Brent Donnelly is president of Spectra Markets and is a veteran FX trader and market maker. His latest book, Alpha Trader, was published last summer to great acclaim (by me, among others!) and can be found at your favorite bookseller. I think it’s an outstanding read, and not just for professional traders. He publishes an excellent daily (!) note on FX, which you can subscribe to here.

You can contact Brent at bdonnelly@spectramarkets.com and on Twitter at @donnelly_brent. As with all of our guest contributors, Brent’s post may not represent the views of Epsilon Theory or Second Foundation Partners, and should not be construed as advice to purchase or sell any security.

Download a PDF of Fostering Reality in an Unreal World (paid subscribers only)

At the end of May, I attended the Epsilon Connect conference, hosted by Ben Hunt and Rusty Guinn in Nashville. It took me a bit to get my notes and all the slides sorted; here are my summary and takeaways!

What is Epsilon Connect?

The conference was a meeting of like-minded people that follow Epsilon Theory and the basic premise, as nicely described by Matt Zeigler here, is:

Epsilon Connect is a gathering for people who have figured out how to make models work for them. Not in a mercenary way, but in a “We all have found success without hurting others, so how do we now make others successful while reducing the success-via-hurting-others models that seem to be everywhere and making people like us sad/jaded/cynical when we don’t want to be” way.

Sessions revolved around various strategies for the metagame of how to exist in this crazy, mad world of financialization, media insanity, and accelerated techno-futurism without losing your mind or getting angry all the time for no reason. This appeals to me because one of the most meta and whoa moments for me during peak COVID malaise was Googling “derealization” and hating what I found… After hearing these lyrics from Bo Burnham’s “Inside.”

Full agoraphobic, losing focus, cover blown

A book on getting better hand-delivered by a drone

Total disassociation, fully out your mind

Googling “derealization”, hating what you find

That unapparent summer air in early fall

The quiet comprehending of the ending of it all

There it is again, that funny feeling

That funny feeling

There it is again, that funny feeling

That funny feeling

The Phoebe Bridgers cover of the song is here. It is a perfectly-written song. One of the best combinations of wit and darkness you could ever find. Listen to the lyrics if you have a chance sometime. I find the song’s razor sharp cynical accuracy to be deeply moving.

Many of us have or have had that funny feeling of late… That feeling that something is off. For me, Epsilon Connect was one in a series of ongoing attempts to figure out what to do about it.

Ben Hunt Convocation Address

Ben opened the conference with a presentation in the main auditorium. I feel the slides are good enough to almost do it justice, so I won’t interrupt, I’ll just put them in here.

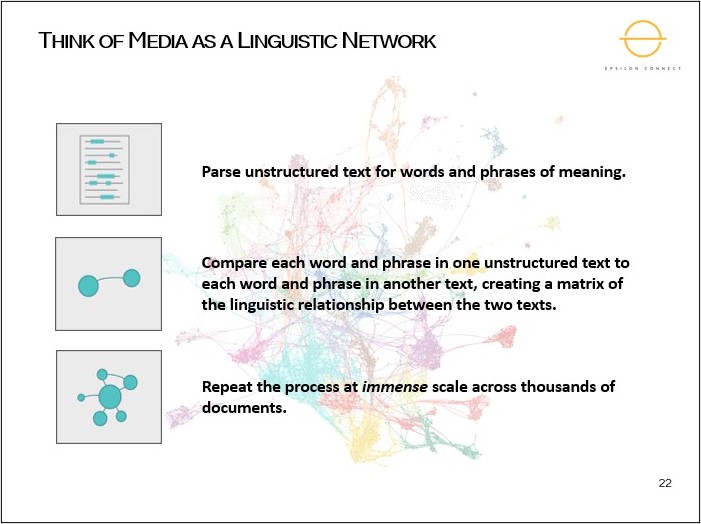

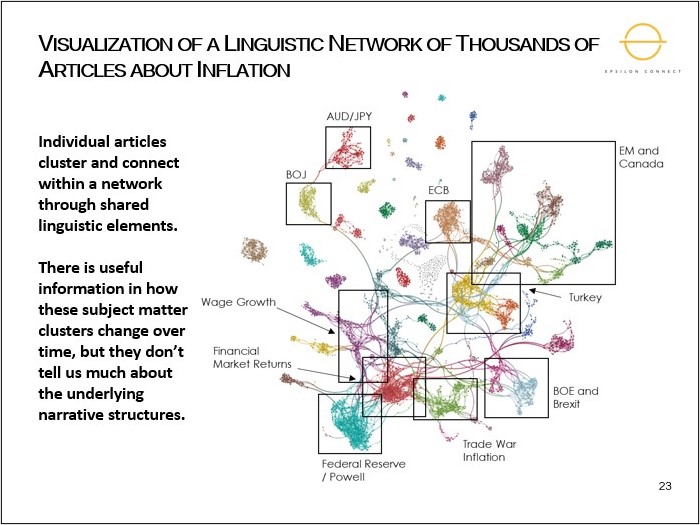

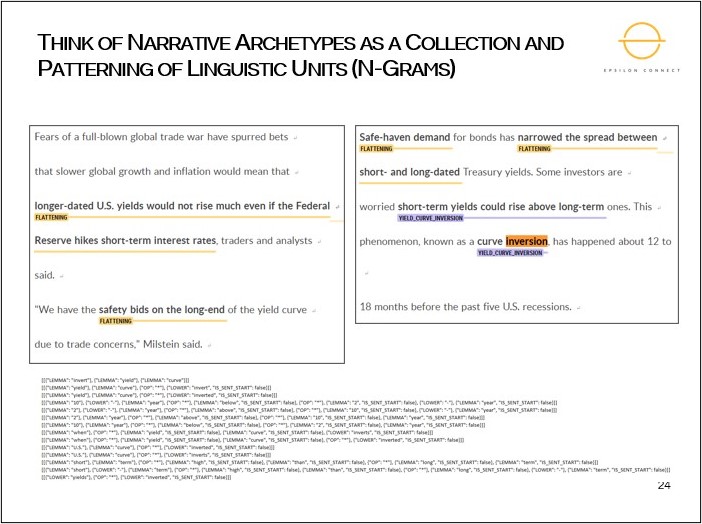

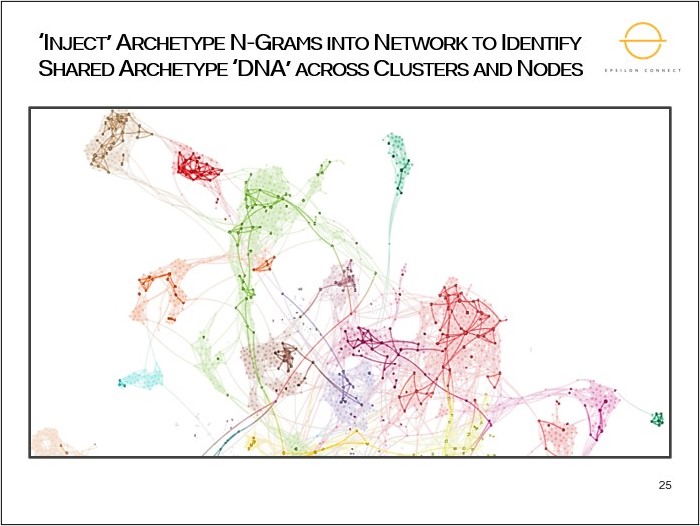

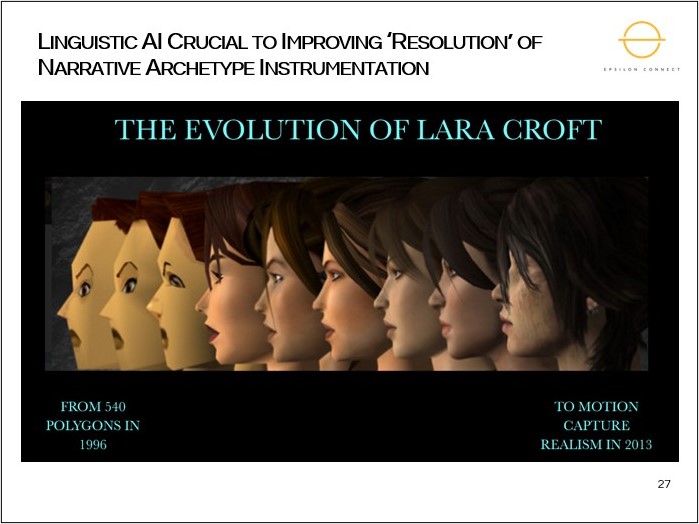

The speech works as both an introduction to the conference and an announcement of the new joint biolinguistics venture between Epsilon and Vanderbilt University. Tons of cool stuff therein.

They are building a new science: Biolinguistics. Very ambitious! I have never built a new science. That’s part of what I love about Ben. He thinks bigger than I ever could, but also does many small, kind, and thoughtful things.

>>>APPLAUSE<<<

Breakout Session: Investing in the Real

Ben Hunt also hosted a session called “Investing in the Real” which put up some mildly depressing slides that capture the rise of passive and the decline of quality, value, and skill during the post-GFC era. I’m going to plop his slides in here as I think most of it is self-explanatory but I’ll interject here and there as well.

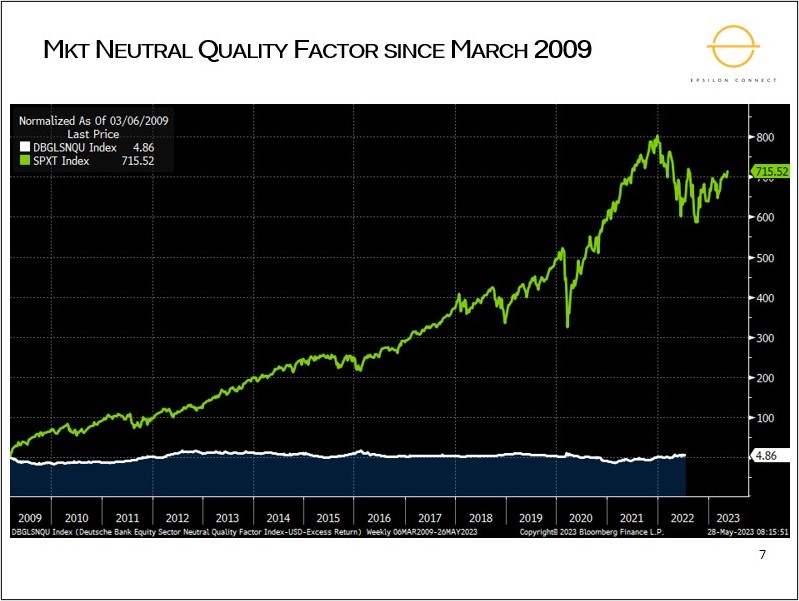

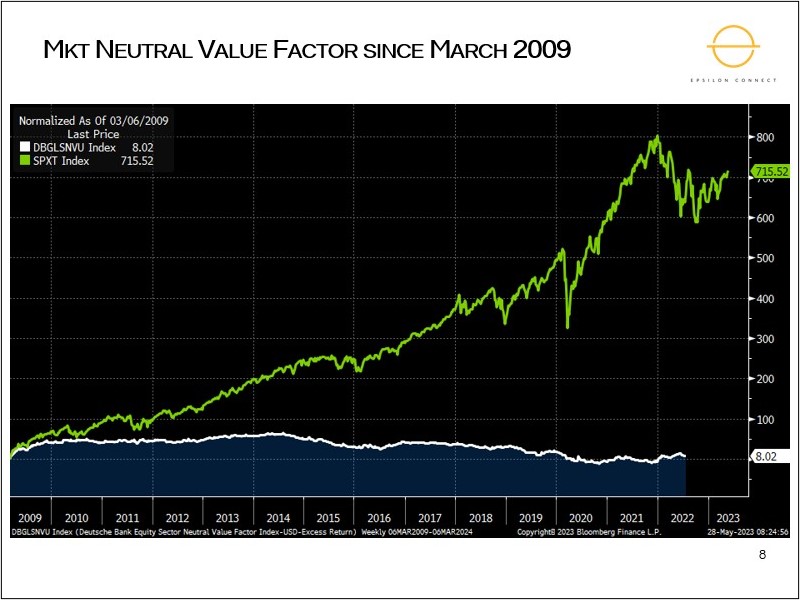

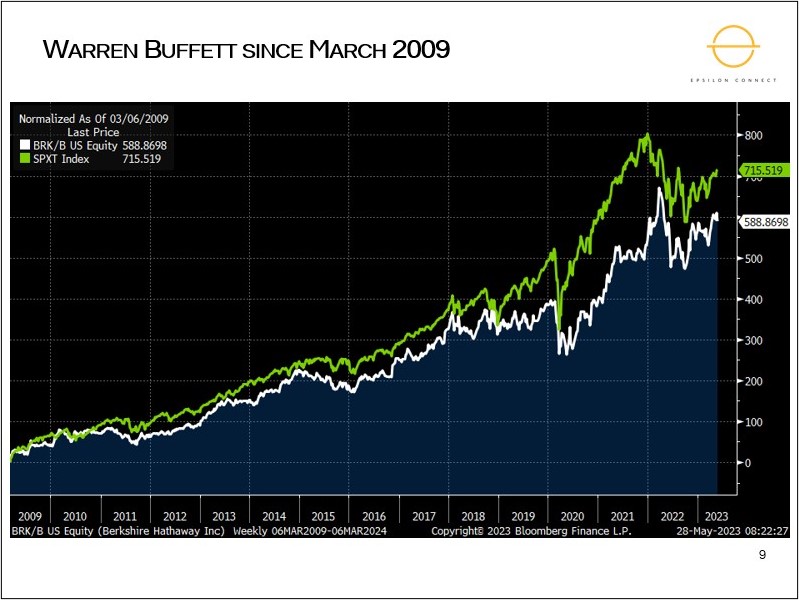

In all these charts, SPX is green and the other thing (quality, value or skill factor) is white. 2000 to 2009, quality, value and skill paid off. White beats green. 2009 to now, green crushes white. Quality, value and skill are irrelevant.

To be clear, Ben is using Warren Buffet as a proxy for skill because a) Buffett had shown skill over many decades already and b) he has access to cheap financing, sweetheart deals, and the best information in the business. If anyone should be able to outperform 2009 to now, it would be Berkshire.

This all might sound like Harry Hindsight or an investor letter from a grumpy value investor, but Ben shut down his hedge fund and returned all clients’ money in 2012, sans drawdown, because he saw the writing on the wall, early. Also, if you look at those charts on the last page, you can see that DB discontinued its quality and value indices in 2022, presumably because they too saw those factors as irrelevant.

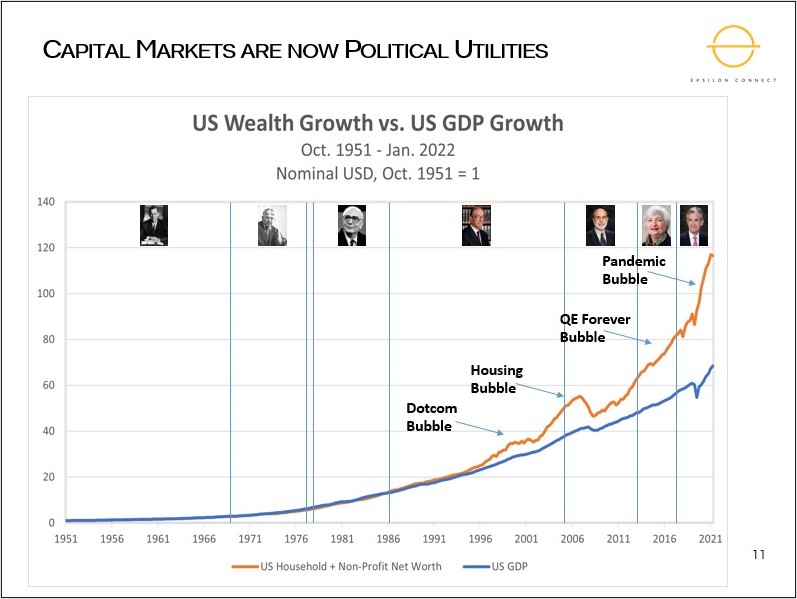

After presenting this background context, Ben went on to explain his thesis:

We are in an unstable or fragile equilibrium that can continue for a long time, but not forever.

Eventually, a reset is necessary to reconnect capital markets to reality. Reality meaning a system where capital market exist to raise money for productive functions like investment and redistribution of profits, not as political utilities with actors mostly gaming to extract maximum compensation via stock short- or medium-term stock price maximization.

This does not mean that every story is untrue. It means that it doesn’t matter if the story is true, as long as enough people believe it. Value, quality, and skill and DCFs and all that stuff don’t matter. All that matters are flows and stories.

And that includes the stories told by central banks as their attempts at central planning demonstrate the most magical thinking of all.

Ben showed this one-minute video of central bankers managing the economy. It’s well worth a minute of your time! It captures the essence of post-GFC central banking perfectly.

If the end of this magical thinking requires massive wealth destruction, how will this come about? Ben’s thesis is that a war, probably a war with China, will pull the rug out. While there is a common refrain that war between USA and China will never happen because it would be too economically destructive, Ben notes this exact story was the reason many thought World War I would never happen. The economic links to Germany were too strong and thus a war would be too dangerous for both sides.

I think this is a useful and viable framework. The obvious question that emerges, though, is what do we do about it. The Cold War smoldered for 45 years and never erupted. There are very few pessimists on the Forbes 100 richest list. It’s impossible to be permabearish in a world where capital markets function as utilities and financial repression is necessary due to the massive debt transfer from citizens to sovereigns post-GFC and again post-COVID.

As an investor or finance person, there are two ways to deal with Ben’s thesis if you think it’s valid, which I do.

- Assume the status quo (low real rates, strong equities, increasing debt, increasingly extreme aversion to pain and recession, more MMT-style policies and so on. And be on high alert for war. If there is any sort of war or a war looks probable, reduce exposure quickly.

- Attempt to build an all-weather portfolio that will survive both the frost of financial repression and the heat of war. I’m an FX guy, so you can probably figure out how to build this better than me! Hard assets seem most logical, e.g., arable land, diamonds, etc. Gold and bitcoin, too perhaps, though if there is massive wealth destruction, those could rerate lower as they often behave more like liquidity sponges than safe havens. CHF, maybe?

The market can stay stupid longer than you can stay smart!

The other takeaway from this conference and the one I went to in April (see am/FX: China Alarm) is that I’m surprised that many experts believe a war with China is increasingly inevitable and probable in the next two years. Experts can be wrong! But it’s still scary.

“When did the future switch from being a promise to being a threat?”

― Chuck Palahniuk, Invisible Monsters

Well, that was kind of depressing! The conference overall was the opposite though—uplifting.

Breakout Session: Defining your pack(s)

This was a bit like group therapy as everyone chimed in for a discussion about how we find our pack(s) and connect with like-minded people who share the same values but who also share a range of perspectives and ideas. My takeaways:

- Be thoughtful about the circles you choose to join. Join with citizens, not partisans. Favor ideas over ideology.

- What story do you tell yourself? This story can change. You can be a finance person, or a dad, or a writer, or a tennis player or all those things. But you can also change. You can say “I’m not that person anymore; I’m going to be this person instead.” Tell yourself the story of the person you want to be and over time you will become that person. “I’m the kind of person that works out every day.” “I’m the kind of person that doesn’t engage with or participate in culture wars.” Would be two for me. I’m doing better on the second one but yeah. Work in progress.

- Maintain your sovereignty within packs. If discussions devolve into culture war and ideology, have the courage to speak up or opt out.

- Your packs evolve. It’s OK to not want to be friends anymore with your best friend from high school. If they have changed and you have changed, go in a different direction. Make active decisions about your circles and avoid people and circles that suck the energy out of you.

- As you get older, it gets more important to take an active role in building your pack. In school, and when you start working, you are dropped into many deep pools of individuals and it’s easy to find like-minded connections. As you age (especially if you work from home), you need to find new avenues like sports, charity, church, community service, etc.. You have to go out of your way to build a strong pack as you get older, not just hold on to default packs from the past that no longer serve your needs.

- Shared values don’t have to be “finance” or “baseball fan”. They can be deeper: Purpose, commitment to truth, resilience, values, curiosity.

- Study your interactions with groups and individuals and tune into the ones that fill you. Cut off the ones that drain you. Have agency over your own life; don’t just drift.

That last bullet reminds me of the best book I read to my kids when they were small. It’s cheesy, but in the right way. Good for ages 3 to 8.

Have You Filled a Bucket Today?

Main Session: How to Talk to Anyone, with Grant Williams and Rusty Guinn

I had never met Grant before, despite reading his stuff for more than a decade and watching him in video form for years and years. He’s a nice guy! This session was a Q&A with Rusty asking Grant about his work as a professional interviewer and host of various podcasts and video interactions. Takeaways:

- The schism in the US (US vs. them, pick a team!, etc.) where politics is just about off limits is more severe than other countries, but UK, Australia, and Canada are moving in that direction. Talking about politics is hard and often best left alone as new ideas or changed opinions rarely emerge from such conversations.

- The greatest weakness Grant sees in the world is a lack of humility. People love when he says that he’s wrong. Note: I am always endlessly fascinated by how excited people get when I write about being wrong. I find that being wrong is just part of trading and I don’t have a strong emotional response to it. But others love when I say “I was wrong” and shower me with happy emails. It’s interesting. Like, admitting you’re wrong is something that people really appreciate—so why not just do it whenever appropriate?

- Grant believes his success as an interviewer comes from two key traits: Humility and curiosity. He is genuinely interested in the person and what they have to say and the process is about the interviewee, not the interviewer.

- Enter conversations hoping to learn, not convince.

- If you need something, ask. People are generally good, and caring.

- Stocks used to be about owning a business. Now they are about buying and selling 3-letter codes.

- One of the great US failures over the years has been leadership’s refusal to do the hard thing. Whether it’s Obama, Bernanke, Paulson, Yellen, and so on. The US never chooses to do the hard thing.

- Someone asked Grant of all the hundreds of interviews you have done, what is the most powerful one of all? This interview with Tony Deden was his answer. 2+ hours, 1.7 million views. Awesome.

Ask Me Anything with Ben, Rusty and Grant Williams

This was a Q&A session in the auditorium. Some quick bullets:

- Question: What is the biggest danger right now? Answer from Rusty: Nihilism. The idea that nothing matters has been internalized by many and manifests in many symptoms from deaths of despair to YOLO crypto trading. If fundamentals, valuation, profits, skill, and quality don’t matter in investing… What the hell are we even doing here?!

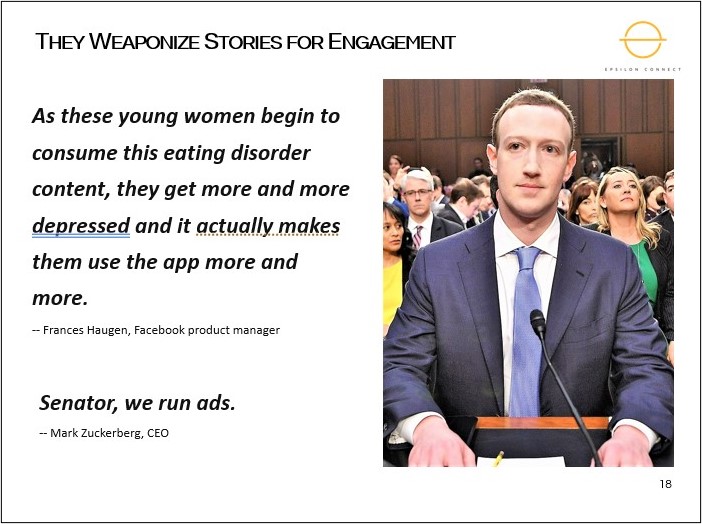

- Media and social media are jammed full of opinion masquerading as fact and as journalism. Learn to read with critical distance and understand the bias and potential manipulation embedded in media you consume.

- Look for adverbs, causal language, embedded questions, subjunctive, etc. Is the publication trying to educate and inform you, or Nudge you in a particular direction?

- Under ZIRP, the future was infinite, and time was irrelevant because there was no discount rate. With rates in normal territory, the now matters. Profits will matter. Companies have overoptimized for now and ignored the future for more than 10 years.

- The dangers of social media are now recognized. Derealization, negativity, extrapolation, etc. are all amplified by social media. Turn off your phone.

- To be successful in any aspect of life, you need to be a good storyteller.

- The key story across society right now is grievance. Everyone is a victim.

Final Thoughts

If you can make it to Epsilon Connect next year, I strongly recommend it. The vibe is somewhere between the Olympics or a playoff game, where everyone is excited and optimistic… And group therapy where everyone is there to talk about what’s wrong and try to figure out better ways to think and act.

There were other sessions, but I don’t want this to take more than one entire weekend for you to read (!), so I tried to offer some highlights, not a conclusive recap. My first action following the conference is to commit to a complete rejection of culture wars and mainstream media. I don’t need it. It all makes me feel bad, doesn’t teach me anything, and gets me nowhere. Whether Barack Obama or Donald Trump is president affects me much less than the immediate world I’m immersed in. I can’t vote in the US, and even if I could, my vote would be meaningless as I do not live in one of seven or eight states that are not pre-decided by the two-party system.

Instead of voting at the ballot box and worrying about Federal politics which receive much more coverage than they deserve given their impact on daily life, I’m voting with my dollars, my words, and small acts. I’m voting by spending time with my kids instead of Netflix. Etc. When it comes to Federal Politics, you can cast a null vote.

I muted “Biden, Trump, 2024, election, vaccine, Kennedy, woke, left, right, and politics” on Twitter. My feed is objectively better. You could say I’m just putting my head in the sand, but I would argue I’m just worrying about what I can control inside my own house and choosing to ignore the insane clattering calliope music blasting from the insane circus parading down the street outside. You don’t need to go to church to appreciate the Serenity Prayer:

God grant me the serenity to accept the things I cannot change, courage to change the things I can, and the wisdom to know the difference, living one day at a time; enjoying one moment at a time; taking this world as it is and not as I would have it…

By equipping ourselves to see clearly, think clearly, and find and maintain good packs, we can get off our phones, ignore that which we believe does not matter, and consume mainstream and social media with eyes wide open. We can go back to the way we want to live and turn away from the Nudging, corporatist state and away from absurd and polarized political discourse. We can go back to the way it was before that funny feeling crept in and everything became this deep fried, unreal Cartoon. Living in service to some real purpose in the real world. In cooperation with others in and outside our chosen packs.

Have an excellent July. All of it. Every single day.

Thank you, Brent, for this excellent summation of Epsilon Connect. I’m adding the full text of Wallace’s Commencement Address, as it, IMO, hits the essence of our study of narratives.

An example of a synchronicity moment:

I got a text from from my grandson and his girlfriend (W+K) saying they were leaving our house (enroute stay) on the way to Boston.

I texted, I’m leaving Nashville as well! She added to the text:

K: “This week I’m reading “On Earth We’re Briefly Gorgeous” by Ocean Vuong. It’s a novel about his life growing up as an immigrant from Vietnam. I made it to part 2 of the book and paused. It’s very good so far. He is an excellent writer.”

Jim: “When someone recommends a book, I look it up on Wikipedia and Goodreads with the author’s name followed by quotes.

“What were you before you met me?"

“I think I was drowning”

“And what are you now?”

"Water”

― Ocean Vuong, On Earth We’re Briefly Gorgeous

One of the stories repeated at this conference is the story of two young fish meeting an old fish swimming the other way. The old fish says, "How’s the water boys?” One young fish looks at his friend and says, “What is water?”

And in keeping with my comments to you:

“The role of a writer is not to say what we can all say, but what we are unable to say.”

Anais Nin

Jim, the quotist