Ben Hunt

Co-Founder and CIO

Ben Hunt is the creator of Epsilon Theory and inspiration behind Second Foundation Partners, which he co-founded with Rusty Guinn in June 2018.

Epsilon Theory, Second Foundation’s principal publishing brand, is a newsletter and website that examines markets through the lenses of game theory and history. Over 100,000 professional investors and allocators across 180 countries read Epsilon Theory for its fresh perspective and novel insights into market dynamics. As Chief Investment Officer, Ben bears primary responsibility for determining the Company’s investment views and positioning of model portfolios. He is also the primary author of materials distributed through Epsilon Theory.

Ben taught political science for 10 years: at New York University from 1991 until 1997 and (with tenure) at Southern Methodist University from 1997 until 2000. He also wrote two academic books: Getting to War (Univ. of Michigan Press, 1997) and Policy and Party Competition (Routledge, 1992), which he co-authored with Michael Laver. Ben is the founder of two technology companies and the co-founder of SmartEquip, Inc., a software company for the construction equipment industry that provides intelligent schematics and parts diagrams to facilitate e-commerce in spare parts.

He began his investment career in 2003, first in venture capital and subsequently on two long/short equity hedge funds. He worked at Iridian Asset Management from 2006 until 2011 and TIG Advisors from 2012 until 2013. He joined Rusty at Salient in 2013, where he combined his background as a portfolio manager, risk manager, and entrepreneur with academic experience in game theory and econometrics to work with Salient’s own portfolio managers and its financial advisor clients to improve client outcomes.

Ben is a graduate of Vanderbilt University (1986) and earned his Ph.D. in Government from Harvard University in 1991. He lives in the wilds of Redding, CT on Little River Farm, where he personifies the dilettante farmer that has been a stock comedic character since Cicero's day. Luckily his wife, Jennifer, and four daughters, Harper, Hannah, Haven and Halle, are always there to save the day. Ben's hobbies include comic books, Alabama football, beekeeping, and humoring Rusty in trivia "competitions".

Articles by Ben:

The Hertz bankruptcy is not a story of financialization by an entrenched, self-dealing management team.

It’s a story of financialization by an entrenched, self-dealing minority ownership.

Can a free world survive an endemic COVID-19, where there’s no vaccine but a chronic global affliction?

I used to think yes. Now I think no.

A truth that’s told with bad intent

Beats all the lies you can invent.

– William Blake

Our narratives of COVID-19 are all lies.

They are lies of a particular sort, political narratives that have a nugget of truth within them, but are told with bad intent. They are told this way because it works. Because the nugget of truth hides a deeper, unpleasant truth. And a Big Lie.

I know it’s forbidden to say this, but I like Woody Allen movies. If you’ve never seen “Everything You Always Wanted to Know About Sex* … But Were Afraid to Ask”, it’s worth your time just for the Gene Wilder scenes. And yes, credit default swaps are the sheep in this story.

Take away a great performer’s live audience, and you take away their source of Narrative power.

That’s true for American Idol. That’s true for Warren Buffett.

It’s also true for Donald Trump.

The dominant COVID-19 narrative today is a “short and deep” economic impact, with a corollary narrative of “pent-up demand”. These are market-positive narratives.

Here’s how we think those narratives could reverse, and here’s what investors should watch for to see if that reversal happens.

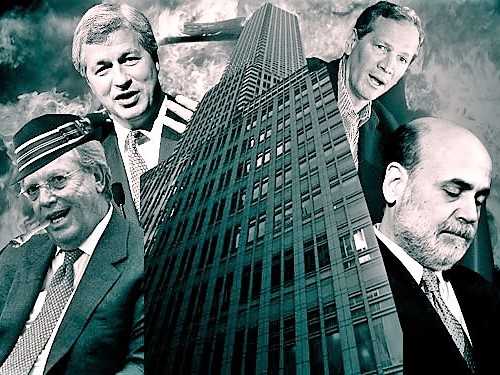

The systemic risk question you need to ask yourself today is the same question you needed to ask in 2008.

What is the micro-level truth of the potential real-world shock, and does that micro-level truth threaten the Common Knowledge surrounding a levered business model and securitized asset class of enormous size?

In 2008, the market came roaring back after Bear Stearns was sold for parts to Jamie Dimon. Why? Because narrative. Because with Bear’s elimination, “systemic risk was off the table.”

That’s the question you need to ask yourself today. Is systemic risk off the table?

I, for one, am delighted to learn of the “Through No Fault of Their Own” exemption to stock market risk.

One day, and soon, there will be a reckoning. Time to choose a side.

We’re going to change the world, you know … you and me. We’re going to create points of failure for the system of sociopathic oligarchy AT SCALE.