Category: Adaptive Investing

Post-Fed Follow-Up

Tell My Horse

Westworld

The Art of the Probe

You Had One Job

Anthem!

Cat’s Cradle

“No wonder kids grow up crazy. A cat’s cradle is nothing but a bunch of X’s between somebody’s hands, and little kids look and look…

Optical Illusion / Optical Truth

Portion of original dot map by Dr. John Snow, the founding father of epidemiology, showing the clusters of cholera cases in the London epidemic of…

The Placebo Effect

BOTOX® is the only FDA-approved, preventive treatment that is injected by a doctor every 12 weeks for adults with Chronic Migraine (15 or more headache…

My Passion is Puppetry

Campaign Company Launch Date “Flo” Progressive Insurance 2008 “Rhetorical Question” “Happier Than A … ” “Did You Know?” “It’s What You Do” GEICO 2009 2012…

Hobson’s Choice

Snikt

As longtime Epsilon Theory readers know, I’m a big comic book fan. One of the joys of a comic done well is the effective representation…

You Can Either Surf, or You Can Fight

Kilgore: Smell that? You smell that? Lance: What? Kilgore: Napalm, son. Nothing else in the world smells like that. – Apocalypse Now (1979) Hello, hello, hello,…

Storm Warning

Unfortunately for mariners, the total amount of wave energy in a storm does not rise linearly with wind speed, but to its fourth power. The…

I Know It Was You, Fredo

Sen. Geary: Hey, Freddie, where did you find this place? Fredo Corleone: Johnny Ola told me about this place. He brought me here. I didn’t…

Rounders

Mike McDermott: In “Confessions of a Winning Poker Player,” Jack King said, “Few players recall big pots they have won, strange as it seems, but…

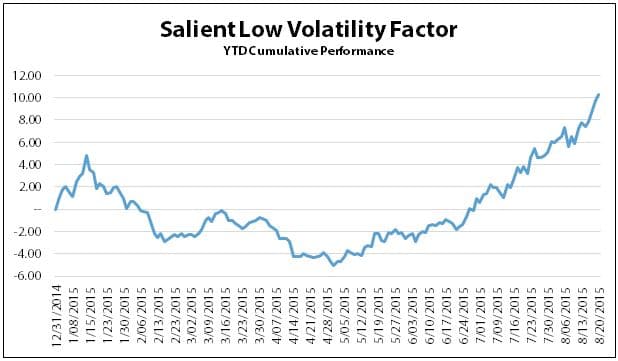

Season of the Glitch

When I look over my shoulder What do you think I see? Some other cat lookin’ over His shoulder at me. – Donovan, “Season of…

When the Story Breaks

The Three Types of Fear: The Gross-out: the sight of a severed head tumbling down a flight of stairs. It’s when the lights go out…

The New TVA

War is too important to be left to the generals. – Georges Clemenceau (1841 -1929) Competition has been shown to be useful up to a…