This is our feature of the 10 most on-Narrative (i.e. interconnected, highly similar) stories in financial media. It’s not a list of best articles, or articles we think are most interesting, or articles we agree with. But if you’re going to read 5-10 stories when you start your day, these are the ones that are most connected to the financial news that got published today.

Sustaining the Buyout Governance Model: Inside Secondary Management Buyout Boards

II Live: What’s the Buzz at II’s Equity Trading Summit?

The VC Game Is Changing: 5 Ways To Compete

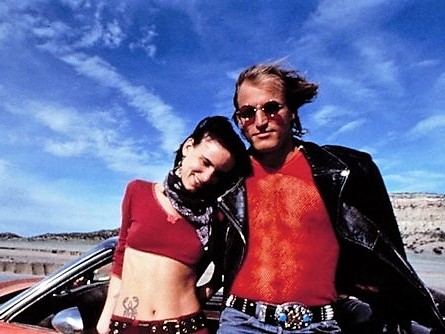

How a 91% rate sparked the golden age of tax avoidance in 1950s Hollywood

Boeing Stock Flies Higher on Blockbuster Earnings

Emergent Accuses Beal, GWG, Silver Point of Conspiring to Take Portfolio

Mark Zuckerberg, Let Me Fix That Op-Ed You Wrote

General Electric: Proceed With Caution

Start the discussion at the Epsilon Theory Forum