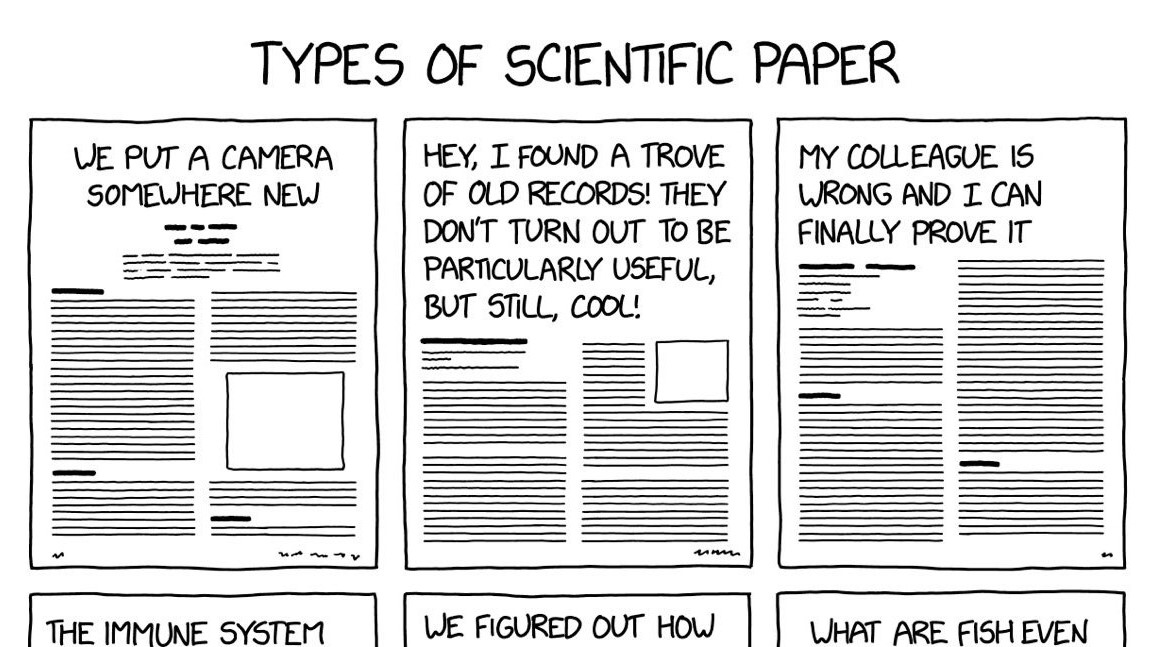

Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

April 12, 2019 Narrative Map – US Equities

Gilead Sciences: Hitting Bottom [Seeking Alpha]

The last few years have been brutal for shareholders of Gilead Sciences (GILD). The biotech actually started healing Hep C patients causing a plunge in revenues from a key drug. The company has now shifted to a HIV growth machine and when combined with a reduced dependence on HCV drugs makes for a promising scenario where revenues have finally hit bottom setting the stock up for a rally.

I think of Gilead as a cautionary tale for the entire healthcare industry. Two things have crushed the stock over the past two years:

- A couple of drugs saw their patent protection expire, so prices plunged as generics came into the market.

- Hep C patients were effectively cured by a new drug regimen, crushing demand for the lucrative drugs that didn’t cure them but kept them alive.

The first point here is the smaller of the two and has been debated endlessly. It will be debated more endlessly still in the 2020 presidential campaign.

The second point, though, is by FAR the larger issue. Which means that NO ONE will talk about it.

The business of “healthcare” depends on people staying sick. So they will.

Cures are soooo 20th century.

The 21st century is all about “testing for” your disease and “living with” your disease.

Why?

Because that’s where the money lives.

Another Warning on Asia’s $4 Trillion Stock Rally Is Flashing [Bloomberg]

The wall of worry surrounding Asia’s double-digit stock market growth this year just got another impetus: equity ETFs inflows have dwindled.

Despite a 9 percent increase to $502 billion in assets under management for Asia equity exchange-traded funds so far this year, net inflows have been tapering off, according to data compiled by Citigroup Inc. On top of that, a monthly net outflow — the second time in more than two years — was recorded in March.

Two ET points to make here:

Walls of Worry are a good thing for asset prices, not a bad thing. You always climb the wall.

There are better ways to track money flows than eyeballing historical monthly data.

For more, read this:

Op-Ed: Musings on the 737 MAX [Airways Magazine]

Consumer activist and former Presidential candidate Ralph Nader lost a grand niece in the Ethiopian Airlines, so naturally he is close to the issue.

He came out with a rather extreme claim that the 737 MAX as it stands needs to be treated as a faulty product and, in his words “recalled.”

Centering around the aerodynamic changes caused by engine placement, he argues that the “grandfathered” certification by the FAA was rash and that Boeing’s involvement in the certification process of its own plane was an example of regulatory capture.

Nader argues that trust is lost, the aircraft is fundamentally less safe than the aircraft before it.

My father owned a red Corvair almost exactly like this one. He loved that car. Almost died in it, too, when he was t-boned at an intersection on his way to work in Bessemer, Alabama. That was in 1966. I was two years old.

Ralph Nader wrote “Unsafe At Any Speed” in 1965. That book changed the US automotive industry forever, although I bet not 1 in 10 automotive sector analysts have ever heard of it, much less read it.

And I can guarantee you that not 1 in 100 aerospace sector analysts have ever heard of that book, much less read it.

The Boeing 737 MAX is our generation’s Chevy Corvair.

Or at least it should be.

Seward & Kissel New Hedge Fund Study: Funds Placing Premium on Strong Start [Press Release]

Twice as many companies paying zero taxes under Trump tax plan [CNBC]

Review: A Magnificent Road to Ruin in ‘The Lehman Trilogy’; Critic’s Pick [New York Times]

Though never stepping out of Katrina Lindsay’s original costumes — sharply tailored suits in shades of gray that bring to mind daguerreotype family portraits — the brothers Lehman transform themselves into an innumerable host of others. These include their descendants, spouses, colleagues, rivals and employees during more than 160 years.

The word “nothing” echoes throughout. Nothing is what the Lehman brothers say they come from; nothing is finally what’s left of all they’ve achieved. That’s what happens when money floats into the ether of latter-day Wall Street, unmoored by connection to substance.

Did you know that the Lehman Brothers – by which I mean THE Lehman Brothers – got their start in America by setting up shop in Montgomery, Alabama?

This is a long play … more than 3 hours, which is apparently way down from the original 5 hours staging … so not for the faint of heart. But seeing this is a bucket list item for me.

“Unsafe At Any Speed” was a bible to some of my high school teachers in the '70s (schools didn’t just spontaneously turn left recently); hence, it took me some adult years to unwind myth from fact about the Corvair.

And having paid pretty close attention to the 737 Max issues - design/software and pilot errors (at least in the Ethiopian event) seem to be the cause - I’ve “enjoyed” watching the narrative gallop away from rational analysis as it did with the Corvair.

It would be dismissed as unbelievable in fiction, so it had to happen in the real world that Ralph Nader would have a connection to the 737 Max.

The only real add I have is this: the spin will spin, the plane will fly again this year and all will be fine as long as there is no new crash for years and years.

The irony is that the airline industry is a victim of its own safety success as back when socialist teachers were preaching the gospel of Nader to me in the '70s, fliers accepted that a plane would crash once in a distant while.

Now, that’s unacceptable.

The initial report on the Ethiopian crash did NOT blame pilot error. The Max was created with bigger engines to take a bigger payload but fixing them at the original mounting points on the wing wasn’t possible as they were too close to the ground. Mounting them higher up the wing created an unstable condition that Boeing decided to overcome by installing correcting software rather than redesigning the wing something the bean counters would not consider. The software was and still is deficient the flight data showing the struggle with the trim over ride and the final 30 second precipitous fall to earth from 10,000 feet is sobering. I’m with Nadar on this one.

Strange that Roche (maker of Hemlibra, a drug that treats hemophilia) is trying to purchase Spark Therapeutics (company trying to cure hemophilia).

Even if one does not believe the investigatory article in Seattle Times - Flawed analysis, failed oversight- which was researched in response to the previous crash and before the latest one, the speed with which all national agencies (ie experts in the field) recoiled from FAA (formerly a gold standard in safety) and defied its assurances is the best indication that the certification process was compromised.

It is not a question of just this bug but all the other possible shortcuts and that they allowed to be risk accepted. Not only should this plane be recertified but we should go back and see when the process broke and recertify all the planes that went through the deficient process.

Now we are dealing with very small probabilities and even if they multiply it still takes years before the sample size gets you,. Just saying they will fall out if the sky once in a while is like taking aircraft safety standards back half a century.

Boeing will be fine - another war, more military contracts whilst civilian side is taking losses. Sad thing is a lot more civilians will die this way than by falling out of the sky if the faulty max is left to fly.

The aircraft safety industry is one of the greatest indisputable success stories of our times and it is sad to see it being hurt like this. Let’s hope it does not go down the road of narratives to fix itself with a whitewash but rights the flawed processes and and gets stronger.