Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

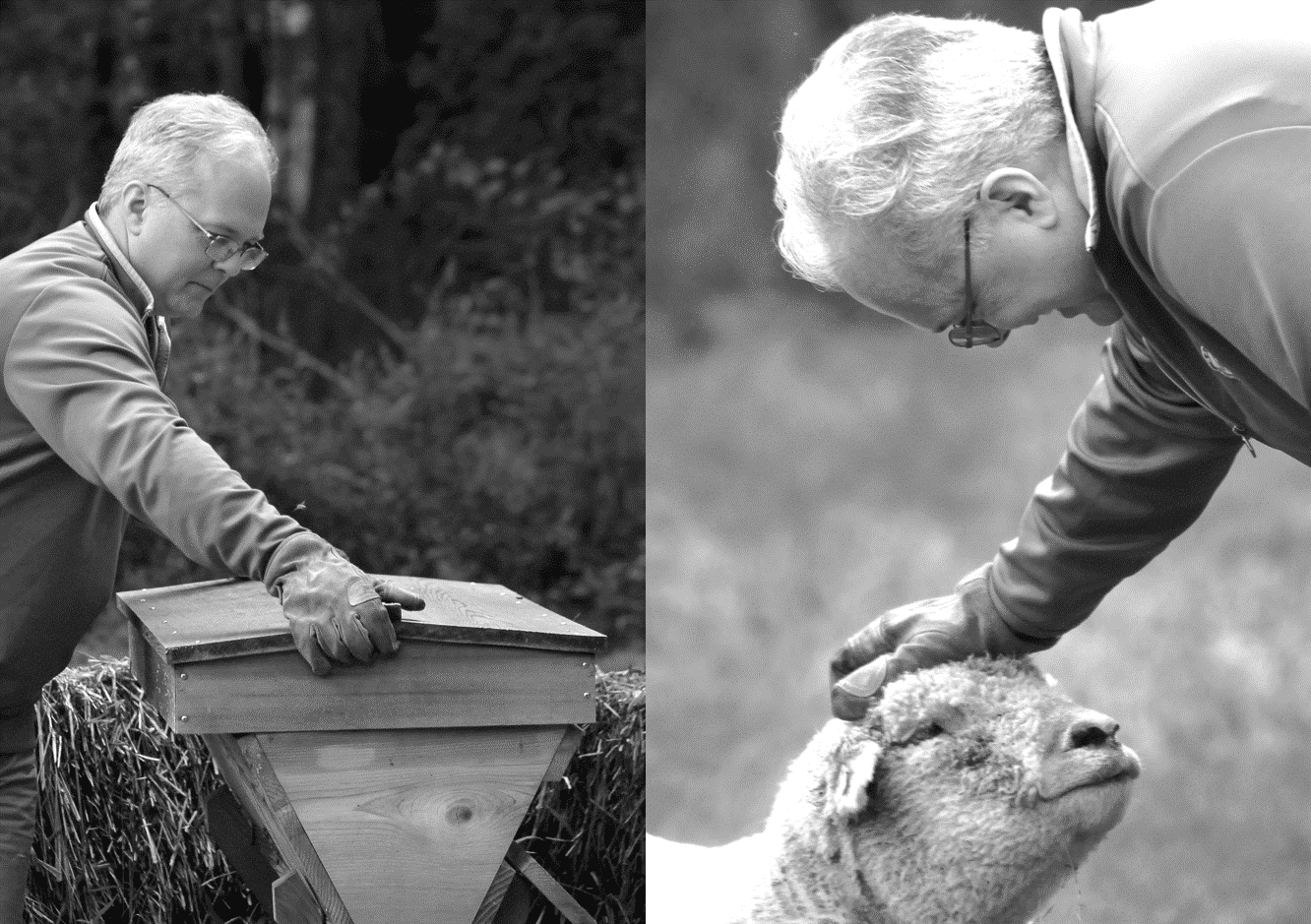

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

I think that we’re gearing up for Round Two of the Unmooring Trade.

We do a lot of work here to understand how the media frames issues linguistically, but we haven’t done much to see how that carries over in graphical Narrative representations. Would the same patterns we see in the WSJ’s words be represented in the WSJ’s pictures?

Oh yes.

The language FROM central bankers remains hawkish (“slow down on your projected 2024 rate cut schedule”), but the language TO central bankers is not only decidedly dovish but is starting to veer into “we need a Fed put” territory.

We’ve moved from the promise of cutting rates (mission accomplished on inflation and a soft landing, so now the Fed should cut rates by choice rather than by necessity … well done and take a bow, you geniuses!) to the threat of not cutting rates (if the Fed doesn’t cut rates soon, then it will cause a recession … hurry up and cut, you fools!).

Every once in a very great while, the direct beneficiaries of a yay-something narrative construction overplay their hand so egregiously, embarrass themselves so publicly, reveal their mediocrity so clearly, that the Common Knowledge propping up the yay-something narrative collapses.

This is the breaking of “Yay, College!”.

Recording of our kick-off call for an ET Professional working group on private credit.

Last week, Jay Powell told you that the Fed intends to cut interest rates next year, not because they must, but because they can.

But inflation is a bird that always comes home to roost. And when it does, we will look back at Powell’s Christmas 2023 “I got you fam” pivot as a BFD in the Great Unmooring.

The Fed just raised their inflation target from 2% to 4% without saying that they raised their inflation target from 2% to 4%.

Sure, you can do it. But you shouldn’t.

This used to be our common knowledge about risk-taking men on Wall Street. Today it’s our common knowledge about women.

And we are all paying a heavy price for that.

If the Fed cuts four times in 2024, it’s because we are having a nasty recession. If we don’t have a nasty recession, I don’t think the Fed cuts at all. Why not? Because common knowledge. Because everyone knows that everyone knows that inflation is still a thing, allowing companies to pass along higher prices to maintain/expand margins even as labor pushes for higher wages.

We are SOOOO not done with inflation.