To receive a free full-text email of The Zeitgeist whenever we publish to the website, please sign up here. You’ll get two or three of these emails every week, and your email will not be shared with anyone. Ever.

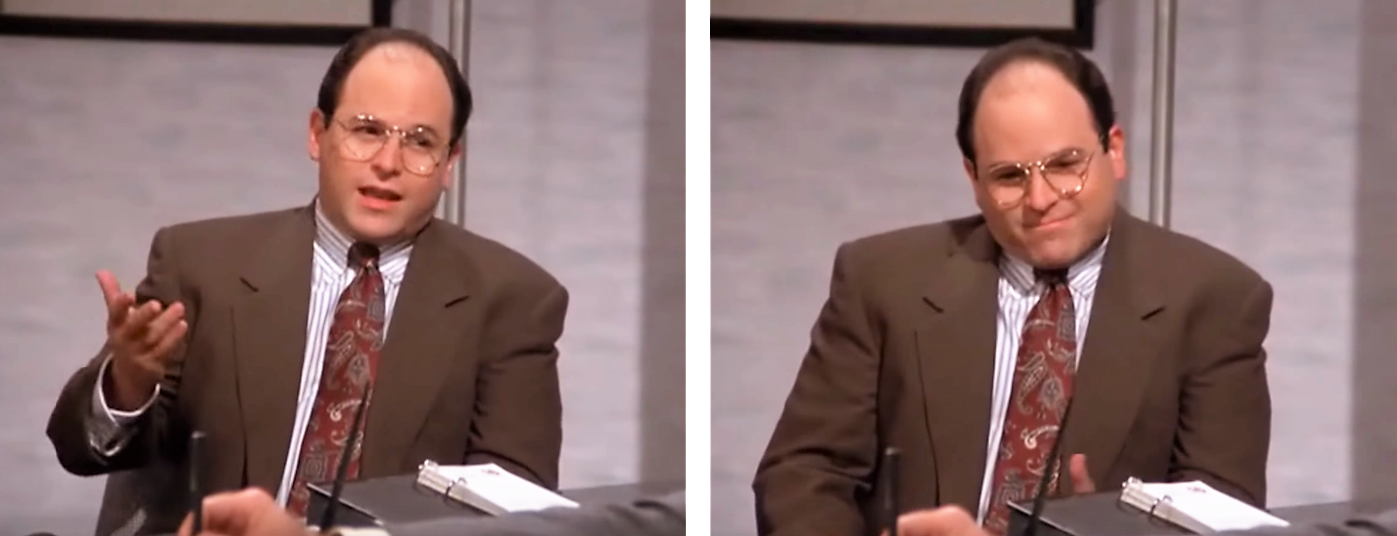

Mr. Lippman: It’s come to my attention that you and the cleaning woman have engaged in sexual intercourse on the desk in your office. Is that correct?

George Costanza: Who said that?

Mr. Lippman: She did.

[pause]

George Costanza: Was that wrong? Should I not have done that? I tell you, I gotta plead ignorance on this thing, because if anyone had said anything to me at all when I first started here that that sort of thing is frowned upon … you know, cause I’ve worked in a lot of offices, and I tell you, people do that all the time.

“THERE IS DEFINITE HANKY-PANKY GOING ON”: THE FANTASTICALLY PROFITABLE MYSTERY OF THE TRUMP CHAOS TRADES [Vanity Fair]

Three days earlier, in the last 10 minutes of trading, someone bought 82,000 S&P e-minis when the index was trading at 2969. That was nearly 4 a.m. on September 11 in Beijing, where a few hours later, the Chinese government announced that it would lift tariffs on a range of American-made products. As has been the typical reaction in the U.S. stock markets as the trade war with China chugs on without any perceptible logic, when the news about a potential resolution of it seems positive, stock markets go up, and when the news about the trade war appears negative, they go down.

The news was viewed positively. The S&P index moved swiftly on September 11 to 2996, up nearly 30 points. That same day, President Donald Trump said he would postpone tariffs on some Chinese goods, and the S&P index moved to 3016, or up 47 points since the fortunate person bought the 82,000 e-minis just before the market closed on September 10. Since a one-point movement, up or down, in an e-mini contract is worth $50, a 47-point movement up in a day was worth $2,350 per contract. If you were the lucky one who bought the 82,000 e-mini contracts, well, then you were sitting on a one-day profit of roughly $190 million.

This Vanity Fair feature article is as badly sourced and as poorly vetted and as ridiculously misleading an article about markets as I’ve ever read. It’s an embarrassment to the author and the editors and everyone associated with the piece.

And yet I still think there’s a non-trivial chance the Carl Icahns and Steve Schwarzmans of the world are, in fact, being tipped by the White House.

Do I think Carl and Steve, both of whom talk directly with Trump and Mnuchin all the time, are buying 400,000 e-minis on Friday afternoon?

Of course not.

Do I think Carl and Steve are told exactly what’s happening in the China talks as soon as it happens?

Yes, I do.

Is it illegal for Carl and Steve to make trades based on that information, particularly in the swaps, futures and commodities markets?

No, it is not.

Are S&P 500 e-mini contracts part of that more lightly-regulated swaps, futures and commodities market?

Yes, they are.

To be clear, the restrictions on how and what market-impacting information can be legally shared from government sources has gotten a lot tougher over the past 10 years.

First, under the 2012 Stop Trading on Congressional Knowledge (STOCK) Act, it is now illegal for members of Congress (and the Executive and Judiciary!) to trade their personal accounts based on non-public information acquired under their official business, and they are held to the same standards on tipping insider information as the SEC applies to everyone else. There are also beefed up reporting requirements for their personal trades, including in commodity markets, and clear language that government employees and appointees owe a “duty of care” to the US government.

Second, Dodd-Frank contained language that gave the CFTC more leeway in bringing insider trading cases against participants in commodity markets, which includes traders in derivative instruments like the S&P 500 e-mini contract. The CFTC still can’t bring cases based on a traditional insider information basis, because the idea of an inside track on material, non-public corporate information (“Blue Horseshoe loves Anacott Steel!”) makes no sense when you’re talking about commodities. What the CFTC can do, however, is bring an insider trading case based on a “misappropriation” theory of non-public information, which they’ve done in a couple of cases since 2016. Basically, if you “steal” non-public information from your employer or client and use that to your advantage in a CFTC-regulated market, they can now go after you.

But here’s what hasn’t changed:

Reg-FD does not apply to the President of the United States.

If Carl Icahn calls up the CEO of GM and asks her how the UAW talks are going, it is illegal for Mary Barra to tell him anything that she does not also tell everyone else.

If Carl Icahn calls up the President of the United States and asks him how the China talks are going, it is perfectly legal for Donald Trump to tell him anything without obligation to tell anyone else.

You don’t think Trump knows this? You think Trump believes he owes some sort of “duty of care” to anyone beyond his family and circle of fellow oligarchs? You think Trump lies awake at night asking himself “was that wrong?”

#BITFD

This could have been Fiat news on CNN or slightly reworded and on Fox news.

How’s this?

You don’t think Hillary knows this? You think Hillary believes he owes some sort of “duty of care” to anyone beyond his family and circle of fellow oligarchs? You think Hillary lies awake at night asking himself “was that wrong?”

LOL.

After all the act was signed into law by Obama.

“Why am I reading this now?” (on Epsilon Theory)