Category: Monetary Policy

Post-Fed Follow-Up

Essence of Decision

Magical Thinking

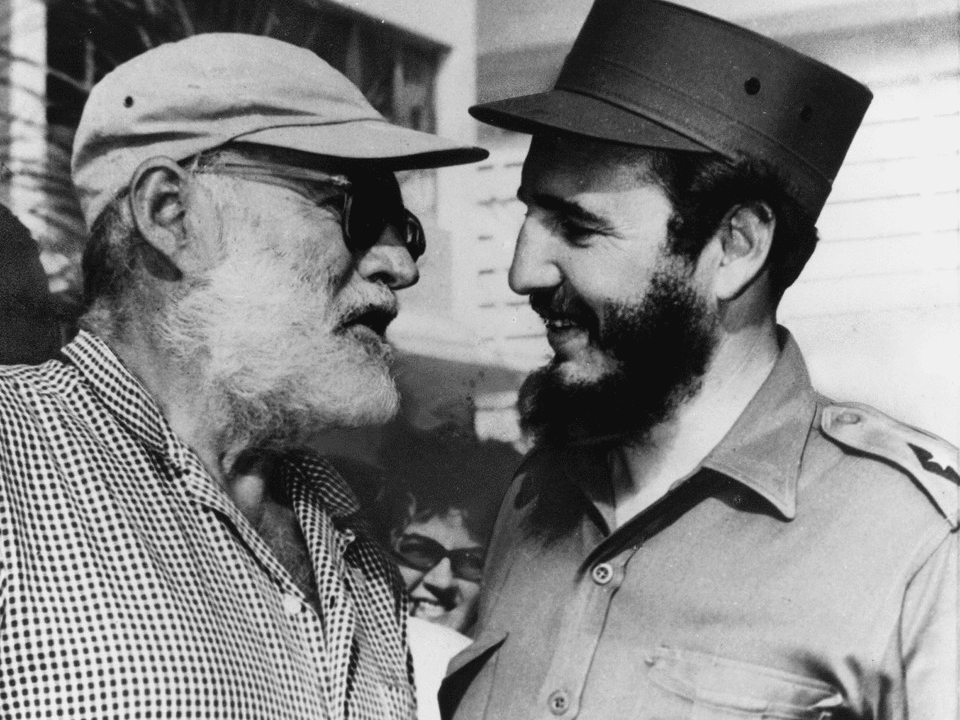

Crisis Actors and a Reichstag Fire

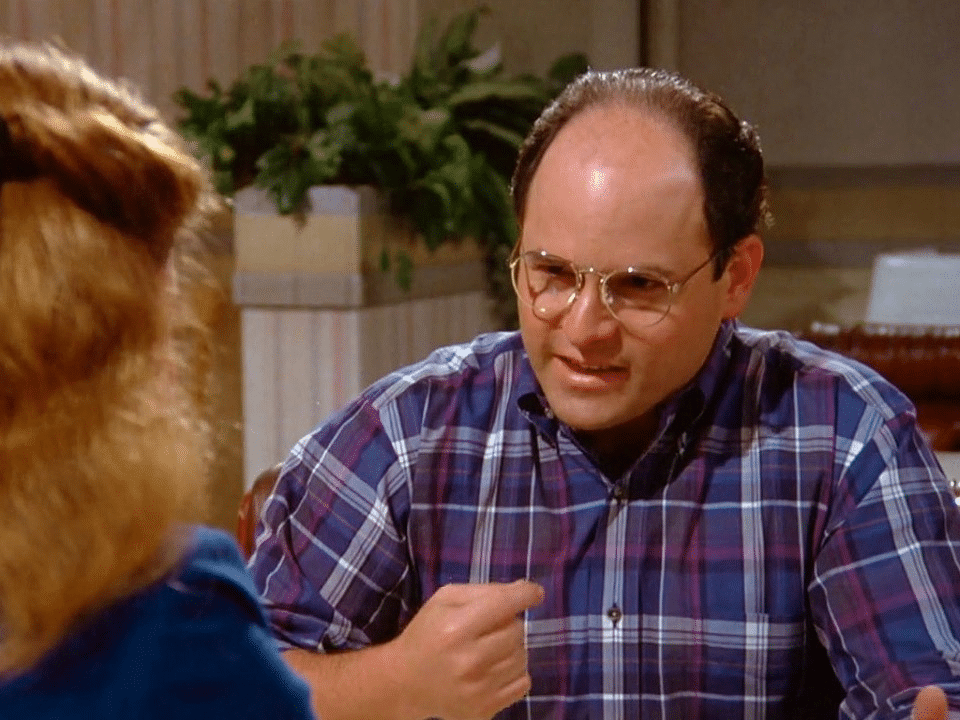

Man in Bar: Tomorrow, I’m gonna be a hero. Gideon: I’m sorry? Man in Bar: You may just be a patsy, but you’re an important…

When Narratives Go Bad

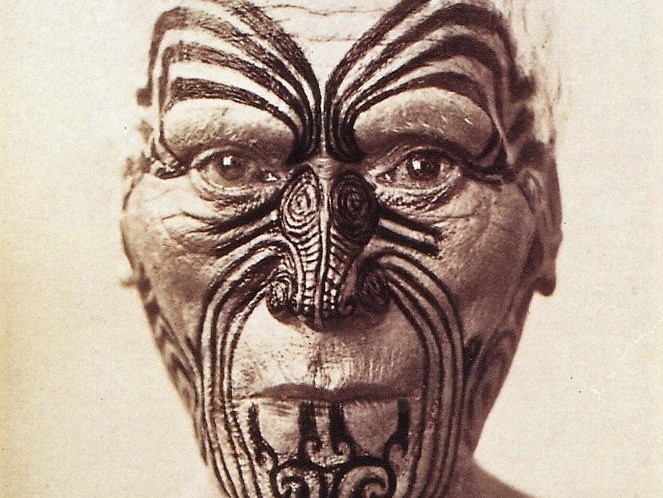

How many things served us yesterday as articles of faith, which today are fables for us? – Michel de Montaigne, The Complete Essays (1580) That…

Waiting for Humpty Dumpty

Humpty Dumpty sat on a wall, Humpty Dumpty had a great fall. All the king’s horses and all the king’s men Couldn’t put Humpty together…

Cat’s Cradle

“No wonder kids grow up crazy. A cat’s cradle is nothing but a bunch of X’s between somebody’s hands, and little kids look and look…

Who’s Being Naïve, Kay?

Optical Illusion / Optical Truth

Portion of original dot map by Dr. John Snow, the founding father of epidemiology, showing the clusters of cholera cases in the London epidemic of…

The Placebo Effect

BOTOX® is the only FDA-approved, preventive treatment that is injected by a doctor every 12 weeks for adults with Chronic Migraine (15 or more headache…

My Passion is Puppetry

Campaign Company Launch Date “Flo” Progressive Insurance 2008 “Rhetorical Question” “Happier Than A … ” “Did You Know?” “It’s What You Do” GEICO 2009 2012…

Welcome to the Jungle

Zero-sum, Elliot. You’re playing a game you already lost. You know I’m right. – “Mr. Robot” (2015) You can have anything you want But you…

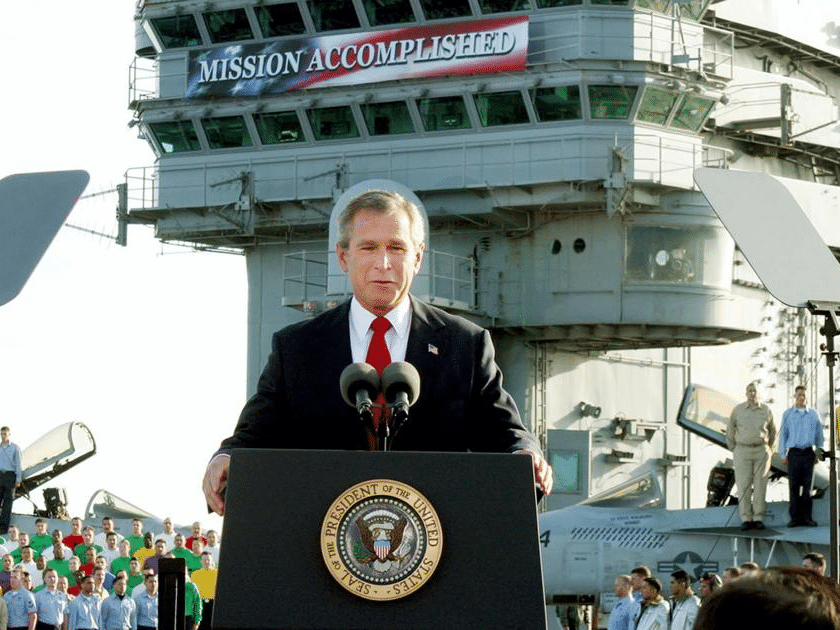

The Silver Age of the Central Banker

We all sing along But the notes are wrong – Matt & Kim, “Get It” (2015) The strong do what they will, and the weak…

Rewardless Risk

Faramir: Then farewell! But if I should return, think better of me. Denethor: That depends on the manner of your return. – J.R.R. Tolkien “The…

Storm Warning

Unfortunately for mariners, the total amount of wave energy in a storm does not rise linearly with wind speed, but to its fourth power. The…

“Suddenly, Last Summer”

A quick Epsilon Theory email and a quick announcement. Announcement first. I’ll be giving a 1-hour webcast on Risk Premia strategies next Tuesday, August 4th,…

Why Take a Chance?

Vinny Forlano: He won’t talk. Stone is a good kid. Stand-up guy, just like his old man. That’s the way I see it. Vincent Borelli:…

Catch – 22

Four times during the first six days they were assembled and briefed and then sent back. Once, they took off and were flying in formation…

We Now Return to Our Regularly Scheduled Programming

Hilsenrath Analysis: Friday’s Jobs Report Assures Global Central Banks Going in Two Directions ― Wall Street Journal, December 5th, 9:59a ET Earlier today I tweeted that “I…