Month: May 2019

The Zeitgeist – 5.17.2019

The Zeitgeist – 5.16.2019

The Zeitgeist – 5.15.2019

The Zeitgeist – 5.14.2019

Office Hours – 5.14.2019

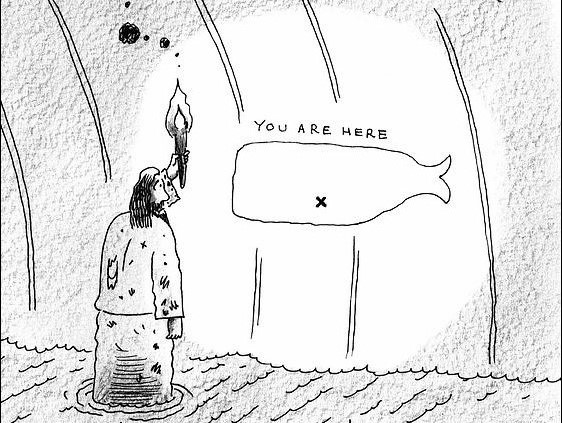

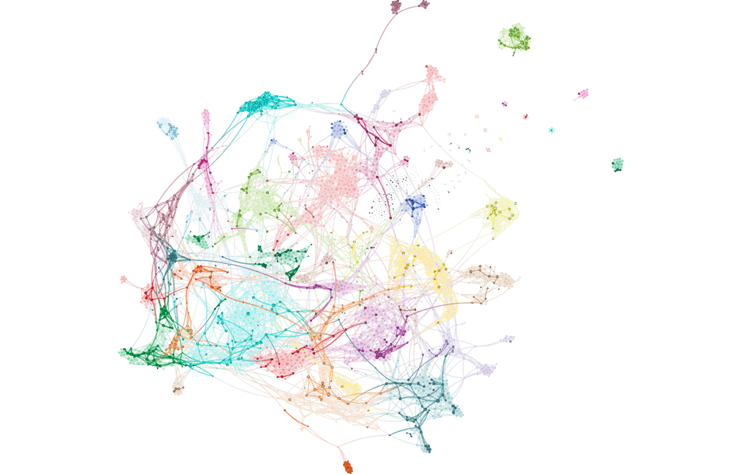

In the Flow – You Are Here, May 2019

The Zeitgeist – 5.13.2019

The Weekend Zeitgeist – 5.11.2019

The Zeitgeist – 5.10.2019

What Country Friends Is This?

The Zeitgeist – 5.9.2019

The Zeitgeist – 5.8.2019

The Zeitgeist – 5.7.2019

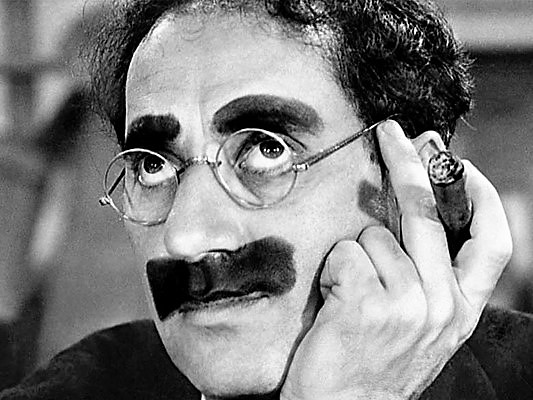

Wage Growth, Groucho Marx Edition

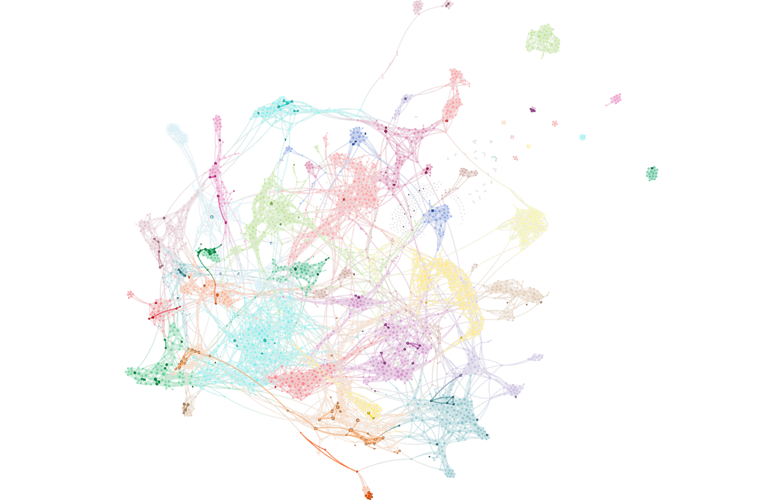

Credit Cycle Monitor – 4.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

US Fiscal Policy Monitor – 4.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

Trade and Tariffs Monitor – 4.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

Central Bank Omnipotence Monitor – 4.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…

Inflation Monitor – 4.30.2019

Access the Powerpoint slides of this month’s ET Pro monitors here. Access the PDF version of the ET Pro monitor slides here. Access the underlying Excel data here.…