Here’s what we’re reading and working on this week at Epsilon Theory.

Every item in this email is a discussion thread on the Epsilon Theory Forum – a safe space to speak your mind, a safe space to find like-minded truth-seekers. We’re not crowd-sourcing ideas for being better investors and citizens, we’re pack-sourcing them.

Clear Eyes. Full Hearts. Can’t lose.

Watch from a distance if you like, but when you’re ready … join us.

To receive a weekly full-text email of The Zeitgeist, please sign up here. It’s free, and your email will not be shared with anyone. Ever.

The Narrative Machine

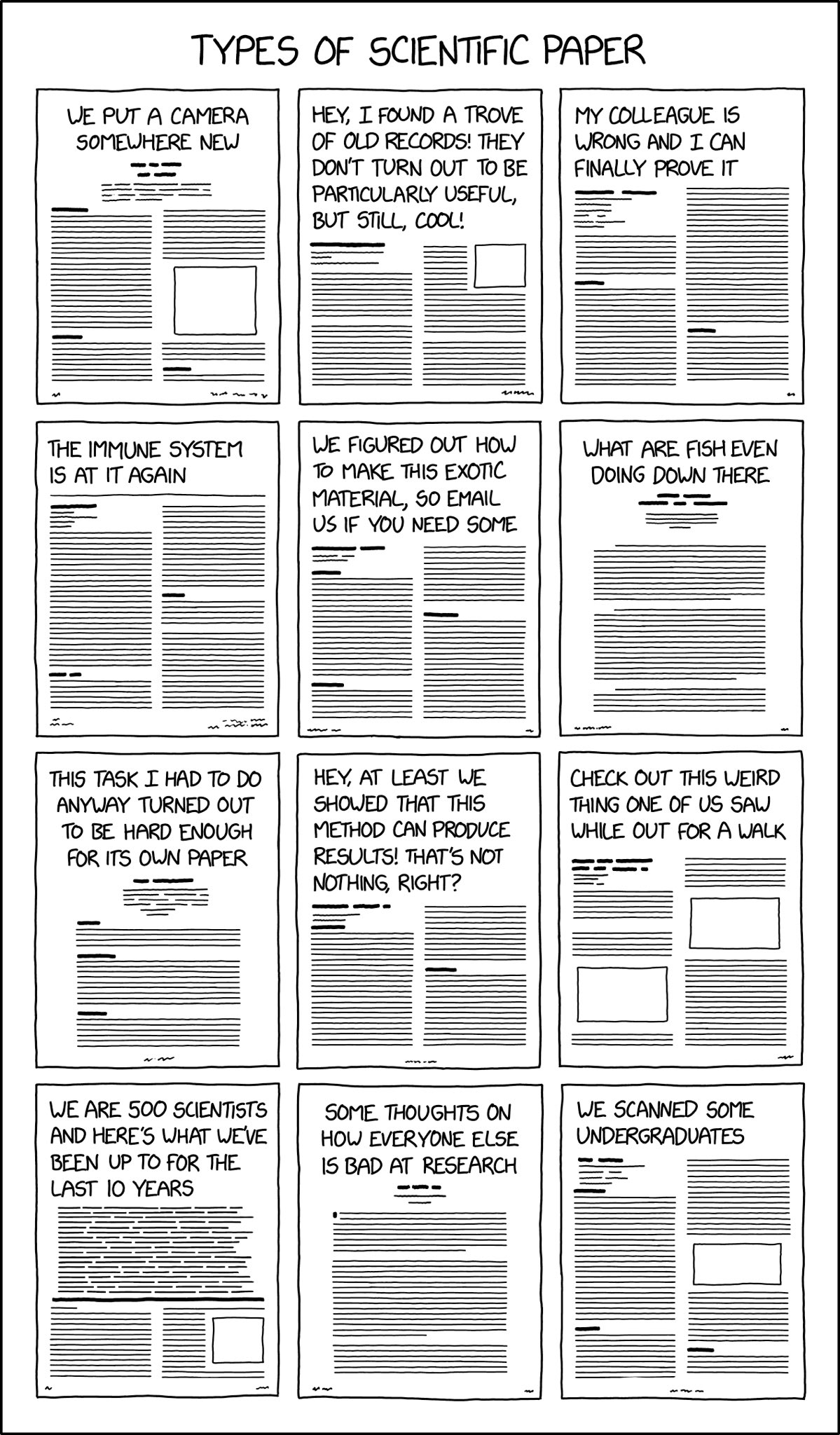

Randall Munroe of xkcd fame posted this yesterday. Like all of Munroe’s work, it’s brilliant and Truth with a capital T.

It’s also a great intro to the research side of Second Foundation Partners (our company name … like Alphabet is to Google, so is Second Foundation Partners to Epsilon Theory, just on a slightly different scale).

What Randall is describing here with scientific paper archetypes is the same for ALL financial media. There are a finite number of narrative archetypes {n} that can be applied to any financial entity [x], and they map directly to subsequent investor behaviors. Think of all the squiggly lines in Randall’s drawings as the “facts” in any financial news story you hear or read. Or as I put it In Praise of Bitcoin:

In exactly the same way that there are only, say, a dozen archetypal scripts for every TV sitcom episode ever filmed, or in exactly the same way that there are three acts to every modern movie screenplay, so is there an underlying structure and a finite number of underlying archetypes to the media coverage of every market entity.

This is what we’re currently cataloguing with the Narrative Machine. It’s extremely cool (imo), but also more than a little scary!

The Primacy of Scale

From Blackrock’s earnings announcement, AUM grew +40% for the year ended 3/31/21.

Blackrock now has more than 9 TRILLION American dollars under management.

I mean … wut?

Ben

These kinds of systemic states – the massive accumulation of financial scale – are plain and simple a direct product of the digitalization of money. In a more physical world it would be impossible for a single firm to achieve that Primacy of Scale.

It is my belief (must be – this is my second post about it – its a whole movement in my mind! j/k 🙂 that the transformation of money from paper to digital is as significant event as the transformation of knowledge from spoken to written and that we keep trying to jam the new tech into the old systems.

The result? A single firm has the ability to do something like capture and manage $9trillion dollars of wealth.

And no, this isn’t just about Crypto (although it has huge intersections with that space) – its about everything. Its about how your behavior changes when you no longer pay for things in cash or where you can borrow reliably from other or where the transaction cost of small loans becomes close to zero…its about a massive transformation in the laws that govern what is possible in our financial world.

We are cavepeople (ugh that sounds like a indie pop group) trying to understand what to do with this rocket fuel we just discovered. We need to learn to build rocket engines.

Zenzei

It’s the digitalization of everything, right? Atoms to bits, or whatever Negroponte was writing about way back when. I think of digitalization as the crystallization of information, the stripping away of the physical shell of information, and we imbue more information in money than anything else.

One other point, though. At the same time we have seen the triumph of scale in everything that can be digitalized, we have seen a similar triumph of scale in the purely physical world (farming, mining, transportation) as well. There’s a political dimension to all this in addition to the technological dimension of digitalization.

Ben

Oscar Nonsense

Multiple interesting narrative topics here:

1. How did the Boseman-as-icon narrative emerge so powerfully in the first place? There’s certainly a social/racial dimension to the role he played in Black Panther and the huge meaning that role and movie had for a lot of Americans. But the outpouring vs, say, Philip Seymour Hoffman, who died tragically at a similar age and with a far more storied career, is fascinating to me. At a certain point, it seemed everyone knew that everyone knew immediately that Boseman was a superstar, and I don’t remember anything prior to that sudden emergence.

2. How does the social loafing of “I assume Boseman will win, but I’m voting for Hopkins” become such a widespread thing?

3. How did a non-year for cinema – especially in the public! – affect the Common Knowledge dynamics of a race like this? It is a rare year when I have seen more than half of the nominated films, but it is also a rare year when I’ve never even heard of half of the nominated films.

4. Is there no amount of poor execution (seriously with that NFT and ending build-up?) that can affect the prestige of the Oscars? I know we all make fun of it and say “Oh, they’re so dumb now”, but everyone STILL knows that everyone knows that the Oscar is the only film award that matters. If this doesn’t CAN that change? Does it?

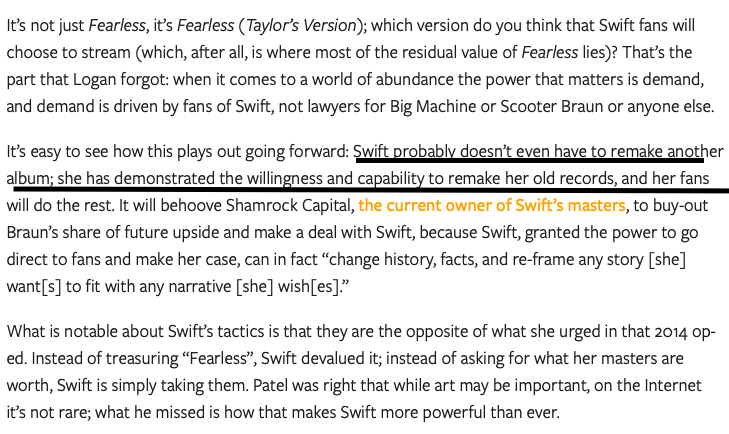

The Genius of Taylor Swift

I’m a big fan of what Taylor Swift is doing with a re-recording of the Fearless tracks (she owns the song copyrights, but not the recording copyrights).

Ben Thompson at Stratechery wrote a good post on this (https://stratechery.com/2021/non-fungible-taylor-swift/) with an excerpt noted and underlined by a Pack member.

The Pack member’s comment on the underlined passage … “Tom Schelling and Taylor Swift would have understood each other perfectly.”

I agree! Great example of game theory in real life!

Ben

I’m a long time Swiftie and Fearless was one of my favorite albums. For those who haven’t spent more than a decade following her every move, here’s the breakdown.

The original Fearless was released in 2008 and is the Joe Jonas breakup album. This is where songs like You Belong With Me, Love Story, and Forever & Always come from. This album gave her the first of many Grammys and made Taylor the youngest winner of a Best Album Grammy at 20. The You Belong With Me video is what started the Taylor v Kanye saga. This is the album that made her *Taylor Swift* and not another blonde country singer.

For Fearless (Taylor’s Version), she rerecorded all of the original songs with slight differences from the original recordings due to different sound mixing and the fact that her voice has matured. There are also several “new” songs that were written in 2008 but weren’t included in the first version. I love them all.

The really interesting part of this for me is that only Taylor Swift could have done this. There are a few singers who could probably rerecord an album and have it sell well, but Taylor is one of the only artists who is all but guaranteed a best selling album no matter what she does. She’s also only able to rerecord the songs because she wrote them all. She lost control of the master recordings, but because she wrote all of the songs herself she has the copyright and can rerecord them without issue.

Harper

I’m trying to picture some junior analyst at Carlyle explaining to the people at the pension board of Saskatchewan why they should expect lower returns this quarter because the ABS they sold them was funded by royalties on Taylor Swift songs.

Desperate Yuppie

Digitization of everything is not new a concept, but it is only now becoming real as a technology. Additive/Digital Manufacturing has been around for a long time as a concept and as a toy technology. We’re now at a point in the digitization of the made environment comparable to the late 1980s when the programmable microchip became a real technology setting the stage for the internet to take off beginning in the early 1990s. This article about the scanning of a T-Rex skeleton in the Netherlands demonstrates that anything that can be scanned can be digitized. The next “obvious” step was the replication of the skeleton from the digital files for display in Nagasaki. For your purpose Ben, the most interesting aspect of this article comes at the end.

“If you have a 3D printer yourself, you can print your own cat-sized T.Rex via the manual that Naturalis provides online,” Jacob noted. “There is also a 3D-print available of our Triceratops.”

This one won’t break the bank, either. “It will cost you approximately one roll of filament, some glue, and some patience I’d say,” she said.

When anything can be replicated anywhere what is the “value” of the physical original? And what impact does this have on the acceleration of productivity and the globalization/democratization of wealth. Will “Wall Street” capture this value for the distribution networks or will a budding Taylor Swift of the physical world find a way to monetize tangible art on a scale previously unimaginable?

I think you just came up with the plot line for the next installment of Jurassic World.

Antiques Roadshow provides a readily accessible insight into the value of originals at least in the collectibles market.

I think there’s an element to the Digitization and the rerecording that is being missed. Namely, accelerated obsolescence. Analogue storage of data is relatively easy to recover and reproduce at any time. You need to protect the physical media, but as long as the paper, film, canvass, stone, vinyl, wax, glass, etc. is intact, the information can be retrieved. With Digitization and electronic storage, that is not the case. You could have perfectly good media, but the data can be garbage because the format of the data is undecipherable. It’s a little bit like a dead language but with one major difference. With a dead language there can be enough information to decode the symbols and retrieve the message. With digitization and electronic storage you only get ones and zeros. Not only do you need to be able to read the ones and zeros, you need to be able to group them and then decode them into an understandable format. Have you tried to open up an ancient (pre Y2K) Word document? How about a Word Perfect Document? What if it’s stored on Floppy Disk? (5 1/4 or 3 1/2 take your pick) Does anyone still have a zip drive to read those disks? What happens when we can’t read the archive files any more? How do you do a title search on the block chain when the earlier links have been lost in time? It’s not just about data, it’s also about ownership. Can you still enjoy the movies that you bought on VHS? You never owned the movie, but you had a license for private viewing. What happens to that license you bought when you can’t buy a device to play the tape or you can’t buy a display screen that can decode the signal? What about online music, movies, apps, photos, etc. How do you preserve history when all of it will become unrecognizable, unrecoverable noise in very short order?