the nature of game-playing in markets, but for the balance of this letter I just want to make a simple, and I hope obvious, point: structural change in any social environment wreaks havoc on historically observed correlations and patterns within that environment.

Unfortunately this sort of structural change is effectively invisible to econometric modeling of portfolios, and as a result understates the risks inherent in portfolios that rely heavily on historical correlation patterns. In a market undergoing structural change, all of the “timeless and universal” relationships that form the backbone of Risk Parity funds like Bridgewater’s All-Weather Fund and similar offerings by Invesco and AQR are much less certain than their econometric justifications would suggest. The underperformance of these strategies in recent weeks and months (“Fashionable ‘Risk Parity’ Funds Hit Hard”, Wall Street Journal, June 27, 2013) takes on new meaning when seen in this light.

There’s nothing wrong with the math of the correlation exercises that underpin Risk Parity funds, any more than there was anything wrong with the math of the correlation exercises that ratings agencies like Moody’s and S&P used to grade Residential Mortgage-Backed Securities (RMBS). But in both cases there is an assumption about market behavior – the relationship of asset performance under varying conditions of growth and inflation for Risk Parity funds; the role of geographical diversity in mitigating the risk profile of mortgage portfolios for RMBS ratings – that is exogenous to the calculation of the projected returns. In both cases, the standard portfolio model of y = α + β + Ɛ, where Epsilon is treated as an error term and the preference functions of market participants are assumed, gives a very compelling result: Risk Parity funds demonstrate an excellent risk-adjusted return profile, and trillions of dollars worth of RMBS deserve a AAA rating. But if you are wrong in your exogenous assumptions – if, for example, there is a nation-wide decline in US home prices for the first time since the 1930’s and geographical diversity provides no protection for a mortgage portfolio – then all the Gaussian cupolas and other econometric legerdemain in the world won’t save your AAA-rated security.

Risk Parity funds are a more broadly conceived, less levered version of Long-Term Capital Management. I mean that as a compliment, because it was the narrow conception and over-use of leverage at LTCM that ruined a solid investment premise and made it impossible for that firm to survive even a small disruption in patterns of market participant preferences – in LTCM’s case, the strong historical preference of major sovereign nations not to default on their debt obligations and the strong historical preference of major bond investors not to pay non-economic prices for the safety of US sovereign debt. The investment premise of LTCM was to identify small arbitrage opportunities between securities on the basis of historical correlations and to lever up those opportunities to generate nice returns. If you can take that premise and improve it significantly by expanding the scope and depth of the arbitrage opportunities and by shrinking the leverage turns required for acceptable returns … well, that seems like a really great idea to me. And I have zero doubt that investment giants like Ray Dalio, Bob Prince, and Cliff Asness can design a complex levered bond portfolio that is both safer and more rewarding than a simple unlevered stock and bond portfolio under most conditions. But I get VERY nervous when I am told that the reason these complex levered bond portfolios work so well is that a socially constructed behavior such as the assignment of value to highly symbolic securities is “timeless and universal”, particularly when the composition and preference functions of major market participants are clearly shifting, particularly when monetary policy is both massively sized and highly experimental, particularly when political fragmentation is rampant within and between every nation on earth.

Timing is everything with levered bond arbitrage, just ask Jon Corzine. Five years ago, this is a guy for whom there was a plausible path to become President of the United States. This is why he left the US Senate to become Governor of New Jersey, so that he could more easily and more effectively run for President. Losing his re-election bid in 2009 to Chris Christie closed that door, but only temporarily, as F. Scott Fitzgerald’s line that “there are no second acts in American lives” was probably wrong when he wrote it and is clearly not applicable to American society today.

So MF Global came along after the gubernatorial defeat and gave him a place to hang his hat for a few years, maybe refill the personal coffers that had been depleted by his phenomenally expensive campaigns. Within a year of taking the MF Global reins in March 2010, Corzine transformed the firm from a poorly managed commodities brokerage plagued by rogue traders and seemingly constant regulatory fines into a significant capital markets and prop trading player under his direct control. The culmination of this transformation was MF Global’s approval by the New York Fed as a primary dealer in February 2011, allowing the firm to fund itself as cheaply as any major investment bank. From that moment on Corzine – who started his career at Goldman Sachs as a sovereign bond trader – began to build a levered position in distressed European peripheral sovereign debt. By levering MF Global’s capital to the hilt in order to borrow dollars at historically low rates and buy, say, Portuguese 5-year paper with a 10% current yield in April 2011, Corzine stood to make an absolute killing as soon as the Europeans got their act together. After all, this is the sovereign nation of Portugal we’re talking about here, a full-fledged member of the European Union with a currency backstopped by the ECB and Germany, and it’s trading like a distressed corporate bond? Time to back up the truck. In fact, why don’t we put a little bit of duration risk into the mix to juice the returns even more. What could possibly go wrong?

We all know the rest of the story. One day you’re at the pinnacle of business and politics, poised to make a billion or two on a killer trade; the next day you’re testifying before Congress about misuse of client funds and considering taking the Fifth; tomorrow there may be a perp walk. The irony, of course, is that if Corzine had put this trade on 6 to 9 months later, we would today be talking about the brilliance of Jon Corzine, Lion of Wall Street, and how he had created a new Goldman Sachs.

The lesson? Pride may goeth before a fall, but so does leverage, bad timing, and poorly examined assumptions. A dislocation in the price of gold may be the least of our worries in a market and world undergoing structural change.

PDF Download (Paid Membership Required):

http://www.epsilontheory.com/download/15736/

Start the discussion at the Epsilon Theory Forum