Every morning, we run The Narrative Machine on the past 24 hours worth of financial media to find the most on-narrative (i.e. interconnected and central) stories in financial media. It’s not a list of best articles or articles we think are most interesting … often far from it.

But for whatever reason these are articles that are representative of some sort of chord that has been struck in Narrative-world.

Taxi and rideshare drivers desperately need revenue from rooftop ads [Business Insider]

While officials in New York, Washington, Chicago, and others have responded to similar situations with a focus on equity, embracing the added driver income opportunity provided by digital taxi-top advertising, some city leaders in Los Angeles stand alone.

The L.A. City Council is considering a new policy to criminalize advertising on taxis and rideshare vehicles — even the decades-old practice of static rooftop taxi ads — going so far as to threaten drivers’ vehicles with impounding. This is especially unsettling given the impending massive, multi-year renovation plan for LAX, a project poised to significantly disrupt operations for taxi drivers, throwing another wrench in their efforts to make a living. It is not an exaggeration to suggest that this latest disruption could be one of the final straws for the city’s taxi industry.

We believe that all full-time drivers should be able to make a living wage and support their families, and we look forward to collaborating with city leaders to build a more equitable future.

“The writer is CEO and co-founder of Firefly, a digital media company.”

Shocker.

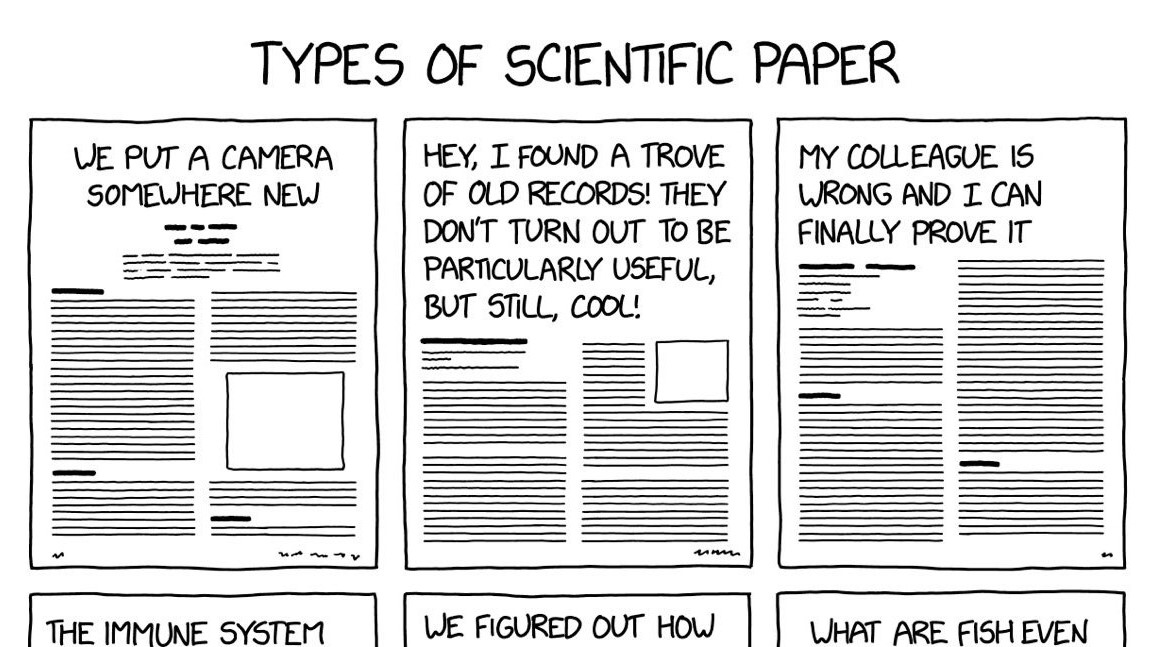

I came across this “article” the other day.

Turns out this is a thing. Again, shocker. Here’s a guy you supposedly made $37k by selling his forehead space. Temporary tattoo.

And I’m sure this was a stunt. But you KNOW where this is going. You KNOW what the narrative is going to be.

What kind of regulatory monster are you to prevent people from selling themselves in more and more degrading ways? This is a choice. This is a path to a living wage. This is opportunity and equity.

Grrrrrr.

From Pecking Order, one of my fave notes …

Out of all the animals we keep on our “farm”, chickens are the only ones that bring me no joy. Chickens are, by nature, brutal and cruel. They will torture the weak to death with their pecks, not because they have to, but because they can. It’s the way their brains are hard-wired, and it works for them, as a species. So I pretend that chickens aren’t evil and I’m not complicit. Because I really like the eggs.

We are trained and told that the pecking order is not a real and brutal thing in the human species. This is a lie. It is an intentional lie, one that we pretend isn’t evil and where we are not complicit.

Because we really like the eggs.

“Because we really like the eggs” is also why we did not do anything about my brother who thought he was a chicken. W. Allen.