Notes From The Diamond

In this series kicked off in October 2018, long-time friend and subscriber David Salem explores the many similarities between money management and America's national pastime.

Axioms to live by in baseball and in investing!

1) Outsiders to an organization can never know in real time what goes on inside it.

2) Human labors can never be gauged fully and dispositively in real time.

3) Chains are never stronger than their weakest links.

In both baseball and in investing, we need an all-purpose test of excellence, not just for identifying MVPs like Mike Trout, but for seeing how all of us mere mortals stack up.

ET contributor David Salem makes the case for an investing corollary to baseball’s Wins Above Replacement (WAR). It’s a defense of value investing, but with a twist.

ET contributor David Salem is back with five core tenets for achieving 5+% real returns over the next few decades.

It’s all a must-read, but I’m gonna highlight #4: “Favor equity investments in companies employing or serving primarily people with abundance as distinct from scarcity mindsets.”

This is the foundation for behavioral economics on a macro scale.

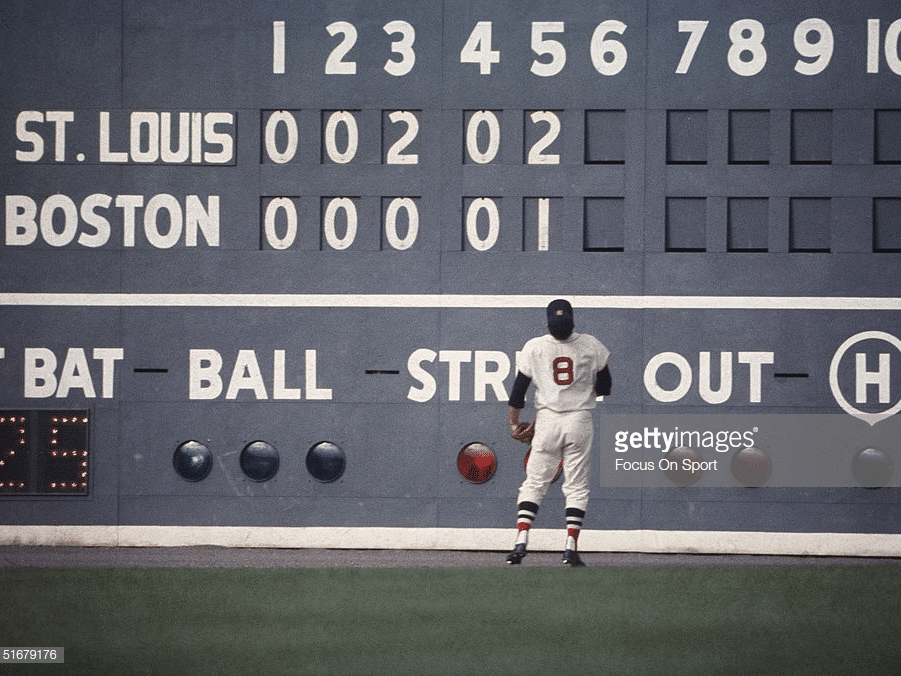

In baseball and in investing, how do we distinguish truly great practitioners from merely good ones? Let’s start by looking at two greats who revolutionized how the game is played – Branch Rickey in baseball and David Swensen in investing.

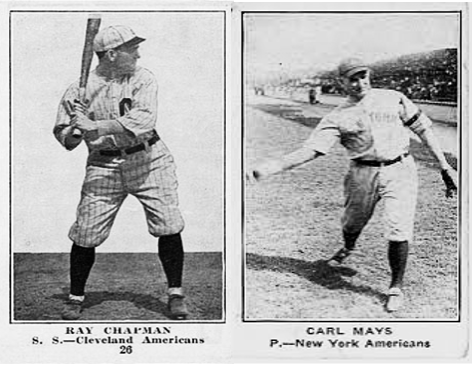

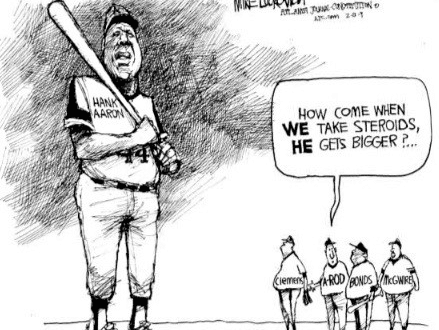

Imitation is not only the sincerest form of flattery, it’s also the engine behind so much of what we do in both professional baseball and professional investing. The trick, of course, is not to get beaned in the process!

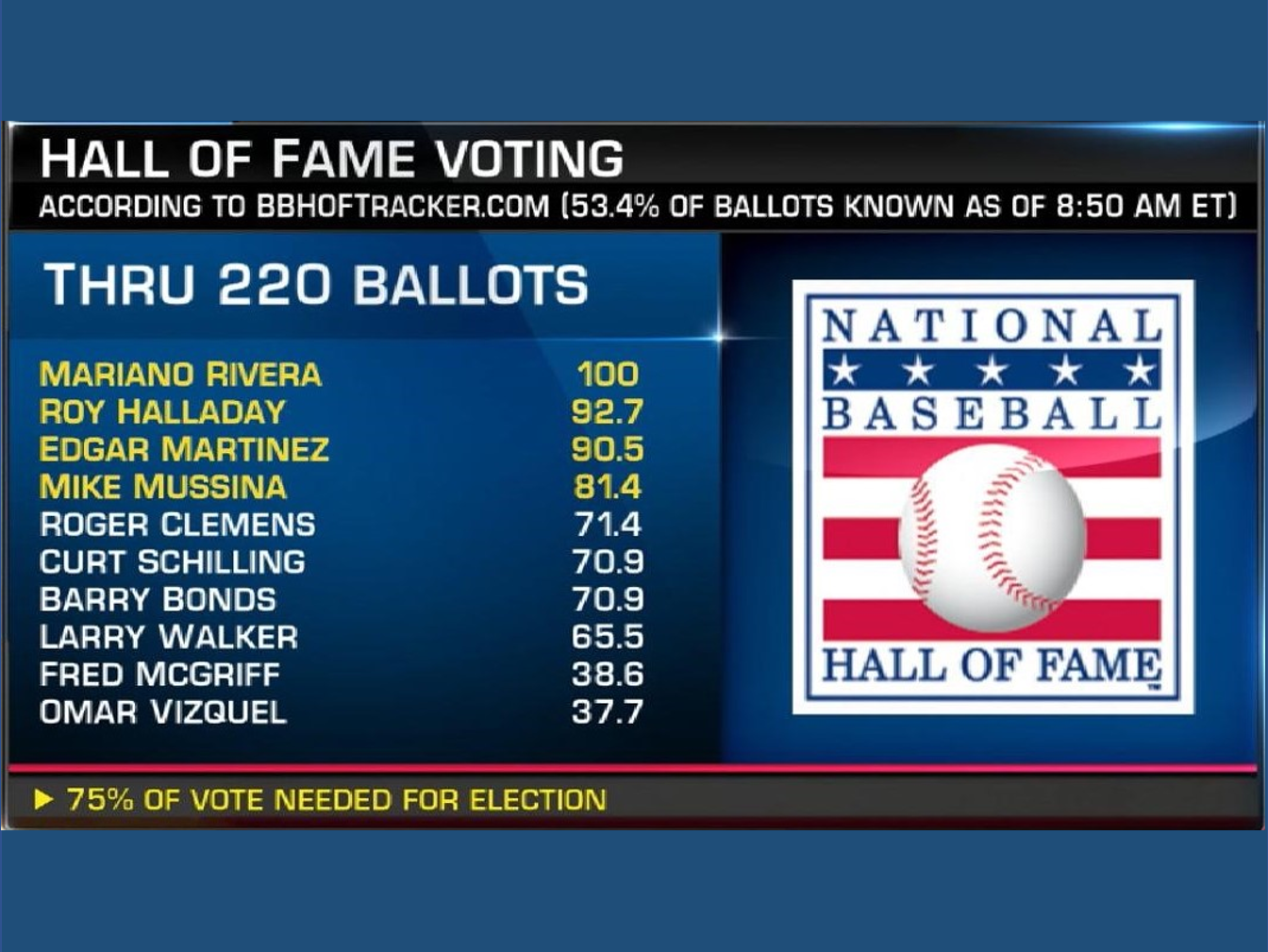

Peer group comparisons are the primary measuring stick of both baseball GMs and investment PMs. Here’s how they are used and (more often) abused.

Allocators and investors can learn a lot from professional baseball about how to structure incentives and compensation for portfolio managers. And how NOT to do it.

Part 2 of a multi-part series that seeks to enhance readers’ deployment of both human and financial capital through the exploration of parallels between money management and professional baseball.

Part 1 of a multi-part series that seeks to enhance readers’ deployment of both human and financial capital through the exploration of parallels between money management and professional baseball.